Boston Properties Announces 2015 Tax Treatment of Its Distributions

January 19 2016 - 8:13PM

Business Wire

Boston Properties, Inc. (NYSE: BXP), a real estate investment

trust, announced today the 2015 tax treatment of its common stock

and 5.25% Series B Cumulative Redeemable Preferred Stock

distributions as described below. Shareholders are encouraged to

consult with their personal tax advisors as to their specific tax

treatment of Boston Properties distributions.

Common Shares

(CUSIP #101121101)

Record Date

PaymentDate

TotalDistributionper

Share

TotalDistributionAllocable to2015

2015TaxableOrdinaryDividends

2015QualifiedDividends(1)

2015 TotalCapital

GainDistribution

2015UnrecapturedSection

1250Gain (2)

12/31/14 01/28/15 $5.150000(3)

$0.736813 $0.427101 $0.003225 $0.309712 $0.049210 03/31/15 04/30/15

$0.650000 $0.650000 $0.376779 $0.002845 $0.273221 $0.043412

06/30/15 07/31/15 $0.650000 $0.650000 $0.376779 $0.002845 $0.273221

$0.043412 09/30/15 10/30/15 $0.650000 $0.650000 $0.376779 $0.002845

$0.273221 $0.043412 12/31/15 01/28/16 $1.900000(4) $1.355047

$0.785467 $0.005931 $0.569580 $0.090501

$9.000000 $4.041860 $2.342905 $0.017691 $1.698955 $0.269947

100% 57.9660% 42.0340% (1) Qualified Dividends is a subset

of, and included in, the 2015 Taxable Ordinary Dividends amount.

(2) Unrecaptured Section 1250 Gain is a subset of, and included in,

the 2015 Total Capital Gain Distribution amount. (3) Amount

consists of a $4.50 per share special distribution and a $0.65 per

share regular quarterly distribution. (4) Amount consists of a

$1.25 per share special distribution and a $0.65 per share regular

quarterly distribution.

The common stock distribution with a record date of December 31,

2014 is a split-year distribution with $0.736813 allocable to 2015

for federal income tax purposes. The common stock distribution with

a record date of December 31, 2015 will be a split-year

distribution with $1.355047 allocable to 2015 for federal income

tax purposes and $0.544953 allocable to 2016 for federal income tax

purposes.

Series B

Preferred (CUSIP #101121408)

Record Date

PaymentDate

TotalDistributionper

Share

TotalDistributionAllocable to2015

2015TaxableOrdinaryDividends

2015QualifiedDividends(1)

2015 TotalCapital

GainDistribution

2015UnrecapturedSection

1250Gain (2)

02/07/15 02/18/15 $0.328125 $0.328125

$0.190201 $0.001436 $0.137924 $0.021915 05/05/15 05/15/15 $0.328125

$0.328125 $0.190201 $0.001436 $0.137924 $0.021915 08/05/15 08/15/15

$0.328125 $0.328125 $0.190201 $0.001436 $0.137924 $0.021915

11/05/15 11/17/15 $0.328125 $0.328125 $0.190201

$0.001436 $0.137924 $0.021915 $1.312500

$1.312500 $0.760804 $0.005744 $0.551696 $0.087660 100% 57.9660%

42.0340% (1) Qualified Dividends is a subset of, and

included in, the 2015 Taxable Ordinary Dividends amount. (2)

Unrecaptured Section 1250 Gain is a subset of, and included in, the

2015 Total Capital Gain Distribution amount.

Boston Properties is a fully integrated, self-administered and

self-managed real estate investment trust that develops,

redevelops, acquires, manages, operates and owns a diverse

portfolio of Class A office space, one hotel, four residential

properties and five retail properties. The Company is one of the

largest owners and developers of Class A office properties in the

United States, concentrated in four markets – Boston, New York, San

Francisco and Washington, DC.

For more information about Boston Properties, please visit the

Company’s web site at www.bostonproperties.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160119006973/en/

Boston Properties, Inc.Mike LaBelle, 617-236-3300Senior Vice

President, Chief Financial OfficerorLori Silverstein,

617-236-3300Vice President, Controller

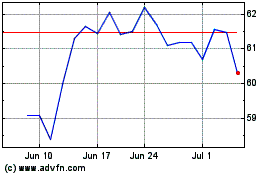

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

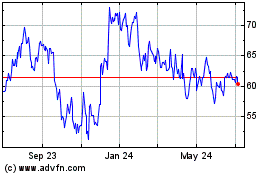

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Apr 2023 to Apr 2024