Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 21 2015 - 12:22PM

Edgar (US Regulatory)

|

|

|

|

|

FILED PURSUANT TO RULE 433 |

| 2,000,000 DEPOSITARY SHARES |

|

FILE NO. 333-192302 |

EACH REPRESENTING A 1/25TH INTEREST

IN A SHARE OF

5.950% FIXED RATE/FLOATING

RATE NONCUMULATIVE PREFERRED STOCK, SERIES P

$1,000

LIQUIDATION PREFERENCE PER DEPOSITARY SHARE

Terms and

Conditions:

|

|

|

| Issuer: |

|

Citigroup Inc. |

| Securities: |

|

2,000,000 depositary shares, each representing a 1/25th interest in a share of perpetual 5.950% Fixed Rate/Floating Rate Noncumulative Preferred Stock, Series P (the “Series P preferred stock”). |

| Ratings*: |

|

Ba3 (review for upgrade) / BB (negative outlook) / BB+ (stable outlook) / BBBL (positive outlook)

(Moody’s / S&P / Fitch / DBRS). |

| Trade Date: |

|

April 20, 2015. |

| Settlement Date: |

|

April 24, 2015 (T+4 days). |

| Maturity: |

|

Perpetual. |

| Liquidation Preference: |

|

$25,000 per share of Series P preferred stock (equivalent to $1,000 liquidation preference per depositary share). |

| Aggregate Liquidation Preference: |

|

$2,000,000,000. |

| Public Offering Price: |

|

$1,000 per depositary share. |

| Net Proceeds to Citigroup: |

|

$1,970,000,000 (before expenses). |

| Dividend Rate and Payment

Dates: |

|

When, as and if declared by the board of directors of Citigroup or a duly authorized committee thereof, (i) from and including the Settlement Date to but excluding May 15, 2025 (the “fixed rate period”), at an annual rate

of 5.950%, payable semiannually in arrears and on a noncumulative basis, on each May 15 and November 15, beginning November 15, 2015, and (ii) from and including May 15, 2025 (the “floating rate period”), at an annual floating rate equal

to three-month USD LIBOR plus 3.905%, payable quarterly in arrears on each February 15, May 15, August 15 and November 15, beginning August 15, 2025, on a noncumulative basis. Following business day convention during the fixed rate period. Modified

following business day convention during the floating rate period. Business days New York. |

| First Dividend Payment: |

|

If declared, November 15, 2015. |

| Day Count: |

|

30/360 during the fixed rate period, Actual/360 during the floating rate period. |

| Redemption at Issuer’s Option: |

|

Subject to any required approval of the Federal Reserve, Citigroup may redeem the Series P preferred stock, and thus redeem a proportionate number of depositary shares (i) in whole or in part, from time to time, on any dividend

payment date on or after May 15, 2025, or (ii) in whole but not in part at any time within 90 days following a Regulatory Capital Event, in each case at a cash redemption price equal to 100% of the liquidation preference, plus any declared and

unpaid dividends, and without accumulation of any undeclared dividends, to but excluding the redemption date. |

| Sinking Fund: |

|

Not applicable. |

| Listing: |

|

The depositary shares will not be listed on any exchange. |

| Voting Rights: |

|

The holders of the Series P preferred stock do not have voting rights, except (i) as specifically required by Delaware law; (ii) in the case of certain dividend non-payments; (iii) with respect to the issuance of senior capital

stock of Citigroup; and (iv) with respect to changes to Citigroup’s organizational documents that would adversely affect the voting powers, preferences or special rights of the Series P preferred stock. Holders of depositary shares must act

through the depositary to exercise any voting rights. |

| Sole Structuring Agent and Sole

Bookrunner: |

|

Citigroup Global Markets Inc. |

| Senior Co-Managers: |

|

Barclays Capital Inc. BNY Mellon Capital

Markets, LLC Deutsche Bank Securities Inc. HSBC Securities

(USA) Inc. ING Financial Markets LLC Lloyds Securities

Inc. SG Americas Securities, LLC UBS Securities LLC

UniCredit Capital Markets LLC Wells Fargo Securities,

LLC |

1

|

|

|

|

|

FILED PURSUANT TO RULE 433 |

| 2,000,000 DEPOSITARY SHARES |

|

FILE NO. 333-192302 |

EACH REPRESENTING A

1/25TH INTEREST IN A SHARE OF

5.950% FIXED

RATE/FLOATING RATE NONCUMULATIVE PREFERRED STOCK, SERIES P

$1,000 LIQUIDATION PREFERENCE PER DEPOSITARY SHARE

|

|

|

| Junior Co-Managers: |

|

ABN AMRO Securities (USA) LLC ANZ Securities,

Inc. Apto Partners, LLC BB&T Capital Markets, a division

of BB&T Securities, LLC BBVA Securities Inc. Blaylock

Beal Van, LLC CAVU Securities, LLC Credit Agricole Securities

(USA) Inc. Drexel Hamilton, LLC Fifth Third Securities,

Inc. Imperial Capital, LLC Lebenthal & Co., LLC

Loop Capital Markets LLC MFR Securities, Inc.

Mischler Financial Group, Inc. nabSecurities, LLC

Nomura Securities International, Inc. RBC Capital Markets,

LLC Samuel A. Ramirez & Company, Inc. Santander

Investment Securities Inc. Siebert Brandford Shank & Co., L.L.C.

SunTrust Robinson Humphrey, Inc. TD Securities (USA) LLC

The Williams Capital Group, L.P. |

| Depositary Shares CUSIP/ISIN: |

|

172967JM4 / US172967JM45 |

| * |

Note: A securities rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time. |

Citigroup Inc. has filed a registration statement (including a prospectus) with the Securities and Exchange Commission for the offering to which this

communication relates. Before you invest, you should read the prospectus in the registration statement and the other documents Citigroup has filed with the SEC for more complete information about Citigroup and this offering. You may get these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. The file number for Citigroup’s registration statement is No. 333-192302. Alternatively, you can request the prospectus by calling toll-free in the United States

1-800-831-9146.

2

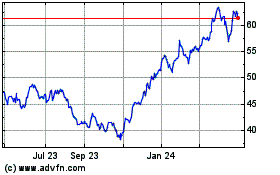

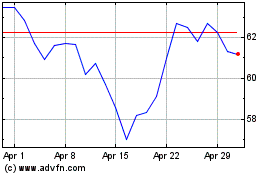

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024