Boston Properties Revises 2016 Guidance, Gives Disappointing 2017 Projections

October 25 2016 - 7:59PM

Dow Jones News

By Maria Armental

Boston Properties Inc. (BXP) on Tuesday revised projections for

the year and gave disappointing guidance for 2017.

The real-estate investment trust, which focuses on office space,

cut its 2016 profit projection to $2.98 to $3 a share, largely tied

to the redevelopment of the low-rise portion of the 59-story 601

Lexington Ave., and said it expects to make $5.97 to $5.99 a share

in funds from operations. Before, it expected $3.04 to $3.11 in

profit and $5.92 to $5.99 a share in FFO.

Next year, it expects to make $2.58 to $2.76 a share and $6.05

to $6.23 in FFO, compared with analysts' projected $3.12 a share

and $6.39 a share in FFO, according to Thomson Reuters.

Boston Properties defines funds from operations as net income

less real-estate-related depreciation and amortization along with

impairment losses or gains or losses from sales.

Over all, quarterly profit dropped 58% to $79.3 million, or 50

cents a share. FFO were $1.42 a share, up from $1.41 a year

earlier.

The company had projected profit of 57 cents to 59 cents and FFO

of $1.40 to $1.42.

Revenue edged down to $625.2 million, above analysts' projected

$621.7 million.

As of Sept. 30, 89.6% of its portfolio was leased.

Shares, inactive in after-hours trading, closed Tuesday at

$125.33, down 2% this year.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

October 25, 2016 19:44 ET (23:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

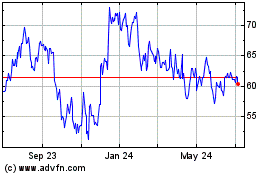

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

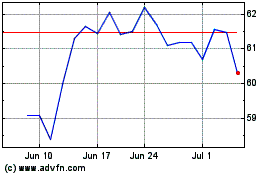

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Apr 2023 to Apr 2024