Current Report Filing (8-k)

May 08 2015 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 7, 2015

BOSTON SCIENTIFIC CORPORATION

(Exact name of registrant as specified in charter)

|

DELAWARE |

|

1-11083 |

|

04-2695240 |

|

(State or other

jurisdiction of

incorporation) |

|

(Commission

file number) |

|

(IRS employer

identification no.) |

|

300 Boston Scientific Way, Marlborough,

Massachusetts |

|

01752-1234

|

|

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: (508) 683-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. OTHER EVENTS

On May 7, 2015, Boston Scientific Corporation (the “Company”) announced the pricing of a public offering of $1.85 billion in aggregate principal amount of its senior notes under its existing shelf registration statement. The public offering consists of $600 million in aggregate principal amount of 2.850% notes due 2020, $500 million in aggregate principal amount of 3.375% notes due 2022 and $750 million in aggregate principal amount of 3.850% notes due 2025. The Company expects the offering to close on May 12, 2015, subject to customary closing conditions. The Company intends to use the net proceeds from this offering, together with borrowings under its $750 million five-year term loan facility, to (i) pay the purchase price of the American Medical Systems urology portfolio acquisition (the “AMS Portfolio Acquisition”) and related fees and expenses and (ii) redeem all or a portion of its (a) 5.500% notes due November 2015, of which $400 million aggregate principal amount was outstanding as of the date hereof, and (b) 6.400% notes due June 2016, of which $600 million aggregate principal amount was outstanding as of the date hereof, and to pay related fees, expenses and premiums. Any such redemption will be made in accordance with the terms of the applicable indenture, including provision of the required notice of redemption.

A copy of the press release is filed with this report as Exhibit 99.1.

Cautionary Statement Regarding Forward-Looking Information

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by words like “anticipate,” “expect,” “project,” “believe,” “plan,” “estimate,” “intend” and similar words. These forward-looking statements are based on our beliefs, assumptions and estimates using information available to us at the time and are not intended to be guarantees of future events or performance. These forward-looking statements include, among other things, statements regarding our proposed offering, intended use of proceeds and timing of closing of the AMS Portfolio Acquisition. If our underlying assumptions turn out to be incorrect, or if certain risks or uncertainties materialize, actual results could vary materially from the expectations and projections expressed or implied by our forward-looking statements. These risks and uncertainties, in some cases, have affected and in the future could affect our ability to implement our business strategy and may cause actual results to differ materially from those contemplated by the statements expressed in this document. As a result, readers are cautioned not to place undue reliance on any of our forward-looking statements.

Risks and uncertainties that may cause such differences include, among other things: future economic, competitive, reimbursement and regulatory conditions; new product introductions; demographic trends; the closing and integration of acquisitions; intellectual property; litigation; financial market conditions; and future business decisions made by us and our competitors. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. For a further list and description of these and other important risks and uncertainties that may affect our future operations, see Part I, Item IA - Risk Factors in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we may update in Part II, Item 1A - Risk Factors in Quarterly Reports on Form 10-Q we have filed or will file hereafter. We disclaim any intention or obligation to publicly update or revise any forward-looking statement to reflect any change in our expectations or in events, conditions, or circumstances on which those expectations may be based, or that may affect the likelihood that actual results will differ from those contained in the forward-looking statements. This cautionary statement is applicable to all forward- looking statements contained in this document.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

2

|

Exhibit No. |

|

Description |

|

|

|

|

|

Exhibit 99.1 |

|

Press Release issued by Boston Scientific Corporation dated May 7, 2015 |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: May 7, 2015 |

BOSTON SCIENTIFIC CORPORATION |

|

|

|

|

|

|

|

|

By: |

/s/ Robert J. Castagna |

|

|

|

Robert J. Castagna |

|

|

|

Vice President and Treasurer |

4

INDEX TO EXHIBITS

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press release issued by Boston Scientific Corporation dated May 7, 2015 |

5

Exhibit 99.1

Boston Scientific Prices $1.85 Billion Of Senior Notes

May 7, 2015

MARLBOROUGH, Mass., May 7, 2015 /PRNewswire/ — Boston Scientific Corporation (NYSE: BSX) announced the pricing of a public offering of $1.85 billion aggregate principal amount of its senior notes under the company’s shelf registration statement. The public offering consists of $600 million of 2.850% notes due May 15, 2020, $500 million of 3.375% notes due May 15, 2022, and $750 million of 3.850% notes due May 15, 2025.

The company expects to receive the net offering proceeds upon closing on May 12, 2015, subject to customary closing conditions. Boston Scientific intends to use the net proceeds from the offering, together with borrowings under its $750 million five-year term loan facility, to (i) pay the purchase price of the American Medical Systems urology portfolio (the “AMS Portfolio Acquisition”) and to pay related fees and expenses and (ii) redeem all or a portion of its (a) 5.500% notes due November 2015, of which $400 million aggregate principal amount was outstanding as of the date hereof, and (b) 6.400% notes due June 2016, of which $600 million aggregate principal amount was outstanding as of the date hereof, and to pay related fees, expenses and premiums. Any such redemption would be made in accordance with the terms of the applicable indenture, including providing the required notice of redemption. The AMS Portfolio Acquisition is expected to close in the third quarter of 2015, subject to customary closing conditions.

Nothing herein shall constitute an offer to sell or the solicitation of an offer to buy the securities, nor shall there be any sale of the securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to qualification under the securities laws of any such state or jurisdiction. The offering is being made by means of a prospectus and related preliminary prospectus supplement only, copies of which or information concerning this offering may be obtained by contacting the joint book-running managers: Barclays Capital Inc., toll-free at (888) 603-5847; Citigroup Global Markets Inc., toll-free at (800) 831-9146, Deutsche Bank Securities Inc., toll-free at (800) 503-4611 or J.P. Morgan Securities LLC, toll-free at (866) 803-9204.

About Boston Scientific

Boston Scientific transforms lives through innovative medical solutions that improve the health of patients around the world. As a global medical technology leader for more than 35 years, we advance science for life by providing a broad range of high performance solutions that address unmet patient needs and reduce the cost of healthcare.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by words like “anticipate,” “expect,” “project,” “believe,” “plan,” “estimate,” “intend” and similar words. These forward-looking statements are based on our beliefs, assumptions and estimates using information available to us at the time and are not intended to be guarantees of future events or performance. These forward-looking statements include, among other things, statements regarding our offering and intended use of proceeds, the timing of closing of the AMS Portfolio Acquisition and our redemption of certain notes and expected charge associated therewith. If our underlying assumptions turn out to be incorrect, or if certain risks or uncertainties materialize, actual results could vary materially from the expectations and projections expressed or implied by our forward-looking statements. These risks and uncertainties, in some cases, have affected and in the future could affect our ability to implement our business strategy and may cause actual results to differ materially from those contemplated by the statements expressed in this press release. As a result, readers are cautioned not to place undue reliance on any of our forward-looking statements.

Risks and uncertainties that may cause such differences include, among other things: future economic, competitive, reimbursement and regulatory conditions; new product introductions; demographic trends; the closing and integration of acquisitions; intellectual property; litigation; financial market conditions; and future business decisions made by us and our competitors. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. For a further list and description of these and other important risks and uncertainties that may affect our future operations, see Part I, Item IA - Risk Factors in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we may update in Part II, Item 1A - Risk Factors in Quarterly Reports on Form 10-Q we have filed or will file hereafter. We disclaim any intention or obligation to publicly update or revise any forward-looking statement to reflect any change in our expectations or in events, conditions, or circumstances on which those expectations may be based, or that may affect the likelihood that actual results will differ from those contained in the forward-looking statements. This cautionary statement is applicable to all forward- looking statements contained in this press release.

CONTACT:

Kelly Leadem

508-683-5543 (office)

Global Media Relations

Boston Scientific Corporation

media@bsci.com

Susie Lisa, CFA

508-683-5565 (office)

Investor Relations

Boston Scientific Corporation

investor_relations@bsci.com

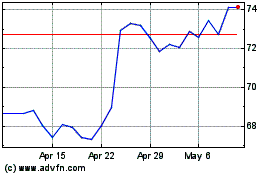

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

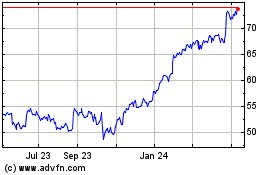

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Apr 2023 to Apr 2024