Current Report Filing (8-k)

July 20 2016 - 6:33AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________________________________________________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

______________________________________________________________________

Date of Report (Date of earliest event reported): July 19, 2016

BOSTON SCIENTIFIC CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

DELAWARE

|

1-11083

|

04-2695240

|

|

(State or other

|

(Commission

|

(IRS employer

|

|

jurisdiction of

|

file number)

|

identification no.)

|

|

incorporation)

|

|

|

|

|

|

|

|

|

300 Boston Scientific Way, Marlborough, Massachusetts

|

01752-1234

|

|

(Address of principal executive offices)

|

(Zip code)

|

Registrant's telephone number, including area code:

(508) 683-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

o

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

ITEM 8.01.

OTHER EVENTS.

On July 19, 2016, Boston Scientific Corporation (the “Company”), entered into a Stipulation of Settled Issues with the Internal Revenue Service (the “IRS”) intended to resolve all disputes related to the previously disclosed transfer pricing issues for Guidant Corporation’s 2001 through 2006 tax years and the Company’s 2006 and 2007 tax years currently before the United States Tax Court (the “Tax Court”). The Stipulation of Settled Issues is contingent upon the IRS Office of Appeals (“IRS Appeals”) applying the same basis of settlement to all transfer pricing issues for the Company’s 2008 through 2010 tax years and, if applicable, review by the United States Congress Joint Committee on Taxation. For a description of the Company’s transfer pricing dispute for the 2001 through 2010 tax years see

Note J - Income Taxes

of the notes to the consolidated financial statements set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

If finalized, the settlement would resolve substantially all aspects of the controversy before the Tax Court described above as well as the Company’s transfer pricing issues before IRS Appeals. In addition, the Company believes the basis of the settlement provides a framework that can be consistently applied by the IRS to all of the Company’s U.S. income tax returns filed subsequent to 2010.

If the settlement is finalized, the Company will make net tax payments to the IRS of approximately $275 million to resolve both the controversy before the Tax Court as well as the transfer pricing issues before IRS Appeals. In addition, the Company will pay interest on the net taxes due, accruing from the date the tax liability originated through the date of payment. Based on the contingencies to be satisfied before final resolution as well as the experiences of other companies in similar situations, the Company expects to remit all tax and interest payments resulting from this settlement to the IRS in the next 12 to 24 months. The Company does not expect to recognize any additional charges related to the resolution as the Company had previously recorded sufficient reserves with respect to this controversy. The Company does not expect to change its 2016 estimated annual effective tax rate as a result of the resolution.

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by words like “anticipate,” “expect,” “project,” “believe,” “plan,” “estimate,” “intend” and similar words. These forward-looking statements are based on our beliefs, assumptions and estimates using information available to us at the time and are not intended to be guarantees of future events or performance. These forward-looking statements include, among other things, statements addressing the proposed settlement with the IRS relating to the Company’s transfer pricing dispute for the 2001 through 2007 tax years before the U.S. Tax Court and 2008 through 2010 tax years before the IRS Office of Appeals, including the proposed settlement terms, and the application by the IRS of the same settlement or framework to all the Company’s U.S. income tax returns filed subsequent to 2010. If our underlying assumptions turn out to be incorrect, or if certain risks or uncertainties materialize, actual results could vary materially from the expectations and projections expressed or implied by our forward-looking statements. In many cases, these risks and uncertainties are outside our control, and may cause actual results to differ materially from those contemplated by the statements expressed in this document. As a result, readers are cautioned not to place undue reliance on any of its forward-looking statements.

Risks and uncertainties that may cause such differences include, among other things: the risk that the conditions precedent to the settlement are never met and the transfer pricing dispute is not settled with the IRS and the risk that the IRS may not consistently apply the terms of the settlement to all the Company’s U.S. income tax returns filed subsequent to 2010. New risks and uncertainties may arise from time to time and are difficult to predict. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. For a further list and description of these and other important risks and uncertainties that may affect our future operations, see Part I, Item 1A - Risk Factors in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we may update in Part II, Item 1A - Risk Factors in Quarterly Reports on Form 10-Q we have filed or will file hereafter. We disclaims any intention or obligation to publicly update or revise any forward-looking statements to reflect any change in our expectations or in events, conditions, or circumstances on which those expectations may be based, or that may affect the likelihood that actual results will differ from those contained in the forward-looking statements. This cautionary statement is applicable to all forward-looking statements contained in this document.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: July 20, 2016

|

BOSTON SCIENTIFIC CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

/s/ Vance R. Brown

|

|

|

|

|

Vance R. Brown

|

|

|

|

|

Vice President and Chief Corporate Counsel

|

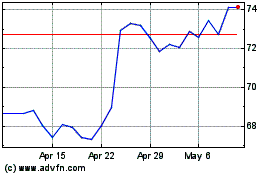

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

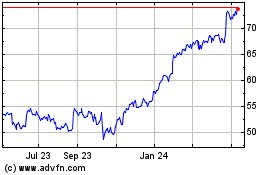

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Apr 2023 to Apr 2024