Sam Zell has agreed to sell more than 23,000 apartments

controlled by his real-estate company, Equity Residential, for $5.4

billion to Starwood Capital Group, the companies said.

The transaction, announced Monday, represents about a quarter of

the units in Equity Residential's portfolio of apartments and would

be one of the largest since the recession. It also comes on the

heels of Blackstone Group LP's announcement on Tuesday that it is

buying Stuyvesant Town and Peter Cooper Village in Manhattan for

$5.3 billion.

Across the commercial-property sector, which includes office,

retail and apartment buildings, growing numbers of investors have

begun to question how long good times can last after a steep run-up

in prices since the downturn.

Record values for offices and hotels in the U.S. and Europe,

fueled in part by central banks' multiyear efforts to keep interest

rates near record lows, have prompted some big investors to

reassess the market. Apartments have been especially hot, with

average U.S. rents climbing 20% over the past five years, according

to research firm REIS Inc.

The transaction brings together two savvy deal makers on

opposite sides of the trade, Mr. Zell and Starwood Capital Chairman

and Chief Executive Barry Sternlicht.

Mr. Zell, 74 years old, is credited for calling the top of the

real-estate market in 2007, when he sold another of his companies,

Equity Office Properties Trust, to Blackstone for $23 billion, not

including $16 billion in debt. Soon after, the commercial-property

market crashed as prices fell and debt defaults surged.

This deal is Mr. Zell's biggest since 2012. Back then, Equity

Residential was a buyer. The firm teamed with AvalonBay Communities

to purchase apartment giant Archstone for $6.5 billion, not

including about $9.5 billion in debt.

But Equity Residential has become "less aggressive as buyers of

assets" in recent years, Mr. Zell said in an interview late Friday.

Instead, it is getting out of suburban markets and into downtown

urban centers, where young people are moving and where it is more

difficult to build, he said.

Most of the 23,300 apartment units in the deal, roughly a

quarter of Equity Residential's total, are low-rise and mid-rise

units in suburban markets in and around southern Florida, Denver,

Seattle, Washington, D.C., and Southern California. Analysts expect

a significant amount of new supply to be concentrated in those

markets in coming years.

"There's an awful lot of apartments under construction," Mr.

Zell said, "and the majority of them are garden apartments in

suburban areas."

For Mr. Sternlicht, who made his name in the hotel industry, the

move represents a big wager on apartments. His Greenwich, Conn.,

company has bought or put under contract 67,800 apartment units

over the past year, including the Equity Residential deal.

"This is the healthiest U.S. apartment market in my lifetime,"

Mr. Sternlicht said in an interview Friday. "We don't see that

trend reversing."

Demographic shifts appear to be in his favor. The homeownership

rate has continued to fall, as younger households are putting off

buying homes and as the number of minority households, which have

historically low homeownership rates, is on the rise.

But real estate giants such as Boston Properties and Vornado

Realty Trust have dialed back acquisitions of commercial property,

saying they fear prices have grown unreasonably high compared with

rents.

"The easy money has been made in this cycle," Vornado CEO Steven

Roth said in an August investor call. "This is a time when the

smart guys are starting to build cash…we do acquisitions very

carefully at this point in the cycle."

Green Street Advisors wrote in a note to clients on Thursday

titled "The Ninth Inning" that signals from the markets for bonds

and real-estate investment trusts have begun to suggest that

"commercial real-estate prices may soon stall, and probably even

drift lower by the time 2016 winds down."

In the recessions of the 1970s and the early 1990s, Mr. Zell

made a name for himself scooping up vast swaths of office

buildings, apartments and malls across the U.S. on the cheap. As

the economy recovered, holdings soared in value, giving him a

collection of companies that were some of the country's largest

owners of commercial property.

Mr. Sternlicht, 54, became an active buyer of distressed

property after the financial crisis. His firm and its partners in

2009 invested $1.38 billion for the residential assets of failed

real estate lender Corus Bank, one of the most high-profile deals

during the downturn. Some rival bidders dismissed that price as too

high, even though about half the money came in the form of a

federal interest-free loan. Starwood created a property-management

firm, ST Residential, to oversee the apartments and sell some of

the units as condominiums. In April, Starwood announced its

consortium had sold the last major asset in the Corus portfolio.

Mr. Sternlicht said it more than doubled its initial investment

Starwood is paying about $230,600 per unit for the Equity

Residential portfolio. That price represents a so-called

capitalization rate—a measure of yield—of 5.5%, roughly on par with

recent deals. Mr. Sternlicht said he expects the Equity Residential

portfolio to deliver "solid double-digit returns."

Equity Residential said it plans to sell an additional 4,700

suburban apartments, mostly spread out over western Massachusetts

and Connecticut.

The suburban apartment market has been outperforming urban

markets of late. The vacancy rate in the urban core ticked up to 6%

in the second quarter of 2015, while continuing to hover around 4%

in the suburbs, according to REIS. But analysts said that

three-quarters of new apartment supply expected to come online in

2015 will be in the suburbs.

Until now, Equity Residential has been gradually selling off its

suburban properties and investing the proceeds in expanding its

portfolio of urban apartments in places such as Boston, New York

and urban areas of Southern California.

But seeing few additional opportunities to invest, Equity

Residential said it plans to deliver about $3.8 billion of the

proceeds it expects to generate as a dividend to shareholders in

the January 2016 second quarter.

Separately, Equity Residential also reported its third-quarter

results. The company posted normalized funds from operations of 87

cents a share, up from 81 cents a year earlier. Normalized funds

from operations excludes one-time items, such as acquisition- and

asset-sale impacts, and is a key metric for real-estate

companies.

The company raised its year per-share guidance for normalized

fund from operations to a range of $3.43 to $3.47 from its previous

estimate of $3.39 to $3.45.

Equity Residential reported third-quarter earnings of $195.9

million, or 53 cents a share, down from $220.7 million, or 61

cents, a year earlier. Revenue rose 4.9% to $696.3 million.

Analysts polled by Thomson Reuters had forecast earnings of 40

cents a share on $689 million in revenue.

Eliot Brown, Craig Karmin and Anne Steele contributed to this

article.

Write to Laura Kusisto at laura.kusisto@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 26, 2015 08:05 ET (12:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

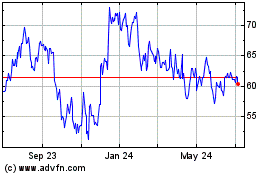

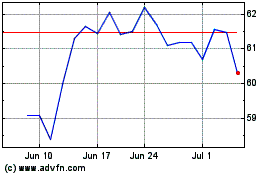

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Apr 2023 to Apr 2024