Billionaire investor Carl Icahn, who has made successful bets on

casinos in recent years, is taking some chips off the table by

putting up for sale the Fontainebleau Las Vegas on the Strip.

Mr. Icahn said he has hired CBRE Group Inc. to market the

unfinished resort and casino, which was planned as a $3 billion

project by its developer before Mr. Icahn bought it out of

bankruptcy for about $150 million in 2010. CBRE expects to sell the

property for about $650 million.

Mr. Icahn, known as an activist who aims to boost share prices

by targeting and publicly scolding companies he believes are

underperforming, has also been an active casino investor. In 2007,

he said he realized a gain of about $1 billion after selling the

Stratosphere in Las Vegas and some smaller casinos for $1.3 billion

near the market's top.

"I think Las Vegas still has a fair amount of room to run," Mr.

Icahn said in an interview on Wednesday. "But I'd rather sell it

than take the time and energy to build it out, which we have been

considering doing."

A sale of the Fontainebleau could provide a fresh boost to the

Strip's stagnant northern end, which has failed to generate much

buzz amid stalled projects and limited foot traffic even as much of

Las Vegas enjoys a comeback.

But in recent months, there are signs the malaise at that end

could be lifting as new players prepare ambitious projects.

Malaysian developer Genting Group, which acquired an unfinished

hotel and casino site from Boyd Gaming Corp. in 2013, broke ground

this year on a $4 billion Chinese-themed resort.

Australian business mogul James Packer and partners are also

preparing to build a new casino nearby that would rise on the site

of the former New Frontier casino. That property was demolished by

its Israeli owners, which had planned to build a project based on

New York City's Plaza Hotel before the recession stymied it.

The former Riviera Hotel & Casino, meanwhile, is being

cleared to make way for part of a $2.5 billion expansion of the

city's convention center that officials hope will be a magnet for

conference business.

"There has been a giant void" where the main part of the Strip

ends, said Christopher Jones, an analyst for Union Gaming Research.

With the convention center and new casinos, "you can see critical

mass coming to that end of the Strip."

It hasn't arrived yet. The 1,620-room SLS Las Vegas, the former

Sahara Hotel and Casino, opened last year and reported a net loss

of nearly $84 million during the first six months of 2015.

This week the SLS's owner, Stockbridge Capital Partners, reached

a deal with Starwood Hotels & Resorts Worldwide Inc. to convert

one of the property's three towers into a W Hotel.

The wave of activity complements a rebound for the rest of the

Strip after tough times for all during the downturn, when most of

the biggest casino operators in Nevada turned their attention to

Macau.

Macau's gambling revenue has tumbled more recently as Beijing

cracked down on corruption. Las Vegas, meanwhile, has been

diversifying its revenue stream, relying increasingly on income

from nightclubs, restaurants and high-end retail. Visitor numbers

hit an all-time high, growing 3.7% to 41.1 million during 2014,

according to the Las Vegas Convention and Visitors Authority.

But the Strip is still nowhere near as profitable as it once

was. Casino operators generated $3.36 billion in adjusted earnings

before interest, taxes, depreciation and amortization from their

properties there in 2014 compared with $4.7 billion in 2007,

according to a Fitch Ratings analysis of listed companies and

companies with public debt.

It isn't clear whether the city would be able to support the $8

billion worth of projects currently planned or under construction

around the Strip, says Jeremy Aguero, a principal analyst at Las

Vegas-based research firm Applied Analysis.

What's more, any buyer of the Fontainebleau would face more than

just acquisition costs. John Knott, an executive vice president for

CBRE, says the project on a 22-acre site is roughly two-thirds

completed.

Real-estate investors suggest that finishing the massive

project—which includes plans for 2,882 hotel rooms, 933 condos and

300,000 square feet of retail space—could require another $1

billion or more.

The Fontainebleau was the brainchild of Miami developer Jeffrey

Soffer and was intended to be an offshoot of the popular

Fontainebleau resort in Miami Beach. He invested about $2 billion

in the development, which at 730 feet high would be the tallest

hotel tower on the Strip.

The project ran out of money during the financial crisis and

filed for chapter 11 bankruptcy protection in 2009. Mr. Icahn

bought it the following year, sparking widespread speculation about

whether he intended to flip the property for a quick gain. He has

spent about $6 million to $7 million annually on taxes, utilities

and security costs, say people familiar with the property.

Mr. Icahn has done well in Atlantic City, getting out before

that seaside town went into steep decline. He acquired the

Vegas-style Sands Atlantic City out of bankruptcy in 2000, and sold

it with some adjacent property for about $275 million in 2006,

right around the time of Atlantic City's peak casino revenue. He

still owns a majority stake in Tropicana Entertainment Inc., which

includes an Atlantic City property among its eight casinos.

Write to Craig Karmin at craig.karmin@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 11, 2015 17:35 ET (22:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

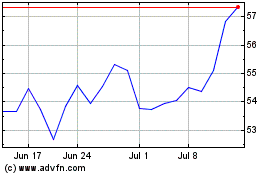

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Apr 2023 to Apr 2024