Boston Properties In Talks To Buy First Office Building In London-Sources

March 06 2012 - 10:47AM

Dow Jones News

Boston Properties Inc., one of the nation's largest office

landlords, is in negotiations to buy Drapers Gardens, a trophy

office building in London's financial district, for GBP285 million

pounds ($450 million), according to people familiar with the

matter.

If Drapers Gardens sells, it would be the second time in two

years that the building changes hands. It was sold to Evans

Randall, a private equity firm, in 2010 for GBP242.5 million ($385

million) by Canary Wharf Group, a unit of Morgan Stanley Real

Estate Fund, and Exemplar Properties, a London developer.

The deal would mark Boston Properties' first acquisition of an

office building in London and comes as foreign buyers have

stampeded into London's office market in recent years. Nearly 60%

of the buyers of London office buildings were foreign investors

between 2008 and 2011, according to CBRE Group. Most of the foreign

investment came from Canadian pension funds, private equity money

from Malaysia, and investors in South Korea and elsewhere.

Boston Properties declined to comment, but the company has said

in the past that it was eyeing Britain's capital and largest city.

"We have looked seriously at London ... as a possibility of another

market opening up to us," said Mort Zuckerman, chief executive of

Boston Properties, according to a transcript of the company's

third-quarter conference call. "But we're going to be very careful

about how (we) go into markets."

Demand has been strong for London office buildings in part

because it's perceived as ultra safe. London tenants usually sign

long-term leases that aren't subject to rent reductions, unlike New

York and other cities where tenants can often request and receive

rent concessions during weak economic times.

Even though rents in London have been relatively flat in the

past few years at around GBP55, or $87 per square foot, investment

bankers say big investors are drawn to London. "The upward only

rent ... provisions and the ... long-term leases are important

factors in attracting capital," said Simon Barrowcliff, executive

director of Central London Investment for CBRE.

The London acquisition isn't the first time that Boston

Properties has sought new markets. The company, which is known

mainly as an office landlord, was among a handful of REITs to

recently make a foray into developing and operating apartment

buildings.

Some analysts remain wary of companies entering markets with no

on-the-ground training or local partners to guile them. This is

"not the first time we question a U.S. REIT management's appetite

for overseas adventures," wrote David Harris, an analyst Imperial

Capital in a recent report. He noted that Drapers Gardens is so

safe and low yielding that Boston Properties isn't likely to get

much bang for its buck.

Drapers Gardens' sole tenant is investment firm BlackRock, which

signed a 25-year lease agreement in 2010 that calls for modest rent

increases after five years ranging between 2.5% and 4.5%.

Mitch Germain, an analyst at JMP Securities, said playing it

safe is probably a wise move because it gives Boston Properties

room to soak in the market first without risking a serious misstep.

"I rather that (they buy) a stable property ... to get their foot

in the door and then follow up when they really get a sense of the

operating history there," he said.

-By A.D. Pruitt, Dow Jones Newswires; 212-416-2197;

angela.pruitt@dowjones.com

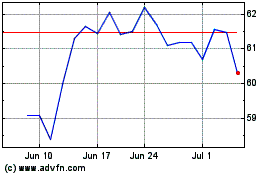

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

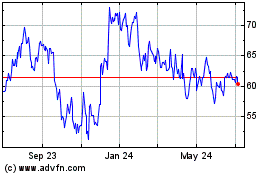

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Apr 2023 to Apr 2024