ConAgra Foods Swings to a Loss on Charges from Private-Label Business -- 2nd Update

September 22 2015 - 8:00PM

Dow Jones News

By Annie Gasparro And Lisa Beilfuss

ConAgra Foods Inc. on Tuesday reported a quarterly loss, as the

food maker seeks a buyer for its struggling private-label business

and invests more in reviving older brands such as Hunt's tomato

sauce and Reddi-wip dessert topping.

The Omaha, Neb.-based company announced a $1.95 billion charge

for the private-label unit, which makes foods that supermarkets

sell under their own brands. ConAgra acquired that business in 2012

for $5 billion but said in June it planned to sell the unit, after

having written down its value by some $2.2 billion.

In its branded business, which also includes Pam cooking spray

and Chef Boyardee canned pastas, ConAgra has been battling weak

demand for many traditional U.S. packaged foods, which also has

sapped sales at rivals including General Mills Inc. and Campbell

Soup Co.

Chief Executive Sean Connolly, who took the helm at ConAgra in

April, said he is putting more money behind some of

well-known-but-outdated brands such as Marie Callender's pot-pies

and Healthy Choice frozen dinners, which had been relatively

neglected by the company in recent years.

"One thing that happens when companies reduce investments in

brands and in consumer insights is the brands start to atrophy,"

Mr. Connolly said in an interview. "But brands are incredibly

resilient...you can make them relevant to a whole new

generation."

He said Reddi-wip, for instance, has benefited from new

marketing and packaging highlighting its main ingredient is "real

cream," as opposed to water and hydrogenated vegetable oil that

appear as the two main ingredients in a rival whipped topping.

Not all of ConAgra's stable of brands will get that kind of

attention, though. ConAgra will keep around others, such as Wesson

cooking oil, for the cash but not as a growth engine. "The key that

I want to emphasize is that you don't treat all brands as if they

are created equal," Mr. Connolly said. "Not all have equal growth

opportunities."

In the latest quarter, sales in ConAgra's consumer business were

flat, though operating profit rose 25% to $242 million, as he cuts

costs to keep up with rival Kraft Heinz Co., which is setting a

higher bar for profitability among U.S. food companies.

Mr. Connolly said ConAgra has seen a lot of interest from

potential buyers for the private-label unit. Still, investors

appear worried that the business might not be worth as much as they

hoped, given the size of the write-off announced on Tuesday.

Bernstein analyst Alexia Howard said that the accounting approach

for valuing discontinued items is different from negotiating deals,

"yet investors understandably see some links between the two,"

pushing the stock down 7.1% on Tuesday.

While it looks for a buyer of that unit, ConAgra faces

additional pressure from activist investor Jana Partners LLC, which

owned 2.7% of ConAgra's stock as of early July, with options that

take its stake to about 7%. In July, ConAgra struck a deal with

Jana to add two members to its board.

The $1.95 billion charge is related to ConAgra's decision to

reclassify the private-label unit as discontinued operations,

because of its plans to exit the business.

In the latest quarter, ended Aug. 30, the overall quarterly loss

for ConAgra was $1.24 billion, or $2.85 a share, compared with a

year-earlier profit of $482.3 million, or $1.12 a share. Stripping

out the loss from discontinued operations and other items, earnings

rose to 45 cents a share from 39 cents. Revenue edged up 1.1% to

$2.79 billion.

In the commercial unit, which includes sales of Lamb Weston

frozen potatoes to restaurants, revenue rose 3.5% to $1.1 billion

as operating profit grew 17% to $139 million.

Write to Annie Gasparro at annie.gasparro@wsj.com and Lisa

Beilfuss at lisa.beilfuss@wsj.com

Access Investor Kit for "ConAgra Foods, Inc."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US2058871029

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 22, 2015 19:45 ET (23:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

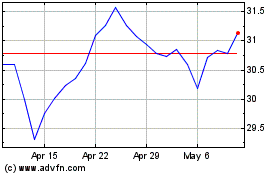

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024