Buenaventura Announces the Completion of Its Debt Reprofiling

June 30 2016 - 6:20PM

Business Wire

Compañía de Minas Buenaventura S.A.A. (“Buenaventura” or “the

Company”) (NYSE:BVN; Lima Stock Exchange: BUE.LM), Peru’s largest

publicly traded, precious metals mining company, today announced a

US$ 275 million syndicate loan agreement with 7 banks, in line with

its cash preservation strategy.

At the beginning of 2016, Buenaventura announced its updated

financial strategy aimed at cash preservation. The main objectives

include:

- A cost reduction plan

- CAPEX discipline

- A dividend from Yanacocha (US$131

million)

- Debt Reprofiling

The proceeds of the loan will be allocated towards:

- Prepayment of US$245 million short-term

debt

- General corporate purposes

Details of the Syndicate loan are:

- Type: Senior Unsecured Syndicated Term

Loan Facility

- Interest Rate: Libor (3-months) +

3.0%

- Maturity: 5 years (including 2-year

grace period)

- Principal Amortization: Semi-annual

installments, beginning in 2018

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious metals Company and a major holder of

mining rights in Peru. The Company is engaged in the mining,

processing, development and exploration of gold and silver and

other metals via wholly owned mines, as well as through its

participation in joint exploration projects.

Buenaventura currently operates several mines in Peru

(Orcopampa*, Uchucchacua*, Mallay*, Julcani*, El Brocal, La Zanja

and Coimolache) and is developing the Tambomayo and San Gabriel

Projects.

The Company owns 43.65% of Minera Yanacocha S.R.L (a partnership

with Newmont Mining Corporation), an important precious metal

producer and 19.58% of Sociedad Minera Cerro Verde, an important

Peruvian copper producer.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release may contain forward-looking information (as

defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning the Company’s, Yanacocha’s and Cerro Verde’s costs and

expenses, results of exploration, the continued improving

efficiency of operations, prevailing market prices of gold, silver,

copper and other metals mined, the success of joint ventures,

estimates of future explorations, development and production,

subsidiaries’ plans for capital expenditures, estimates of reserves

and Peruvian political, economic, social and legal developments.

These forward-looking statements reflect the Company’s view with

respect to the Company’s, Yanacocha’s and Cerro Verde’s future

financial performance. Actual results could differ materially from

those projected in the forward-looking statements as a result of a

variety of factors discussed elsewhere in this Press Release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160630006411/en/

Contacts in Lima:Compañía de Minas Buenaventura

S.A.A.Carlos Galvez, 511-419-2540Chief Financial

OfficerorDaniel Dominguez, 511-419-2591Manager of Financial

Planning and Investor

Relationsdaniel.dominguez@buenaventura.peorRodrigo Echecopar,

511-419-2609Investor Relations

Coordinatorrodrigo.echecopar@buenaventura.peorContacts in New

York:i-advize Corporate CommunicationsMaria Barona / Rafael

Borja212-406-3691/3693buenaventura@i-advize.comorVisit our

website:www.buenaventura.com/ir

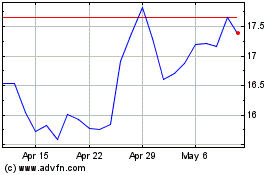

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

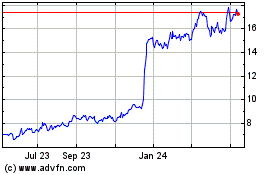

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Apr 2023 to Apr 2024