UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

QUARTERLY REPORT

|

| | |

(Mark One) | | |

þ | | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | For the quarterly period ended June 30, 2015 |

OR

|

| | |

o | | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | For the transition period from to |

BORGWARNER INC.

________________________________________________

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 13-3404508 |

State or other jurisdiction of | | (I.R.S. Employer |

Incorporation or organization | | Identification No.) |

| | |

3850 Hamlin Road, Auburn Hills, Michigan | | 48326 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (248) 754-9200

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES þ NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES þ NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | |

Large accelerated filer | þ | Accelerated filer | o | Non-accelerated filer | o | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES o NO þ

As of July 24, 2015, the registrant had 226,314,731 shares of voting common stock outstanding.

BORGWARNER INC.

FORM 10-Q

THREE AND SIX MONTHS ENDED JUNE 30, 2015

INDEX

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

BORGWARNER INC. AND CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

|

| | | | | | | |

(in millions) | June 30, 2015 | | December 31,

2014 |

ASSETS |

| |

|

Cash | $ | 1,107.9 |

| | $ | 797.8 |

|

Receivables, net | 1,573.0 |

| | 1,443.5 |

|

Inventories, net | 525.7 |

| | 505.7 |

|

Deferred income taxes | 49.8 |

| | 93.6 |

|

Prepayments and other current assets | 145.0 |

| | 130.2 |

|

Total current assets | 3,401.4 |

| | 2,970.8 |

|

|

|

| |

|

|

Property, plant and equipment, net | 2,160.5 |

| | 2,093.9 |

|

Investments and other long-term receivables | 437.5 |

| | 403.3 |

|

Goodwill | 1,184.9 |

| | 1,205.7 |

|

Other non-current assets | 582.0 |

| | 554.3 |

|

Total assets | $ | 7,766.3 |

| | $ | 7,228.0 |

|

|

|

| |

|

|

LIABILITIES AND EQUITY |

|

| |

|

|

Notes payable and other short-term debt | $ | 72.1 |

| | $ | 623.7 |

|

Accounts payable and accrued expenses | 1,528.2 |

| | 1,530.3 |

|

Income taxes payable | 35.3 |

| | 14.2 |

|

Total current liabilities | 1,635.6 |

| | 2,168.2 |

|

|

|

| |

|

|

Long-term debt | 1,731.7 |

| | 716.3 |

|

| | | |

Other non-current liabilities: |

|

| |

|

|

Retirement-related liabilities | 311.0 |

| | 326.6 |

|

Other | 336.5 |

| | 326.0 |

|

Total other non-current liabilities | 647.5 |

| | 652.6 |

|

|

|

| |

|

|

Common stock | 2.5 |

| | 2.5 |

|

Capital in excess of par value | 1,099.9 |

| | 1,112.4 |

|

Retained earnings | 3,985.4 |

| | 3,717.1 |

|

Accumulated other comprehensive loss | (539.5 | ) | | (383.6 | ) |

Common stock held in treasury | (861.6 | ) | | (832.2 | ) |

Total BorgWarner Inc. stockholders’ equity | 3,686.7 |

| | 3,616.2 |

|

Noncontrolling interest | 64.8 |

| | 74.7 |

|

Total equity | 3,751.5 |

| | 3,690.9 |

|

Total liabilities and equity | $ | 7,766.3 |

| | $ | 7,228.0 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

BORGWARNER INC. AND CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(in millions, except share and per share amounts) | 2015 | | 2014 | | 2015 | | 2014 |

Net sales | $ | 2,031.9 |

| | $ | 2,197.0 |

| | $ | 4,016.1 |

| | $ | 4,281.1 |

|

Cost of sales | 1,602.9 |

| | 1,724.2 |

| | 3,158.1 |

| | 3,362.5 |

|

Gross profit | 429.0 |

| | 472.8 |

| | 858.0 |

| | 918.6 |

|

| | | | | | | |

Selling, general and administrative expenses | 167.4 |

| | 181.2 |

| | 335.6 |

| | 355.0 |

|

Other expense, net | 19.1 |

| | 11.0 |

| | 20.3 |

| | 49.8 |

|

Operating income | 242.5 |

| | 280.6 |

| | 502.1 |

| | 513.8 |

|

| | | | | | | |

Equity in affiliates’ earnings, net of tax | (11.1 | ) | | (12.2 | ) | | (19.6 | ) | | (21.0 | ) |

Interest income | (1.6 | ) | | (1.4 | ) | | (3.3 | ) | | (2.9 | ) |

Interest expense and finance charges | 17.6 |

| | 9.0 |

| | 27.6 |

| | 17.2 |

|

Earnings before income taxes and noncontrolling interest | 237.6 |

| | 285.2 |

| | 497.4 |

| | 520.5 |

|

| | | | | | | |

Provision for income taxes | 80.2 |

| | 85.3 |

| | 152.3 |

| | 153.4 |

|

Net earnings | 157.4 |

| | 199.9 |

| | 345.1 |

| | 367.1 |

|

Net earnings attributable to the noncontrolling interest, net of tax | 9.3 |

| | 9.7 |

| | 18.1 |

| | 17.8 |

|

Net earnings attributable to BorgWarner Inc. | $ | 148.1 |

| | $ | 190.2 |

| | $ | 327.0 |

| | $ | 349.3 |

|

| | | | | | | |

Earnings per share — basic | $ | 0.66 |

| | $ | 0.84 |

| | $ | 1.45 |

| | $ | 1.54 |

|

| | | | | | | |

Earnings per share — diluted | $ | 0.65 |

| | $ | 0.83 |

| | $ | 1.44 |

| | $ | 1.52 |

|

| | | | | | | |

Weighted average shares outstanding (thousands): | | | | | | | |

Basic | 225,353 |

| | 227,678 |

| | 225,575 |

| | 227,554 |

|

Diluted | 226,615 |

| | 229,670 |

| | 226,852 |

| | 229,499 |

|

| | | | | | | |

Dividends declared per share | $ | 0.13 |

| | $ | 0.125 |

| | $ | 0.26 |

| | $ | 0.25 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

BORGWARNER INC. AND CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(in millions) | 2015 | | 2014 | | 2015 | | 2014 |

Net earnings attributable to BorgWarner Inc. | $ | 148.1 |

| | $ | 190.2 |

| | $ | 327.0 |

| | $ | 349.3 |

|

| | | | | | | |

Other comprehensive income (loss) | | | | | | | |

Foreign currency translation adjustments | 84.2 |

| | (1.1 | ) | | (165.6 | ) | | (3.8 | ) |

Hedge instruments* | (2.7 | ) | | 0.7 |

| | 1.5 |

| | (0.6 | ) |

Defined benefit postretirement plans* | (4.3 | ) | | (1.3 | ) | | 8.0 |

| | (0.1 | ) |

Other* | 0.2 |

| | (0.1 | ) | | 0.2 |

| | (0.1 | ) |

Total other comprehensive income (loss) attributable to BorgWarner Inc. | 77.4 |

| | (1.8 | ) | | (155.9 | ) | | (4.6 | ) |

| | | | | | | |

Comprehensive income attributable to BorgWarner Inc. | 225.5 |

| | 188.4 |

| | 171.1 |

| | 344.7 |

|

Comprehensive (loss) income attributable to the noncontrolling interest | (0.7 | ) | | 2.3 |

| | (0.6 | ) | | 1.2 |

|

Comprehensive income | $ | 224.8 |

| | $ | 190.7 |

| | $ | 170.5 |

| | $ | 345.9 |

|

____________________________________

See accompanying Notes to Condensed Consolidated Financial Statements.

BORGWARNER INC. AND CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) |

| | | | | | | |

| Six Months Ended June 30, |

(in millions) | 2015 | | 2014 |

OPERATING | | | |

Net earnings | $ | 345.1 |

| | $ | 367.1 |

|

Adjustments to reconcile net earnings to net cash flows from operations: | | | |

Non-cash charges (credits) to operations: | | | |

Depreciation and tooling amortization | 149.3 |

| | 151.4 |

|

Amortization of intangible assets and other | 8.7 |

| | 13.8 |

|

Restructuring expense, net of cash paid | 19.1 |

| | 38.9 |

|

Gain on previously held equity interest | (10.8 | ) | | — |

|

Stock-based compensation expense | 20.6 |

| | 15.8 |

|

Deferred income tax provision | 22.3 |

| | 37.6 |

|

Equity in affiliates’ earnings, net of dividends received, and other | (18.7 | ) | | (20.8 | ) |

Net earnings adjusted for non-cash charges to operations | 535.6 |

| | 603.8 |

|

Changes in assets and liabilities: |

|

| | |

|

Receivables | (174.8 | ) | | (265.8 | ) |

Inventories | (41.1 | ) | | (18.0 | ) |

Prepayments and other current assets | (17.2 | ) | | (17.0 | ) |

Accounts payable and accrued expenses | 28.8 |

| | 120.0 |

|

Income taxes payable | 20.1 |

| | (37.0 | ) |

Other non-current assets and liabilities | (32.1 | ) | | (59.8 | ) |

Net cash provided by operating activities | 319.3 |

| | 326.2 |

|

|

|

| |

|

|

INVESTING |

|

| | |

|

Capital expenditures, including tooling outlays | (285.0 | ) | | (257.3 | ) |

Payments for businesses acquired, net of cash acquired | (12.6 | ) | | (106.4 | ) |

Proceeds from asset disposals and other | 2.5 |

| | 2.0 |

|

Net cash used in investing activities | (295.1 | ) | | (361.7 | ) |

|

|

| |

|

|

FINANCING |

|

| | |

|

Net (decrease) increase in notes payable | (539.0 | ) | | 304.5 |

|

Additions to long-term debt, net of debt issuance costs | 1,015.9 |

| | 97.8 |

|

Repayments of long-term debt, including current portion | (15.5 | ) | | (420.2 | ) |

Payments for purchase of treasury stock | (62.9 | ) | | (25.0 | ) |

Proceeds from stock options exercised, including the tax benefit | 13.6 |

| | 12.8 |

|

Taxes paid on employees' restricted stock award vestings | (13.2 | ) | | (23.4 | ) |

Dividends paid to BorgWarner stockholders | (58.7 | ) | | (56.8 | ) |

Dividends paid to noncontrolling stockholders | (18.1 | ) | | (18.8 | ) |

Net cash provided by (used in) financing activities | 322.1 |

| | (129.1 | ) |

Effect of exchange rate changes on cash | (36.2 | ) | | (3.5 | ) |

Net increase (decrease) in cash | 310.1 |

| | (168.1 | ) |

Cash at beginning of year | 797.8 |

| | 939.5 |

|

Cash at end of period | $ | 1,107.9 |

| | $ | 771.4 |

|

| | | |

SUPPLEMENTAL CASH FLOW INFORMATION | | | |

|

Cash paid during the period for: | | | |

|

Interest | $ | 24.8 |

| | $ | 25.3 |

|

Income taxes, net of refunds | $ | 75.8 |

| | $ | 124.8 |

|

Non-cash investing transactions | | | |

Liabilities assumed from business acquired | $ | — |

| | $ | 3.2 |

|

Non-cash financing transactions | | | |

Debt assumed from business acquired | $ | — |

| | $ | 40.3 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

BORGWARNER INC. AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(1) Basis of Presentation

The accompanying unaudited Condensed Consolidated Financial Statements of BorgWarner Inc. and Consolidated Subsidiaries (the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes necessary for a comprehensive presentation of financial position, results of operations and cash flow activity required by GAAP for complete financial statements. In the opinion of management, all normal recurring adjustments necessary for a fair presentation of results have been included. Operating results for the three and six months ended June 30, 2015 are not necessarily indicative of the results that may be expected for the year ending December 31, 2015. The balance sheet as of December 31, 2014 was derived from the audited financial statements as of that date. For further information, refer to the Consolidated Financial Statements and Footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014.

Management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and accompanying notes, as well as, the amounts of revenues and expenses reported during the periods covered by those financial statements and accompanying notes. Actual results could differ from these estimates.

(2) Research and Development Expenditures

The Company's net Research & Development ("R&D") expenditures are included in selling, general and administrative expenses of the Condensed Consolidated Statements of Operations. Customer reimbursements are netted against gross R&D expenditures as they are considered a recovery of cost. Customer reimbursements for prototypes are recorded net of prototype costs based on customer contracts, typically either when the prototype is shipped or when it is accepted by the customer. Customer reimbursements for engineering services are recorded when performance obligations are satisfied in accordance with the contract and accepted by the customer. Financial risks and rewards transfer upon shipment, acceptance of a prototype component by the customer or upon completion of the performance obligation as stated in the respective customer agreement.

The following table presents the Company’s gross and net expenditures on R&D activities:

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(in millions) | 2015 | | 2014 | | 2015 | | 2014 |

Gross R&D expenditures | $ | 94.2 |

| | $ | 101.5 |

| | $ | 186.6 |

| | $ | 196.0 |

|

Customer reimbursements | (14.1 | ) | | (11.4 | ) | | (31.1 | ) | | (23.9 | ) |

Net R&D expenditures | $ | 80.1 |

| | $ | 90.1 |

| | $ | 155.5 |

| | $ | 172.1 |

|

The Company has contracts with several customers at the Company's various R&D locations. No such contract exceeded 5% of annual net R&D expenditures in any of the periods presented.

(3) Other Expense, net

Items included in other expense, net consist of:

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(in millions) | 2015 | | 2014 | | 2015 | | 2014 |

Restructuring expense | $ | 19.9 |

| | $ | 15.0 |

| | $ | 32.0 |

| | $ | 54.5 |

|

Gain on previously held equity interest | — |

| | — |

| | (10.8 | ) | | — |

|

Other income | (0.8 | ) | | (4.0 | ) | | (0.9 | ) | | (4.7 | ) |

Other expense, net | $ | 19.1 |

| | $ | 11.0 |

| | $ | 20.3 |

| | $ | 49.8 |

|

During the first half of 2015 and 2014, the Company recorded restructuring expense of $32.0 million and $54.5 million, respectively. This expense relates to Drivetrain and Engine segment actions designed to improve future profitability and competitiveness, as well as a global realignment plan intended to enhance treasury management flexibility. See the Restructuring footnote to the Condensed Consolidated Financial Statements for further discussion of these expenses.

During the first quarter of 2015, the Company completed the purchase of the remaining 51% of BERU Diesel Start Systems Pvt. Ltd. ("BERU Diesel") by acquiring the shares of its former joint venture partner. As a result of this transaction, the Company recorded a $10.8 million gain on the previously held equity interest in this joint venture. See the Recent Transactions footnote to the Condensed Consolidated Financial Statements for further discussion of this acquisition.

(4) Income Taxes

The Company's provision for income taxes is based upon an estimated annual tax rate for the year applied to federal, state and foreign income. On a quarterly basis, the annual effective tax rate is adjusted, as appropriate, based upon changed facts and circumstances, if any, as compared to those forecasted at the beginning of the fiscal year and each interim period thereafter.

At June 30, 2015, the Company's effective tax rate for the first six months was 30.6%. This rate includes tax expense of $10.3 million related to a global realignment plan, offset by tax benefits of $3.9 million related to tax settlements, $3.7 million primarily related to foreign tax incentives and $3.4 million related to restructuring expense as discussed in the Other Expense, net footnote to the Condensed Consolidated Financial Statements.

At June 30, 2014, the Company's effective tax rate for the first six months was 29.5%, which includes tax benefits of $10.5 million related to restructuring expense discussed in the Other Expense, net footnote to the Condensed Consolidated Financial Statements.

The annual effective tax rates differ from the U.S. statutory rate primarily due to foreign rates which differ from those in the U.S., the realization of certain business tax credits, including foreign tax credits, and favorable permanent differences between book and tax treatment for certain items, including equity in affiliates' earnings.

(5) Inventories, net

Inventories are valued at the lower of cost or market. The cost of U.S. inventories is determined by the last-in, first-out (“LIFO”) method, while the operations outside the U.S. use the first-in, first-out (“FIFO”) or average-cost methods. Inventories consisted of the following:

|

| | | | | | | |

| June 30, | | December 31, |

(in millions) | 2015 | | 2014 |

Raw material and supplies | $ | 325.5 |

| | $ | 319.5 |

|

Work in progress | 87.7 |

| | 89.0 |

|

Finished goods | 130.9 |

| | 115.5 |

|

FIFO inventories | 544.1 |

| | 524.0 |

|

LIFO reserve | (18.4 | ) | | (18.3 | ) |

Inventories, net | $ | 525.7 |

| | $ | 505.7 |

|

(6) Property, Plant and Equipment, net

|

| | | | | | | |

| June 30, | | December 31, |

(in millions) | 2015 | | 2014 |

Land, land use rights and buildings | $ | 772.1 |

| | $ | 784.8 |

|

Machinery and equipment | 1,912.8 |

| | 1,940.3 |

|

Capital leases | 9.1 |

| | 8.4 |

|

Construction in progress | 373.7 |

| | 310.4 |

|

Total property, plant and equipment, gross | 3,067.7 |

| | 3,043.9 |

|

Less: accumulated depreciation | (1,042.7 | ) | | (1,076.8 | ) |

Property, plant and equipment, net, excluding tooling | 2,025.0 |

| | 1,967.1 |

|

Tooling, net of amortization | 135.5 |

| | 126.8 |

|

Property, plant and equipment, net | $ | 2,160.5 |

| | $ | 2,093.9 |

|

As of June 30, 2015 and December 31, 2014, accounts payable of $58.3 million and $58.4 million, respectively, were related to property, plant and equipment purchases.

Interest costs capitalized for the six months ended June 30, 2015 and 2014 were $7.7 million and $7.0 million, respectively.

(7) Product Warranty

The Company provides warranties on some, but not all, of its products. The warranty terms are typically from one to three years. Provisions for estimated expenses related to product warranty are made at the time products are sold. These estimates are established using historical information about the nature, frequency and average cost of warranty claim settlements as well as product manufacturing and industry developments and recoveries from third parties. Management actively studies trends of warranty claims and takes action to improve product quality and minimize warranty claims. Management believes that the warranty accrual is appropriate; however, actual claims incurred could differ from the original estimates, requiring adjustments to the accrual.

The following table summarizes the activity in the product warranty accrual accounts:

|

| | | | | | | |

(in millions) | 2015 | | 2014 |

Beginning balance, January 1 | $ | 132.0 |

| | $ | 72.7 |

|

Provisions | 12.7 |

| | 15.9 |

|

Acquisition* | (17.1 | ) | | 64.9 |

|

Payments | (28.9 | ) | | (16.9 | ) |

Translation adjustment | (7.9 | ) | | — |

|

Ending balance, June 30 | $ | 90.8 |

| | $ | 136.6 |

|

____________________________________

| |

* | The 2014 acquisition relates to the Company's 2014 purchase of Gustav Wahler GmbH u. Co. KG and its general partner. In the fourth quarter of 2014, a measurement period adjustment of $42.1 million was made to increase the fair value of the warranty liability at the acquisition date, see Note 7 "Product Warranty" to the Company's Annual Report on Form 10-K for the year ended December 31, 2014 for additional details. In the second quarter of 2015, the Company settled a significant warranty claim associated with a product issue that pre-dated the Company's acquisition of Gustav Wahler GmbH u. Co. KG. Including the impact of the reversal of a corresponding receivable, this settlement had an immaterial impact on the Condensed Consolidated Balance Sheet at June 30, 2015 and Condensed Consolidated Statements of Operations for the three and six months ended June 30, 2015. |

The product warranty liability is classified in the Condensed Consolidated Balance Sheets as follows:

|

| | | | | | | |

| June 30, | | December 31, |

(in millions) | 2015 | | 2014 |

Accounts payable and accrued expenses | $ | 43.9 |

| | $ | 91.9 |

|

Other non-current liabilities | 46.9 |

| | 40.1 |

|

Total product warranty liability | $ | 90.8 |

| | $ | 132.0 |

|

(8) Notes Payable and Long-Term Debt

As of June 30, 2015 and December 31, 2014, the Company had short-term and long-term debt outstanding as follows:

|

| | | | | | | |

| June 30, | | December 31, |

(in millions) | 2015 | | 2014 |

Short-term debt |

|

| |

|

|

Short-term borrowings | $ | 60.3 |

| | $ | 601.2 |

|

|

|

| |

|

|

Long-term debt |

|

| |

|

|

5.75% Senior notes due 11/01/16 ($150 million par value) | $ | 149.8 |

| | $ | 149.8 |

|

8.00% Senior notes due 10/01/19 ($134 million par value) | 134.0 |

| | 134.0 |

|

4.625% Senior notes due 09/15/20 ($250 million par value) | 248.5 |

| | 248.4 |

|

3.375% Senior notes due 03/15/25 ($500 million par value) | 499.0 |

| | — |

|

7.125% Senior notes due 02/15/29 ($121 million par value) | 119.5 |

| | 119.4 |

|

4.375% Senior notes due 03/15/45 ($500 million par value) | 498.4 |

| | — |

|

Term loan facilities and other | 84.2 |

| | 75.1 |

|

Unamortized portion of debt derivatives | 10.1 |

| | 12.1 |

|

Total long-term debt | 1,743.5 |

| | 738.8 |

|

Less: current portion | 11.8 |

| | 22.5 |

|

Long-term debt, net of current portion | $ | 1,731.7 |

| | $ | 716.3 |

|

The weighted average interest rate on short-term borrowings outstanding as of June 30, 2015 and December 31, 2014 was 1.9% and 0.8%, respectively. The weighted average interest rate on all borrowings outstanding as of June 30, 2015 and December 31, 2014 was 4.7% and 2.9%, respectively.

On March 16, 2015, BorgWarner Inc. issued $500 million in 3.375% senior notes due March 2025 and $500 million in 4.375% senior notes due March 2045. Interest is payable semi-annually in arrears on March 15 and September 15 of each year, beginning on September 15, 2015.

The Company has a $1 billion multi-currency revolving credit facility which includes a feature that allows the Company's borrowings to be increased to $1.25 billion. The facility provides for borrowings through June 30, 2019. The Company has one key financial covenant as part of the credit agreement which is a debt to EBITDA ("Earnings Before Interest, Taxes, Depreciation and Amortization") ratio. The Company was in compliance with the financial covenant at June 30, 2015 and expects to remain compliant in future periods. At June 30, 2015 and December 31, 2014, the Company had no outstanding borrowings under this facility.

The Company's commercial paper program allows the Company to issue short-term, unsecured commercial paper notes up to a maximum aggregate principal amount outstanding of $1 billion. Under this program, the Company may issue notes from time to time and will use the proceeds for general corporate purposes. The Company had no borrowings outstanding under this program at June 30, 2015. At December 31, 2014, the Company had outstanding borrowings of $460.9 million under this program, which is classified in the Condensed Consolidated Balance Sheets in Notes payable and other short-term debt.

The total current combined borrowing capacity under the multi-currency revolving credit facility and commercial paper program cannot exceed $1 billion.

As of June 30, 2015 and December 31, 2014, the estimated fair values of the Company’s senior unsecured notes totaled $1,702.1 million and $750.3 million, respectively. The estimated fair values were $52.9 million and $98.7 million higher than their carrying value at June 30, 2015 and December 31, 2014, respectively. Fair market values of the senior unsecured notes are developed using observable values for similar debt instruments, which are considered Level 2 inputs as defined by ASC Topic 820. The carrying values of the Company's multi-currency revolving credit facility and commercial paper program approximates fair value. The fair value estimates do not necessarily reflect the values the Company could realize in the current markets.

The Company had outstanding letters of credit of $32.2 million and $28.3 million at June 30, 2015 and December 31, 2014, respectively. The letters of credit typically act as guarantees of payment to certain third parties in accordance with specified terms and conditions.

(9) Fair Value Measurements

ASC Topic 820 emphasizes that fair value is a market-based measurement, not an entity specific measurement. Therefore, a fair value measurement should be determined based on assumptions that market participants would use in pricing an asset or liability. As a basis for considering market participant assumptions in fair value measurements, ASC Topic 820 establishes a fair value hierarchy, which prioritizes the inputs used in measuring fair values as follows:

| |

Level 1: | Observable inputs such as quoted prices for identical assets or liabilities in active markets; |

| |

Level 2: | Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and |

| |

Level 3: | Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions. |

Assets and liabilities measured at fair value are based on one or more of the following three valuation techniques noted in ASC Topic 820:

| |

A. | Market approach: Prices and other relevant information generated by market transactions involving identical or comparable assets, liabilities or a group of assets or liabilities, such as a business. |

| |

B. | Cost approach: Amount that would be required to replace the service capacity of an asset (replacement cost). |

| |

C. | Income approach: Techniques to convert future amounts to a single present amount based upon market expectations (including present value techniques, option-pricing and excess earnings models). |

The following tables classify assets and liabilities measured at fair value on a recurring basis as of June 30, 2015 and December 31, 2014:

|

| | | | | | | | | | | | | | | | | |

| | | Basis of fair value measurements | | |

(in millions) | Balance at June 30, 2015 | | Quoted prices in active markets for identical items (Level 1) | | Significant other observable inputs (Level 2) | | Significant unobservable inputs (Level 3) | | Valuation technique |

Assets: | | | | | | | | | |

Foreign currency contracts | $ | 6.1 |

| | $ | — |

| | $ | 6.1 |

| | $ | — |

| | A |

Other long-term receivables (insurance settlement agreement note receivable) | $ | 90.7 |

| | $ | — |

| | $ | 90.7 |

| | $ | — |

| | C |

Liabilities: | | | | | | | | | |

Foreign currency contracts | $ | 3.1 |

| | $ | — |

| | $ | 3.1 |

| | $ | — |

| | A |

Commodity contracts | $ | 0.1 |

| | $ | — |

| | $ | 0.1 |

| | $ | — |

| | A |

|

| | | | | | | | | | | | | | | | | |

| | | Basis of fair value measurements | | |

(in millions) | Balance at December 31, 2014 | | Quoted prices in active markets for identical items (Level 1) | | Significant other observable inputs (Level 2) | | Significant unobservable inputs (Level 3) | | Valuation technique |

Assets: | | | | | | | | | |

Foreign currency contracts | $ | 3.8 |

| | $ | — |

| | $ | 3.8 |

| | $ | — |

| | A |

Other long-term receivables (insurance settlement agreement note receivable) | $ | 90.4 |

| | $ | — |

| | $ | 90.4 |

| | $ | — |

| | C |

Liabilities: | | | | | | | | | |

Foreign currency contracts | $ | 2.9 |

| | $ | — |

| | $ | 2.9 |

| | $ | — |

| | A |

(10) Financial Instruments

The Company’s financial instruments include cash and marketable securities. Due to the short-term nature of these instruments, their book value approximates their fair value. The Company’s financial instruments may include long-term debt, interest rate and cross-currency swaps, commodity derivative contracts and foreign currency derivatives. All derivative contracts are placed with counterparties that have an S&P, or equivalent, investment grade credit rating at the time of the contracts’ placement. At June 30, 2015 and December 31, 2014, the Company had no derivative contracts that contained credit risk related contingent features.

The Company uses certain commodity derivative contracts to protect against commodity price changes related to forecasted raw material and supplies purchases. The Company primarily utilizes forward and option contracts, which are designated as cash flow hedges. At June 30, 2015, the following commodity derivative contracts were outstanding:

|

| | | | | | |

| Commodity derivative contracts |

Commodity | Volume hedged June 30, 2015 | | Units of measure | | Duration |

Copper | 439.0 |

| | Metric Tons | | Dec -16 |

The Company uses foreign currency forward and option contracts to protect against exchange rate movements for forecasted cash flows, including capital expenditures, purchases, operating expenses or sales transactions designated in currencies other than the functional currency of the operating unit. Foreign currency derivative contracts require the Company, at a future date, to either buy or sell foreign currency in exchange for the operating units’ local currency.

At June 30, 2015 and December 31, 2014, the following foreign currency derivative contracts were outstanding:

|

| | | | | | | | | | |

Foreign currency derivatives (in millions) |

Functional currency | | Traded currency | | Notional in traded currency June 30, 2015 | | Notional in traded currency December 31, 2014 | | Duration |

| | | | | | | | |

Chinese yuan | | Euro | | 33.2 |

| | — |

| | Jun - 16 |

Chinese yuan | | US dollar | | 20.0 |

| | 24.9 |

| | Dec - 16 |

Euro | | British pound | | 2.9 |

| | 5.7 |

| | Dec - 15 |

Euro | | Japanese yen | | 2,582.0 |

| | 4,371.8 |

| | Feb - 16 |

Euro | | US dollar | | 32.1 |

| | 23.5 |

| | Dec - 16 |

Japanese yen | | Chinese yuan | | 45.4 |

| | 88.6 |

| | Dec - 15 |

Japanese yen | | Korean won | | 3,290.0 |

| | 6,712.5 |

| | Dec - 15 |

Japanese yen | | US dollar | | 2.0 |

| | 3.8 |

| | Dec - 15 |

Korean won | | Euro | | 5.1 |

| | 2.5 |

| | Dec - 15 |

Korean won | | Japanese yen | | 440.1 |

| | 72.0 |

| | Dec - 15 |

Korean won |

| US dollar | | 11.4 |

| | 22.7 |

| | Dec - 15 |

Mexican peso | | US dollar | | 6.0 |

| | 22.6 |

| | Dec - 15 |

Swedish krona | | Euro | | 15.9 |

| | 31.4 |

| | Dec - 15 |

At June 30, 2015 and December 31, 2014, the following amounts were recorded in the Condensed Consolidated Balance Sheets as being payable to or receivable from counterparties under ASC Topic 815:

|

| | | | | | | | | | | | | | | | | | | | |

| | Assets | | Liabilities |

(in millions) | | Location | | June 30, 2015 | | December 31, 2014 | | Location | | June 30, 2015 | | December 31, 2014 |

Foreign currency | | Prepayments and other current assets | | $ | 6.0 |

| | $ | 3.7 |

| | Accounts payable and accrued expenses | | $ | 3.1 |

| | $ | 2.4 |

|

| | Other non-current assets | | $ | 0.1 |

| | $ | 0.1 |

| | Other non-current liabilities | | $ | — |

| | $ | 0.5 |

|

Commodity | | Prepayments and other current assets | | $ | — |

| | $ | — |

| | Accounts payable and accrued expenses | | $ | 0.1 |

| | $ | — |

|

Effectiveness for cash flow and net investment hedges is assessed at the inception of the hedging relationship and quarterly, thereafter. To the extent that derivative instruments are deemed to be effective, gains and losses arising from these contracts are deferred into accumulated other comprehensive income (loss) ("AOCI") and reclassified into income as the underlying operating transactions are recognized. These

realized gains or losses offset the hedged transaction and are recorded on the same line in the statement of operations. To the extent that derivative instruments are deemed to be ineffective, gains or losses are recognized into income.

The table below shows deferred gains (losses) reported in AOCI as well as the amount expected to be reclassified to income in one year or less. The amount expected to be reclassified to income in one year or less assumes no change in the current relationship of the hedged item at June 30, 2015 market rates.

|

| | | | | | | | | | | | |

(in millions) | | Deferred gain (loss) in AOCI at | | Gain (loss) expected to be reclassified to income in one year or less |

Contract Type | | June 30, 2015 | | December 31, 2014 | |

Foreign currency | | $ | 3.1 |

| | $ | 1.3 |

| | $ | 3.0 |

|

Commodity | | (0.1 | ) | | — |

| | (0.1 | ) |

Net investment hedges | | 0.2 |

| | 0.2 |

| | — |

|

Total | | $ | 3.2 |

| | $ | 1.5 |

| | $ | 2.9 |

|

Derivative instruments designated as hedging instruments as defined by ASC Topic 815 held during the period resulted in the following gains and losses recorded in income:

|

| | | | | | | | | | | | | | | | | | | | |

| | | | Gain (loss) reclassified from AOCI to income (effective portion) | | | | Gain (loss) recognized in income (ineffective portion) |

(in millions) | | | | Three Months Ended | | | | Three Months Ended |

Contract Type | | Location | | June 30, 2015 | | June 30, 2014 | | Location | | June 30, 2015 | | June 30, 2014 |

Foreign currency | | Sales | | $ | — |

| | $ | 1.0 |

| | SG&A expense | | $ | (0.1 | ) | | $ | 0.1 |

|

Foreign currency | | Cost of goods sold | | $ | 2.3 |

| | $ | (1.0 | ) | | SG&A expense | | $ | — |

| | $ | — |

|

Foreign currency | | SG&A expense | | $ | — |

| | $ | (0.1 | ) | | SG&A expense | | $ | — |

| | $ | — |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | | | Gain (loss) reclassified from AOCI to income (effective portion) | | | | Gain (loss) recognized in income (ineffective portion) |

(in millions) | | | | Six Months Ended | | | | Six Months Ended |

Contract Type | | Location | | June 30, 2015 | | June 30, 2014 | | Location | | June 30, 2015 | | June 30, 2014 |

Foreign currency | | Sales | | $ | (0.3 | ) | | $ | 1.3 |

| | SG&A expense | | $ | (0.4 | ) | | $ | 0.1 |

|

Foreign currency | | Cost of goods sold | | $ | 3.8 |

| | $ | (1.8 | ) | | SG&A expense | | $ | 0.1 |

| | $ | 0.1 |

|

Foreign currency | | SG&A expense | | $ | — |

| | $ | (0.4 | ) | | SG&A expense | | $ | — |

| | $ | — |

|

Cross-currency swap | | N/A | |

|

| |

|

| | Interest expense | | $ | — |

| | $ | 0.7 |

|

At June 30, 2015, derivative instruments that were not designated as hedging instruments as defined by ASC Topic 815 were immaterial.

(11) Retirement Benefit Plans

The Company has a number of defined benefit pension plans and other postretirement benefit plans covering eligible salaried and hourly employees and their dependents. The estimated contributions to the Company's defined benefit pension plans for 2015 range from $15.0 million to $25.0 million, of which $9.8 million has been contributed through the first six months of the year. The other postretirement benefit plans, which provide medical and life insurance benefits, are unfunded plans.

The components of net periodic benefit cost recorded in the Condensed Consolidated Statements of Operations are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Pension benefits | | Other postretirement employee benefits |

(in millions) | | 2015 | | 2014 | |

Three Months Ended June 30, | | US | | Non-US | | US | | Non-US | | 2015 | | 2014 |

Service cost | | $ | — |

| | $ | 3.7 |

| | $ | — |

| | $ | 3.2 |

| | $ | — |

| | $ | 0.1 |

|

Interest cost | | 2.7 |

| | 3.5 |

| | 3.1 |

| | 4.7 |

| | 1.4 |

| | 1.7 |

|

Expected return on plan assets | | (4.3 | ) | | (6.2 | ) | | (4.4 | ) | | (5.4 | ) | | — |

| | — |

|

Amortization of unrecognized prior service benefit | | (0.2 | ) | | — |

| | (0.2 | ) | | — |

| | (1.4 | ) | | (1.6 | ) |

Amortization of unrecognized loss | | 1.7 |

| | 1.7 |

| | 1.7 |

| | 1.3 |

| | 0.8 |

| | 0.6 |

|

Net periodic benefit (income) cost | | $ | (0.1 | ) | | $ | 2.7 |

| | $ | 0.2 |

| | $ | 3.8 |

| | $ | 0.8 |

| | $ | 0.8 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Pension benefits | | Other postretirement employee benefits |

(in millions) | | 2015 | | 2014 | |

Six Months Ended June 30, | | US | | Non-US | | US | | Non-US | | 2015 | | 2014 |

Service cost | | $ | — |

| | $ | 7.4 |

| | $ | — |

| | $ | 6.5 |

| | $ | 0.1 |

| | $ | 0.1 |

|

Interest cost | | 5.5 |

| | 7.1 |

| | 6.2 |

| | 9.3 |

| | 2.8 |

| | 3.4 |

|

Expected return on plan assets | | (8.6 | ) | | (12.4 | ) | | (8.8 | ) | | (10.8 | ) | | — |

| | — |

|

Amortization of unrecognized prior service benefit | | (0.4 | ) | | — |

| | (0.4 | ) | | — |

| | (2.8 | ) | | (3.2 | ) |

Amortization of unrecognized loss | | 3.3 |

| | 3.4 |

| | 3.3 |

| | 2.5 |

| | 1.5 |

| | 1.3 |

|

Net periodic benefit (income) cost | | $ | (0.2 | ) | | $ | 5.5 |

| | $ | 0.3 |

| | $ | 7.5 |

| | $ | 1.6 |

| | $ | 1.6 |

|

(12) Stock-Based Compensation

Under the Company's 2004 Stock Incentive Plan ("2004 Plan"), the Company granted options to purchase shares of the Company's common stock at the fair market value on the date of grant. The options vested over periods of up to three years and have a term of 10 years from date of grant. At its November 2007 meeting, the Company's Compensation Committee decided that restricted common stock awards and stock units ("restricted stock") would be awarded in place of stock options for long-term incentive award grants to employees. Restricted stock granted to employees primarily vests 50% after two years and the remainder after three years from the date of grant. Restricted stock granted to non-employee directors generally vests on the first anniversary date of the grant. In February 2014, the Company's Board of Directors replaced the expired 2004 Plan by adopting the BorgWarner Inc. 2014 Stock Incentive Plan ("2014 Plan"). On April 30, 2014, the Company's stockholders approved the 2014 Plan. Under the 2014 Plan, 8 million shares are authorized for grant, of which approximately 7.0 million shares are available for future issuance as of June 30, 2015.

Stock options A summary of the Company’s stock option activity for the six months ended June 30, 2015 is as follows:

|

| | | | | | | | | | | | |

| Shares under option (thousands) | | Weighted average exercise price | | Weighted average remaining contractual life (in years) | | Aggregate intrinsic value (in millions) |

Outstanding and exercisable at December 31, 2014 | 1,714 |

| | $ | 16.11 |

| | 1.7 | | $ | 66.5 |

|

Exercised | (251 | ) | | $ | 14.72 |

| | | |

|

Outstanding and exercisable at March 31, 2015 | 1,463 |

| | $ | 16.35 |

| | 1.5 | | $ | 64.6 |

|

Exercised | (103 | ) | | $ | 14.66 |

| | | | |

Outstanding and exercisable at June 30, 2015 | 1,360 |

| | $ | 16.48 |

| | 1.3 | | $ | 54.9 |

|

Restricted stock The value of restricted stock is determined by the market value of the Company’s common stock at the date of grant. In 2015, restricted stock in the amount of 669,754 shares and 16,983 shares was granted to employees and non-employee directors, respectively. The value of the awards is recorded as unearned compensation within capital in excess of par value in equity and is amortized as compensation expense over the restriction periods.

The Company recorded restricted stock compensation expense of $6.9 million and $14.2 million for the three and six months ended June 30, 2015, respectively, and $5.4 million and and $9.9 million for the three and six months ended June 30, 2014, respectively.

A summary of the Company’s nonvested restricted stock for the six months ended June 30, 2015 is as follows:

|

| | | | | | |

| Shares subject to restriction (thousands) | | Weighted average price |

Nonvested at December 31, 2014 | 1,266 |

| | $ | 43.57 |

|

Granted | 563 |

| | $ | 57.90 |

|

Vested | (568 | ) | | $ | 38.35 |

|

Forfeited | (12 | ) | | $ | 45.10 |

|

Nonvested at March 31, 2015 | 1,249 |

| | $ | 52.49 |

|

Granted | 124 |

| | $ | 60.97 |

|

Vested | (20 | ) | | $ | 61.79 |

|

Forfeited | (5 | ) | | $ | 52.82 |

|

Nonvested at June 30, 2015 | 1,348 |

| | $ | 53.15 |

|

(13) Accumulated Other Comprehensive Loss

The following tables summarize the activity within accumulated other comprehensive loss during the three and six months ended June 30, 2015 and 2014:

|

| | | | | | | | | | | | | | | | | | | | |

(in millions) | | Foreign currency translation adjustments | | Hedge instruments | | Defined benefit postretirement plans | | Other | | Total |

Beginning balance, March 31, 2015 | | $ | (410.5 | ) | | $ | 5.9 |

| | $ | (215.0 | ) | | $ | 2.7 |

| | $ | (616.9 | ) |

Comprehensive income (loss) before reclassifications | | 84.2 |

| | (1.4 | ) | | (7.9 | ) | | 0.2 |

| | 75.1 |

|

Income taxes associated with comprehensive income (loss) before reclassifications | | — |

| | 0.3 |

| | 1.8 |

| | — |

| | 2.1 |

|

Reclassification from accumulated other comprehensive loss | | — |

| | (2.3 | ) | | 2.6 |

| | — |

| | 0.3 |

|

Income taxes reclassified into net earnings | | — |

| | 0.7 |

| | (0.8 | ) | | — |

| | (0.1 | ) |

Ending balance, June 30, 2015 | | $ | (326.3 | ) | | $ | 3.2 |

| | $ | (219.3 | ) | | $ | 2.9 |

| | $ | (539.5 | ) |

|

| | | | | | | | | | | | | | | | | | | | |

(in millions) | | Foreign currency translation adjustments | | Hedge instruments | | Defined benefit postretirement plans | | Other | | Total |

Beginning balance, March 31, 2014 | | $ | 178.4 |

| | $ | (17.3 | ) | | $ | (180.3 | ) | | $ | 2.4 |

| | $ | (16.8 | ) |

Comprehensive income (loss) before reclassifications | | (1.1 | ) | | 0.5 |

| | — |

| | (0.1 | ) | | (0.7 | ) |

Income taxes associated with comprehensive income (loss) before reclassifications | | — |

| | 0.1 |

| | — |

| | — |

| | 0.1 |

|

Reclassification from accumulated other comprehensive loss | | — |

| | 0.1 |

| | (0.9 | ) | | — |

| | (0.8 | ) |

Income taxes reclassified into net earnings | | — |

| | — |

| | (0.4 | ) | | — |

| | (0.4 | ) |

Ending balance, June 30, 2014 | | $ | 177.3 |

| | $ | (16.6 | ) | | $ | (181.6 | ) | | $ | 2.3 |

| | $ | (18.6 | ) |

|

| | | | | | | | | | | | | | | | | | | | |

(in millions) | | Foreign currency translation adjustments | | Hedge instruments | | Defined benefit postretirement plans | | Other | | Total |

Beginning balance, December 31, 2014 | | $ | (160.7 | ) | | $ | 1.7 |

| | $ | (227.3 | ) | | $ | 2.7 |

| | $ | (383.6 | ) |

Comprehensive income (loss) before reclassifications | | (165.6 | ) | | 5.2 |

| | 6.6 |

| | 0.2 |

| | (153.6 | ) |

Income taxes associated with comprehensive income (loss) before reclassifications | | — |

| | (1.3 | ) | | (2.2 | ) | | — |

| | (3.5 | ) |

Reclassification from accumulated other comprehensive loss | | — |

| | (3.5 | ) | | 5.0 |

| | — |

| | 1.5 |

|

Income taxes reclassified into net earnings | | — |

| | 1.1 |

| | (1.4 | ) | | — |

| | (0.3 | ) |

Ending balance, June 30, 2015 | | $ | (326.3 | ) | | $ | 3.2 |

| | $ | (219.3 | ) | | $ | 2.9 |

| | $ | (539.5 | ) |

|

| | | | | | | | | | | | | | | | | | | | |

(in millions) | | Foreign currency translation adjustments | | Hedge instruments | | Defined benefit postretirement plans | | Other | | Total |

Beginning balance, December 31, 2013 | | $ | 181.1 |

| | $ | (16.0 | ) | | $ | (181.5 | ) | | $ | 2.4 |

| | $ | (14.0 | ) |

Comprehensive loss before reclassifications | | (3.8 | ) | | (2.8 | ) | | — |

| | (0.1 | ) | | (6.7 | ) |

Income taxes associated with comprehensive loss before reclassifications | | — |

| | 1.4 |

| | — |

| | — |

| | 1.4 |

|

Reclassification from accumulated other comprehensive loss | | — |

| | 0.9 |

| | 0.8 |

| | — |

| | 1.7 |

|

Income taxes reclassified into net earnings | | — |

| | (0.1 | ) | | (0.9 | ) | | — |

| | (1.0 | ) |

Ending balance, June 30, 2014 | | $ | 177.3 |

| | $ | (16.6 | ) | | $ | (181.6 | ) | | $ | 2.3 |

| | $ | (18.6 | ) |

(14) Contingencies

In the normal course of business, the Company is party to various commercial and legal claims, actions and complaints, including matters involving warranty claims, intellectual property claims, general liability and various other risks. It is not possible to predict with certainty whether or not the Company will ultimately be successful in any of these commercial and legal matters or, if not, what the impact might be. The Company's environmental and product liability contingencies are discussed separately below. The Company's management does not expect that an adverse outcome in any of these commercial and legal claims, actions and complaints will have a material adverse effect on the Company's results of operations, financial position or cash flows, although it could be material to the results of operations in a particular quarter.

Litigation

In January 2006, BorgWarner Diversified Transmission Products Inc. ("DTP"), a subsidiary of the Company, filed a declaratory judgment action in United States District Court, Southern District of Indiana (Indianapolis Division) against the United Automobile, Aerospace, and Agricultural Implements Workers of America (“UAW”) Local No. 287 and Gerald Poor, individually and as the representative of a defendant class. DTP sought the Court's affirmation that DTP did not violate the Labor-Management Relations Act or the Employee Retirement Income Security Act (ERISA) by unilaterally amending certain medical plans effective April 1, 2006 and October 1, 2006, prior to the expiration of the then-current collective bargaining agreements. On September 10, 2008, the Court found that DTP's reservation of the right to make such amendments reducing the level of benefits provided to retirees was limited by its collectively bargained health insurance agreement with the UAW, which did not expire until April 24, 2009. Thus, the amendments were untimely. In 2008, the Company recorded a charge of $4.0 million as a result of the Court's decision.

DTP filed a declaratory judgment action in the United States District Court, Southern District of Indiana (Indianapolis Division) against the UAW Local No. 287 and Jim Barrett and others, individually and as representatives of a defendant class, on February 26, 2009 again seeking the Court's affirmation that DTP did not violate the Labor - Management Relations Act or ERISA by modifying the level of benefits provided retirees to make them comparable to other Company retiree benefit plans after April 24, 2009. Certain retirees, on behalf of themselves and others, filed a mirror-image action in the United States District Court, Eastern District of Michigan (Southern Division) on March 11, 2009, for which a class has been certified. During the last quarter of 2009, the action pending in Indiana was dismissed, while the action in Michigan is continuing. The Company is vigorously defending against the suit. This contingency is subject to many uncertainties, therefore based on the information available to date, the Company cannot reasonably estimate the amount or the range of potential loss, if any.

Environmental

The Company and certain of its current and former direct and indirect corporate predecessors, subsidiaries and divisions have been identified by the United States Environmental Protection Agency and certain state environmental agencies and private parties as potentially responsible parties (“PRPs”) at various hazardous waste disposal sites under the Comprehensive Environmental Response, Compensation and Liability Act (“Superfund”) and equivalent state laws and, as such, may presently be liable for the cost of clean-up and other remedial activities at 27 such sites. Responsibility for clean-up and other remedial activities at a Superfund site is typically shared among PRPs based on an allocation formula.

The Company believes that none of these matters, individually or in the aggregate, will have a material adverse effect on its results of operations, financial position or cash flows. Generally, this is because either the estimates of the maximum potential liability at a site are not material or the liability will be shared with other PRPs, although no assurance can be given with respect to the ultimate outcome of any such matter.

Based on information available to the Company (which in most cases includes: an estimate of allocation of liability among PRPs; the probability that other PRPs, many of whom are large, solvent public companies, will fully pay the cost apportioned to them; currently available information from PRPs and/or federal or state environmental agencies concerning the scope of contamination and estimated remediation and consulting costs; and remediation alternatives), the Company has an accrual for indicated environmental liabilities of $5.5 million and $6.2 million at June 30, 2015 and at December 31, 2014, respectively. The Company expects to pay out substantially all of the amounts accrued for environmental liability over the next five years.

In connection with the sale of Kuhlman Electric Corporation (“Kuhlman Electric”), the Company agreed to indemnify the buyer and Kuhlman Electric for certain environmental liabilities, then unknown to the Company, relating to certain operations of Kuhlman Electric that pre-date the Company's 1999 acquisition of Kuhlman Electric. The Company previously settled or obtained dismissals of various lawsuits that were filed against Kuhlman Electric and others, including the Company, on behalf of plaintiffs alleging personal injury relating to alleged environmental contamination at its Crystal Springs, Mississippi plant. The Company filed a lawsuit against Kuhlman Electric and a related entity challenging the validity of the indemnity and the defendants filed counterclaims and a related lawsuit. The Company may in the future become subject to further legal proceedings.

Product Liability

Like many other industrial companies who have historically operated in the U.S., the Company (or parties the Company is obligated to indemnify) continues to be named as one of many defendants in asbestos-related personal injury actions. We believe that the Company's involvement is limited because, in general, these claims relate to a few types of automotive products that were manufactured many years ago and contained encapsulated asbestos. The nature of the fibers, the encapsulation and the manner of use lead the Company to believe that these products are highly unlikely to cause harm. As of June 30, 2015 and December 31, 2014, the Company had approximately 12,000 and 13,300 pending asbestos-related product liability claims, respectively. The decrease in the pending claims is primarily a result of the Company's continued efforts to obtain dismissal of dormant claims.

The Company's policy is to vigorously defend against these lawsuits and the Company has been successful in obtaining dismissal of many claims without any payment. The nature of the historical product being encapsulated and the lifecycle of the product allow the Company to aggressively defend against these lawsuits. The Company expects that the vast majority of the pending asbestos-related product liability claims where it is a defendant (or has an obligation to indemnify a defendant) will result in no payment being made by the Company or its insurers. In the first six months of 2015, of the approximately 2,300 claims resolved, 187 (8%) resulted in payment being made to a claimant by or on behalf of the Company. In the full year of 2014, of the approximately 6,500 claims resolved, 397 (6%) resulted in payment being made to a claimant by or on behalf of the Company.

Prior to June 2004, the settlement and defense costs associated with all claims were paid by the Company's primary layer insurance carriers under a series of funding arrangements. In addition to the primary insurance available for asbestos-related claims, the Company has excess insurance coverage available for potential future asbestos-related product claims. In June 2004, primary layer insurance carriers notified the Company of the alleged exhaustion of their policy limits.

A declaratory judgment action was filed in January 2004 in the Circuit Court of Cook County, Illinois by Continental Casualty Company and related companies against the Company and certain of its historical general liability insurers. The court has issued a number of interim rulings and discovery is continuing. The Company has entered into settlement agreements with some of its insurance carriers, resolving their coverage disputes by agreeing to pay specified amounts to the Company. The Company is vigorously pursuing the litigation against the remaining insurers.

In August 2013, the Los Angeles Superior Court entered a jury verdict against the Company in an asbestos-related personal injury action with damages of $35.0 million, of which $32.5 million were punitive and would not be recoverable through insurance. In July 2015, the Court of Appeal for the State of California issued a verdict striking the $32.5 million in punitive damages assessed by the Los Angeles Superior Court. The Company cannot predict the outcome of this pending litigation and therefore cannot reasonably estimate the amount of possible loss, if any, that could result from any future action.

To date, the Company has paid and accrued $365.2 million in defense and indemnity costs in advance of insurers' reimbursement and has received $195.9 million in cash and notes from insurers. The net balance of $169.3 million is expected to be fully recovered. Timing of recovery is dependent on final resolution of the declaratory judgment action referred to above or additional negotiated settlements. At December 31, 2014, insurers owed $141.9 million in association with these claims.

In addition to the $169.3 million net balance relating to past settlements and defense costs, the Company has estimated a liability of $113.0 million for claims asserted, but not yet resolved and their related defense costs at June 30, 2015. The Company also has a related asset of $113.0 million to recognize proceeds from the insurance carriers, which is expected to be fully recovered. Receipt of these proceeds is not expected prior to the resolution of the declaratory judgment action referred to above, which is expected to occur subsequent to June 30, 2016. At December 31, 2014, the comparable value of the accrued liability and associated insurance asset was $111.8 million.

The amounts recorded in the Condensed Consolidated Balance Sheets related to the estimated future settlement of existing claims are as follows:

|

| | | | | | | |

| June 30, | | December 31, |

(in millions) | 2015 | | 2014 |

Assets: | | | |

Other non-current assets | $ | 113.0 |

| | $ | 111.8 |

|

Total insurance assets | $ | 113.0 |

| | $ | 111.8 |

|

Liabilities: | | | |

Accounts payable and accrued expenses | $ | 48.5 |

| | $ | 47.4 |

|

Other non-current liabilities | 64.5 |

| | 64.4 |

|

Total accrued liabilities | $ | 113.0 |

| | $ | 111.8 |

|

The Company believes that its ultimate liability (i.e., the total of its indemnity or other claim dispositions plus legal related fees) cannot be reasonably estimated at this time in excess of amounts accrued. The Company's ability to reasonably estimate its liability has been significantly affected by, among other factors, the volatility of asbestos-related litigation in the United States, the significant number of co-defendants that have filed for bankruptcy, the magnitude and timing of co-defendant bankruptcy trust payments, the inherent uncertainty of future disease incidence and claiming patterns against the Company, and the impact of tort reform legislation that may be enacted at the state or federal levels. The Company’s ability to reasonably estimate its liability for asbestos-related claims may also be affected in the future by the new discovery of facts, changes in litigation, the impact of any possible tort reform, changes in assumptions regarding the number and nature of asbestos-related claims, the amount of any judgments over time, and changes in settlement/defense strategies. The Company reviews factors relevant to asbestos-related claims that have been, or may in the future, be asserted against it on an ongoing basis.

(15) Restructuring

In the fourth quarter of 2013, the Company initiated actions primarily in the Drivetrain segment designed to improve future profitability and competitiveness. As a continuation of these actions, in 2014, the Company finalized severance agreements with two labor unions at separate facilities in Western Europe for approximately 350 employees. The Company recorded restructuring expense related to these facilities of $7.9 million and $15.2 million for the three and six months ended June 30, 2015, respectively, and $9.4 million and $44.8 million for the three and six months ended June 30, 2014, respectively. Included in this restructuring expense are employee termination benefits of $6.8 million and $13.2 million for the three and six months ended June 30, 2015, respectively, and $6.4 million and $38.5 million for the three and six months ended June 30, 2014, respectively. Also included is other restructuring expense of $1.1 million and $2.0 million for the three and six months ended June 30, 2015, respectively, and $3.0 million and $6.3 million for the three and six months ended June 30, 2014 respectively.

The Company expects negligible restructuring expense related to employee termination benefits to be incurred in the remainder of 2015 related to the Drivetrain segment. Cash payments for these restructuring activities are expected to be complete by the end of 2015.

In the second quarter of 2014, the Company initiated actions to improve the future profitability and competitiveness of Gustav Wahler GmbH u. Co. KG and its general partner ("Wahler") and recorded $3.1 million of employee termination benefits in the three and six months ended June 30, 2014. These termination benefits relate to approximately 60 employees in Germany, Brazil and China.

The Company recorded restructuring expense of $9.4 million and $12.1 million for the three and six months ended June 30, 2015, respectively, and $2.0 million and $3.1 million for the three and six months ended June 30, 2014, respectively, related to a global realignment plan intended to enhance treasury management flexibility by creating a legal entity structure that better aligns with the Company's business strategy.

Estimates of restructuring expense are based on information available at the time such charges are recorded. Due to the inherent uncertainty involved in estimating restructuring expenses, actual amounts paid for such activities may differ from amounts initially recorded. Accordingly, the Company may record revisions of previous estimates by adjusting previously established accruals.

The following table displays a rollforward of the severance accruals recorded within the Company's Condensed Consolidated Balance Sheet and the related cash flow activity for the three and six months ended June 30, 2015 and 2014:

|

| | | | | | | | | | | | |

| | Severance Accruals |

(in millions) | | Drivetrain | | Engine | | Total |

Balance at December 31, 2014 | | $ | 41.9 |

| | $ | 2.0 |

| | $ | 43.9 |

|

Provision | | 7.4 |

| | 0.4 |

| | 7.8 |

|

Cash payments | | (10.7 | ) | | (0.9 | ) | | (11.6 | ) |

Translation adjustment | | (4.7 | ) | | (0.2 | ) | | (4.9 | ) |

Balance at March 31, 2015 | | $ | 33.9 |

| | $ | 1.3 |

| | $ | 35.2 |

|

Provision | | 6.8 |

| | 2.6 |

| | 9.4 |

|

Cash payments | | (25.9 | ) | | (1.7 | ) | | (27.6 | ) |

Translation adjustment | | 1.3 |

| | — |

| | 1.3 |

|

Balance at June 30, 2015 | | $ | 16.1 |

| | $ | 2.2 |

| | $ | 18.3 |

|

|

| | | | | | | | | | | | |

| | Severance Accruals |

(in millions) | | Drivetrain | | Engine | | Total |

Balance at December 31, 2013 | | $ | 8.4 |

| | $ | 2.9 |

| | $ | 11.3 |

|

Provision | | 32.1 |

| | 0.7 |

| | 32.8 |

|

Cash payments | | (1.2 | ) | | (1.7 | ) | | (2.9 | ) |

Balance at March 31, 2014 | | $ | 39.3 |

| | $ | 1.9 |

| | $ | 41.2 |

|

Provision | | 6.4 |

| | 3.6 |

| | 10.0 |

|

Cash payments | | (2.7 | ) | | (3.9 | ) | | (6.6 | ) |

Translation adjustment | | (0.2 | ) | | — |

| | (0.2 | ) |

Balance at June 30, 2014 | | $ | 42.8 |

| | $ | 1.6 |

| | $ | 44.4 |

|

(16) Earnings Per Share

The Company presents both basic and diluted earnings per share of common stock (“EPS”) amounts. Basic EPS is calculated by dividing net earnings attributable to BorgWarner Inc. by the weighted average shares of common stock outstanding during the reporting period. Diluted EPS is calculated by dividing net earnings attributable to BorgWarner Inc. by the weighted average shares of common stock and common equivalent stock outstanding during the reporting period.

The dilutive impact of stock-based compensation is calculated using the treasury stock method. The treasury stock method assumes that the Company uses the assumed proceeds from the exercise of awards to repurchase common stock at the average market price during the period. The assumed proceeds under the treasury stock method include the purchase price that the grantee will pay in the future, compensation cost for future service that the Company has not yet recognized and any windfall/(shortfall) tax benefits that would be credited/(debited) to capital in excess of par value when the award generates a tax deduction. Options are only dilutive when the average market price of the underlying common stock exceeds the exercise price of the options.

The following table reconciles the numerators and denominators used to calculate basic and diluted earnings per share of common stock:

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(in millions, except per share amounts) | 2015 | | 2014 | | 2015 | | 2014 |

Basic earnings per share: | | | | | | | |

Net earnings attributable to BorgWarner Inc. | $ | 148.1 |

| | $ | 190.2 |

| | $ | 327.0 |

| | $ | 349.3 |

|

Weighted average shares of common stock outstanding | 225.353 |

| | 227.678 |

| | 225.575 |

| | 227.554 |

|

Basic earnings per share of common stock | $ | 0.66 |

| | $ | 0.84 |

| | $ | 1.45 |

| | $ | 1.54 |

|

| | | | | | | |

Diluted earnings per share: | | | | | | | |

Net earnings attributable to BorgWarner Inc. | $ | 148.1 |

| | $ | 190.2 |

| | $ | 327.0 |

| | $ | 349.3 |

|

| | | | | | | |

Weighted average shares of common stock outstanding | 225.353 |

|

| 227.678 |

|

| 225.575 |

|

| 227.554 |

|

| | | | | | | |

Effect of stock-based compensation | 1.262 |

| | 1.992 |

| | 1.277 |

| | 1.945 |

|

| | | | | | | |

Weighted average shares of common stock outstanding including dilutive shares | 226.615 |

|

| 229.670 |

|

| 226.852 |

|

| 229.499 |

|

Diluted earnings per share of common stock | $ | 0.65 |

|

| $ | 0.83 |

|

| $ | 1.44 |

|

| $ | 1.52 |

|

| | | | | | | |

(17) Reporting Segments

The Company's business is comprised of two reporting segments: Engine and Drivetrain. These segments are strategic business groups, which are managed separately as each represents a specific grouping of related automotive components and systems.

The Company allocates resources to each segment based upon the projected after-tax return on invested capital ("ROIC") of its business initiatives. ROIC is comprised of Adjusted EBIT after deducting notional taxes compared to the projected average capital investment required. Adjusted EBIT is comprised of earnings before interest, income taxes and noncontrolling interest (“EBIT") adjusted for restructuring, goodwill impairment charges, affiliates' earnings and other items not reflective of on-going operating income or loss.

Adjusted EBIT is the measure of segment income or loss used by the Company. The Company believes Adjusted EBIT is most reflective of the operational profitability or loss of our reporting segments. The following tables show segment information and Adjusted EBIT for the Company's reporting segments.

Net Sales by Reporting Segment

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(in millions) | 2015 | | 2014 | | 2015 | | 2014 |

Engine | $ | 1,413.0 |

|

| $ | 1,497.5 |

|

| $ | 2,793.9 |

|

| $ | 2,909.6 |

|

Drivetrain | 626.9 |

|

| 708.7 |

|

| 1,238.1 |

|

| 1,389.4 |

|

Inter-segment eliminations | (8.0 | ) |

| (9.2 | ) |

| (15.9 | ) |

| (17.9 | ) |

Net sales | $ | 2,031.9 |

|

| $ | 2,197.0 |

|

| $ | 4,016.1 |

|

| $ | 4,281.1 |

|

Adjusted Earnings Before Interest, Income Taxes and Noncontrolling Interest (“Adjusted EBIT”)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(in millions) | 2015 | | 2014 | | 2015 | | 2014 |

Engine | $ | 228.0 |

|

| $ | 241.7 |

|

| $ | 458.4 |

|

| $ | 473.4 |

|

Drivetrain | 72.1 |

|

| 89.1 |

|

| 143.1 |

|

| 169.6 |

|

Adjusted EBIT | 300.1 |

|

| 330.8 |

|

| 601.5 |

|

| 643.0 |

|

Restructuring expense | 19.9 |

|

| 15.0 |

|

| 32.0 |

|

| 54.5 |

|

Gain on previously held equity interest | — |

|

| — |

|

| (10.8 | ) |

| — |

|

Corporate, including equity in affiliates' earnings and stock-based compensation | 26.6 |

|

| 23.0 |

|

| 58.6 |

|

| 53.7 |

|

Interest income | (1.6 | ) |

| (1.4 | ) |

| (3.3 | ) |

| (2.9 | ) |

Interest expense and finance charges | 17.6 |

|

| 9.0 |

|

| 27.6 |

|

| 17.2 |

|

Earnings before income taxes and noncontrolling interest | 237.6 |

|

| 285.2 |

|

| 497.4 |

|

| 520.5 |

|

Provision for income taxes | 80.2 |

|

| 85.3 |

|

| 152.3 |

|

| 153.4 |

|

Net earnings | 157.4 |

|

| 199.9 |

|

| 345.1 |

|

| 367.1 |

|

Net earnings attributable to the noncontrolling interest, net of tax | 9.3 |

|

| 9.7 |

|

| 18.1 |

|

| 17.8 |

|

Net earnings attributable to BorgWarner Inc. | $ | 148.1 |

|

| $ | 190.2 |

|

| $ | 327.0 |

|

| $ | 349.3 |

|

Total Assets

|

| | | | | | | |

(in millions) | June 30, 2015 | | December 31, 2014 |

Engine | $ | 4,043.2 |

| | $ | 3,936.2 |

|

Drivetrain | 1,864.4 |

| | 1,783.5 |

|

Total | 5,907.6 |

| | 5,719.7 |

|

Corporate * | 1,858.7 |

| | 1,508.3 |

|

Total assets | $ | 7,766.3 |

| | $ | 7,228.0 |

|

____________________________________

* Corporate assets include investments and other long-term receivables and deferred income taxes.

(18) Recent Transactions

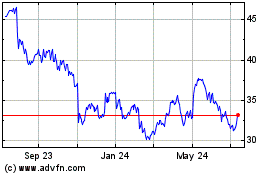

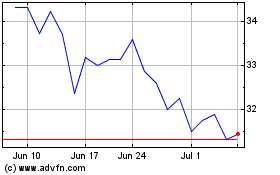

Remy International, Inc.

On July 13, 2015, the Company announced that it had entered into a definitive agreement to acquire Remy International, Inc. (“Remy”) for $29.50 per share in cash, which implies an enterprise value of Remy of approximately $1.2 billion. Remy is a global market leading producer of rotating electrical components with key technologies and operations in ten countries. This acquisition is expected to strengthen the Company’s position in the rapidly developing powertrain electrification trend. As of December 31, 2014, Remy employed approximately 6,600 people and, for the fiscal year, generated net sales of approximately $1.2 billion. The transaction is expected to close in the fourth quarter of 2015 subject to certain customary terms and conditions, including the approval of Remy's stockholders and antitrust and other regulatory clearances in the United States and abroad.

BERU Diesel Start Systems Pvt. Ltd.

In January 2015, the Company completed the purchase of the remaining 51% of BERU Diesel by acquiring the shares of its former joint venture partner. The former joint venture was formed in 1996 to develop and manufacture glow plugs in India. After this transaction, the Company owns 100% of the entity. The cash paid, net of cash acquired, was $12.6 million (783.1 million Indian rupees).

The operating results are reported within the Company's Engine reporting segment. The Company paid $12.6 million, which is recorded as an investing activity in the Company's Condensed Consolidated Statement of Cash Flows. As a result of this transaction, the Company recorded a $10.8 million gain on the previously held equity interest in this joint venture. Additionally, the Company acquired assets of $16.0 million, including $11.2 million in definite-lived intangible assets, and assumed liabilities of $4.6 million. The Company also recorded $13.9 million of goodwill, which is expected to be non-deductible for tax purposes.

Gustav Wahler GmbH u. Co KG

On February 28, 2014, the Company acquired 100% of the equity interests in Gustav Wahler GmbH u. Co. KG and its general partner ("Wahler"). Wahler was a producer of exhaust gas recirculation ("EGR") valves, EGR tubes and thermostats, and had operations in Germany, Brazil, the U.S., China and Slovakia. The cash paid, net of cash acquired was $110.5 million (80.1 million Euro).

The operating results and assets are reported within the Company's Engine reporting segment as of the date of the acquisition. The Company paid $110.5 million, which is recorded as an investing activity in the Company's Condensed Consolidated Statement of Cash Flows. Additionally, the Company assumed retirement-related liabilities of $3.2 million and assumed debt of $40.3 million, which are reflected in the supplemental cash flow information on the Company's Condensed Consolidated Statement of Cash Flows.

The following table summarizes the aggregated estimated fair value of the assets acquired and liabilities assumed on February 28, 2014, the date of acquisition:

|

| | | | |

(in millions) | | |

Receivables, net | | $ | 52.4 |

|

Inventories, net | | 46.8 |

|

Property, plant and equipment, net | | 55.3 |

|

Goodwill | | 74.6 |

|

Other intangible assets | | 42.7 |

|

Other assets and liabilities | | (47.4 | ) |

Accounts payable and accrued expenses | | (70.4 | ) |

Total consideration, net of cash acquired | | 154.0 |

|

| | |

Less: Assumed retirement-related liabilities | | 3.2 |

|

Less: Assumed debt | | 40.3 |

|

Cash paid, net of cash acquired | | $ | 110.5 |

|

In connection with the acquisition, the Company capitalized $24.9 million for customer relationships, $10.2 million for know-how, $4.1 million for patented technology and $3.5 million for the Wahler trade name. These intangible assets will be amortized over a period of 5 to 15 years. The income approach was used to determine the fair value of all intangible assets. Additionally, $56.9 million in goodwill is expected to be non-deductible for tax purposes.

(19) New Accounting Pronouncements