Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 08 2015 - 6:04AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433 under the Securities Act of 1933

Registration Statement No. 333-188918

Issuer Free Writing Prospectus, dated May 7, 2015

Boston Scientific Corporation

$1,850,000,000

Senior Notes Offering

Terms and Conditions — 5-, 7- and 10-Year Fixed Rate Notes

|

|

|

5-Year |

|

7-Year |

|

10-Year |

|

Issuer |

|

Boston Scientific Corporation |

|

Boston Scientific Corporation |

|

Boston Scientific Corporation |

|

Note Type |

|

Senior Notes |

|

Senior Notes |

|

Senior Notes |

|

Form of Offering |

|

SEC Registered |

|

SEC Registered |

|

SEC Registered |

|

Ratings(1) |

|

Baa3/BBB-/BBB- (stable/negative/stable) |

|

Baa3/BBB-/BBB- (stable/negative/stable) |

|

Baa3/BBB-/BBB- (stable/negative/stable) |

|

Principal Amount |

|

$600,000,000 |

|

$500,000,000 |

|

$750,000,000 |

|

Trade Date |

|

May 7, 2015 |

|

May 7, 2015 |

|

May 7, 2015 |

|

Settlement Date (T+3) |

|

May 12, 2015 |

|

May 12, 2015 |

|

May 12, 2015 |

|

Maturity Date |

|

May 15, 2020 |

|

May 15, 2022 |

|

May 15, 2025 |

|

Coupon |

|

2.850% per annum |

|

3.375% per annum |

|

3.850% per annum |

|

Yield to Maturity |

|

2.850% per annum |

|

3.478% per annum |

|

3.867% per annum |

|

Price to Public |

|

100.000% |

|

99.364% |

|

99.860% |

|

Spread to Benchmark Treasury |

|

Plus 130 basis points |

|

Plus 155 basis points |

|

Plus 170 basis points |

|

Benchmark Treasury |

|

1.375% UST due April 30, 2020 |

|

1.750% UST due April 30, 2022 |

|

2.000% UST due February 15, 2025 |

|

Benchmark Treasury Yield |

|

1.550% |

|

1.928% |

|

2.167% |

|

Benchmark Treasury Price |

|

99-05 ¼ |

|

98-27 |

|

98-17 |

|

Interest Payment Dates |

|

Semi-annually on May 15 and November 15 |

|

Semi-annually on May 15 and November 15 |

|

Semi-annually on May 15 and November 15 |

|

First Interest Payment Date |

|

November 15, 2015 (long first coupon) |

|

November 15, 2015 (long first coupon) |

|

November 15, 2015 (long first coupon) |

|

Optional Redemption |

|

Plus 20 basis points |

|

Plus 25 basis points |

|

Plus 30 basis points |

|

Special Mandatory Redemption |

|

N/A |

|

In the event the AMS Portfolio Acquisition (as defined in the prospectus supplement) has not been consummated on or prior to the Outside Date (as defined in the prospectus supplement) or if, prior to such date, the Purchase Agreement (as defined in the prospectus supplement) is terminated for any reason, then the Issuer will be required to redeem all outstanding 2022 notes on the special mandatory redemption date at a special mandatory redemption price equal to 101% of the principal amount thereof, plus accrued and unpaid interest thereon (if any) to, but not including, the special mandatory redemption date. The ‘‘special mandatory redemption date’’ means the earlier to occur of (1) the 30th |

|

N/A |

|

|

|

|

|

day (or if such day is not a business day, the first business day thereafter) following the Outside Date and (2) the 30th day (or if such day is not a business day, the first business day thereafter) following the termination of the Purchase Agreement for any reason. |

|

|

|

Optional Par Call |

|

N/A |

|

N/A |

|

N/A |

|

Day Count Basis |

|

30/360 |

|

30/360 |

|

30/360 |

|

Minimum Denominations |

|

$2,000 and integral multiples of $1,000 in excess of such amount |

|

$2,000 and integral multiples of $1,000 in excess of such amount |

|

$2,000 and integral multiples of $1,000 in excess of such amount |

|

CUSIP / ISIN |

|

101137 AP2 / US101137AP29 |

|

101137 AQ0 / US101137AQ02 |

|

101137 AR8 / US101137AR84 |

|

Joint Bookrunners |

|

Barclays Capital Inc.

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc.

J.P. Morgan Securities LLC

BNP Paribas Securities Corp.

Merrill Lynch, Pierce, Fenner & Smith Incorporated

RBC Capital Markets, LLC

SMBC Nikko Securities America, Inc. |

|

Barclays Capital Inc.

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc.

J.P. Morgan Securities LLC

BNP Paribas Securities Corp.

Merrill Lynch, Pierce, Fenner & Smith Incorporated

RBC Capital Markets, LLC

SMBC Nikko Securities America, Inc. |

|

Barclays Capital Inc.

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc.

J.P. Morgan Securities LLC

BNP Paribas Securities Corp.

Merrill Lynch, Pierce, Fenner & Smith Incorporated

RBC Capital Markets, LLC

SMBC Nikko Securities America, Inc. |

|

Co-Managers |

|

Banca IMI S.p.A.

HSBC Securities (USA) Inc.

Standard Chartered Bank

U.S. Bancorp Investments, Inc.

Wells Fargo Securities, LLC

DNB Markets, Inc.

Santander Investment Securities Inc.

Scotia Capital (USA) Inc. |

|

Banca IMI S.p.A.

HSBC Securities (USA) Inc.

Standard Chartered Bank

U.S. Bancorp Investments, Inc.

Wells Fargo Securities, LLC

DNB Markets, Inc.

Santander Investment Securities Inc.

Scotia Capital (USA) Inc. |

|

Banca IMI S.p.A.

HSBC Securities (USA) Inc.

Standard Chartered Bank

U.S. Bancorp Investments, Inc.

Wells Fargo Securities, LLC

DNB Markets, Inc.

Santander Investment Securities Inc.

Scotia Capital (USA) Inc. |

Pro Forma Ratio of Earnings to Fixed Charges

|

|

|

Three Months

Ended March 31, |

|

|

|

|

Pro Forma 2015 |

|

|

|

|

(Unaudited) |

|

|

Fixed Charges: |

|

|

|

|

Interest expense and amortization of debt issuance costs |

|

$ |

53 |

|

|

Interest portion of rental expense |

|

6 |

|

|

Total fixed charges |

|

$ |

59 |

|

|

Earnings: |

|

|

|

|

Income (loss) before income taxes |

|

$ |

(44 |

) |

|

Fixed charges, per above |

|

59 |

|

|

Total earnings (deficit), adjusted |

|

$ |

15 |

|

|

Ratio of earnings to fixed charges |

|

0.25 |

|

2

Note:

(1) A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

THE ISSUER HAS FILED A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SEC FOR THE OFFERING TO WHICH THIS COMMUNICATION RELATES. BEFORE YOU INVEST, YOU SHOULD READ THE PROSPECTUS IN THAT REGISTRATION STATEMENT AND OTHER DOCUMENTS THE ISSUER HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT THE ISSUER AND THIS OFFERING. YOU MAY GET THESE DOCUMENTS FOR FREE BY VISITING EDGAR ON THE SEC WEB SITE AT WWW.SEC.GOV. ALTERNATIVELY, THE ISSUER, ANY UNDERWRITER OR ANY DEALER PARTICIPATING IN THE OFFERING WILL ARRANGE TO SEND YOU THE PROSPECTUS IF YOU REQUEST IT BY CALLING BARCLAYS CAPITAL INC. TOLL-FREE AT (888) 603-5847, CITIGROUP GLOBAL MARKETS INC. TOLL-FREE AT (800) 831-9146, DEUTSCHE BANK SECURITIES INC. TOLL-FREE AT (800) 503-4611 OR J.P. MORGAN SECURITIES LLC COLLECT AT (212) 834-4533.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

3

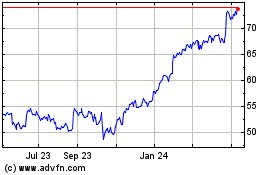

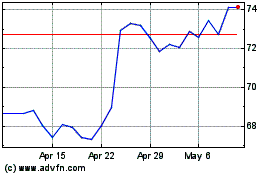

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Apr 2023 to Apr 2024