Pemex & Global Water Development Partners/Blackstone Announce the Signing of a Memorandum of Understanding to Develop Water-f...

May 12 2015 - 10:00AM

Business Wire

Petroleos Mexicanos ("Pemex"), and Global Water Development

Partners (“GWDP”), founded by private equity funds managed by

Blackstone, announced the signing of a Memorandum of Understanding

(MOU) focused on the creation of a partnership to invest in water

and wastewater infrastructure for Pemex’s upstream and downstream

facilities.

The Pemex/GWDP Partnership would accelerate Pemex’s efforts to

design, implement and finance critical and

environmentally-conscious solutions for its oil and gas water and

wastewater treatment operations. Jose Manuel Carrera, General

Director of PMI commented, “The partnership will enable Pemex to

better focus its financial resources on its core business, while

addressing its water and wastewater needs with a world-class

partner like Global Water Development Partners. In addition to

providing a source of financing, the partnership will facilitate

access to the industry’s most advanced technology and integrated

full-service water systems for all of Pemex’s water supply and

wastewater treatment needs at both its onshore and offshore oil

production facilities, refineries and petrochemical plants.”

Sean Klimczak, Senior Managing Director of Blackstone, said,

"Blackstone is very excited to partner with Pemex in its

mission-critical oil and gas-related water and wastewater treatment

efforts.” Last year, Blackstone established Global Water

Development Partners, as a platform for expanding investment in the

global water and waste sector. GWDP’s CEO Usha Rao-Monari

commented, “We look forward to partnering with Pemex to provide

innovative and sustainable water solutions throughout its value

chain."

About Pemex

Pemex is the most important company in Mexico and one of the

largest in Latin America and the biggest tax contributor to the

Mexican government. Pemex has become one of the few fully

integrated oil companies, developing its entire productive chain:

exploration, production, industrial processing/refining, logistics

and marketing.

Its business involves a complex myriad of installations and

advanced technology, yet the core of the company is its experienced

and trained personnel. Pemex carries out extensive exploration and

extraction projects every year, generating approximately 2.5

million barrels of oil daily and more than 6 million of cubic feet

of natural gas.

It has 6 refineries, 8 petrochemical complexes and 9 gas

processing complexes, where it produces multiple refined products

in order to attend to customer’s needs in different segments.

Logistically, Pemex has 83 land and maritime terminals, as well

as oil and gas pipelines, maritime vessels, and varying fleets of

ground transportation in order to supply over 10,000 service

stations throughout the country.

Pemex seeks to continuously be a socially responsible company

that works under stringent safety, job, health and environmental

protection standards. It actively participates in protecting and

contributing to the communities where it operates by making

significant donations to public works, environmental protection and

community building projects with the goal of improving health and

welfare. All this facts positions Pemex as competitive oil company

worldwide.

About Global Water Development Partners

GWDP was launched by Blackstone in 2014 as the first formal

attempt by a mainstream private equity player to support companies

with critically needed capital to create long-term and sustainable

water facilities, develop desalination facilities and large-scale

wastewater treatment for industrial customers, and identify,

develop, finance, construct and operate large-scale independent

water development projects. GWDP combines its own management team's

extensive knowledge and sectoral experience with Blackstone's

expertise as an active investor and developer

of infrastructure projects.

About Blackstone

Blackstone Energy Partners is Blackstone’s energy-focused

private equity business, with a successful record built on

Blackstone’s industry expertise and partnerships with exceptional

management teams. Blackstone has invested approximately $8 billion

of equity globally across a broad range of sectors within the

energy industry.

Blackstone is one of the world’s leading investment firms. We

seek to create positive economic impact and long-term value for our

investors, the companies we invest in, and the communities in which

we work. We do this by using extraordinary people and flexible

capital to help companies solve problems. Our asset management

businesses, with over $300 billion in assets under management,

include investment vehicles focused on private equity, real estate,

public debt and equity, non-investment grade credit, real assets

and secondary funds, all on a global basis. Blackstone also

provides various financial advisory services, including financial

and strategic advisory, restructuring and reorganization advisory

and fund placement services. Further information is available at

www.blackstone.com. Follow Blackstone on Twitter @Blackstone.

BlackstoneChristine Anderson, + 1 212 583

5182christine.anderson@blackstone.com

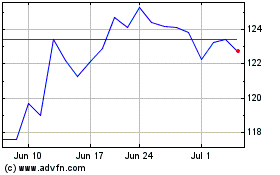

Blackstone (NYSE:BX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackstone (NYSE:BX)

Historical Stock Chart

From Apr 2023 to Apr 2024