Global Stocks Climb

October 12 2015 - 4:50AM

Dow Jones News

Global stocks edged higher Monday following a week of strong

gains for financial markets.

The Stoxx Europe 600 rose 0.2% in early trade, led by a 0.8%

rise in Germany's DAX index.

Chinese shares saw strong gains earlier Monday amid signs of

reform in the telecommunications sector and stimulus measures from

Beijing. The Shanghai Composite was up over 4% and Hong Kong's Hang

Seng Index rose 0.7%. Japan's markets were closed for a

holiday.

The moves come after a sharp rally in global stocks last week

following a rebound in oil prices and the prospect of continued

accommodative policy from the U.S. Federal Reserve.

Wall Street stocks ended higher Friday, sending the Dow Jones

Industrial Average to its best weekly performance since February on

gains in energy companies and expectations for a prolonged period

of ultralow U.S. interest rates. Low interest rates in the U.S.

have boosted global stock markets over the past several years.

"Markets are boosted by the prospect of no rate increase,

despite the fact that this suggests that the economy is therefore

weaker than previously thought," said Craig Erlam, senior market

analyst at Oanda.

At a meeting of the International Monetary Fund over the

weekend, central bank officials urged the Federal Reserve to

proceed with its rate increase in order to reduce uncertainty. Fed

Vice Chairman Stanley Fischer said Sunday that the U.S. central

bank is taking a cautious approach in light of developments

overseas and the effect of higher interest rates on emerging

markets.

Looking ahead, investors are awaiting key economic data releases

later in the week including retail sales and consumer prices

data.

Meanwhile, the third-quarter earnings season is set to continue

with major financial firms J.P. Morgan Chase & Co, Bank of

America Corp., Wells Fargo and Co., Citigroup Inc. and Goldman

Sachs Group Inc. due to report this week.

In currencies, the euro fell slightly against the dollar to

$1.1371.

In commodities, Brent crude was up 0.9% at $53.41 a barrel. Gold

was up 0.7% at $1164.10 per troy ounce.

Write to Riva Gold at riva.gold@wsj.com

Access Investor Kit for "CitiGroup Inc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US1729674242

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 12, 2015 04:35 ET (08:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

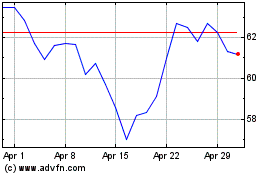

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

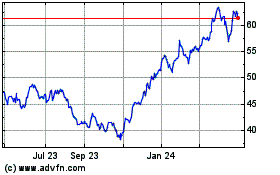

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024