Dalian Wanda Nears Higher Buyout Offer for Property Arm

May 05 2016 - 7:30AM

Dow Jones News

Chinese property-and-entertainment conglomerate Dalian Wanda

Group Co. is close to announcing a sweetened offer for its $4

billion-plus commercial-property arm buyout to woo investors, which

include sovereign-wealth fund Kuwait Investment Authority and China

Life Insurance Group Co.

Wanda, controlled by Chinese billionaire Wang Jianlin, is likely

to raise the offer for Hong Kong-listed Dalian Wanda Commercial

Properties Co. by about 10%, according to people familiar with the

matter. The original buyout price of at least HK$48, which was 24%

above the last trading price before the offer was announced, is the

same price that investors paid in Wanda Commercial's initial public

offering in December 2014.

Founders of U.S.-listed Chinese companies are buying out their

shareholders at an unprecedented rate with a plan to later sell

those shares to local Chinese investors at a higher valuation. But

as the privatization wave reaches closer to home, those deals are

facing more uncertainty. Hong Kong's takeover rules are more

friendly to minority shareholders than those in the U.S., where

Chinese companies are often listed as Cayman Island holding

companies and sell American depositary receipts.

"Practical hurdles for the deal look high," Oscar Choi, an

analyst who covers the company for Citigroup Inc., said in a

report. Wanda would need 90% of shareholders to accept the tender

offer and more than 75% of the number of shareholders attending the

vote to accept it, he said. Opposition to the deal must be less

than 10% of the voter head count.

Wanda needs to convince a number of large investors who bought

shares at the time of the IPO, known as cornerstone investors, who

hold about half of the shares offered in the original listing.

Kuwait Investment Authority holds 8.07% of Wanda Commercial's

shares, according to the company's latest filing to the Hong Kong

stock exchange, followed by China Life, which owns 7.42%. BlackRock

is another significant investor, with a 6.78% stake.

Wanda Commercial's existing investors have been demanding better

terms for the buyout offer, according to people familiar with the

situation, after they learned that Wanda had told investors joining

the going private deal that they could triple their money when it

lists domestically.

Before trading in Wanda Commercial's shares was halted on April

22, the stock traded above the offer price in an indication that

shareholders expected a sweetened bid. The stock, which last closed

at HK$51.30, had traded at around 20% below its IPO price earlier

this year as its business took a hit from a glut of shopping malls

in China and the growing popularity of online shopping.

This would mark at least the second attempt by Wanda to float

its commercial-property arm domestically. Wanda first tried listing

it at home before the Hong Kong IPO in late 2014. Wanda resubmitted

its application to China's securities regulator on Sept. 2,

official records show. Wanda could consider a backdoor listing if

it wants to skip the line—China has 768 companies in the listing

pipeline as of the end of April. A backdoor listing, however, could

trigger other legal complexities, such as obtaining special

approval for having foreign shareholders, lawyers and bankers said.

An A-share IPO would be the most straightforward route to a

domestic listing if allowed by regulators.

A raised offer for Wanda Commercial means investors joining

Wanda's buyout bid might have to accept a lower return. Initially,

Wanda said if it failed to list the company in the A-share market

within two years after delisting, it will buy back shares from

offshore investors at a price giving them a 12% annualized return,

and from domestic investors at an annual return of 10%, according

to an offering document viewed by The Wall Street Journal. The

increased buyout bid will result in the company cutting the

promised return to 10% for investors outside China and to 8% for

investors inside China, according to a person familiar with the

matter.

These buyout deals are being fueled with debt and money from

local investors hungry for pieces of overseas-listed business seen

as higher quality than companies currently for sale on the local

exchanges. Wanda is tapping large institutional investors, both in

and outside China, as well as private wealth money to fund the

buyout, according to people familiar with the situation.

At least one rating agency is concerned about Wanda Group taking

on more debt. Fitch Ratings said in April that its ratings on

Wanda's commercial-property arm, which has bonds due in 2018 and

2024, might come under pressure if an offer to take the company

private by its parent was completed.

"The privatization, if successful, will increase Wanda Group's

leverage and further weaken its financial profile after it made a

series of aggressive acquisitions since 2014," Vicki Shen, director

at Fitch, said in a note. "Wanda's ratings would come under

pressure if the formal offer does not provide sufficient

ringfencing for Wanda from the group and because of less

transparency after the delisting."

Write to Wei Gu at wei.gu@wsj.com

(END) Dow Jones Newswires

May 05, 2016 07:15 ET (11:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

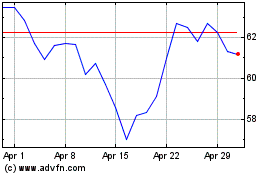

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

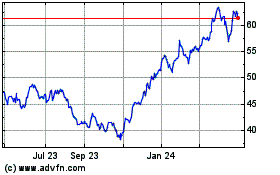

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024