UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 3, 2015

|

|

BABCOCK & WILCOX ENTERPRISES, INC. |

(Exact name of registrant as specified in its charter) |

|

| | |

DELAWARE | 001-36876 | 47-2783641 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

13024 BALLANTYNE CORPORATE PLACE SUITE 700 CHARLOTTE, NORTH CAROLINA | 28277 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s Telephone Number, including Area Code: (704) 625-4900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

⃞ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

⃞ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

⃞ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

⃞ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

_____________________________________________

Item 2.02 Results of Operations and Financial Condition.

On November 3, 2015, we issued a press release announcing our financial results for the third quarter ended September 30, 2015. A copy of the press release is attached as Exhibit 99.1, and the information contained in Exhibit 99.1 is incorporated by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Earnings Release dated November 3, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | |

| BABCOCK & WILCOX ENTERPRISES, INC. | |

| | |

| | | |

| By: | /s/ J. André Hall | |

| | J. André Hall | |

| | Senior Vice President, General Counsel and Corporate Secretary |

| | |

November 3, 2015 | | |

EXHIBIT INDEX

|

| |

99.1 | Earnings Release dated November 3, 2015 |

Babcock & Wilcox Announces Third Quarter 2015 Results

- 2015 Guidance for Adjusted EPS Lifted to $1.15 to $1.30

- Global Power Revenues Increase 29.1%

- Share Buyback Program to Target up to $50 million by the end of Q1 2016

(CHARLOTTE, N.C. – November 3, 2015) – Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE:BW) announced today third quarter 2015 revenues of $420.0 million, an increase of $18.0 million, or 4.5%, from the third quarter of 2014. GAAP earnings per share from continuing operations for the third quarter of 2015 were $0.11 compared to $0.24 in the third quarter of 2014. Adjusted earnings per share, which excludes the impact of a litigation settlement, spin-related costs and restructuring for the quarter, were $0.25 for the three months ended September 30, 2015 compared to $0.33 in the prior year period.

"Third quarter performance met our internal targets, as a strong quarter from Global Power allowed us to overcome a challenging project in Global Services,” said Mr. E. James Ferland, Chairman and Chief Executive Officer. “We continue to expect strong performance in Q4 and we are raising the bottom end of our guidance for adjusted earnings per share by 5 cents to a range of $1.15 to $1.30.”

Results of Operations

Consolidated revenues for the third quarter of 2015 were $420.0 million, an increase of 4.5%, compared to $402.0 million for the third quarter of 2014. GAAP operating income for the third quarter of 2015 decreased $15.9 million to $9.6 million compared to $25.5 million in the prior year period primarily due to lower profits in Global Services and the inclusion of stand-alone costs. GAAP operating income for the third quarter of 2015 also included a $9.6 million charge comprised of $7.8 million of non-cash revenue reversal plus $1.8 million of legal costs related to the litigation settlement for Berlin Station, in addition to $1.6 million in spin-related costs and $1.1 million of restructuring costs. Adjusted operating income in the third quarter of 2015 was $21.9 million, a decrease of $10.4 million compared to adjusted operating income of $32.3 million in the third quarter of 2014 primarily due to a loss accrual on a construction services project and increased overhead costs due to running a stand-alone company. Adjusted operating income for the nine months ended September 30, 2015, increased 23.5% compared to the prior year period.

Third quarter 2015 revenues for the Global Power segment increased 29.1% to $160.0 million in the quarter compared to $123.9 million in revenues in the prior year period driven by an increase in new build steam projects that was partially offset by a decline in new build environmental projects. Gross profit in the Global Power segment was $25.8 million, compared to $29.7 million for the same period in 2014. Without the Berlin settlement, gross profit in Global Power was up for the quarter compared to the third quarter 2014.

"Although we remained confident in our case, by settling the Berlin Station litigation, we avoided potential draws on our letters of credit, significant management distraction and the inherent uncertainty of collecting on any favorable court decisions years in the future," Mr. Ferland said.

Revenues in the Global Services segment were $221.1 million in the three months ending September 30, 2015, versus $229.2 million in the corresponding period in 2014, a decrease of $8.1 million primarily related to lower boiler auxiliaries sales in China and parts and technical services sales that were partially offset by a higher level of construction activities. The Global Services segment reported a gross profit of $38.9 million in the third quarter of 2015, which was $8.8 million less than the gross profit of $47.7 million in the prior year third quarter primarily due to a loss accrual on a construction services project.

The Industrial Environmental segment contributed $38.9 million in revenues this period compared to $48.9 million in the third quarter of 2014, a decrease of $10.0 million due to lower volume of aftermarket sales and timing of product delivery. Gross profit in the Industrial Environmental segment was $13.2 million in the third quarter of 2015, a $2.2 million increase compared to $11.0 million in the prior year period due to the completion of the amortization period of the transaction-related backlog intangible asset on June 30, 2015.

"We continued to execute our strategy to drive shareholder value through revenue growth and margin improvement in the core businesses in the quarter," Mr. Ferland said. "We are also making progress on our plans to grow the business through value-added acquisitions and the number of M&A opportunities that we are evaluating continues to rise.”

Liquidity and Debt

The Company’s cash and investments position, net of restricted cash, increased $22.2 million to $334.9 million at the end of the third quarter of 2015. This consolidated cash position includes $194.4 million in non-U.S. cash.

At September 30, 2015, the Company had no borrowings outstanding under the revolving credit facility, and after giving effect to the leverage ratio and $120.1 million in letters of credit issued under the credit agreement, we had approximately $364.6 million of capacity available to fund acquisitions or to meet letter of credit requirements.

Share Repurchase Program

"We plan to accelerate the utilization of our $100 million share repurchase authorization to buy back up to $50 million in shares by the end of the first quarter of 2016," Mr. Ferland said. "We have a strong balance sheet that allows us to pursue concurrent buy-back and acquisition strategies to create shareholder value."

The Company may utilize various methods to effect the repurchases and the timing of repurchases will depend upon several factors, including market and business conditions, and repurchases may be discontinued at any time. The pace of buy-backs beyond Q1 2016 will be determined based on the status of potential acquisitions as well as market conditions.

2015 Outlook

The Company updated its guidance for 2015 by narrowing the range for earnings per share to an adjusted EPS of $1.15 to $1.30, which raises the bottom of the range by 5 cents. Adjusted EPS excludes mark-to-market adjustment for pension and post-retirement benefits, the Berlin settlement, spin-related costs and restructuring charges.

All other financial benchmarks remain the same:

| |

• | Consolidated revenue is expected to increase to approximately $1.7 billion through a combination of core growth and the full year of the MEGTEC acquisition; and |

| |

• | Adjusted tax rate for 2015 is expected to be in the range of 32% to 34%. |

Conference Call to Discuss Third Quarter 2015 Results

Date: Wednesday, November 4, 2015, at 8:30 a.m. EST

Live Webcast: Investor Relations section of website at www.babcock.com

Forward-Looking Statements

B&W cautions that this release contains forward-looking statements, including, without limitation, statements relating to backlog, to the extent they may be viewed as an indicator of future revenues; management’s expectations regarding the industries in which we operate; our guidance and forecasts for 2015; our projected operating margin improvements, savings and restructuring costs; and growth through acquisitions. These forward-looking statements are based on management’s current expectations and involve a number of risks and uncertainties, including, among other things, disruptions experienced with customers and suppliers; the inability to successfully operate independently following the spin-off; the inability to retain key personnel; adverse changes in the industries in which we operate and delays, changes or termination of contracts in backlog; the timing and amount of repurchases of our common stock, if any; and the inability to grow and diversify through acquisitions. If one or more of these risks or other risks materialize, actual results may vary materially from those expressed. For a more complete discussion of these and other risk factors, see B&W’s filings with the Securities and Exchange Commission, including the information statement on Form 10 and subsequent quarterly reports on Form 10-Q. B&W cautions not to place undue reliance on these forward-looking statements, which speak only as of the date of this release, and undertakes no obligation to update or revise any forward-looking statement, except to the extent required by applicable law.

About B&W

Headquartered in Charlotte, N.C., Babcock & Wilcox is a global leader in energy and environmental technologies and services for the power and industrial markets. B&W companies employ approximately 6,000 people around the world. Follow us on Twitter @BabcockWilcox and learn more at www.babcock.com.

# # #

Investor Contact: Media Contact:

Leslie Kass Ryan Cornell

| |

Vice President Investor Relations and Communications | Public Relations |

Babcock & Wilcox Babcock & Wilcox

704.625.4944 » investors@babcock.com 330.860.1345 » rscornell@babcock.com

Exhibit 1

Babcock & Wilcox Enterprises, Inc.

Reconciliation of Non-GAAP Operating Income and Earnings Per Share(1)(2)

$ in millions, except per share amounts

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2015 | |

| GAAP | Litigation Settlement(3) | Spin Costs | Restructuring | Non-GAAP |

Operating Income (Loss) | $ | 9.6 |

| $ | 9.6 |

| $ | 1.6 |

| $ | 1.1 |

| $ | 21.9 |

|

Other Income / (Expense) | (1.6 | ) | — |

| — |

| — |

| (1.6 | ) |

Income Tax (Expense) / Benefit | (1.8 | ) | (3.7 | ) | (0.6 | ) | (0.4 | ) | (6.5 | ) |

Net Income | $ | 6.3 |

| $ | 5.8 |

| $ | 1.0 |

| $ | 0.7 |

| $ | 13.8 |

|

Non-Controlling Interest | (0.1 | ) | — |

| — |

| — |

| (0.1 | ) |

Net Income from Continuing Operations | $ | 6.2 |

| $ | 5.8 |

| $ | 1.0 |

| $ | 0.7 |

| $ | 13.7 |

|

| | | | | |

Diluted EPS - Continuing Operations | $ | 0.11 |

| $ | 0.11 |

| $ | 0.02 |

| $ | 0.01 |

| $ | 0.25 |

|

| | | | | |

Tax Rate | 22.0% | | | | 32.1% |

|

| | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2014 |

| GAAP | Restructuring | Pension & OPEB MTM (Gain) / Loss | NE Sgmt Allocation | MEGTEC Acquisition Costs | Non-GAAP |

Operating Income (Loss) | $ | 25.5 |

| $ | 2.8 |

| $ | 2.0 |

| $ | 1.3 |

| $ | 0.6 |

| $ | 32.3 |

|

Other Income / (Expense) | 0.1 |

| — |

| — |

| — |

| — |

| 0.1 |

|

Income Tax (Expense) / Benefit | (12.9 | ) | (1.0 | ) | (0.5 | ) | (0.3 | ) | (0.2 | ) | (14.9 | ) |

Net Income | $ | 12.8 |

| $ | 1.8 |

| $ | 1.5 |

| $ | 1.0 |

| $ | 0.4 |

| $ | 17.5 |

|

Non-Controlling Interest | (0.1 | ) | — |

| — |

| — |

| — |

| (0.1 | ) |

Net Income from Continuing Operations | $ | 12.7 |

| $ | 1.8 |

| $ | 1.5 |

| $ | 1.0 |

| $ | 0.4 |

| $ | 17.5 |

|

| | | | | | |

Diluted EPS - Continuing Operations | $ | 0.24 |

| $ | 0.03 |

| $ | 0.03 |

| $ | 0.02 |

| $ | 0.01 |

| $ | 0.33 |

|

| | | | | | |

Tax Rate | 50.2% | | | | | 45.9% |

|

| | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2015 | |

| GAAP | Litigation Settlement(3) | Impairments | Restructuring | NE Sgmt Allocation | Spin Costs | Non-GAAP |

Operating Income (Loss) | $ | 31.8 |

| $ | 9.6 |

| $ | 9.0 |

| $ | 8.7 |

| $ | 2.7 |

| $ | 2.5 |

| $ | 64.3 |

|

Other Income / (Expense) | (1.7 | ) | — |

| — |

| — |

| — |

| — |

| (1.7 | ) |

Income Tax (Expense) / Benefit | (8.4 | ) | (3.7 | ) | (3.4 | ) | (3.1 | ) | (0.7 | ) | (1.0 | ) | (20.3 | ) |

Net Income | $ | 21.8 |

| $ | 5.8 |

| $ | 5.6 |

| $ | 5.6 |

| $ | 2.0 |

| $ | 1.6 |

| $ | 42.3 |

|

Non-Controlling Interest | (0.2 | ) | | — |

| — |

| — |

| — |

| (0.2 | ) |

Net Income from Continuing Operations | $ | 21.5 |

| $ | 5.8 |

| $ | 5.6 |

| $ | 5.6 |

| $ | 2.0 |

| $ | 1.6 |

| $ | 42.1 |

|

| | | | | | | |

Diluted EPS - Continuing Operations | $ | 0.40 |

| $ | 0.11 |

| $ | 0.10 |

| $ | 0.10 |

| $ | 0.04 |

| $ | 0.03 |

| $ | 0.78 |

|

| | | | | | | |

Tax Rate | 27.8% | | | | | | 32.5% |

|

| | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2014 | |

| GAAP | Restructuring | NE Sgmt Allocation | Pension & OPEB MTM (Gain) / Loss

| MEGTEC Acquisition Costs | Non-GAAP |

Operating Income (Loss) | $ | 33.2 |

| $ | 11.7 |

| $ | 4.0 |

| $ | 2.0 |

| $ | 1.1 |

| $ | 52.1 |

|

Other Income / (Expense) | 2.2 |

| — |

| — |

| — |

| — |

| 2.2 |

|

Income Tax (Expense) / Benefit | (13.7 | ) | (4.1 | ) | (1.2 | ) | (0.5 | ) | (0.4 | ) | (19.9 | ) |

Net Income | $ | 21.7 |

| $ | 7.7 |

| $ | 2.8 |

| $ | 1.5 |

| $ | 0.7 |

| $ | 34.3 |

|

Non-Controlling Interest | (0.3 | ) | — |

| — |

| — |

| — |

| (0.3 | ) |

Net Income from Continuing Operations | $ | 21.4 |

| $ | 7.7 |

| $ | 2.8 |

| $ | 1.5 |

| $ | 0.7 |

| $ | 34.1 |

|

| | | | | | |

Diluted EPS - Continuing Operations | $ | 0.39 |

| $ | 0.14 |

| $ | 0.05 |

| $ | 0.03 |

| $ | 0.01 |

| $ | 0.62 |

|

| | | | | | |

Tax Rate | 38.8% | | | | | 36.7% |

| | | | | | |

(1) May not foot due to rounding.

(2) B&W is providing non-GAAP information regarding certain of its historical results and guidance on future earnings per share to supplement the results provided in accordance with GAAP and it should not be considered superior to, or as a substitute for, the comparable GAAP measures. B&W believes the non-GAAP measures provide meaningful insight into the Company’s operational performance and provides these measures to investors to help facilitate comparisons of operating results with prior periods and to assist them in understanding B&W’s ongoing operations.

(3) On a GAAP basis, the litigation settlement in the three and nine months ended September 30, 2015 reduced revenues and gross margin of the Global Power segment by $7.8 million and added $1.8 million to selling general and administrative expense.

Exhibit 2

Babcock & Wilcox Enterprises, Inc.

Condensed Consolidated and Combined Statements of Operations

|

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Unaudited) |

| (In thousands, except per share amounts) |

| | | | | | | |

Revenues | $ | 419,977 |

| | $ | 402,016 |

| | $ | 1,254,617 |

| | $ | 1,041,473 |

|

Costs and expenses: | | | | | | | |

Cost of operations | 342,055 |

| | 313,646 |

| | 1,011,414 |

| | 827,224 |

|

Research and development costs | 3,977 |

| | 4,502 |

| | 12,457 |

| | 12,795 |

|

Losses on asset disposals and impairments, net | 10 |

| | 19 |

| | 9,037 |

| | 1,476 |

|

Selling, general and administrative expenses | 62,637 |

| | 58,414 |

| | 178,539 |

| | 160,666 |

|

Restructuring and spin transaction costs | 2,713 |

| | 2,752 |

| | 11,279 |

| | 11,743 |

|

Total costs and expenses | 411,392 |

| | 379,333 |

| | 1,222,726 |

| | 1,013,904 |

|

Equity in income of investees | 1,047 |

| | 2,859 |

| | (57 | ) | | 5,658 |

|

Operating income | 9,632 |

| | 25,542 |

| | 31,834 |

| | 33,227 |

|

Other income (expense): | | | | | | | |

Interest income | 138 |

| | 242 |

| | 420 |

| | 919 |

|

Interest expense | (389 | ) | | (181 | ) | | (673 | ) | | (385 | ) |

Other – net | (1,326 | ) | | 63 |

| | (1,436 | ) | | 1,617 |

|

Total other income (expense) | (1,577 | ) | | 124 |

| | (1,689 | ) | | 2,151 |

|

Income from continuing operations before provision for income taxes | 8,055 |

| | 25,666 |

| | 30,145 |

| | 35,378 |

|

Provision for income taxes | 1,770 |

| | 12,894 |

| | 8,381 |

| | 13,727 |

|

Income from continuing operations | 6,285 |

| | 12,772 |

| | 21,764 |

| | 21,651 |

|

Income from discontinued operations, net of tax | — |

| | (7,102 | ) | | 2,803 |

| | 237 |

|

Net income | 6,285 |

| | 5,670 |

| | 24,567 |

| | 21,888 |

|

Net income attributable to noncontrolling interest | (116 | ) | | (61 | ) | | (222 | ) | | (254 | ) |

Net Income attributable to Babcock & Wilcox Enterprises, Inc. | $ | 6,169 |

| | $ | 5,609 |

| | $ | 24,345 |

| | $ | 21,634 |

|

| | | | | | | |

Amounts attributable to Babcock & Wilcox Enterprises, Inc. | | | | | | | |

Income from continuing operations | $ | 6,169 |

| | $ | 12,711 |

| | $ | 21,542 |

| | $ | 21,397 |

|

Income from discontinued operations, net of tax | — |

| | (7,102 | ) | | 2,803 |

| | 237 |

|

Net income attributable to Babcock & Wilcox Enterprises, Inc. | $ | 6,169 |

| | $ | 5,609 |

| | $ | 24,345 |

| | $ | 21,634 |

|

| | | | | | | |

Basic earnings per common share: | | | | | | | |

Continuing operations | $ | 0.11 |

| | $ | 0.24 |

| | $ | 0.40 |

| | $ | 0.39 |

|

Discontinued operations | — |

| | (0.14 | ) | | 0.05 |

| | 0.01 |

|

Basic earnings per common share | $ | 0.11 |

| | $ | 0.10 |

| | $ | 0.45 |

| | $ | 0.40 |

|

Diluted earnings per common share: | | | | | | | |

Continuing operations | $ | 0.11 |

| | $ | 0.24 |

| | $ | 0.40 |

| | $ | 0.39 |

|

Discontinued operations | — |

| | (0.14 | ) | | 0.05 |

| | 0.01 |

|

Diluted earnings per common share | $ | 0.11 |

| | $ | 0.10 |

| | $ | 0.45 |

| | $ | 0.40 |

|

| | | | | | | |

Shares used in the computation of earnings per common share: | | | | | | | |

Basic | 53,758 |

| | 53,553 |

| | 53,569 |

| | 54,552 |

|

Diluted | 53,787 |

| | 53,722 |

| | 53,716 |

| | 54,741 |

|

Exhibit 3

Babcock & Wilcox Enterprises, Inc.

Condensed Consolidated and Combined Balance Sheets

|

| | | | | | | |

| September 30, 2015 | | December 31, 2014 |

| (Unaudited) |

| (In thousands) |

ASSETS | | | |

| | | |

Current assets: | | | |

Cash and cash equivalents | $ | 334,150 |

| | $ | 218,659 |

|

Restricted cash and cash equivalents | 40,293 |

| | 26,311 |

|

Investments | 750 |

| | 1,607 |

|

Accounts receivable – trade, net | 274,679 |

| | 265,456 |

|

Accounts receivable – other | 59,337 |

| | 36,147 |

|

Contracts in progress | 113,431 |

| | 107,751 |

|

Inventories | 96,358 |

| | 98,711 |

|

Deferred income taxes | 39,900 |

| | 36,601 |

|

Other current assets | 22,124 |

| | 11,347 |

|

Current assets of discontinued operations | — |

| | 46,177 |

|

Total current assets | 981,022 |

| | 848,767 |

|

| | | |

Property, plant and equipment - gross | 330,230 |

| | 335,761 |

|

Accumulated depreciation | (184,956 | ) | | (200,525 | ) |

Net property, plant and equipment | 145,274 |

| | 135,236 |

|

| | | |

Investments | 1,055 |

| | 214 |

|

Goodwill | 201,870 |

| | 209,277 |

|

Deferred income taxes | 130,149 |

| | 115,111 |

|

Investments in unconsolidated affiliates | 86,785 |

| | 109,248 |

|

Intangible assets | 38,479 |

| | 50,646 |

|

Other assets | 27,040 |

| | 9,227 |

|

Non-current assets of discontinued operations

| — |

| | 38,828 |

|

TOTAL ASSETS | $ | 1,611,674 |

| | $ | 1,516,554 |

|

Exhibit 3

Babcock & Wilcox Enterprises, Inc.

Condensed Consolidated and Combined Balance Sheets (continued)

|

| | | | | | | |

| September 30, 2015 | | December 31, 2014 |

| (Unaudited) |

| (In thousands, except share

and per share amounts) |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| | | |

Current liabilities: | | | |

Notes payable and current maturities of long-term debt | $ | 3,140 |

| | $ | 3,215 |

|

Accounts payable | 151,178 |

| | 160,606 |

|

Accrued employee benefits | 44,783 |

| | 39,464 |

|

Advance billings on contracts | 200,932 |

| | 148,098 |

|

Accrued warranty expense | 38,643 |

| | 37,735 |

|

Accrued liabilities – other | 81,094 |

| | 54,827 |

|

Current liabilities of discontinued operations | — |

| | 44,145 |

|

Total current liabilities | 519,770 |

| | 488,090 |

|

| | | |

Accumulated postretirement benefit obligation | 28,947 |

| | 28,347 |

|

Pension liability | 243,532 |

| | 253,763 |

|

Other liabilities | 42,862 |

| | 42,929 |

|

Non-current liabilities of discontinued operations | — |

| | 15,988 |

|

Total liabilities | 835,111 |

| | 829,117 |

|

| | | |

Commitments and contingencies | | | |

| | | |

Stockholders’ Equity: | | | |

Common stock, par value $0.01 per share, authorized 200,000,000 shares; issued 53,690,776 and 0 shares at September 30, 2015 and December 31, 2014, respectively | 537 |

| | — |

|

Preferred stock, par value $0.01 per share,

authorized 20,000,000 shares; No shares issued | — |

| | — |

|

Capital in excess of par value | 786,264 |

| | — |

|

Treasury stock at cost, 126,409 shares at September 30, 2015 | (2,372 | ) | | — |

|

Retained earnings | 6,169 |

| | — |

|

Accumulated other comprehensive income (loss) | (14,975 | ) | | 10,374 |

|

Former net parent investment | — |

| | 676,036 |

|

Stockholders’ equity – Babcock & Wilcox Enterprises, Inc. | 775,623 |

| | 686,410 |

|

Noncontrolling interest | 940 |

| | 1,027 |

|

Total Stockholders’ equity | 776,563 |

| | 687,437 |

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 1,611,674 |

| | $ | 1,516,554 |

|

Exhibit 4

Babcock & Wilcox Enterprises, Inc.

Condensed Consolidated and Combined Statements of Cash Flows

|

| | | | | | | |

| Nine Months Ended

September 30, |

| 2015 | | 2014 |

| (Unaudited) |

| (In thousands) |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

Net Income | $ | 24,567 |

| | $ | 21,888 |

|

Non-cash items included in net income: | | | |

Depreciation and amortization | 28,885 |

| | 21,193 |

|

Income of equity method investees | 57 |

| | (5,641 | ) |

Losses on asset disposals and impairments | 11,335 |

| | 4,644 |

|

Write-off of accrued claims receivable, net | 7,832 |

| | — |

|

Recognition of losses for pension and postretirement plans | 300 |

| | 462 |

|

Stock-based compensation charges and excess tax benefits | 2,482 |

| | (12 | ) |

Changes in assets and liabilities, net of effects of acquisitions: | | | |

Accounts receivable | (23,247 | ) | | 16,452 |

|

Accounts payable | (7,823 | ) | | (42,709 | ) |

Contracts in progress and advance billings on contracts | 48,549 |

| | (128,077 | ) |

Inventories | 528 |

| | 2,303 |

|

Income taxes | (13,720 | ) | | 10,154 |

|

Accrued and other current liabilities | 26,872 |

| | 14,869 |

|

Pension liability, accrued postretirement benefit obligation and employee benefits | (7,075 | ) | | (19,680 | ) |

Other, net | (6,494 | ) | | 1,716 |

|

NET CASH PROVIDED FROM OPERATING ACTIVITIES | 93,048 |

| | (102,438 | ) |

| | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

Decrease in restricted cash and cash equivalents | 1,627 |

| | 1,270 |

|

Purchases of property, plant and equipment | (21,931 | ) | | (11,467 | ) |

Acquisition of business, net of cash acquired | — |

| | (127,705 | ) |

Purchase of intangible assets | — |

| | (722 | ) |

Purchases of available-for-sale securities | (9,935 | ) | | (2,845 | ) |

Sales and maturities of available-for-sale securities | 5,997 |

| | 9,834 |

|

Proceeds from asset disposals | (796 | ) | | 137 |

|

Investment in equity method investees | — |

| | (4,900 | ) |

NET CASH FROM INVESTING ACTIVITIES | (25,038 | ) | | (136,398 | ) |

| | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

Payment of short-term borrowing and long-term debt | — |

| | (4,424 | ) |

Increase in short-term borrowing | — |

| | 2,855 |

|

Net transfers from former Parent | 80,589 |

| | 244,174 |

|

Repurchase of shares of common stock | (1,275 | ) | | — |

|

Excess tax benefits from stock-based compensation | — |

| | 12 |

|

Other | (256 | ) | | 129 |

|

NET CASH PROVIDED FROM FINANCING ACTIVITIES | 79,058 |

| | 242,746 |

|

| | | |

EFFECTS OF EXCHANGE RATE CHANGES ON CASH | (6,360 | ) | | (7,642 | ) |

CASH FLOWS FROM CONTINUING OPERATIONS | 140,708 |

| | (3,732 | ) |

| | | |

CASH FLOWS FROM DISCONTINUED OPERATIONS: | | | |

Operating cash flows from discontinued operations, net | (25,194 | ) | | (5,486 | ) |

Investing cash flows from discontinued operations, net | (23 | ) | | (864 | ) |

Effects of exchange rate changes on cash | — |

| | 1,286 |

|

NET CASH FLOWS PROVIDED FROM DISCONTINUED OPERATIONS | (25,217 | ) | | (5,064 | ) |

| | | |

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 115,491 |

| | (8,796 | ) |

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 218,659 |

| | 191,318 |

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 334,150 |

| | $ | 182,522 |

|

Exhibit 5

Babcock & Wilcox Enterprises, Inc.

Segment Information(1)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Unaudited) |

| (In thousands) |

REVENUES: | | | | | | | |

Global Power | $ | 160,004 |

| | $ | 123,905 |

| | $ | 441,263 |

| | $ | 343,890 |

|

Global Services | 221,077 |

| | 229,209 |

| | 689,971 |

| | 645,081 |

|

Industrial Environmental | 38,896 |

| | 48,902 |

| | 123,383 |

| | 52,502 |

|

| $ | 419,977 |

| | $ | 402,016 |

| | $ | 1,254,617 |

| | $ | 1,041,473 |

|

GROSS PROFIT: | | | | | | | |

Global Power | $ | 25,780 |

| | $ | 29,718 |

| | $ | 72,884 |

| | $ | 64,437 |

|

Global Services | 38,925 |

| | 47,680 |

| | 138,521 |

| | 137,640 |

|

Industrial Environmental | 13,217 |

| | 10,972 |

| | 31,798 |

| | 12,172 |

|

| $ | 77,922 |

| | $ | 88,370 |

| | $ | 243,203 |

| | $ | 214,249 |

|

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Unaudited) |

| (In millions) |

BOOKINGS: | | | | | | | |

Global Power | $ | 236.0 |

| | $ | 62.8 |

| | $ | 750.0 |

| | $ | 374.8 |

|

Global Services | 146.6 |

| | 212.6 |

| | 555.1 |

| | 595.9 |

|

Industrial Environmental | 35.0 |

| | 44.9 |

| | 142.9 |

| | 44.9 |

|

| $ | 417.6 |

| | $ | 320.3 |

| | $ | 1,448.0 |

| | $ | 1,015.6 |

|

|

| | | | | | | |

| As of September 30, |

| 2015 | | 2014 |

| (Unaudited) |

| (In millions) |

BACKLOG: | | | |

Global Power | $ | 1,253 |

| | $ | 795 |

|

Global Services | 1,097 |

| | 1,260 |

|

Industrial Environmental | 92 |

| | 79 |

|

| $ | 2,442 |

| | $ | 2,134 |

|

(1) May not foot due to rounding.

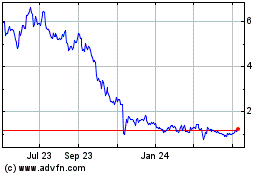

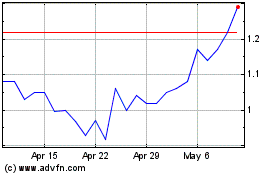

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Apr 2023 to Apr 2024