Harman CEO Expects to Double Revenue in 5 Years

January 25 2016 - 5:40PM

Dow Jones News

Harman International Industries Inc. Chief Executive Dinesh

Paliwal said he intends to double the company's revenue over the

next five years, fueled by a big backlog of orders from auto makers

anxious to buy his high-tech multimedia systems.

Mr. Paliwal on Monday was in a northwest suburb of Detroit to

open a new office that will employ 1,000 people and serve as the

company's largest research and development center aimed at

designing new car technologies to support everything from

infotainment to hands-free driving. The company is expected to

finish its 2016 fiscal year with $7 billion in revenue and a

backlog of orders totaling $23 billion.

The company is best known for its audio systems, which take the

form of more than a dozen brands, including JBL, Harmon/Kardon,

Infinity, Revel and Mark Levinson, among others. But increasingly

Harman's focus has been on developing the software that allows

digital interfaces inside the car to work. Mr. Paliwal estimates

that 80% of the value of Harman's products are software code, and

he is already planning to outsource more hardware

manufacturing.

Perhaps no company in the auto space has done more in the past

year and a half to try to evolve. That has included making $1.5

billion in acquisitions, gobbling up Symphony Teleca, an

8,000-employee software development company in Silicon Valley, and

Red Bend, an Israeli software firm that handles over-the-air update

capabilities. Its latest purchase came three weeks ago -- a network

security company called TowerSec.

Mr. Paliwal said Harman will be able to leverage the purchases

into much more revenue. Its sales are forecast to rise to $7

billion for the fiscal year that ends June 30, almost twice the

$3.7 billion it booked in 2010.

"My aspiration would be of us to double our revenues again," he

said.

Investors initially cheered the investments in Symphony Teleca

and Red Bend, sending Harman's shares to record highs. In April the

stock hit $146 a share after starting 2015 around $100. It has

since plunged to around $78.

Brian Johnson, an automotive analyst with Barclays, said

investors may fear that Harman and companies like it, could be

pushed aside by the emergence of Alphabet Inc.'s Google Android

Auto and Apple Inc.'s CarPlay, as the tech giants invest more into

cars. The emergence of these new highflying competitors has put

pressure on Harman as well as traditional parts suppliers such as

Lear Corp. and BorgWarner Inc. that for decades quietly provided

auto makers everything from engine components and brakes to tires

and seats.

Some are selling off businesses, but most are making

acquisitions to increase their high-tech offerings or refine what

they already make.

For example, Delphi Automotive PLC has shed its past of churning

out commodity components—such as steering systems—and is now a car

tech leader producing the electrical systems in vehicles and the

advanced sensors that allow for autonomous driving capability. It

made a handful of acquisitions last year, including

Pittsburgh-based Ottomatika Inc., an autonomous vehicle control

company.

ZF Friedrichshafen AG Chief Executive Stefan Sommer, said

earlier this month that suppliers need to buy technology companies

if they want to compete. ZF purchased TRW Automotive Holdings Corp.

last year.

"The automotive world needs to see the opportunities and the

technologies of the digital world," he said.

Write to Mike Ramsey at michael.ramsey@wsj.com and Jeff Bennett

at jeff.bennett@wsj.com

(END) Dow Jones Newswires

January 25, 2016 17:25 ET (22:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

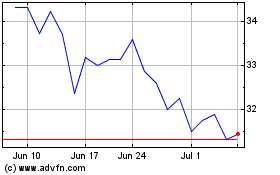

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Mar 2024 to Apr 2024

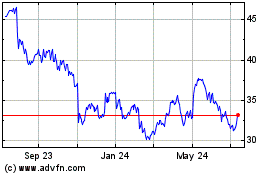

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Apr 2023 to Apr 2024