U.S. Parts Suppliers See Few Bumps From VW Scandal

October 23 2015 - 4:00PM

Dow Jones News

Two U.S. parts suppliers said Friday they expect little fallout

from Volkswagen AG's emissions scandal, easing concerns that have

lingered for weeks over how heavier scrutiny on diesel engines

might impact the components makers.

Tenneco Inc. Chief Executive Gregg Sherrill, who runs a company

considered a leader in emissions components, said Friday during an

earnings conference call that the auto industry was already

adopting more stringent guidelines and "real world" testing of

diesel emissions before VW admitted in September it had installed

software to mask emissions output during lab tests.

"We really don't see any effect in the next several years," Mr.

Sherrill said, adding there will be a positive for the industry as

auto makers increase component purchases to conform to more

stringent regulations. "It really hasn't changed our product

planning at all," he said.

The comments helped lift most shares of U.S. auto parts makers.

The biggest gainer was Lake Forest, Ill.-based Tenneco, which saw

its shares rise 12% to $54.20 in Friday afternoon trading.

BorgWarner Inc., another emissions components supplier, rose 2.7%

to $43.40.

Investors had initially punished Tenneco and BorgWarner's stock

over the past weeks since the companies relies on VW for 8% and 17%

of their revenue, respectively.

Tenneco reported earnings Friday and said net income dropped to

$52 million in the third quarter compared with $78 million to a

year earlier due to restructuring costs. Operating earnings far

exceeded analyst expectations.

The company's report helps kick off an earnings season for the

auto-supply sector at a time when parts makers are pressured by

questions about emissions testing, weak China volumes, currency

headwinds and tough conditions in emerging markets.

Axle maker Dana Corp., reporting on Thursday, said third-quarter

net income rose to $119 million compared with $90 million for the

same period a year earlier, but it said unfavorable currency

fluctuations and the divestiture of its operations in Venezuela

reduced its sales by $136 million.

Like many suppliers, Dana and Tenneco are pointing to strong

light-vehicle and truck demand in North America and Europe as

factors that more than offset those concerns.

Lear Corp., known as a seat supplier, also makes electrical

components that could be affected by shifting emissions standards

or higher scrutiny. Lear CEO Matt Simoncini echoed Mr. Sherrill's

comments after the company reported its third quarter numbers,

saying he hasn't seen any customer production changes and is

instead expecting some increase in component orders.

"Stricter fuel economy and lower emission requirements are

driving electrical content growth," Mr. Simoncini told analysts

Friday. "Traditional powertrains are requiring more signal

management to achieve better fuel economy."

Lear's third-quarter profit jumped 29% in its latest quarter as

results rode robust demand in the auto sector even in the face of

currency headwinds. Lear also increased its annual outlook for core

operating earnings to a range of $1.27 billion to $1.3 billion, up

from a previous $1.23 billion to $1.27 billion.

Write to Jeff Bennett at jeff.bennett@wsj.com

Access Investor Kit for "Volkswagen AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0007664039

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 23, 2015 15:45 ET (19:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

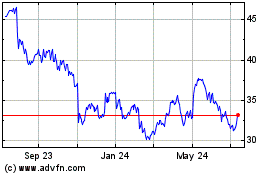

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Mar 2024 to Apr 2024

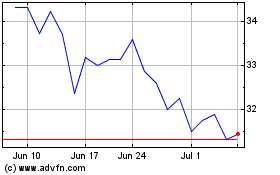

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Apr 2023 to Apr 2024