| SECURITIES AND EXCHANGE COMMISSION |

|

| |

|

| Washington, D.C. 20549 |

|

| _______________ |

|

| |

|

| SCHEDULE 13D |

| |

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a) |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. ) |

| |

|

ConAgra Foods,

Inc. |

| (Name of Issuer) |

| |

|

Common Stock,

par value $5.00 per share |

| (Title of Class of Securities) |

| |

|

205887102 |

| (CUSIP Number) |

| |

|

Marc Weingarten, Esq.

Eleazer Klein, Esq. |

| 919 Third Avenue |

| New York, New York 10022 |

|

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

June 8,

2015 |

| (Date of Event which Requires |

| Filing of this Schedule) |

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f)

or 13d-1(g), check the following box. [ ]

NOTE: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

(Continued on following pages)

(Page 1 of 11 Pages)

--------------------------

The information required on the remainder of this cover page shall

not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or

otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP No. 205887102 | 13D | Page 2 of 11 Pages |

| 1 |

NAME OF REPORTING PERSON

JANA PARTNERS LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

30,863,322 Shares (including options to purchase

19,032,000 Shares) |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

30,863,322 Shares (including options to

purchase 19,032,000 Shares) |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

30,863,322 Shares (including options to purchase

19,032,000 Shares) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item

5)

7.2% |

| 14 |

TYPE OF REPORTING PERSON

IA |

| |

|

|

|

|

| CUSIP No. 205887102 | 13D | Page 3 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

BRAD ALFORD |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

PF

(See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

26,500

Shares |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

26,500 Shares |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

26,500 Shares |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item

5)

0.0% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 205887102 | 13D | Page 4 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

JAMES LAWRENCE |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

PF

(See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

515,000 Shares |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

515,000 Shares |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

515,000 Shares |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item

5)

0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 205887102 | 13D | Page 5 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

DIANE DIETZ |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

PF

(See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

36,000 Shares

(including options to purchase 15,000 shares) |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

36,000 Shares (including options to purchase

15,000 shares) |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

36,000 Shares (including options to purchase

15,000 shares) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item

5)

0.0% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 205887102 | 13D | Page 6 of 11 Pages |

| Item 1. |

SECURITY AND ISSUER |

This statement on Schedule 13D relates

to the shares ("Shares") of common stock, par value $5.00 per share, of ConAgra Foods, Inc., a Delaware corporation

(the "Issuer"). The principal executive office of the Issuer is located at One ConAgra Drive, Omaha, NE 68102-5001.

| Item 2. |

IDENTITY AND BACKGROUND. |

(a) This statement is filed by (i) JANA

Partners LLC, a Delaware limited liability company ("JANA"); (ii) Brad Alford ("Mr. Alford");

(iii) James Lawrence ("Mr. Lawrence") and (iv) Diane Dietz ("Ms. Dietz" and together with JANA,

Mr. Alford and Mr. Lawrence, the "Reporting Persons"). JANA is a private money management firm which holds Shares

of the Issuer in various accounts under its management and control. The principal owner of JANA is Barry Rosenstein ("Mr.

Rosenstein" or the "Principal").

(b) The principal business

address of JANA and the Principal is 767 Fifth Avenue, 8th Floor, New York, NY 10153.

(c) The principal business of JANA and

the Principal is investing for accounts under their management. The principal business of Mr. Lawrence is serving as chairman

of Great North Star, LLC, an investment and advisory firm. Mr. Alford is retired. The principal business of Ms. Dietz is consulting services.

(d) Neither the Reporting Persons nor

the Principal has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors).

(e) Neither the Reporting Persons nor

the Principal has, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent

jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to

such laws.

(f) JANA is a limited liability company

organized in Delaware. The Principal, Mr. Alford, Mr. Lawrence and Ms. Dietz are United States citizens.

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION. |

The 31,440,822 Shares reported herein as

beneficially owned by the Reporting Persons were acquired at an aggregate purchase price of approximately $562 million.

JANA used a total of approximately

$540 million (including brokerage commissions) in

the aggregate to acquire the 30,863,322 Shares (including options to purchase 19,032,000 Shares) reported herein as

beneficially owned by JANA. Funds for the purchase of the Shares reported herein as beneficially owned by JANA were derived

from investment funds in accounts managed by JANA. Such Shares are held by the investment funds managed by JANA in cash

accounts and none of the funds used to purchase the Shares reported herein as beneficially owned by JANA were provided

through borrowings of any nature.

| CUSIP No. 205887102 | 13D | Page 7 of 11 Pages |

Mr. Alford used a total of approximately $1

million in the aggregate to acquire the 26,500 Shares reported herein as beneficially owned by him. The Shares reported herein

as beneficially held by Mr. Alford were purchased solely with the personal funds of Mr. Alford and none of the funds used to purchase

the Shares reported herein as beneficially owned by him were provided through borrowings of any nature.

Mr. Lawrence used a total of approximately

$20 million in the aggregate to acquire the 515,000 Shares reported herein as beneficially owned by him. Funds for the purchase

of the Shares reported herein as beneficially owned by Mr. Lawrence were derived from personal funds and margin borrowings described

in the following sentence. Such Shares are held by Mr. Lawrence in a commingled margin account, which may extend margin credit

to Mr. Lawrence from time to time, subject to applicable federal margin regulations, stock exchange rules, and credit policies.

In such instances, the positions held in the margin account are pledged as collateral security for the repayment of debit balances

in the account. The margin account bears interest at a rate based upon the broker's call rate from time to time in effect.

Ms.

Dietz used a total of approximately $1 million in the aggregate to acquire the 36,000 Shares (including options

to purchase 15,000 Shares) reported herein as beneficially owned by her. The Shares reported herein as beneficially held by

Ms. Dietz were purchased solely with the personal funds of Ms. Dietz and none of the funds used to purchase the Shares

reported herein as beneficially owned by her were provided through borrowings of any nature.

| Item 4. |

PURPOSE OF TRANSACTION. |

The Reporting Persons acquired the Shares because

they believe the Shares are undervalued and represent an attractive investment opportunity. JANA believes that the Issuer

has significantly underperformed in shareholder value creation. Most significantly, the acquisition of Ralcorp Inc. in January

2013, which in JANA’s opinion was the most significant recent strategic decision made by the Issuer’s Board

of Directors (the “Board”), has been followed by

disappointing performance for shareholders, repeated guidance misses, negative revisions to long term earnings targets, no dividend

per share growth, and operating performance challenges. Issues with this acquisition led to the Issuer taking a $1.3 billion impairment

on March 26, 2015, after which JANA began purchasing the Shares and analyzing opportunities for improved shareholder value creation.

JANA believes that in the period since the Ralcorp acquisition, the Board has failed to adequately address the

shareholder value destruction and persistent underperformance that followed the Ralcorp acquisition.

JANA is prepared, if necessary, to

nominate Messrs. Alford, Lawrence and Rosenstein (collectively, the “Potential Nominees”) for election to

the Issuer’s board of directors and to participate in the solicitation of proxies in support of the Potential Nominees.

JANA believes that the Potential Nominees possess the necessary expertise, experience and focus on shareholder

value to help the Board evaluate and address opportunities for shareholder value creation, including but not limited to:

undertaking a strategic review of the Issuer’s strategy and corporate structure to determine if its businesses

are optimally positioned to succeed, as well as various potential alternative transactions and structures; addressing the

Issuer’s operational performance and cost structure; and optimizing the Issuer’s capital allocation policies and

capital structure. JANA has requested, however, that the Issuer delay the June 21, 2015, deadline to

submit notice of stockholder nominations for the Issuer’s 2015 annual meeting of stockholders (the “Annual

Meeting”) in order to give the Issuer and JANA more time to have collaborative discussions regarding the steps JANA

believes the Issuer should take to maximize shareholder value, as well as why JANA believes stockholders would benefit from

the addition of the Potential Nominees to the Board.

| CUSIP No. 205887102 | 13D | Page 8 of 11 Pages |

Mr. Lawrence is the former Chairman of Rothschild

North America and former CFO of both Unilever, plc and General Mills, Inc. Mr. Alford is the former CEO of Nestlé

USA. Mr. Rosenstein is the Managing Partner of JANA. In addition, JANA has retained Diane Dietz, who is the former

Chief Marketing and Merchandising Officer of Safeway Inc. and had responsibility for all product categories, supply chain and Safeway’s

$7 billion private label program, to provide consulting services with respect to analyzing the Issuer’s performance and opportunities.

Messrs. Lawrence and Alford and Ms. Dietz have all made significant personal investments in the Shares totaling over $21 million.

The Reporting

Persons may also take other steps to increase shareholder value as well as pursue other plans or proposals that relate to or would

result in any of the matters set forth in subparagraphs (a)-(j) of Item 4 of Schedule 13D, excluding (i) acquiring a control stake

in the Issuer’s Shares, or grouping with any other party or parties to do so, (ii) engaging in an extraordinary transaction,

such as a merger, with the Issuer, or acquiring a material amount of the Issuer’s assets, or grouping with any other party

or parties to do either, or (iii) seeking to exert negative control over the important corporate actions of the Issuer, or grouping

with any other party or parties to do so, although the Reporting Persons may seek to influence such actions through customary

means, including presenting its views for consideration to the Issuer, shareholders and other interested parties, privately or

publicly, and, if necessary, through the exercise of its shareholder rights including the right to propose new directors for the

Issuer’s board of directors.

Depending on various factors including,

without limitation, the Issuer's financial position and strategic direction, the outcome of the discussions and actions referenced

above, actions taken by the Issuer's board of directors, price levels of the Shares, other investment opportunities available

to the Reporting Persons, conditions in the securities market and general economic and industry conditions, the Reporting Persons

may in the future take such actions with respect to their investment position in the Issuer as they deem appropriate including,

without limitation, purchasing additional Shares or selling some or all of their Shares, and/or engaging in short selling of or

hedging or similar transactions with respect to the Shares.

| CUSIP No. 205887102 | 13D | Page 9 of 11 Pages |

| Item 5. |

INTEREST IN SECURITIES OF THE COMPANY. |

(a) The aggregate percentage of Shares

reported to be beneficially owned by the Reporting Persons is based upon 427,052,296 Shares outstanding, which is the total number

of Shares outstanding as of February 22, 2015, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly period

ended February 22, 2015, filed with the SEC on March 30, 2015.

As of the close of business on

the date hereof, JANA may be deemed to beneficially own 30,863,322 Shares (including options to purchase 19,032,000

Shares), constituting approximately 7.2% of the Shares outstanding.

As of the close of business on the date

hereof, Mr. Alford may be deemed to beneficially own 26,500 Shares, constituting approximately 0.0% of the Shares outstanding.

As of the close of business on the date

hereof, Mr. Lawrence may be deemed to beneficially own 515,000 Shares, constituting approximately 0.1% of the Shares outstanding.

As of the close of business on the

date hereof, Ms. Dietz may be deemed to beneficially own 36,000 Shares (including options to purchase 15,000 Shares),

representing approximately 0.0% of the Shares outstanding.

By virtue of the Nominee

Agreements and the Consulting Agreement (as defined and described in Item 6 below), JANA, each of the Independent Nominees

and Ms. Dietz may be deemed to have formed a "group" within the meaning of Section 13(d)(3) of the Exchange Act and

may be deemed to beneficially own an aggregate of 31,440,822 Shares (including options to purchase 19,047,000 Shares),

representing approximately 7.4% of the outstanding Shares. Each Nominee expressly disclaims beneficial ownership of the

Shares beneficially owned by JANA, each other Nominee and Ms. Dietz and JANA expressly disclaims beneficial ownership of

the Shares beneficially owned by each Nominee and Ms. Dietz. Ms. Dietz expressly disclaims beneficial ownership of

the Shares beneficially owned by JANA and each Nominee.

(b) JANA has sole voting and

dispositive power over 30,863,322 Shares (including options to purchase 19,032,000 Shares), which power is exercised by the

Principal. Mr. Alford has sole voting and

| CUSIP No. 205887102 | 13D | Page 10 of 11 Pages |

dispositive power over the 26,500 Shares beneficially owned by him.

Mr. Lawrence has sole voting and dispositive power over the 515,000 Shares beneficially owned by him. Ms. Dietz has sole

voting and dispositive power over the 36,000 Shares (including options to purchase 15,000 Shares) beneficially owned by

her.

(c) Information concerning transactions

in the Shares effected by the Reporting Persons during the past sixty days is set forth in Exhibit A hereto and is incorporated

herein by reference. All of the transactions in Shares listed hereto were effected in the open market through various brokerage

entities.

(d) No person (other than the Reporting

Persons) is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale

of, the Shares.

(e) Not applicable.

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER. |

Messrs. Alford and Lawrence (each an

"Independent Nominee") have each entered into a nominee agreement (the "Nominee Agreement") with

JANA substantially in the form attached as Exhibit B to this Schedule 13D whereby each Independent Nominee agreed, if JANA

so elects, to become a member of a slate of nominees (the "Slate") and stand for election as a director of the

Issuer. Pursuant to each Nominee Agreement, JANA has agreed to pay the costs of soliciting proxies in connection with the Annual

Meeting, and to defend and indemnify each Independent Nominee against, and with respect to, any losses that may be incurred by

them in the event they become a party to litigation based on their nomination as a candidate for election to the Board and the solicitation of proxies in support of their election. Each Independent Nominee will receive compensation under

the Nominee Agreement in the amount of $90,000 in the event that he serves on the Slate until the Annual Meeting (or the earlier

abandonment of the proxy solicitation), and an additional $140,000 in the event of his appointment or election. A copy of the form

of the Nominee Agreement is attached as Exhibit B and is incorporated by reference herein.

JANA also entered into a

consulting agreement (the "Consulting Agreement") pursuant to which Ms. Dietz agreed to provide analysis of

the Issuer and certain related services. JANA shall pay Ms. Dietz a one-time fee in the amount of $90,000. The Consulting

Agreement permits Ms. Dietz to buy Shares as long as Ms. Dietz agrees to hold such Shares until the earlier of (i) the

conclusion of the Annual Meeting or (ii) the termination of the Proxy Solicitation. A copy of the Consulting

Agreement is attached as Exhibit C and is incorporated by reference herein.

JANA beneficially owns (i) 21,178

call options with a strike price of $33 which expire on July 17, 2015, (ii) 89,242 call options with a strike price of $33

which expire on July 24, 2015, (iii) 24,900 call options with a strike price of $34 that expire on July 31, 2015, (iv) 40,000

call options with a strike price of $34 that expire on August 5, 2015, and (v) 15,000 call options with a strike price of $34

that expire on August 7, 2015, for a total of call options for 19,032,000 Shares.

Ms. Dietz beneficially owns 150

call options with a strike price of $38 which expire on July 17, 2015.

Except as otherwise set forth herein

and the joint filing agreement attached hereto as Exhibit D, the Reporting Persons have no contracts, arrangements, understandings

or relationships with any person with respect to the securities of the Issuer.

| CUSIP No. 205887102 | 13D | Page 11 of 11 Pages |

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS. |

| Exhibit A: |

Transactions in the Shares During the Last 60 Days. |

| Exhibit B: |

Form of Nominee Agreement |

| Exhibit C: |

Consulting Agreement |

| Exhibit D: |

Joint Filing Agreement, dated June 18, 2015 |

| CUSIP No. 205887102 | 13D | Page 12 of 11 Pages |

SIGNATURES

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: June 18, 2015

| |

JANA PARTNERS LLC |

| |

|

|

| |

|

|

| |

By: |

/s/ Jennifer Fanjiang |

| |

Name: |

Jennifer Fanjiang |

| |

Title: |

General Counsel |

| |

|

| |

|

| |

/s/ Brad Alford |

| |

BRAD ALFORD |

| |

|

| |

|

| |

/s/ James Lawrence |

| |

JAMES LAWRENCE |

| |

|

| |

|

| |

/s/ Diane Dietz |

| |

DIANE DIETZ |

|

| |

|

|

|

| |

|

|

|

EXHIBIT A

Transactions in Shares of the Issuer During

the Last 60 Days

The following table sets forth all transactions

in the Shares effected in the past sixty days by the Reporting Persons. Except as otherwise noted, all such transactions were effected

in the open market through brokers and the price per share is net of commissions.

JANA

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

| 4/20/2015 |

200,000 |

37.62 |

| 4/20/2015 |

192,765 |

37.72 |

| 4/20/2015 |

25,000 |

37.78 |

| 4/21/2015 |

180,060 |

37.68 |

| 4/22/2015 |

103,840 |

37.52 |

| 4/23/2015 |

72,956 |

37.60 |

| 4/24/2015 |

73,809 |

37.53 |

| 4/27/2015 |

71,585 |

37.35 |

| 4/30/2015 |

5,300 |

36.09 |

| 4/30/2015 |

100,000 |

36.10 |

| 5/1/2015 |

133,336 |

36.41 |

| 5/4/2015 |

93,679 |

37.10 |

| 5/5/2015 |

114,007 |

37.00 |

| 5/6/2015 |

145,723 |

36.99 |

| 5/7/2015 |

101,546 |

37.38 |

| 5/8/2015 |

50,000 |

37.58 |

| 5/11/2015 |

81,573 |

37.43 |

| 5/12/2015 |

80,600 |

37.59 |

| 5/13/2015 |

1,700 |

37.85 |

| 5/15/2015 |

18,900 |

38.07 |

| 5/15/2015 |

13,600 |

38.11 |

| 5/15/2015 |

147,300 |

38.34 |

| 5/18/2015 |

64,213 |

38.58 |

| 5/18/2015 |

68,106 |

38.59 |

| 5/18/2015 |

79,800 |

38.62 |

| 5/19/2015 |

16,381 |

38.41 |

| 5/19/2015 |

149,059 |

38.49 |

| 5/20/2015 |

267,326 |

38.87 |

| 5/20/2015 |

34,585 |

38.92 |

| 5/21/2015 |

142,390 |

38.89 |

| 5/21/2015 |

286,400 |

38.91 |

| 5/22/2015 |

8,300 |

38.85 |

| 5/22/2015 |

195,654 |

38.86 |

| 5/26/2015 |

48,703 |

38.93 |

| 5/26/2015 |

52,719 |

38.94 |

| 5/27/2015 |

40,843 |

38.68 |

| 5/28/2015 |

91,367 |

38.68 |

| 5/29/2015 |

100,000 |

38.67 |

| 6/1/2015 |

99,829 |

38.78 |

| 6/2/2015 |

80,783 |

38.03 |

| 6/2/2015 |

46,300 |

38.08 |

| 6/3/2015 |

28,762 |

38.43 |

| 6/5/2015 |

42,000 |

37.67 |

| 6/8/2015 |

164,400 |

37.65 |

| 6/9/2015 |

173,434 |

37.79 |

| 6/9/2015 |

89,900 |

38.00 |

| 6/10/2015 |

28,467 |

38.00 |

| 6/10/2015 |

126,133 |

38.04 |

| 6/10/2015 |

345,400 |

38.11 |

| 6/11/2015 |

152,600 |

38.30 |

| 6/12/2015 |

200,000 |

38.04 |

| 6/15/2015 |

149,533 |

37.98 |

| 6/15/2015 |

146,571 |

38.00 |

| 6/16/2015 |

6,780 |

38.18 |

| 6/16/2015 |

490,720 |

38.19 |

| 6/16/2015 |

52,500 |

38.66 |

| 6/17/2015 |

15,001 |

38.49 |

| 6/17/2015 |

199,700 |

38.85 |

| 6/18/2015 |

9,000 |

38.92 |

| 6/18/2015 |

422,000 |

38.99 |

| |

|

|

Mr. Alford

| Trade Date |

Amount Acquired (Sold) |

Price Per Share ($)[1] |

| 06/09/2015 |

26,500 |

37.75 |

Mr. Lawrence

| Trade Date |

Amount Acquired (Sold) |

Price Per Share ($)[2] |

| 06/03/2015 |

515,000 |

38.40 |

Ms. Dietz

| Trade Date |

Amount Acquired (Sold) |

Price

Per Share ($) |

| 06/09/2015 |

15,000 |

38.05 |

| 06/09/2015 |

3,000 |

38.09 |

| 06/15/2015 |

3,000 |

37.94 |

[1]

The price reported is a weighted average price. These shares were purchased in multiple transactions at prices ranging from

$37.65 to $37.88, inclusive. The Reporting Persons undertake to provide to the Issuer, any security holder of the Issuer, or

staff of the SEC, upon request, full information regarding the number of shares acquired at each price within the range set

forth herein.

[2]

The price reported is a weighted average price. These shares were purchased in multiple transactions at prices ranging from

$38.10 to $38.64, inclusive. The Reporting Persons undertake to provide to the Issuer, any security holder of the Issuer, or

staff of the SEC, upon request, full information regarding the number of shares acquired at each price within the range set

forth herein.

EXHIBIT B

Form of Nominee Agreement

AGREEMENT

1.

This Nomination Agreement (the “Agreement”), is by and between JANA Partners LLC (“JANA,”

“we” or “us”) and ___ (“you”).

2.

You agree that you are willing, should we so elect, to become a member of a slate of nominees (the “Slate”)

of a JANA affiliate (the “Nominating Party”) which nominees shall stand for election as directors of ConAgra Foods,

Inc. (“ConAgra”) in connection with a proxy solicitation (the “Proxy Solicitation”) to be conducted in

respect of the 2015 annual meeting of stockholders of ConAgra (including any adjournment or postponement thereof or any

special meeting held in lieu thereof, the “Annual Meeting”) or appointment or election by other means. You further

agree to serve as a director of ConAgra if so elected or appointed. JANA agrees on behalf of the Nominating Party to pay the costs

of the Proxy Solicitation. JANA also agrees on behalf of the Nominating Party to pay you, (i) $90,000 within three (3) business

days of the date hereof and (ii) in the event that you are appointed or elected and serve as a director of ConAgra, $140,000 within

three (3) business days of such appointment or election, provided that in the case of clauses (i) and (ii) you agree that an amount

equal to the estimated after-tax proceeds of such compensation (assuming a combined federal, state and city tax rate of 45%, rounded

to the nearest whole dollar) will be invested in the common stock of ConAgra within five (5) business days of receipt (or such

longer period as may be required to comply with any legal or regulatory requirements, or in the case of clause (ii) to comply with

the policies of the board of directors of ConAgra (the “Board”)). You agree to hold any securities purchased by you

in accordance with this paragraph (i) in the event you are chosen by JANA to become a member of the Slate and are appointed or

elected as a director of ConAgra pursuant to this Agreement, until at least the later of (A) the first date as of which you are

no longer a director of ConAgra and (B) three (3) years from the date of such appointment or election (or if earlier, the date

of any merger or sale which has been approved if applicable by the Board and shareholders), (ii) in the event you are chosen by

JANA to become a member of the Slate but are not appointed or elected as a director of ConAgra, until at least the earlier of (A)

the conclusion of the Annual Meeting and (B) the termination of the Proxy Solicitation, or (iii) in the event you are not chosen

by JANA to become a member of the Slate, until at least the earlier of (A) public announcement of the nomination by JANA or the

Nominating Party of a Slate or (B) the termination of the Proxy Solicitation, provided, however, that JANA agrees to promptly notify

you of its decision to terminate the Proxy Solicitation. You understand and agree that the compensation described in this paragraph

may not be paid to you, or that you may be required to refund such compensation, in the event that this Agreement is terminated

by JANA for Cause. “Cause” shall mean (i) fraud or willful misconduct by you as determined by a court of competent

jurisdiction in an action to which you are a party, (ii) a material violation by you of applicable laws as determined by a court

of competent jurisdiction in an action to which you are a party, or (iii) your refusal to serve as a nominee for the Board or seated

as a member of the Board.

3.

JANA agrees on behalf of the Nominating Party that it will defend, indemnify and hold you harmless from and against any

and all losses, claims, damages, penalties, judgments, awards, settlements, liabilities, costs, expenses and disbursements (including,

without limitation, reasonable attorneys' fees, costs, expenses and disbursements) incurred by you in the event that you become

a party or are threatened to be made a party to, or are called to give evidence in, any civil, criminal, administrative or arbitrative

action, suit or proceeding,

and any appeal thereof, (i) relating to your role as a nominee for director of ConAgra on the Slate, or (ii) otherwise arising

from or in connection with or relating to the Proxy Solicitation. JANA will advance on your behalf, any and all expenses (including,

without limitation, reasonable attorneys' fees, costs, expenses and disbursements) actually and reasonably incurred by you in such

action, regardless of whether you are ultimately determined to be entitled to such indemnification or advancement of expenses,

provided that, if you are ultimately determined not to be entitled to indemnification under this Agreement for such expenses, you

will reimburse JANA for such expenses. Your right of indemnification hereunder shall continue after the Annual Meeting has taken

place but only for events that occurred prior to the conclusion of the Annual Meeting and on or after the date hereof. Anything

to the contrary herein notwithstanding, JANA is not indemnifying you for any action taken by you or on your behalf that occurs

prior to the date hereof or for any actions taken by you as a director of ConAgra, if you are elected. Nothing herein shall be

construed to provide you with indemnification (i) if you are found by a court of competent jurisdiction in an action to which you

are a party to have engaged in a violation of any provision of state or federal law in connection with the Proxy Solicitation,

unless you demonstrate that your action was taken in good faith and in a manner you reasonably believed to be in or not opposed

to the best interests of electing the Slate; (ii) if you are found by a court of competent jurisdiction in an action to which you

are a party to have, in connection with the Proxy Solicitation, acted in a manner that constitutes gross negligence or willful

misconduct; or (iii) if you are found by a court of competent jurisdiction in an action to which you are a party to have provided

false or misleading information, or omitted material information, in the JANA Questionnaire (as defined below) or to JANA otherwise

in connection with the Proxy Solicitation. You shall promptly notify JANA in writing in the event of any third-party claims actually

made against you or known by you to be threatened if you intend to seek indemnification hereunder in respect of such claims (provided

that your failure to promptly notify JANA shall not relieve JANA from any liability it may have under this Agreement except to

the extent JANA shall have been materially prejudiced by such failure). In addition, upon your delivery of notice with respect

to any such claim, JANA shall promptly assume control of the defense of such claim with counsel chosen by JANA, which counsel shall

be reasonably acceptable to you, provided, however, if such counsel has a conflict as reasonably determined by your counsel or

if the subject matter of the claim includes claims that could result in criminal liability or regulatory discipline for you, you

will be allowed to conduct the defense of such claim with the counsel of your choosing, which counsel shall be reasonably acceptable

to JANA, provided, further, that in such case JANA will pay on your behalf, in advance, any and all expenses (including, without

limitation, reasonable attorneys' fees, costs, expenses and disbursements) actually and reasonably incurred by you in connection

with such defense, regardless of whether you are ultimately determined to be entitled to such indemnification or advancement of

expenses. JANA shall not be responsible for any settlement of any claim against you covered by this indemnity without its prior

written consent. However, JANA may not enter into any settlement of any such claim without your consent unless such settlement

includes (i) no admission of liability or guilt by you, (ii) no request to act or refrain from acting in a particular way and (iii)

an unconditional release of you from any and all liability or obligation in respect of such claim. If you are required to enforce

the obligations of JANA in this Agreement in a court of competent jurisdiction in an action to which you are a party, or to recover

damages for breach of this Agreement, JANA will pay on your behalf, in advance, any and all expenses (including, without limitation,

reasonable attorneys' fees, costs, expenses and disbursements) actually and reasonably incurred by you in such action, regardless

of whether you are ultimately determined to be entitled to such indemnification or advancement of expenses.

4.

You understand that it may be difficult, if not impossible, to replace a nominee who, such as yourself, has agreed to serve

on the Slate and, if elected, as a director of ConAgra if such nominee later changes his mind and determines not to serve on the

Slate or, if elected, as a director of ConAgra. Accordingly, JANA is relying upon your agreement to serve on the Slate and, if

elected, as a director of ConAgra. In that regard, you will be supplied with a questionnaire (the “JANA Questionnaire”)

in which

you will provide JANA with

information necessary for the Nominating Party to make appropriate disclosure to ConAgra and to use in creating the proxy solicitation

materials to be sent to stockholders of ConAgra and filed with the Securities and Exchange Commission in connection with the Proxy

Solicitation.

5.

You agree that (i) upon request you will promptly complete, sign and return the JANA Questionnaire, (ii) your responses

in the JANA Questionnaire will be true, complete and correct in all respects, and (iii) you will provide any additional information

related to the Proxy Solicitation as may be reasonably requested by JANA. In addition, you agree that you will execute and return

a separate instrument confirming that you consent to being nominated for election as a director of ConAgra and, if elected, consent

to serving as a director of ConAgra. Upon being notified that you have been chosen, we and the Nominating Party may forward your

consent and completed JANA Questionnaire (or summary thereof), to ConAgra, and we and the Nominating Party may at any time, in

our and their discretion, disclose the information contained therein, as well as the existence and contents of this Agreement.

Furthermore, you understand that we may elect, at our expense, to conduct a background and reference check on you and you agree

to complete and execute any necessary authorization forms or other documents required in connection therewith, provided, however,

should we elect to conduct such background and/or reference check we shall keep the results of such background and/or reference

check in the strictest of confidence.

6.

You further agree that, subject to any obligation you may have to comply with law, rules, regulation or legal process relating

to the Proxy Solicitation, (i) you will treat confidentially all information relating to the Proxy Solicitation which is non-public,

confidential or proprietary in nature; (ii) you will not issue, publish or otherwise make any public statement or any other form

of public communication relating to ConAgra or the Proxy Solicitation without the prior approval of JANA; and (iii) you will not

agree to serve, or agree to be nominated to stand for election by ConAgra or any other stockholder of ConAgra (other than JANA),

as a director of ConAgra without the prior approval of JANA.

7.

In addition to the purchases of common stock of ConAgra set forth in the first paragraph above, you may invest in additional

securities of ConAgra. With respect to any purchases made pursuant to the first paragraph above or this paragraph, (i) you agree

to consult with JANA regarding such purchases and provide necessary information so that we may comply with any applicable disclosure

or other obligations which may result from such investment and (ii) JANA or its affiliates shall prepare and complete any required

disclosures including all regulatory filings related thereto at no cost to you. With respect to any purchases made pursuant to

this paragraph you agree not to dispose of any such securities prior to the termination of this Agreement.

8.

Each of us recognizes that should you be elected or appointed to the Board all of your activities and decisions as a director

will be governed by applicable law and subject to your fiduciary duties, as applicable, to ConAgra and to the stockholders of ConAgra

and, as a result, that there is, and can be, no agreement between you and JANA that governs the decisions which you will make as

a director of ConAgra.

9.

This Agreement shall automatically terminate on the earliest to occur of (i) the conclusion of the Annual Meeting, (ii)

your election or appointment to the Board, (iii) the termination of the Proxy Solicitation or (iv) our election to not include

you as part of the Slate, provided, however, that the second

and third, JANA’s

confidentiality obligations in the fifth, and the eighth, tenth and eleventh paragraphs of this Agreement shall survive such termination.

10.

This Agreement sets forth the entire agreement between JANA and you as to the subject matter contained herein, and cannot

be amended, modified or terminated except by a writing executed by JANA and you.

11.

This Agreement shall be governed by the laws of the State of New York, without regard to the principles of the conflicts

of laws thereof. The parties agree to the exclusive jurisdiction of the state and federal courts of New York, New York, and waive,

and agree not to plead or to make, any claim that any action or proceeding brought in the state and federal courts of New York,

New York has been brought in an improper or inconvenient forum.

[Signature Page Follows]

Agreed to as of the date both parties have signed:

JANA PARTNERS LLC

By:

Name:

Title:

Date:

___________________________

Name:

Date:

EXHIBIT C

Form of Consulting Agreement

CONSULTING AGREEMENT

This Consulting

Agreement (the "Agreement"), dated as of June 9, 2015, is by and between JANA Partners LLC ("JANA") and

Diane Dietz (the "Consultant") (each a "Party" and collectively, the "Parties").

WHEREAS, JANA desires

to retain the services of the Consultant to provide analysis of ConAgra Foods, Inc. (the “Company”) and related services

(the “Services”) in accordance with the following terms and conditions, and the Consultant desires to be retained by

JANA to provide such Services.

NOW THEREFORE, in

consideration of the covenants and conditions set forth herein, the Parties, intending to be legally bound, hereby agree as follows:

1.

Term. Effective as of the date hereof, JANA shall engage the Consultant to provide

the Services for a term beginning on the date hereof and ending upon the earlier of (a) one (1) year and (b) notice of termination

of the Services from JANA to the Consultant.

2.

Fees and Expenses. JANA shall pay the Consultant a one-time fee for the Services of

$90,000 (the “Consulting Fee”) within ten (10) business days of the date hereof. The Consultant will be responsible

for all business expenses associated with the Services, provided however that JANA will reimburse the Consultant for pre-approved

travel expenses.

3.

Communications. All public statements, regulatory filings or communications,

contacts with Company directors and management and related activity with respect to the Company will be made and conducted by JANA

with the assistance of the Consultant as requested by JANA.

4.

Form 1099. JANA shall issue an Internal Revenue Service Form 1099 to the Consultant

to account for the Consulting Fee.

5.

Independent Contractor. The Consultant and her agents and representatives (collectively,

the “Consultant Group”) are and shall be deemed for all purposes to be independent contractors. This Agreement

is not an employment contract. Consequently, the Consulting Fee shall not be deemed to be wages, and therefore, shall not be subject

to any withholdings or deductions. The Consultant shall be responsible for all tax payments, estimated tax payments or other tax

liabilities. Nothing contained herein shall be construed to create a relationship of employer and employee between JANA and any

of the Consultant Group. The Consultant shall have the sole discretion to determine the manner and means by which she shall perform

the Services, the hours of work, and when and where such Services are to be performed. As an independent contractor, none of the

Consultant Group is entitled to any employee benefits provided to JANA's employees, such as health insurance, pension benefits,

workers' compensation, unemployment insurance, or any similar benefit.

6.

Services Non-Exclusive. The Services to be provided by the Consultant hereunder are

not and shall not be deemed to be exclusive to JANA, and the Consultant shall be free to render similar services to others and

to engage in all such activities as the Consultant deems appropriate, provided that the Consultant's performance

hereunder is not impaired by such other activities.

7.

Non-Public Information. The Consultant agrees that she shall not and shall cause the

Consultant Group to not disclose any non-public information which may be deemed material, including but not limited to financial

projections and information regarding potential strategic transactions, regarding any company or government entity obtained

(i) in the course of any employment (whether permanent, temporary, through a consulting or contractor agreement, or otherwise)

by such company or other entity or (ii) as a result of any communications with employees or representatives of such company or

entity or with any other party which are subject to any non-disclosure or confidentiality obligation.

8.

Confidential Information. The Consultant acknowledges that, during the Term, the Consultant

Group may have access to and may acquire Confidential Information (as defined below) regarding the business of JANA, its

affiliates and affiliated funds, accounts and co-investment vehicles (the "JANA Entities"). Accordingly, the Consultant

agrees that, without the prior written consent of JANA, the Consultant shall not and shall cause the Consultant Group to not, at

any time, disclose to any unauthorized person or otherwise use any such Confidential Information for any reason other than the

business of the JANA Entities. If any of the Consultant Group is served with legal process (such as a subpoena) that (i) may touch

upon, concern, or arise out of Confidential Information or (ii) otherwise require the Consultant to disclose any Confidential Information,

the Consultant will immediately notify JANA in writing, furnish JANA with a copy of such legal process and reasonably cooperate

with JANA to protect the Confidential Information. None of the Consultant Group shall in any event disclose any portion of the

Confidential Information not required to be disclosed in connection with such legal process. "Confidential Information"

means non-public information concerning JANA’s past, current or potential portfolio names, portfolio composition, or plans

with respect to the Company.

9.

Investments in Company Stock. With respect to any purchases made by the Consultant

of securities of the Company prior to the termination of the Services, (i) the Consultant agrees to consult with JANA regarding

such purchases and provide necessary information so that JANA may comply with any applicable disclosure or other obligations

which may result from such investment, (ii) JANA or its affiliates shall prepare and complete any required disclosures including

all regulatory filings related thereto at no cost to the Consultant, and (iii) the Consultant agrees to hold any such securities

until at least the earlier of (A) the conclusion of the 2015 annual meeting of stockholders of the Company (including any adjournment

or postponement thereof or any special meeting held in lieu thereof, the “Annual Meeting”) and (B) the termination

of a proxy solicitation by JANA or any of its affiliates, if any is commenced, in respect of the Annual Meeting.

10.

Governing Law, Venue and Jurisdiction. This Agreement will be governed by and construed

in accordance with the laws of the State of New York, without giving effect to the principles of conflicts of laws. All

disputes arising out of or related to this Agreement shall be

submitted to the

state and federal courts of New York, and each Party irrevocably consents to such personal jurisdiction and waives all objections

thereto, but does so only for the purposes of this Agreement.

11.

Assignability. This Agreement, and the rights and obligations hereunder, may not be

assigned by either Party without the express written consent of the other Party.

12.

Entire Agreement; Amendment. This Agreement may be amended only by a written instrument

signed by the Parties. This Agreement contains the entire agreement between the Parties with respect to the subject matter hereof

and supersedes all prior agreements and understandings, oral or written, between the Parties with respect to the subject matter

of this Agreement.

13.

Survival. The Parties acknowledge that Sections 5, 6, 7, 8, 9, 10, 11, 12 and 13 of

this Agreement shall survive the termination of the Agreement and/or the Consultant's Services.

14.

Counterparts. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original

but all of which together shall constitute one and the same instrument, and it shall not be necessary in making proof of this Agreement

to produce or account for more than one such counterpart.

IN WITNESS WHEREOF, the Parties have executed this Agreement

as of the date and year first above written.

| JANA Partners LLC |

|

|

| |

|

|

| |

|

|

| |

|

|

| By: |

/s/ Charles Penner |

|

/s/ Diane Dietz |

|

| Name: Charles Penner |

|

|

| Title: Chief Legal Officer |

|

|

| |

|

|

| |

|

|

|

|

EXHIBIT D

Joint Filing Agreement, dated June 18,

2015

PURSUANT TO RULE 13d-1(k)

The undersigned

acknowledge and agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all

subsequent amendments to this statement on Schedule 13D may be filed on behalf of each of the undersigned without the

necessity of filing additional joint filing agreements. The undersigned acknowledge that each shall be responsible for the

timely filing of such amendments, and for the completeness and accuracy of the information concerning him, her or it

contained herein and therein, but shall not be responsible for the completeness and accuracy of the information concerning

the others, except to the extent that he, she or it knows that such information is inaccurate.

Dated: June 18, 2015

| |

JANA PARTNERS LLC |

| |

|

|

| |

|

|

| |

By: |

/s/ Jennifer Fanjiang |

| |

Name: |

Jennifer Fanjiang |

| |

Title: |

General Counsel |

| |

|

| |

|

| |

|

| |

/s/ Brad Alford |

| |

Brad Alford |

| |

|

| |

|

| |

|

| |

/s/ James Lawrence |

| |

James Lawrence |

| |

|

| |

|

| |

|

| |

/s/ Diane Dietz |

| |

Diane Dietz |

| |

|

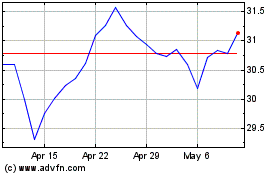

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024