FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August 2014

BUENAVENTURA MINING COMPANY INC.

(Translation of Registrant's Name into

English)

CARLOS VILLARAN 790

SANTA CATALINA, LIMA 13, PERU

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F ___

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to

Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No X

If "Yes" is marked, indicate

below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-________________.

Compañía de Minas Buenaventura S.A.A.

and Subsidiaries

Unaudited interim consolidated

financial statements as of June 30, 2014 and

2013 and for the three-month and six-month periods then ended

Report on review of interim

consolidated financial statements

To the Board of Directors of Compañía de Minas

Buenaventura S.A.A.

Introduction

We have reviewed the accompanying interim consolidated statements

of financial position of Compañía de Minas Buenaventura S.A.A. (a Peruvian public corporation) and Subsidiaries

(together the "Group") as of June 30, 2014, the interim consolidated statements of change in equity for the six-month

periods ended June 30, 2014 and 2013, and the interim consolidated statements of profit or loss, statement of comprehensive income,

and cash flows for the three-month and six-month periods ended June 30, 2014 and 2013, and explanatory notes. The Group’s

Management is responsible for the preparation and presentation of these interim consolidated financial statements in accordance

with IAS 34 “Interim Financial Reporting” (IAS 34). Our responsibility is to express a conclusion on these interim

consolidated financial statements based on our review.

Scope of review

We conducted our review in accordance with International Standard

on Review Engagements 2410 “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”.

A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted

in accordance with generally accepted auditing standards in Peru and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the accompanying interim consolidated financial statements are not prepared, in all material respects,

in accordance with IAS 34.

Lima, Peru

July 21, 2014

Countersigned by:

| |

|

| Víctor Burga |

|

| C.P.C.C. Register No.14859 |

|

Compañía de Minas Buenaventura S.A.A. and

Subsidiaries

Consolidated statements of financial

position

As of June 30, 2014 (unaudited) and December

31, 2013 (audited)

| | |

Note | |

2014 | | |

2013 | |

| | |

| |

US$(000) | | |

US$(000) | |

| | |

| |

| | |

| |

| Assets | |

| |

| | | |

| | |

| Current assets | |

| |

| | | |

| | |

| Cash | |

4(a) | |

| 138,052 | | |

| 61,898 | |

| Trade and other receivables, net | |

5(a) | |

| 272,746 | | |

| 260,434 | |

| Inventories, net | |

7 | |

| 151,833 | | |

| 175,719 | |

| Income tax credit | |

| |

| 55,658 | | |

| 37,370 | |

| Prepaid expenses | |

| |

| 15,652 | | |

| 14,597 | |

| Embedded derivatives for concentrates sales, net | |

6(b) | |

| 5,957 | | |

| 1,857 | |

| | |

| |

| 639,898 | | |

| 551,875 | |

| | |

| |

| | | |

| | |

| Non-current assets | |

| |

| | | |

| | |

| Trade and other receivables, net | |

5(a) | |

| 18,156 | | |

| 20,607 | |

| Long-term inventories | |

7 | |

| 39,124 | | |

| 23,366 | |

| Investments in associates | |

8(a) | |

| 2,363,055 | | |

| 2,358,410 | |

| Mining concessions, development costs, property, plant and equipment, net | |

9 | |

| 1,535,626 | | |

| 1,515,460 | |

| Investment properties | |

| |

| 11,160 | | |

| - | |

| Deferred income tax asset | |

| |

| 72,322 | | |

| 83,525 | |

| Other assets, net | |

| |

| 3,231 | | |

| 7,132 | |

| | |

| |

| 4,042,674 | | |

| 4,008,500 | |

| Total assets | |

| |

| 4,682,572 | | |

| 4,560,375 | |

| Liabilities and shareholders’ equity, net | |

| |

| | | |

| | |

| Current liabilities | |

| |

| | | |

| | |

| Borrowings | |

| |

| 2,321 | | |

| - | |

| Trade and other payables | |

| |

| 253,285 | | |

| 301,811 | |

| Provisions | |

10 | |

| 71,826 | | |

| 69,800 | |

| Income tax payable | |

| |

| 2,186 | | |

| 2,140 | |

| Financial obligations | |

11(a) | |

| 47,641 | | |

| 11,370 | |

| Derivative financial instruments | |

6(a) | |

| 10 | | |

| 1,093 | |

| | |

| |

| 377,269 | | |

| 386,214 | |

| Non-current liabilities | |

| |

| | | |

| | |

| Trade and other payables | |

| |

| 15,057 | | |

| 12,229 | |

| Provisions | |

10 | |

| 100,651 | | |

| 106,376 | |

| Financial obligations | |

11(a) | |

| 336,602 | | |

| 223,027 | |

| Deferred income tax liability | |

| |

| 4,605 | | |

| - | |

| | |

| |

| 456,915 | | |

| 341,632 | |

| Total liabilities | |

| |

| 834,184 | | |

| 727,846 | |

| Shareholders’ equity, net | |

| |

| | | |

| | |

| Capital stock, net of treasury shares for US$(000)62,665 | |

| |

| 750,497 | | |

| 750,497 | |

| Investment shares, net of treasury shares for US$(000)765 | |

| |

| 1,396 | | |

| 1,396 | |

| Additional paid-in capital | |

| |

| 219,055 | | |

| 219,055 | |

| Legal reserve | |

| |

| 162,688 | | |

| 162,663 | |

| Other reserves | |

| |

| 269 | | |

| 269 | |

| Retained earnings | |

| |

| 2,425,720 | | |

| 2,421,238 | |

| Other reserves of equity | |

| |

| 104 | | |

| 104 | |

| Shareholders’ equity, net attributable to equity holders of the parent | |

| |

| 3,559,729 | | |

| 3,555,222 | |

| Non-controlling interest | |

| |

| 288,659 | | |

| 277,307 | |

| Total shareholders’ equity, net | |

| |

| 3,848,388 | | |

| 3,832,529 | |

| Total liabilities and shareholders’ equity, net | |

| |

| 4,682,572 | | |

| 4,560,375 | |

Compañía de Minas Buenaventura S.A.A. and

Subsidiaries

Interim consolidated statements

of profit or loss (unaudited)

For the three-month and six-month periods

ended June 30, 2014 and 2013

| | |

Note | |

For the three–month

periods ended June 30, | |

For the six–month

periods ended June 30, |

| | |

| |

| 2014 | | |

| 2013 | | |

| 2014 | | |

| 2013 | |

| | |

| |

| US$(000) | | |

| US$(000) | | |

| US$(000) | | |

| US$(000) | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| |

| | | |

| | | |

| | | |

| | |

| Net sales | |

14(a) | |

| 297,710 | | |

| 273,099 | | |

| 571,678 | | |

| 613,972 | |

| Royalty income | |

18(a) | |

| 7,399 | | |

| 12,693 | | |

| 15,424 | | |

| 26,495 | |

| Total operating income | |

| |

| 305,109 | | |

| 285,792 | | |

| 587,102 | | |

| 640,467 | |

| Operating costs | |

| |

| | | |

| | | |

| | | |

| | |

| Cost of sales, without considering depreciation and amortization | |

15 | |

| (149,634 | ) | |

| (172,869 | ) | |

| (292,593 | ) | |

| (331,004 | ) |

| Depreciation and amortization | |

| |

| (49,771 | ) | |

| (46,494 | ) | |

| (95,909 | ) | |

| (85,670 | ) |

| Exploration in operating units | |

16 | |

| (21,907 | ) | |

| (49,681 | ) | |

| (53,635 | ) | |

| (96,050 | ) |

| Mining royalties | |

| |

| (7,102 | ) | |

| (6,929 | ) | |

| (14,480 | ) | |

| (16,595 | ) |

| Total operating costs | |

| |

| (228,414 | ) | |

| (275,973 | ) | |

| (456,617 | ) | |

| (529,319 | ) |

| Gross profit | |

| |

| 76,695 | | |

| 9,819 | | |

| 130,485 | | |

| 111,148 | |

| Operating expenses, net | |

| |

| | | |

| | | |

| | | |

| | |

| Administrative expenses | |

17 | |

| (23,061 | ) | |

| (22,262 | ) | |

| (51,817 | ) | |

| (37,168 | ) |

| Exploration in non-operating areas | |

| |

| (14,821 | ) | |

| 4,085 | | |

| (25,195 | ) | |

| (17,675 | ) |

| Paralyzed mining units | |

1(b) | |

| (15,941 | ) | |

| - | | |

| (15,941 | ) | |

| - | |

| Provision for contingencies | |

| |

| (2,002 | ) | |

| (1,340 | ) | |

| (9,643 | ) | |

| (2,393 | ) |

| Selling expenses | |

| |

| (4,614 | ) | |

| (3,970 | ) | |

| (8,784 | ) | |

| (8,480 | ) |

| Impairment loss on long-lived assets | |

| |

| - | | |

| - | | |

| (794 | ) | |

| - | |

| Other, net | |

| |

| 8,268 | | |

| 9,320 | | |

| 9,724 | | |

| 9,631 | |

| Total operating expenses, net | |

| |

| (52,171 | ) | |

| (14,167 | ) | |

| (102,450 | ) | |

| (56,085 | ) |

| Operating profit (loss) | |

| |

| 24,524 | | |

| (4,348 | ) | |

| 28,035 | | |

| 55,063 | |

| Other income, net | |

| |

| | | |

| | | |

| | | |

| | |

| Share in the results of associates under equity method | |

8(b) | |

| 20,169 | | |

| 48,806 | | |

| 15,689 | | |

| 132,974 | |

| Finance income | |

| |

| 1,842 | | |

| 2,228 | | |

| 3,648 | | |

| 3,184 | |

| Finance costs | |

| |

| (3,199 | ) | |

| (8,678 | ) | |

| (6,590 | ) | |

| (9,881 | ) |

| Net loss from currency exchange difference | |

| |

| (268 | ) | |

| (6,715 | ) | |

| (764 | ) | |

| (6,603 | ) |

| Total other income, net | |

| |

| 18,544 | | |

| 35,641 | | |

| 11,983 | | |

| 119,674 | |

| Profit before income tax and non-controlling interest | |

| |

| 43,068 | | |

| 31,293 | | |

| 40,018 | | |

| 174,737 | |

| Income tax | |

12(a) | |

| (10,494 | ) | |

| (10,434 | ) | |

| (17,816 | ) | |

| (42,945 | ) |

| Net profit | |

| |

| 32,574 | | |

| 20,859 | | |

| 22,202 | | |

| 131,792 | |

| Attributable to: | |

| |

| | | |

| | | |

| | | |

| | |

| Equity holders of the parent | |

| |

| 23,088 | | |

| 18,953 | | |

| 6,976 | | |

| 121,630 | |

| Non-controlling interest | |

| |

| 9,486 | | |

| 1,906 | | |

| 15,226 | | |

| 10,162 | |

| | |

| |

| 32,574 | | |

| 20,859 | | |

| 22,202 | | |

| 131,792 | |

| Basic and diluted profit per share attributable to equity holders of the parent, stated in U.S. dollars | |

| |

| 0.09 | | |

| 0.07 | | |

| 0.03 | | |

| 0.48 | |

| Weighted average number of outstanding shares (common and investment), in units | |

| |

| 254,186,867 | | |

| 254,186,867 | | |

| 254,186,867 | | |

| 254,186,867 | |

Compañía de Minas Buenaventura S.A.A. and

Subsidiaries

Interim consolidated statements

of other comprehensive income (unaudited)

For the three-month and six-month periods

ended June 30, 2014 and 2013

| | |

For the three–month

periods ended June 30, | |

For the six–month

periods ended June 30, |

| | |

2014 | |

2013 | |

2014 | |

2013 |

| | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) |

| | |

| |

| |

| |

|

| Net profit | |

| 32,574 | | |

| 20,859 | | |

| 22,202 | | |

| 131,792 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income of the period: | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income to be reclassified to profit or loss in subsequent periods | |

| | | |

| | | |

| | | |

| | |

| Net unrealized gain (loss) on hedging derivative financial instruments, note 6(a) | |

| (3,742 | ) | |

| - | | |

| 1,083 | | |

| - | |

| Income tax effect | |

| 1,296 | | |

| - | | |

| (374 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| (2,446 | ) | |

| - | | |

| 709 | | |

| - | |

| Other comprehensive income not to be reclassified to profit or loss in subsequent periods | |

| | | |

| | | |

| | | |

| | |

| Net unrealized loss in other investments | |

| (114 | ) | |

| (489 | ) | |

| (114 | ) | |

| (434 | ) |

| Income tax effect | |

| 34 | | |

| - | | |

| 34 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| (80 | ) | |

| (489 | ) | |

| (80 | ) | |

| (434 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income | |

| (2,526 | ) | |

| (489 | ) | |

| 629 | | |

| (434 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total other comprehensive income, net of income tax | |

| 30,048 | | |

| 20,370 | | |

| 22,831 | | |

| 131,358 | |

| Attributable to: | |

| | | |

| | | |

| | | |

| | |

| Equity holders of the parent | |

| 21,685 | | |

| 18,464 | | |

| 7,279 | | |

| 121,196 | |

| Non-controlling interest | |

| 8,363 | | |

| 1,906 | | |

| 15,552 | | |

| 10,162 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| 30,048 | | |

| 20,370 | | |

| 22,831 | | |

| 131,358 | |

Compañía de Minas Buenaventura S.A.A. and

Subsidiaries

Interim consolidated statements

of changes in shareholders’ equity (unaudited)

For the six-month periods ended June 30,

2014 and 2013

| | |

Attributable to equity holders of the parent | |

| |

|

| | |

Capital stock, net of treasury shares | |

| |

| |

| |

| |

| |

| |

| |

|

| | |

Number of shares

outstanding | |

Common shares | |

Investment shares | |

Additional paid-in

capital | |

Legal

reserve | |

Other

reserves | |

Retained

earnings | |

Other reserves of

equity | |

Total | |

Non- controlling

interest | |

Total shareholders’

equity, net |

| | |

| |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| As of January 1, 2013 | |

| 253,415,190 | | |

| 750,540 | | |

| 1,399 | | |

| 219,471 | | |

| 162,663 | | |

| 269 | | |

| 2,572,943 | | |

| 925 | | |

| 3,708,210 | | |

| 263,647 | | |

| 3,971,857 | |

| Net profit | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 121,630 | | |

| - | | |

| 121,630 | | |

| 10,162 | | |

| 131,792 | |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (434 | ) | |

| (434 | ) | |

| - | | |

| (434 | ) |

| Total other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 121,630 | | |

| (434 | ) | |

| 121,196 | | |

| 10,162 | | |

| 131,358 | |

| Dividends declared and paid, note 13 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (76,269 | ) | |

| - | | |

| (76,269 | ) | |

| (10,013 | ) | |

| (86,282 | ) |

| Purchase of treasury shares | |

| - | | |

| (43 | ) | |

| (3 | ) | |

| (416 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (462 | ) | |

| - | | |

| (462 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As of June 30, 2013 | |

| 253,415,190 | | |

| 750,497 | | |

| 1,396 | | |

| 219,055 | | |

| 162,663 | | |

| 269 | | |

| 2,618,304 | | |

| 491 | | |

| 3,752,675 | | |

| 263,796 | | |

| 4,016,471 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As of January 1, 2014 | |

| 253,715,190 | | |

| 750,497 | | |

| 1,396 | | |

| 219,055 | | |

| 162,663 | | |

| 269 | | |

| 2,421,238 | | |

| 104 | | |

| 3,555,222 | | |

| 277,307 | | |

| 3,832,529 | |

| Net profit | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,976 | | |

| - | | |

| 6,976 | | |

| 15,226 | | |

| 22,202 | |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 303 | | |

| - | | |

| 303 | | |

| 326 | | |

| 629 | |

| Total comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,279 | | |

| - | | |

| 7,279 | | |

| 15,552 | | |

| 22,831 | |

| Dividends declared and paid, note 13 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,797 | ) | |

| - | | |

| (2,797 | ) | |

| (4,200 | ) | |

| (6,997 | ) |

| Proceeds from expired dividends | |

| - | | |

| - | | |

| - | | |

| - | | |

| 25 | | |

| - | | |

| - | | |

| - | | |

| 25 | | |

| - | | |

| 25 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As of June 30, 2014 | |

| 253,715,190 | | |

| 750,497 | | |

| 1,396 | | |

| 219,055 | | |

| 162,688 | | |

| 269 | | |

| 2,425,720 | | |

| 104 | | |

| 3,559,729 | | |

| 288,659 | | |

| 3,848,388 | |

Compañía de Minas Buenaventura S.A.A. and

Subsidiaries

Interim

consolidated statements of cash flows (unaudited)

For

the three-month and six-month periods ended June 30, 2014 and 2013

| | |

For the three–month

periods ended June 30, | |

For the six–month

periods ended June 30, |

| | |

2014 | |

2013 | |

2014 | |

2013 |

| | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) |

| | |

| |

| |

| |

|

| Operating activities | |

| | | |

| | | |

| | | |

| | |

| Proceeds from sales | |

| 266,880 | | |

| 343,935 | | |

| 533,734 | | |

| 748,397 | |

| Value added tax recovered | |

| 21,981 | | |

| 19,907 | | |

| 39,685 | | |

| 33,707 | |

| Royalties received | |

| 8,429 | | |

| 13,976 | | |

| 15,424 | | |

| 26,178 | |

| Dividends received | |

| 2,065 | | |

| 7,064 | | |

| 4,442 | | |

| 7,064 | |

| Interest received | |

| 1,704 | | |

| 1,165 | | |

| 3,829 | | |

| 2,141 | |

| Payments to suppliers and third parties | |

| (188,407 | ) | |

| (219,791 | ) | |

| (388,141 | ) | |

| (477,919 | ) |

| Payments to employees | |

| (51,341 | ) | |

| (33,649 | ) | |

| (106,961 | ) | |

| (103,732 | ) |

| Payments of royalties | |

| (3,513 | ) | |

| (8,708 | ) | |

| (10,966 | ) | |

| (17,494 | ) |

| Income tax paid | |

| (12,533 | ) | |

| (30,910 | ) | |

| (17,944 | ) | |

| (54,988 | ) |

| Payments of interest | |

| (3,505 | ) | |

| (8,193 | ) | |

| (5,453 | ) | |

| (8,415 | ) |

| Net cash provided by operating activities | |

| 41,760 | | |

| 84,796 | | |

| 67,649 | | |

| 154,939 | |

| Investing activities | |

| | | |

| | | |

| | | |

| | |

| Proceeds from collection of loans to associates | |

| 1,426 | | |

| 14,964 | | |

| 10,458 | | |

| 14,964 | |

| Proceeds from sale of mining concessions, property, plant and equipment | |

| 67 | | |

| 3,015 | | |

| 90 | | |

| 3,015 | |

| Proceeds from sale of investments in shares | |

| 80 | | |

| - | | |

| 80 | | |

| - | |

| Payments for mine development activities and acquisitions of mining concessions, property, plant and equipment | |

| (60,383 | ) | |

| (147,223 | ) | |

| (133,956 | ) | |

| (233,264 | ) |

| Purchase of investment properties | |

| - | | |

| - | | |

| (11,705 | ) | |

| - | |

| Loans to associates | |

| (157 | ) | |

| - | | |

| (157 | ) | |

| - | |

| Contributions to associates | |

| (472 | ) | |

| - | | |

| (1,475 | ) | |

| (3,685 | ) |

| Decrease of time deposits | |

| - | | |

| 772 | | |

| - | | |

| - | |

| Net cash used in investing activities | |

| (59,439 | ) | |

| (128,472 | ) | |

| (136,665 | ) | |

| (218,970 | ) |

| Financing activities | |

| | | |

| | | |

| | | |

| | |

| Proceeds from borrowings | |

| 2,321 | | |

| - | | |

| 2,321 | | |

| - | |

| Proceeds from financial obligations | |

| 108,780 | | |

| 60,000 | | |

| 183,439 | | |

| 60,000 | |

| Payments of financial obligations | |

| (29,053 | ) | |

| (45 | ) | |

| (33,593 | ) | |

| (101 | ) |

| Dividends paid | |

| (2,797 | ) | |

| (76,269 | ) | |

| (2,797 | ) | |

| (76,269 | ) |

| Dividends paid to non-controlling interest | |

| (2,240 | ) | |

| (3,133 | ) | |

| (4,200 | ) | |

| (6,573 | ) |

| Purchase of treasury shares | |

| - | | |

| (462 | ) | |

| - | | |

| (462 | ) |

| Net cash provided by (used in) financing activities | |

| 77,011 | | |

| (19,909 | ) | |

| 145,170 | | |

| (23,405 | ) |

| Increase (decrease) in cash for the period, net | |

| 59,332 | | |

| (63,585 | ) | |

| 76,154 | | |

| (87,436 | ) |

| Cash at beginning of period | |

| 78,720 | | |

| 162,861 | | |

| 61,898 | | |

| 186,712 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cash at end of period | |

| 138,052 | | |

| 99,276 | | |

| 138,052 | | |

| 99,276 | |

Compañía de Minas Buenaventura S.A.A. and

Subsidiaries

Notes to the interim consolidated

financial statements (unaudited)

As of June 30, 2014 and 2013

| 1. | Identification and business activity |

| | | |

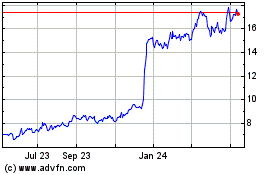

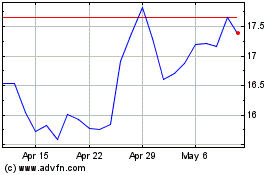

Compañía de Minas Buenaventura S.A.A.

(hereinafter “Buenaventura” or “the Company”) is a Peruvian publicly traded corporation incorporated in

1953 in Lima city. Buenaventura’s stock is traded on the Lima and New York Stock Exchanges through American Depositary Receipts

(ADRs), which represent Company’s shares deposited in the Bank of New York. The Company’s legal domicile is located

at Calle Las Begonias N° 415, San Isidro, Lima, Peru.

The Company and its Subsidiaries (hereinafter “the

Group") are principally engaged in the exploration, mining, concentration, smelting and marketing of polymetallic ores and

metals.

The Company operates directly nine mining

units located in Peru: Uchucchacua, Orcopampa, Julcani, Mallay, Breapampa, Poracota, Recuperada, Antapite and Shila-Paula (the

last four mining units are currently paralyzed). In addition, the Group has a controlling interest in Sociedad Minera El Brocal

S.A.A. (hereinafter “El Brocal”) which operates the Colquijirca mine, in Minera La Zanja S.R.L. (hereinafter “La

Zanja”) which operates La Zanja mine, and in other entities engaged in mining, energy and services activities.

Notes to the interim consolidated

financial statements (unaudited) (continued)

| (c) | The interim consolidated financial statements include the

financial statements of the following subsidiaries: |

| | |

| |

Ownership as of June 30, 2014

and December 31, 2013 |

| | |

Country of

incorporation and

operation | |

Direct | |

Indirect |

| | |

| |

% | |

% |

| Investments and mining concessions held, exploration and exploitation of minerals | |

| |

| | | |

| | |

| Compañía Minera Condesa S.A. | |

Peru | |

| 100.00 | | |

| - | |

| Inversiones Colquijirca S.A. | |

Peru | |

| 99.99 | | |

| - | |

| Sociedad Minera El Brocal S.A.A. | |

Peru | |

| 2.71 | | |

| 51.36 | |

| El Molle Verde S.A.C. | |

Peru | |

| 100.00 | | |

| - | |

| Minera La Zanja S.R.L. | |

Peru | |

| 53.06 | | |

| - | |

| Compañía Minera Colquirrumi S.A. | |

Peru | |

| 100.00 | | |

| - | |

| Minera Julcani S.A. de C.V. | |

Mexico | |

| 100.00 | | |

| - | |

| Compañía de Minas Buenaventura Chile Ltda. | |

Chile | |

| 100.00 | | |

| - | |

| S.M.R.L. Chaupiloma Dos de Cajamarca | |

Peru | |

| 20.00 | | |

| 40.00 | |

| Metalúrgica Los Volcanes S.A. | |

Peru | |

| 100.00 | | |

| - | |

| Cerro Hablador S.A.C. | |

Peru | |

| 99.00 | | |

| 1.00 | |

| Apu Coropuna S.R.L. | |

Peru | |

| 70.00 | | |

| - | |

| Compañía Minera Nueva Italia S.A. | |

Peru | |

| - | | |

| 52.30 | |

| | |

| |

| | | |

| | |

| Electric power activity | |

| |

| | | |

| | |

| Consorcio Energético de Huancavelica S.A. | |

Peru | |

| 100.00 | | |

| - | |

| Empresa de Generación Huanza S.A. | |

Peru | |

| - | | |

| 100.00 | |

| Empresa de Generación Huaura S.A.C. | |

Peru | |

| 0.01 | | |

| 99.99 | |

| | |

| |

| | | |

| | |

| Services | |

| |

| | | |

| | |

| Buenaventura Ingenieros S.A. | |

Peru | |

| 100.00 | | |

| - | |

| Bisa Construcción S.A. | |

Peru | |

| - | | |

| 100.00 | |

| Contacto Corredores de Seguros S.A. | |

Peru | |

| - | | |

| 100.00 | |

| Bisa Argentina S.A. | |

Argentina | |

| 56.00 | | |

| 44.00 | |

| | |

| |

| | | |

| | |

| Industrial activities | |

| |

| | | |

| | |

| Procesadora Industrial Río Seco S.A. | |

Peru | |

| 100.00 | | |

| - | |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| 2. | Basis of preparation and presentation, and changes in the

accounting policies |

| | | |

| 2.1 | Basis of preparation and presentation – |

The

unaudited interim consolidated financial statements have been prepared and presented in accordance with IAS 34 - “Interim

Financial Reporting”, as issued by the International Accounting Standards Board.

The unaudited interim consolidated

financial statements have been prepared on a historical cost basis, from the records of the Group, except for financial assets

and liabilities at fair value through profit or loss. The unaudited interim consolidated financial statements are stated in U.S.

dollars and all values have been rounded to the nearest thousands, except when otherwise indicated.

The unaudited interim consolidated financial statements

provide comparative information for prior periods, however, do not include all information and disclosures required in the annual

consolidated financial statements, and should be read in conjunction with the Group’s audited consolidated financial statements

as of December 31, 2013 and for the year then ended.

| 2.2. | New standards and interpretations adopted by the Group

– |

Several standards and amendments apply from January

1, 2014; however, they do not impact the unaudited interim consolidated financial statements of the Group as of June 30, 2014.

| 3. | Seasonality of operations |

| | | |

The Group operates continuously without major fluctuations

due to seasonality factors.

| (a) | This caption is made up as follow: |

| | |

As of June 30,

2014 | |

As of December 31,

2013 |

| | |

US$(000) | |

US$(000) |

| | |

| |

|

| Cash | |

| 838 | | |

| 753 | |

| Bank accounts (b) | |

| 137,214 | | |

| 61,145 | |

| | |

| | | |

| | |

| | |

| 138,052 | | |

| 61,898 | |

| (b) | The increase of this caption is mainly because of the proceeds

from sales for the six-month period ended June 30, 2014 by US$533,734,000 and new proceeds from borrowings and financial obligations

received in that period by US$183,439,000, partially offset by payments to suppliers and third parties by US$388,141,000, payments

for mine development activities and acquisitions of mining concessions, property, plant and equipment by US$133,956,000 and payments

to employees by US$106,961,000 made during that period. |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| 5. | Trade and other receivables, net |

| | | |

| (a) | This

caption is made up as follow: |

| | |

As of June 30, 2014 | |

As of December 31,

2013 |

| | |

US$(000) | |

US$(000) |

| | |

| |

|

| Trade receivables, net (b) | |

| | | |

| | |

| Domestic customers | |

| 135,651 | | |

| 89,275 | |

| Foreign customers | |

| 62,753 | | |

| 75,487 | |

| Related parties, note 18(b) | |

| 9,030 | | |

| 9,421 | |

| | |

| | | |

| | |

| | |

| 207,434 | | |

| 174,183 | |

| Allowance for doubtful accounts | |

| (21,741 | ) | |

| (21,741 | ) |

| | |

| | | |

| | |

| | |

| 185,693 | | |

| 152,442 | |

| | |

| | | |

| | |

| Other receivables | |

| | | |

| | |

| Value added tax credit | |

| 53,203 | | |

| 65,196 | |

| Due from third parties | |

| 9,426 | | |

| 11,513 | |

| Application for devolution of value added tax credit | |

| 7,032 | | |

| 12,654 | |

| Related parties, note 18(b) | |

| 6,294 | | |

| 15,890 | |

| Claims to Peruvian tax authority | |

| 4,514 | | |

| 14 | |

| Loans to third parties | |

| 3,320 | | |

| 2,759 | |

| Advances to suppliers | |

| 1,760 | | |

| 3,630 | |

| Other accounts receivable | |

| 19,660 | | |

| 16,943 | |

| | |

| 105,209 | | |

| 128,599 | |

| | |

| | | |

| | |

| Total trade and other receivables, net | |

| 290,902 | | |

| 281,041 | |

| | |

| | | |

| | |

| Classification by maturity: | |

| | | |

| | |

| Current portion | |

| 272,746 | | |

| 260,434 | |

| Non-current portion | |

| 18,156 | | |

| 20,607 | |

| | |

| | | |

| | |

| Total trade and other receivables, net | |

| 290,902 | | |

| 281,041 | |

| (b) | The increase in trade

receivables balance as of June 30, 2014, as compared to the balance as of December 31, 2013, was mainly due to higher amount of

revenue from domestic customers caused by the higher prices of metals as of June 30, 2014, compared to those existing as of December

31, 2013. |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| 6. | Derivative

financial instruments |

| | | |

| (a) | Hedge

copper price operations – |

El Brocal’s operating activities

includes extraction, production, concentration and commercialization of polymetallic ores, mainly copper. The volatility of copper’s

price since the year 2013 has caused that El Brocal’s management has decided to enter into future contracts. These contracts,

which have been negotiated since August 8, 2013, are intended to reduce the volatility of cash flows attributable to the fluctuations

in the copper price, according to the risk strategy approved by El Brocal’s Board of Directors. The contracts have a maturity

date in December 2014, and they are related to 50 percent of the annual production of copper as of June 30, 2014 (25 percent as

of December 31, 2013).

As of June 30, 2014 and December

31, 2013, fair value of open futures contracts of El Brocal resulted in a liability of US$10,000 and US$1,093,000, respectively.

| (b) | Embedded derivatives for concentrates sales, net – |

The

Group’s sales of concentrates are based on commercial contracts, under which a provisional sales value is determined based

on future quotations (forward). The adjustment to sales is considered an embedded derivative,

which is required to be separated from the host contract. Commercial contracts are linked to market prices of London Metal Exchange

at the dates of the expected settlements of the open positions. The embedded derivative does not qualify for hedge accounting;

therefore, changes in its fair value are recorded as an adjustment to net sales, see note 14(a).

As

of June 30, 2014 and December 31, 2013, changes in net fair value of embedded derivatives for sales of concentrates resulted in

an asset of US$5,957,000 and US$1,857,000, respectively. The related gains or losses are recognized in the net

sales caption in the interim consolidated statement of profit or loss in the corresponding periods.

Notes to the interim consolidated

financial statements (unaudited) (continued)

This caption is made up as

follow:

| | |

As of June 30, 2014 | |

As of December 31,

2013 |

| | |

US$(000) | |

US$(000) |

| | |

| |

|

| Finished goods | |

| 21,393 | | |

| 45,617 | |

| Products in process | |

| 114,659 | | |

| 112,287 | |

| Spare parts and supplies | |

| 60,717 | | |

| 47,828 | |

| | |

| 196,769 | | |

| 205,732 | |

| Provision for impairment of value of inventories | |

| (5,812 | ) | |

| (6,647 | ) |

| | |

| | | |

| | |

| | |

| 190,957 | | |

| 199,085 | |

| Classification by use: | |

| | | |

| | |

| Current portion | |

| 151,833 | | |

| 175,719 | |

| Non-current portion | |

| 39,124 | | |

| 23,366 | |

| | |

| | | |

| | |

| | |

| 190,957 | | |

| 199,085 | |

| 8. | Investments in associates |

| | | |

| (a) | This caption is made up as follow: |

| | |

As of

January 1, 2014 | |

Dividends

received | |

Contributions | |

Adjustments | |

Share in net

profit (loss) | |

As of June

30,2014 |

| | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) |

| | |

| |

| |

| |

| |

| |

|

| Minera Yanacocha S.R.L. (c) | |

| 1,368,797 | | |

| - | | |

| - | | |

| (7,997 | ) | |

| (37,374 | ) | |

| 1,323,426 | |

| Sociedad Minera Cerro Verde S.A.A. (d) | |

| 904,315 | | |

| - | | |

| - | | |

| - | | |

| 42,187 | | |

| 946,502 | |

| Compañía Minera Coimolache S.A. | |

| 43,367 | | |

| (4,442 | ) | |

| - | | |

| - | | |

| 10,877 | | |

| 49,802 | |

| Canteras del Hallazgo S.A.C. | |

| 39,231 | | |

| - | | |

| 1,475 | | |

| - | | |

| 1 | | |

| 40,707 | |

| Other minor investments | |

| 2,700 | | |

| - | | |

| - | | |

| (80 | ) | |

| (2 | ) | |

| 2,618 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| 2,358,410 | | |

| (4,442 | ) | |

| 1,475 | | |

| (8,077 | ) | |

| 15,689 | | |

| 2,363,055 | |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| (b) | The table below presents the net share in profit (loss)

of associates: |

| | |

For the three–month

periods ended June 30, | |

For the six–month

periods ended June 30, |

| | |

2014 | |

2013 | |

2014 | |

2013 |

| | |

US$(000) | |

US$(000) | |

US$(000) | |

US$(000) |

| | |

| |

| |

| |

|

| Sociedad Minera Cerro Verde S.A.A. | |

| 26,476 | | |

| 20,817 | | |

| 42,187 | | |

| 47,998 | |

| Compañía Minera Coimolache S.A. | |

| 6,086 | | |

| 2,069 | | |

| 10,877 | | |

| 10,209 | |

| Canteras del Hallazgo S.A.C. | |

| 80 | | |

| 2,121 | | |

| 1 | | |

| - | |

| Minera Yanacocha S.R.L. | |

| (12,889 | ) | |

| 23,799 | | |

| (37,374 | ) | |

| 74,767 | |

| Other minor investments | |

| 416 | | |

| - | | |

| (2 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| 20,169 | | |

| 48,806 | | |

| 15,689 | | |

| 132,974 | |

| (c) | Investments that the Company maintains in Minera Yanacocha

S.R.L, through Compañía Minera Condesa S.A., and in Sociedad Minera Cerro Verde S.A.A., represent the most significant

investments of the Company. |

Investment in Minera Yanacocha

S.R.L. -

The Company, through its subsidiary

Compañía Minera Condesa S.A., holds 43.65 percent of the capital stock of Minera Yanacocha S.R.L. (hereinafter “Yanacocha”).

This entity has a gold mine located in Cajamarca, Peru, and is engaged in gold production and exploration and development of gold

and copper in their own concessions or concessions owned by S.M.R.L. Chaupiloma Dos de Cajamarca, with which signed a contract

of use of mineral rights.

During the last several years,

Yanacocha has been developing the Conga project, which consists in two deposits of gold and porphyry of copper located at northeast

of the Yanacocha operating area in the provinces of Celendin, Cajamarca and Hualgayoc, in Cajamarca region. As of June 30, 2014,

the project has proven and probable reserves of 12.6 million ounces (unaudited) of contained gold and 3.3 billion pounds (unaudited)

of copper content.

Due to local political and community

protests by a potential impact on water resources, construction and development activities at the Conga project are suspended

since November 2011. Currently, Yanacocha’s management is developing only the water sustainability activities recommended

by independent experts, mainly, construction of water reservoirs, before to carrying out any development activities of the project.

Notes to the interim consolidated

financial statements (unaudited) (continued)

Investment in Sociedad Minera

Cerro Verde S.A.A. -

Sociedad Minera Cerro Verde S.A.A.

(hereinafter “Cerro Verde”) is involved in extracting, producing and marketing of cathodes and copper concentrate

from its mining unit located in Uchumayo, Arequipa, Peru.

Tax contingency

On June 23, 2004, Law No.28258

-Mining Royalty Law, was approved, and requires the holders of mining concessions to pay a royalty return for the exploitation

of metallic and non-metallic mining resources, which is calculated using rates from one to three percent of the value of concentrate

or its equivalent, according to the international market prices of the commodity published by the Ministry of Energy and Mines.

Based on the 1998 stability agreement,

the payment of mining royalties was not applicable to Cerro Verde, because the contribution was created after Cerro Verde signed

the stability contract with the Peruvian Government.

The Peruvian tax authority (SUNAT)

has assessed mining royalties related to ore processed by Cerro Verde’s concentrator, which commenced operations in late

2006. Such assessments cover the period from October 2006 to December 2007, as well as years 2008 and 2009. SUNAT has issued resolutions

rejecting the claims of Cerro Verde. Cerro Verde has appealed such decisions at the Tax Court. On July 23, 2013, SUNAT notified

the final decision of the Tax Court confirming the assessments for the periods from October to December 2006, and for the years

2007 and 2008. By means of the decision of the Tax Court, the administrative stage for the appeal of these proceedings ended.

In September 2013, Cerro Verde filed judiciary appeals

to Judiciary Court (Civil Court of the Superior Court of Arequipa) suing SUNAT, the Ministry of Energy and Mines and Tax Court

for requiring Cerro Verde to pay mining royalties during the term of the stability agreement in force until December 31, 2013.

Cerro Verde believes that the Stability Agreement entered into with the Peruvian Government in 1998 (which was in force from January

1, 1999 to December 31, 2013) guarantees that all minerals extracted from their production unit are included in the stabilized

tax and administrative regime, which does not include the obligation to pay the mining royalties.

On October 1, 2013, SUNAT issued a payment order

to Cerro Verde by 492 million of Nuevos Soles (US$176 million based on current exchange rates, including interest and penalties

of US$104 million). As permitted by law, Cerro Verde requested and as has been granted an installment payment program that defers

payment for six months and thereafter satisfies the amount via 66 equal monthly payments. In July 2013, claim on SUNAT’s

assessment for 2009 was rejected, but no final decision has been issued by the Tax Court for that year.

In

Cerro Verde management’s and legal advisors’ opinion, Cerro Verde has sound legal grounds; consequently, they expect

to obtain favorable results on these legal proceedings.

| 9. | Mining concessions, development costs, property, plant and equipment,

net |

This caption is made up as follow:

| | |

Cost | | |

Accumulated

depreciation /

amortization | | |

Provision for

impairment of long–

lived

assets | | |

Net cost | |

| | |

US$(000) | | |

US$(000) | | |

US$(000) | | |

US$(000) | |

| | |

| | |

| | |

| | |

| |

| As of January 1, 2014 | |

| 2,534,901 | | |

| (1,000,430 | ) | |

| (19,011 | ) | |

| 1,515,460 | |

| Additions | |

| 133,956 | | |

| - | | |

| - | | |

| 133,956 | |

| Depreciation and amortization | |

| - | | |

| (112,970 | ) | |

| - | | |

| (112,970 | ) |

| Provision for impairment of long-lived assets | |

| - | | |

| - | | |

| (794 | ) | |

| (794 | ) |

| Retirements | |

| (90 | ) | |

| 64 | | |

| - | | |

| (26 | ) |

| As of June 30, 2014 | |

| 2,668,767 | | |

| (1,113,336 | ) | |

| (19,805 | ) | |

| 1,535,626 | |

Notes to the interim consolidated

financial statements (unaudited) (continued)

Main additions during six-month period ended June

30, 2014 were:

| | |

US$(000) | |

| | |

| |

| Operations expansion project of Sociedad Minera El Brocal S.A.A. | |

| 32,831 | |

| Development costs of Compañía de Minas Buenaventura S.A.A. | |

| 28,343 | |

| Construction of hydroelectric plant of Empresa de Generación Huanza S.A. | |

| 13,825 | |

| Development cost of Minera La Zanja S.R.L. | |

| 8,723 | |

| Machinery acquired by Sociedad Minera El Brocal S.A.A. | |

| 7,661 | |

| Development costs of Sociedad Minera El Brocal S.A.A. | |

| 7,445 | |

| Property, plant and equipment acquired by Minera La Zanja S.R.L. | |

| 6,595 | |

| Machinery acquired by Procesadora Industrial Río Seco S.A. | |

| 6,588 | |

| Replacement units acquired by Compañía de Minas Buenaventura S.A.A. | |

| 5,751 | |

| Work in progress of Compañía de Minas Buenaventura S.A.A. | |

| 5,076 | |

| Other minor | |

| 11,118 | |

| | |

| 133,956 | |

Notes to the interim consolidated

financial statements (unaudited) (continued)

This caption is made up as follow:

| | |

As of January 1,

2014 | | |

Accretion | | |

Debit (credit) in

profit or loss | | |

Disbursements | | |

As of

June 30, 2014 | |

| | |

US$(000) | | |

US$(000) | | |

US$(000) | | |

US$(000) | | |

US$(000) | |

| | |

| | |

| | |

| | |

| | |

| |

| Provision for closure of mining units and

exploration projects | |

| 136,357 | | |

| 1,222 | | |

| - | | |

| (6,037 | ) | |

| 131,542 | |

| Provision for obligations with local communities | |

| 6,974 | | |

| - | | |

| 8,609 | | |

| (1,609 | ) | |

| 13,974 | |

| Provision for environmental liabilities | |

| 9,224 | | |

| - | | |

| (85 | ) | |

| (1,863 | ) | |

| 7,276 | |

| Provision for labor contingencies | |

| 6,021 | | |

| - | | |

| (395 | ) | |

| (300 | ) | |

| 5,326 | |

| Provision for security contingencies | |

| 1,679 | | |

| - | | |

| 3,535 | | |

| (163 | ) | |

| 5,051 | |

| Workers’ profit sharing payable | |

| 7,206 | | |

| - | | |

| 2,333 | | |

| (6,689 | ) | |

| 2,850 | |

| Provision for stock appreciation rights | |

| 1,971 | | |

| - | | |

| 1,931 | | |

| (1,598 | ) | |

| 2,304 | |

| Provision for environmental contingencies | |

| 4,031 | | |

| - | | |

| (2,106 | ) | |

| (269 | ) | |

| 1,656 | |

| Board of Directors’ participation | |

| 1,604 | | |

| - | | |

| 1,252 | | |

| (1,405 | ) | |

| 1,451 | |

| Employee bonuses | |

| - | | |

| - | | |

| 11,897 | | |

| (11,897 | ) | |

| - | |

| Other provisions | |

| 1,109 | | |

| - | | |

| 25 | | |

| (87 | ) | |

| 1,047 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| 176,176 | | |

| 1,222 | | |

| 26,996 | | |

| (31,917 | ) | |

| 172,477 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Classification by maturity: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Current portion | |

| 69,800 | | |

| | | |

| | | |

| | | |

| 71,826 | |

| Non-current portion | |

| 106,376 | | |

| | | |

| | | |

| | | |

| 100,651 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| 176,176 | | |

| | | |

| | | |

| | | |

| 172,477 | |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| | | |

| (a) | This caption is made up as follow: |

| | |

Annual interest rate | |

Original

maturity | |

As of

June 30,

2014 | | |

As of

December 31,

2013 | |

| | |

| |

| |

US$(000) | | |

US$(000) | |

| | |

| |

| |

| | |

| |

| Empresa de Generación Huanza

S.A. | |

| |

| |

| | | |

| | |

| Banco de Crédito del Perú

– Finance lease (b) | |

Three-month

Libor plus 4.00% | |

2021 | |

| 204,000 | | |

| 119,000 | |

| | |

| |

| |

| | | |

| | |

| Sociedad Minera El Brocal S.A.A. | |

| |

| |

| | | |

| | |

| Banco de Crédito

del Perú – Leaseback (c) | |

Three-month

Libor plus 5.00% | |

2019 | |

| 169,149 | | |

| 115,397 | |

| | |

| |

| |

| | | |

| | |

| Buenaventura Ingenieros S.A. | |

| |

| |

| | | |

| | |

| Banco

de Crédito del Perú – Finance lease (d) | |

4.60% | |

2018 | |

| 11,094 | | |

| - | |

| | |

| |

| |

| | | |

| | |

| Total financial

obligations | |

| |

| |

| 384,243 | | |

| 234,397 | |

| | |

| |

| |

| | | |

| | |

| Classification by maturity: | |

| |

| |

| | | |

| | |

| Current portion | |

| |

| |

| 47,641 | | |

| 11,370 | |

| Non-current

portion | |

| |

| |

| 336,602 | | |

| 223,027 | |

| | |

| |

| |

| | | |

| | |

| Total financial

obligations | |

| |

| |

| 384,243 | | |

| 234,397 | |

| (b) | On December 2, 2010, Empresa de Generación Huanza

S.A. entered into a finance lease contract with Banco de Crédito del Perú,

with the following terms and conditions: |

| - | Principal: US$119,000,000. |

| - | Term and annual interest rate: 6 years since August 2014,

with an annual variable rate of three-month Libor plus 4.00 percent. |

| - | Guarantee: Leased equipments. |

| - | Amortization: Through 26 quarterly installments and a quota

balloon of US$44,191,000. |

On June 30, 2014, Empresa de Generación

Huanza S.A. expanded the finance lease contract with Banco de Crédito del Perú, through the addition of a new tranche

with the following terms and conditions:

| - | Principal: US$108,780,000. |

| - | Term and annual interest rate: 6 years since August 2014,

with an annual variable rate of three-month Libor plus 4.20 percent. |

| - | Guarantee: Leased equipments. |

| - | Amortization: Through 26 quarterly installments, which includes

an inmediate first installment of US$23,780,000 and a quota balloon of US$68,905,000. |

| (c) | The shareholders’ meeting of El Brocal held on September

25, 2013, approved to enter into a sale and finance leaseback contract up to US$180,000,000

through the sale of assets by the same amount (consisting on equipment, machinery and

production plants located in the Colquijirca mining unit) which has a term of 5 years

and accrues interest calculated at an annual variable rate of three-month Libor plus

5 percent, equivalent to 5.23 percent as of June 30, 2014 (5.25 percent as of December

31, 2013). Proceeds from this loan were used to fully prepay the loan of US$120 million

that El Brocal held with Banco de Crédito del Perú and also to comply with

those obligations that are necessary to complete the operations expansion project. |

Notes to the interim consolidated

financial statements (unaudited) (continued)

The financing is secured by a trust agreement on

receivables, sales contracts and cash inflows on commercial contracts; and other related to the administration, use, disposal

and claim of the assets specified in the contract.

In connection with the above financing,

El Brocal complied with the following financial ratios as of June 30, 2014:

| (i) | Debt service coverage ratio: Higher than 1.3 from January

1, 2014. |

| (ii) | Leverage ratio: Less than 1.0. |

| a. | Less than 5.0 from the closing date to March 31, 2014; |

| b. | Less than 4.5 as of June 30, 2014; |

| c. | Less than 4.0 as of September 30, 2014; |

| d. | Less than 3.0 as of December 31, 2014; |

| e. | Less than 2.5 from January 1, 2015 to December 31, 2015;

and, |

| f. | Less than 2.0 from January 1, 2016 and thereafter. |

These financial ratios are calculated based on the

financial statements of El Brocal as of each quarter ending March, June, September and December.

The compliance with the financial ratios described

above is monitored by El Brocal’s management.

| (d) | On March 28, 2014, Buenaventura Ingenieros S.A. entered

into a finance lease contract with Banco de Crédito del Perú, for the construction

of an administrative building, with the following terms and conditions: |

| - | Principal: US$11,826,000. |

| - | Term and annual interest rate: 5 years and 4 months since

April 2014, with an annual rate of 4.60 percent. |

| - | Guarantee: Leased property. |

| - | Amortization: Through 64 monthly installments. |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| | | |

| (a) | Current and deferred income (expense) tax portions shown

in the unaudited interim consolidated statements of profit or loss for the three-month

and six-month periods ended June 30, 2014 and 2013 are as follow: |

| | |

For the three–month

periods ended June 30, | | |

For the six–month

periods ended June 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

US$(000) | | |

US$(000) | | |

US$(000) | | |

US$(000) | |

| | |

| | |

| | |

| | |

| |

| Income tax | |

| | | |

| | | |

| | | |

| | |

| Current | |

| (6,629 | ) | |

| (7,872 | ) | |

| (12,866 | ) | |

| (26,021 | ) |

| Deferred | |

| (1,455 | ) | |

| (1,876 | ) | |

| (1,201 | ) | |

| (12,561 | ) |

| | |

| (8,084 | ) | |

| (9,748 | ) | |

| (14,067 | ) | |

| (38,582 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Mining royalties and special mining tax | |

| | | |

| | | |

| | | |

| | |

| Current | |

| (311 | ) | |

| (1,083 | ) | |

| (1,879 | ) | |

| (5,164 | ) |

| Deferred | |

| (2,099 | ) | |

| 397 | | |

| (1,870 | ) | |

| 801 | |

| | |

| (2,410 | ) | |

| (686 | ) | |

| (3,749 | ) | |

| (4,363 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total income tax | |

| (10,494 | ) | |

| (10,434 | ) | |

| (17,816 | ) | |

| (42,945 | ) |

Currently, the Peruvian tax authority is reviewing

the Company’s income tax returns for the years 2008, 2009 and 2010, and the value added tax returns for the period from

January to December 2008.

Notes to the interim consolidated

financial statements (unaudited) (continued)

| (b) | The table below presents the reconciliation of income tax

expense and the profit multiplied by income tax rate for the three-month and six-month

periods ended June 30, 2014 and 2013: |

| | |

For the three–month

periods ended June 30, | | |

For the six–month

periods ended June 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

US$(000) | | |

US$(000) | | |

US$(000) | | |

US$(000) | |

| | |

| | |

| | |

| | |

| |

| Profit before income tax | |

| 43,068 | | |

| 31,293 | | |

| 40,018 | | |

| 174,737 | |

| Effect of share in the results of associates | |

| (20,169 | ) | |

| (48,806 | ) | |

| (15,689 | ) | |

| (132,974 | ) |

| | |

| 22,899 | | |

| (17,513 | ) | |

| 24,329 | | |

| 41,763 | |

| | |

| | | |

| | | |

| | | |

| | |

| Theoretical income tax benefit (expense) | |

| (6,870 | ) | |

| 5,254 | | |

| (7,299 | ) | |

| (12,529 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Permanent items and other: | |

| | | |

| | | |

| | | |

| | |

| Non-deductible expenses for tax purposes | |

| (1,599 | ) | |

| (5,889 | ) | |

| (5,367 | ) | |

| (14,196 | ) |

| Effect of translation into U.S. dollars | |

| 1,435 | | |

| (3,271 | ) | |

| (974 | ) | |

| (7,409 | ) |

| Mining royalties and special mining tax | |

| (674 | ) | |

| (407 | ) | |

| (413 | ) | |

| (1,174 | ) |

| Amortization of mining concessions | |

| (15 | ) | |

| 43 | | |

| (20 | ) | |

| (1,007 | ) |

| Effect of exchange difference on tax loss carry-forward | |

| 310 | | |

| (1,213 | ) | |

| 2 | | |

| (2,231 | ) |

| Other permanent items | |

| (671 | ) | |

| (4,265 | ) | |

| 4 | | |

| (36 | ) |

| Income tax expense | |

| (8,084 | ) | |

| (9,748 | ) | |

| (14,067 | ) | |

| (38,582 | ) |

| Mining royalties and special mining tax | |

| (2,410 | ) | |

| (686 | ) | |

| (3,749 | ) | |

| (4,363 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total income tax | |

| (10,494 | ) | |

| (10,434 | ) | |

| (17,816 | ) | |

| (42,945 | ) |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| 13. | Dividends declared and paid |

| | | |

| (a) | The table below presents information about dividends declared

and paid during the six-month periods ended June 30, 2014 and 2013 |

| Meetings | |

Date | |

Dividends

declared and paid | | |

Dividends

per share | |

| | |

| |

US$(000) | | |

US$ | |

| | |

| |

| | |

| |

| Dividends declared and paid in 2014 | |

| |

| | | |

| | |

| Mandatory Annual Shareholders’ Meeting | |

March 27, 2014 | |

| 3,032 | | |

| 0.01 | |

| Less – Dividends on treasury shares | |

| |

| (235 | ) | |

| | |

| | |

| |

| | | |

| | |

| | |

| |

| 2,797 | | |

| | |

| | |

| |

| | | |

| | |

| Dividends declared and paid in 2013 | |

| |

| | | |

| | |

| Mandatory Annual Shareholders’ Meeting | |

March 26, 2013 | |

| 82,690 | | |

| 0.30 | |

| Less – Dividends on treasury shares | |

| |

| (6,421 | ) | |

| | |

| | |

| |

| | | |

| | |

| | |

| |

| 76,269 | | |

| | |

| (b) | Dividends declared by subsidiaries and corresponding to

non-controlling interest, for the three-month and six-month periods ended June 30, 2014

and 2013 are the following: |

| | |

For the three–month

periods ended June 30, | | |

For the six–month

periods ended June 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

US$(000) | | |

US$(000) | | |

US$(000) | | |

US$(000) | |

| | |

| | |

| | |

| | |

| |

| S.M.R.L. Chaupiloma Dos de Cajamarca | |

| 2,240 | | |

| 3,860 | | |

| 4,200 | | |

| 7,300 | |

| Sociedad Minera El Brocal S.A.A. | |

| - | | |

| - | | |

| - | | |

| 2,713 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| 2,240 | | |

| 3,860 | | |

| 4,200 | | |

| 10,013 | |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| | | |

| (a) | The table below presents the detail of net sales for the

three-month and six-month periods ended June 30, 2014 and 2013: |

| | |

For the three–month

periods ended June 30, | | |

For the six–month

periods ended June 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

US$(000) | | |

US$(000) | | |

US$(000) | | |

US$(000) | |

| Sales by product | |

| | | |

| | | |

| | | |

| | |

| Gold | |

| 140,461 | | |

| 155,014 | | |

| 281,859 | | |

| 355,174 | |

| Silver | |

| 97,807 | | |

| 103,166 | | |

| 180,672 | | |

| 200,112 | |

| Copper | |

| 66,970 | | |

| 29,995 | | |

| 129,442 | | |

| 70,331 | |

| Lead | |

| 8,707 | | |

| 16,082 | | |

| 18,051 | | |

| 31,163 | |

| Zinc | |

| 6,182 | | |

| 19,009 | | |

| 13,134 | | |

| 39,248 | |

| | |

| 320,127 | | |

| 323,266 | | |

| 623,158 | | |

| 696,028 | |

| Commercial deductions | |

| (41,884 | ) | |

| (41,554 | ) | |

| (78,914 | ) | |

| (77,528 | ) |

| Adjustments to current period liquidations | |

| (1,476 | ) | |

| (7,533 | ) | |

| (1,179 | ) | |

| (12,455 | ) |

| Embedded derivatives for concentrates sales | |

| 11,152 | | |

| (13,750 | ) | |

| 5,168 | | |

| (13,137 | ) |

| Hedge operations | |

| 1,543 | | |

| - | | |

| 1,864 | | |

| - | |

| | |

| 289,462 | | |

| 260,429 | | |

| 550,097 | | |

| 592,908 | |

Sales of services, electric power

and other minor | |

| 8,248 | | |

| 12,670 | | |

| 21,581 | | |

| 21,064 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| 297,710 | | |

| 273,099 | | |

| 571,678 | | |

| 613,972 | |

| (b) | The tables below present information about volumes of metallic

content sold and average sales prices for the three-month and six-month periods ended

June 30, 2014 and 2013: |

Volumes of metallic contents sold

were the following:

| | |

For the three–month

periods ended June 30, | | |

Increase

(decrease) | |

| | |

2014 | | |

2013 | | |

| |

| | |

| | |

| | |

| |

| Gold | |

| 110,292 | OZ | |

| 116,751 | OZ | |

| (6,459 | )OZ |

| Silver | |

| 4,949,060 | OZ | |

| 4,541,688 | OZ | |

| 407,372 | OZ |

| Copper | |

| 10,186 | MT | |

| 4,503 | MT | |

| 5,683 | MT |

| Lead | |

| 4,199 | MT | |

| 7,934 | MT | |

| (3,735 | )MT |

| Zinc | |

| 2,943 | MT | |

| 10,775 | MT | |

| (7,832 | )MT |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| | |

For the six–month

periods ended June 30, | | |

Increase

(decrease) | |

| | |

2014 | | |

2013 | | |

| |

| | |

| | |

| | |

| |

| Gold | |

| 218,227 | OZ | |

| 241,377 | OZ | |

| (23,150 | )OZ |

| Silver | |

| 9,145,615 | OZ | |

| 7,782,423 | OZ | |

| 1,363,192 | OZ |

| Copper | |

| 19,187 | MT | |

| 9,611 | MT | |

| 9,576 | MT |

| Lead | |

| 8,502 | MT | |

| 14,617 | MT | |

| (6,115 | )MT |

| Zinc | |

| 6,114 | MT | |

| 20,979 | MT | |

| (14,865 | )MT |

Net average sales prices were

the following:

| | |

For the three–month

periods ended June 30, | | |

Increase

(decrease) | |

| | |

2014 | | |

2013 | | |

| |

| | |

US$ | | |

US$ | | |

| |

| | |

| | |

| | |

| |

| Gold | |

| 1,273.54 | /OZ | |

| 1,387.69 | /OZ | |

| (114.15 | )/OZ |

| Silver | |

| 19.76 | /OZ | |

| 23.88 | /OZ | |

| (4.12 | )/OZ |

| Copper | |

| 6,575.03 | /MT | |

| 7,067.56 | /MT | |

| (492.53 | )/MT |

| Lead | |

| 2,073.27 | /MT | |

| 2,066.47 | /MT | |

| 6.80 | /MT |

| Zinc | |

| 2,100.77 | /MT | |

| 1,841.21 | /MT | |

| 259.56 | /MT |

| | |

For the six–month

periods ended June 30, | | |

Increase

(decrease) | |

| | |

2014 | | |

2013 | | |

| |

| | |

US$ | | |

US$ | | |

| |

| | |

| | |

| | |

| |

| Gold | |

| 1,291.59 | /OZ | |

| 1,477.29 | /OZ | |

| (185.70 | )/OZ |

| Silver | |

| 19.75 | /OZ | |

| 25.82 | /OZ | |

| (6.07 | )/OZ |

| Copper | |

| 6,746.34 | /MT | |

| 7,506.29 | /MT | |

| (759.95 | )/MT |

| Lead | |

| 2,123.10 | /MT | |

| 2,136.69 | /MT | |

| (13.59 | )/MT |

| Zinc | |

| 2,148.20 | /MT | |

| 1,896.71 | /MT | |

| 251.49 | /MT |

Notes to the interim consolidated

financial statements (unaudited) (continued)

| 15. | Cost of sales, without considering depreciation and amortization |

The table below presents the components of this

caption for the three-month and six-month periods ended June 30, 2014 and 2013:

| | |

For the three–month

periods ended June 30, | | |

For the six–month

periods ended June 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

US$(000) | | |

US$(000) | | |

US$(000) | | |

US$(000) | |

| | |

| | |

| | |

| | |

| |

| Beginning balance of finished goods and products in process | |

| 150,104 | | |

| 156,410 | | |

| 157,904 | | |

| 158,478 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of production | |

| | | |

| | | |

| | | |

| | |

| Services provided by third parties | |

| 71,472 | | |

| 75,872 | | |

| 129,127 | | |

| 142,812 | |

| Direct labor | |

| 29,318 | | |

| 25,290 | | |

| 52,771 | | |

| 53,685 | |

| Consumption of materials and supplies | |

| 24,461 | | |

| 29,235 | | |

| 50,371 | | |

| 60,731 | |

| Electricity and water | |

| 7,531 | | |

| 9,325 | | |

| 15,520 | | |

| 14,320 | |

| Rentals | |

| 4,375 | | |

| 2,131 | | |

| 7,767 | | |

| 4,022 | |

| Transport | |

| 3,967 | | |

| 4,852 | | |

| 7,209 | | |

| 9,376 | |

| Insurances | |

| 1,834 | | |

| 2,486 | | |

| 3,791 | | |

| 5,052 | |

| Maintenance and repair | |

| 1,826 | | |

| 1,783 | | |

| 3,680 | | |

| 3,338 | |

| Cost of concentrate purchased to third parties | |

| - | | |

| (289 | ) | |

| - | | |

| 1,088 | |

| Purchase of by-products to third parties | |

| - | | |

| - | | |

| - | | |

| 914 | |

| Provision for impairment of value of finished goods | |

| (835 | ) | |

| 1,155 | | |

| (835 | ) | |

| 1,155 | |

| Other production expenses | |

| (8,367 | ) | |

| 3,163 | | |

| 1,340 | | |

| 14,577 | |

| Total cost of production of the period | |

| 135,582 | | |

| 155,003 | | |

| 270,741 | | |

| 311,070 | |

| | |

| | | |

| | | |

| | | |

| | |

| Ending balance of finished goods and products in process | |

| (136,052 | ) | |

| (138,544 | ) | |

| (136,052 | ) | |

| (138,544 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales, without considering depreciation and amortization | |

| 149,634 | | |

| 172,869 | | |

| 292,593 | | |

| 331,004 | |

The balance of this caption decreased by US$38,411,000

during the six-month period ended June 30, 2014, as compared to the balance of the same period in 2013, mainly explained by the

effect of lower costs incurred related to the four paralyzed mining units, see note 1(b).

| 16. | Exploration in operating units |

The balance of this caption decreased by US$42,415,000,

from US$96,050,000 during the six-month period ended June 30, 2013 to US$53,635,000 during the same period of 2014, mainly explained

by the lower exploration activities performed in Poracota and Antapite mining units, due to lower expectations about reserves

in such mining units.

Notes to the interim consolidated

financial statements (unaudited) (continued)

| 17. | Administrative expenses |

The balance of this caption increased by US$14,649,000,

from US$37,168,000 during the six-month period ended June 30, 2013 to US$51,817,000 during the same period of 2014, mainly because

during the first semester of 2013, the Group reversed a provision for stock appreciation rights by US$18,527,000, as a result

of a reduction in the price of the ADR’s of the Company at the end of that semester as compared to December 31, 2012, while

during the first semester of 2014, the Group recorded an increase of such provision by US$1,925,000; partially offset by lower

transport and travel expenses by US$3,197,000 and lower personnel expenses by US$1,650,000 during the six-month period ended June

30, 2014 as compared to the same period in 2013.

| 18. | Related parties transactions |

| | | |

| (a) | The main transactions made by the Group with its related

parties during the three-month and six-month periods ended June 30, 2014 and 2013 are

presented below: |

| | |

For the three–month

periods ended June 30 | | |

For the six–month

periods ended June 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

US$(000) | | |

US$(000) | | |

US$(000) | | |

US$(000) | |

| | |

| | |

| | |

| | |

| |

| Royalties collected from Minera Yanacocha S.R.L. by: | |

| | | |

| | | |

| | | |

| | |

| S.M.R.L. Chaupiloma Dos de Cajamarca | |

| 7,399 | | |

| 12,693 | | |

| 15,424 | | |

| 26,495 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income for services rendered to Minera Yanacocha S.R.L. by: | |

| | | |

| | | |

| | | |

| | |

| Consorcio Energético de Huancavelica S.A. (electric power transmission) | |

| 152 | | |

| 229 | | |

| 381 | | |

| 458 | |

| Buenaventura Ingenieros S.A. (execution of specific work orders) | |

| (68 | ) | |

| 133 | | |

| 137 | | |

| 309 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income for services rendered to Sociedad Minera Cerro Verde S.A.A. by: | |

| | | |

| | | |

| | | |

| | |

| Buenaventura Ingenieros S.A. (engineering services) | |

| 468 | | |

| 448 | | |

| 829 | | |

| 650 | |

| BISA Construcción S.A. (construction services) | |

| 41 | | |

| - | | |

| 82 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Income for services rendered to Compañía Minera Coimolache S.A. by: | |

| | | |

| | | |

| | | |

| | |

| Buenaventura Ingenieros S.A. (engineering services) | |

| 145 | | |

| 171 | | |

| 274 | | |

| 416 | |

| Consorcio Energético de Huancavelica S.A. (electric power transmission) | |

| 125 | | |

| 125 | | |

| 250 | | |

| 250 | |

| Compañía de Minas Buenaventura S.A.A. (management and administrative services) | |

| 258 | | |

| 260 | | |

| 514 | | |

| 535 | |

| | |

| | | |

| | | |

| | | |

| | |

| Dividends received from: | |

| | | |

| | | |

| | | |

| | |

| Compañía Minera Coimolache S.A. | |

| 2,065 | | |

| 3,363 | | |

| 4,442 | | |

| 7,064 | |

| | |

| | | |

| | | |

| | | |

| | |

| Contributions and investments made to: | |

| | | |

| | | |

| | | |

| | |

| Canteras del Hallazgo S.A.C. | |

| 472 | | |

| - | | |

| 1,475 | | |

| 3,685 | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income by loans to: | |

| | | |

| | | |

| | | |

| | |

| Compañía Minera Coimolache S.A. | |

| 50 | | |

| 203 | | |

| 123 | | |

| 530 | |

| | |

| | | |

| | | |

| | | |

| | |

| Sales of supplies to Compañía Minera Coimolache S.A. by: | |

| | | |

| | | |

| | | |

| | |

| Procesadora Industrial Río Seco S.A. | |

| 8 | | |

| - | | |

| 14 | | |

| - | |

| Minera La Zanja S.R.L. | |

| 8 | | |

| - | | |

| 10 | | |