UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

| |

Date

of Report (Date of earliest event reported): May 8, 2015 |

|

| |

BRT REALTY TRUST |

|

| |

(Exact name of

Registrant as specified in charter) |

|

| Massachusetts |

|

001-07172 |

|

13-2755856 |

| (State

or other jurisdiction |

|

(Commission

file No.) |

|

(IRS

Employer |

| of

incorporation) |

|

|

|

I.D.

No.) |

| 60

Cutter Mill Road, Suite 303, Great Neck, New York |

|

11021 |

| (Address of principal

executive offices) |

|

(Zip code) |

Registrant's

telephone number, including area code 516-466-3100

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

2.02 Results of Operations and Financial Condition.

On

May 8, 2015, BRT Realty Trust issued a press release (the “Press Release”) announcing its results of operations for

the quarter ended March 31, 2015. The press release is attached as an exhibit to this Current Report on Form 8-K. This information

and the exhibit attached hereto are being furnished pursuant to Item 2.02 of Form 8-K and are not to be considered "filed"

under the Exchange Act, and shall not be incorporated by reference into any previous or future filing by registrant under the

Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit

No. | |

Description |

| 99.1 | |

Press release dated May 8, 2015. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

BRT

REALTY TRUST |

| |

|

|

| Date: May 8,

2015 |

By: |

/s/ David W.

Kalish |

| |

|

David W. Kalish |

| |

|

Senior Vice President

- Finance |

3

Exhibit 99.1

BRT

REALTY TRUST REPORTS SECOND QUARTER 2015 RESULTS

Great

Neck, New York – May 8, 2015 – BRT REALTY TRUST (NYSE:BRT), today announced operating results for the three months

ended March 31, 2015.

Jeffrey

A. Gould, President and Chief Executive Officer stated: “We are pleased with the progress of our

multi-family operations as reflected in the increase in funds from operations to $0.12 per diluted share in the current

quarter from $0.00 per share in the three months ended March 31, 2014. We also benefitted from our $1.7 million share of the

$2.7 million gain from the February 2015 sale of the Lawrenceville, Georgia multi-family property acquired three years ago.

The operations and sale of this property generated a 27% internal rate of return on our investment and reflects

favorably on our multi-family underwriting activities.”

Operating

Results:

Total

revenues for the three months ended March 31, 2015 were approximately $20.5 million, an increase of $5.3 million, or 34.9%, from

$15.2 million in the corresponding quarter in the prior year. The increase is due primarily to $4.4 million from the inclusion

of six multi-family properties acquired since April 2014 and $790,000 primarily due to improved rental rates from many of the

multi-family properties acquired before April 2014.

Total

expenses for the three months ended March 31, 2015 were $23.6 million, an increase of $4.6 million, or 24.2%, from $19.0 million

in the quarter ended March 31, 2014. Contributing to the change were increases of $1.9 million in real estate operating expenses,

$1.7 million in depreciation and amortization and $916,000 of interest expense, due primarily to the multi-family properties acquired

since April 2014.

Net

loss attributable to common shareholders for the three months ended March 31, 2015 was $748,000, or $0.05 per share, compared

to net loss of $2.6 million, or $0.18 per share, for the three months ended March 31, 2014. The decrease is due primarily to

our $1.7 million share, net of non-controlling interests, of the gain recognized from the February 2015 sale of the

Lawrenceville, Georgia multi-family property. Excluding depreciation, amortization and the Trust’s share of the gain

on the sale of this property, net income attributable to common shareholders was $2.7 million, or $0.19 per share, in the

current period, compared to $792,000, or $0.05 per share, in the corresponding period of the prior year.

Funds

from Operations; Adjusted Funds from Operations:

Funds

from Operations, or FFO, was $1.6 million, or $0.12 per fully diluted share, in the current quarter, compared to $(75,000), or

$0.00 per diluted share, in the second quarter of 2014. Adjusted Funds from Operations, or AFFO, was $2.1 million, or $0.16 per

diluted share, in the current quarter, compared to $353,000, or $0.04 per diluted share, in the second quarter of 2014. The increase

in FFO and AFFO is attributable primarily to multi-family properties acquired after March 31, 2014 and improved operations at

multi-family properties acquired before April 1, 2014.

A

reconciliation of net income to FFO and AFFO, presented in accordance with GAAP, is provided with the financial information included

later in this release.

Balance

Sheet:

At

March 31, 2015, the Trust had $18.0 million of cash and cash equivalents, assets of $760.1 million, debt of $553.9 million and

total BRT shareholders’ equity of $121.8 million.

At

April 30, 2015, the Trust has approximately $15.7 million of cash and cash equivalents.

As

further described in our Quarterly Report on Form 10-Q for the period ended March 31, 2015, the Newark Joint Venture may require

additional funds to complete the Teachers Village project.

Disposition

In

February 2015, the Trust sold a 170 unit multi-family property located in Lawrenceville, Georgia for $9.7 million, realizing a

net gain of $2.7 million. The Trust’s share of this gain, net of non-controlling interests, is $1.7 million.

Subsequent

Event:

On

April 9, 2015, the Trust entered into a contract to sell a 798 unit multi-family property in Houston, TX, for

$39.9 million, including the assumption of $24.1 million mortgage debt. The transaction is anticipated to close in the

quarter ending September 30, 2015, subject to the satisfaction of customary closing conditions, including the lender’s

consent to the buyer’s assumption of the mortgage. The Trust anticipates it will record a gain of approximately $5.3

million on the sale, and that its share of the gain, net of non-controlling interests, will be approximately $4.2

million.

Non-GAAP

Financial Measures:

In

view of BRT’s equity investments in joint ventures which have acquired multi- family properties, it discloses FFO and AFFO

because management believes that such metrics are a widely recognized and appropriate measure of the performance of an equity

REIT.

BRT

computes FFO in accordance with the “White Paper on Funds From Operations” issued by the National Association of Real

Estate Investment Trusts (“NAREIT”) and NAREIT’s related guidance. FFO is defined in the White Paper as net

income (computed in accordance with generally accepting accounting principles), excluding gains (or losses) from sales of property,

plus depreciation and amortization, plus impairment write-downs of depreciable real estate and after adjustments for unconsolidated

partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect

funds from operations on the same basis. In computing FFO, BRT does not add back to net income the amortization of costs in connection

with its financing activities or depreciation of non-real estate assets. Since the NAREIT White Paper only provides guidelines

for computing FFO, the computation of FFO may vary from one REIT to another. BRT computes AFFO by deducting from FFO, straight

line rent accruals and deferrals, adding back amortization of restricted stock compensation and amortization of costs in connection

with financing activities, and adjusting for non-controlling interests.

Management

believes that FFO and AFFO are useful and standard supplemental measures of the operating performance for equity REITs and are

used frequently by securities analysts, investors and other interested parties in evaluating equity REITs, many of which present

FFO and AFFO when reporting their operating results. FFO and AFFO are intended to exclude GAAP historical cost depreciation and

amortization of real estate assets, which assumes that the value of real estate assets diminish predictability over time. In fact,

real estate values have historically risen and fallen with market conditions. As a result, management believes that FFO and AFFO

provide a performance measure that when compared year over year, should reflect the impact to operations from trends in occupancy

rates, rental rates, operating costs, interest costs and other matters without the inclusion of depreciation and amortization,

providing a perspective that may not be necessarily apparent from net income. Management also considers FFO and AFFO to be useful

in evaluating potential property acquisitions.

FFO

and AFFO do not represent net income or cash flows from operations as defined by GAAP. FFO and AFFO should not be considered to

be an alternative to net income as a reliable measure of our operating performance; nor should FFO and AFFO be considered an alternative

to cash flows from operating, investing or financing activities (as defined by GAAP) as measures of liquidity.

FFO

and AFFO do not measure whether cash flow is sufficient to fund all of BRT’s cash needs, including principal amortization

and capital improvements. FFO and AFFO do not represent cash flows from operating, investing or financing activities as defined

by GAAP.

Management

recognizes that there are limitations in the use of FFO and AFFO. In evaluating BRT’s performance, management examines GAAP

measures such as net income and cash flows from operating, investing and financing activities. Management also reviews the reconciliation

of net income to FFO and AFFO.

Forward

Looking Statements:

Certain

information contained herein is forward looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding lending activities and other positive

business activities. BRT intends such forward looking statements to be covered by the safe harbor provisions for forward looking

statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying

with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe our future

plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “believe,”

“expect,” “intend,” “anticipate,” “estimate,” “project,” or similar

expressions or variations thereof. Forward looking statements, including our loan origination and property acquisition activities,

involve known and unknown risks, uncertainties and other factors, which, in some cases, are beyond BRT’s control and could

materially affect actual results, performance or achievements. Investors are cautioned not to place undue reliance on any forward-looking

statements and to carefully review the section entitled “Item 1A. Risk Factors” in BRT’s Annual Report on Form

10-K for the year ended September 30, 2014.

About

BRT Realty Trust:

BRT

is a real estate investment trust that participates as an equity investor in joint ventures which own and operate multi-family

properties, owns and operates and develops commercial, mixed use and other real estate assets. Additional financial and descriptive

information on BRT, its operations and its portfolio, is available at BRT’s website at: www.BRTRealty.com. Interested

parties are encouraged to review the Form 10-Q for the quarter ended March 31, 2015 to be filed with the Securities and Exchange

Commission for additional information.

Contact:

Investor Relations – (516) 466-3100

BRT REALTY

TRUST

60 Cutter

Mill Road

Suite 303

Great Neck,

New York 11021

Telephone

(516) 466-3100

Telecopier

(516) 466-3132

www.BRTRealty.com

BRT

REALTY TRUST AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars

in thousands, except per share data)

| | |

Three months ended | | |

Six months ended | |

| | |

March 31, | | |

March 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Revenues: | |

| | |

| | |

| | |

| |

| Rental and other revenues from real estate | |

$ | 20,186 | | |

$ | 14,877 | | |

$ | 39,667 | | |

$ | 28,684 | |

| Other income | |

| 286 | | |

| 280 | | |

| 582 | | |

| 551 | |

| Total revenues | |

| 20,472 | | |

| 15,157 | | |

| 40,249 | | |

| 29,235 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Real estate operating expenses | |

| 10,314 | | |

| 8,395 | | |

| 20,723 | | |

| 16,029 | |

| Interest expense | |

| 5,865 | | |

| 4,949 | | |

| 12,066 | | |

| 9,633 | |

| Advisor's fee, related party | |

| 605 | | |

| 414 | | |

| 1,189 | | |

| 776 | |

| Property acquisition costs | |

| - | | |

| 292 | | |

| 295 | | |

| 1,528 | |

| General and administrative expenses | |

| 1,736 | | |

| 1,596 | | |

| 3,393 | | |

| 3,170 | |

| Depreciation and amortization | |

| 5,115 | | |

| 3,384 | | |

| 9,273 | | |

| 6,574 | |

| Total expenses | |

| 23,635 | | |

| 19,030 | | |

| 46,939 | | |

| 37,710 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total revenues less total expenses | |

| (3,163 | ) | |

| (3,873 | ) | |

| (6,690 | ) | |

| (8,475 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gain on sale of real estate | |

| 2,777 | | |

| - | | |

| 2,777 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations | |

| (386 | ) | |

| (3,873 | ) | |

| (3,913 | ) | |

| (8,475 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Discontinued operations: | |

| | | |

| | | |

| | | |

| | |

| Income from operations | |

| - | | |

| 362 | | |

| - | | |

| 1,213 | |

| Net loss | |

| (386 | ) | |

| (3,511 | ) | |

| (3,913 | ) | |

| (7,262 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Plus: net (income) loss attributable to non-controlling interests | |

| (362 | ) | |

| 919 | | |

| 667 | | |

| 1,937 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to common shareholders | |

$ | (748 | ) | |

$ | (2,592 | ) | |

$ | (3,246 | ) | |

$ | (5,325 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted per share amounts attributable to common shareholders: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations | |

| (0.05 | ) | |

| (0.21 | ) | |

| (0.23 | ) | |

| (0.46 | ) |

| Discontinued operations | |

| - | | |

| 0.03 | | |

| - | | |

| 0.09 | |

| Basic and diluted (loss) income per share | |

$ | (0.05 | ) | |

$ | (0.18 | ) | |

$ | (0.23 | ) | |

$ | (0.37 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Funds from operations - Note 1 | |

$ | 1,645 | | |

$ | (75 | ) | |

$ | 2,260 | | |

$ | (447 | ) |

| Funds from operations per common share - diluted - Note 2 | |

$ | 0.12 | | |

$ | (0.00 | ) | |

$ | 0.16 | | |

$ | (0.03 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted funds from operations - Note 1 | |

$ | 2,107 | | |

$ | 353 | | |

$ | 3,313 | | |

$ | 345 | |

| Adjusted funds from operations per common share - diluted -Note 2 | |

$ | 0.16 | | |

$ | 0.04 | | |

$ | 0.24 | | |

$ | 0.02 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 14,086,761 | | |

| 14,294,022 | | |

| 14,165,826 | | |

| 14,227,734 | |

| Note 1: | |

| | |

| | |

| | |

| |

| Funds from operations is summarized in the following table: | |

| | |

| | |

| | |

| |

| Net (loss) attributable to common shareholders | |

$ | (748 | ) | |

$ | (2,592 | ) | |

$ | (3,246 | ) | |

$ | (5,325 | ) |

| Add: depreciation of properties | |

| 5,112 | | |

| 3,377 | | |

| 9,266 | | |

| 6,565 | |

| Add: our share of depreciation in unconsolidated joint ventures | |

| 5 | | |

| 5 | | |

| 10 | | |

| 10 | |

| Add: amortization of deferred leasing costs | |

| 28 | | |

| 16 | | |

| 31 | | |

| 31 | |

| Deduct: gain on sale of real estate assets | |

| (2,777 | ) | |

| - | | |

| (2,777 | ) | |

| - | |

| Adjustments for non-controlling interests - depreciation of properties | |

| (1,213 | ) | |

| (874 | ) | |

| (2,261 | ) | |

| (1,715 | ) |

| Adjustments for non-controlling interests - deferred leasing costs | |

| (12 | ) | |

| (7 | ) | |

| (13 | ) | |

| (13 | ) |

| Adjustments for non-controlling interests - gain on sale of real estate | |

| 1,250 | | |

| - | | |

| 1,250 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Funds from operations | |

$ | 1,645 | | |

$ | (75 | ) | |

$ | 2,260 | | |

$ | (447 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Adjust for straight line rents | |

| (101 | ) | |

| (133 | ) | |

| (201 | ) | |

| (268 | ) |

| Add: amortization of restricted stock compensation | |

| 239 | | |

| 214 | | |

| 445 | | |

| 394 | |

| Add: amortization of deferred financing costs | |

| 464 | | |

| 457 | | |

| 1,209 | | |

| 869 | |

| Adjustments for non-controlling interests - straight line rents | |

| 60 | | |

| 76 | | |

| 119 | | |

| 152 | |

| Adjustments for non-controlling interests - deferred financing costs | |

| (200 | ) | |

| (186 | ) | |

| (519 | ) | |

| (355 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted funds from operations | |

$ | 2,107 | | |

$ | 353 | | |

$ | 3,313 | | |

$ | 345 | |

| | |

| | | |

| | | |

| | | |

| | |

| Note 2: | |

| | | |

| | | |

| | | |

| | |

| Funds from operations per share is summarized in the following table: | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income attributable to common shareholders | |

$ | (0.05 | ) | |

$ | (0.18 | ) | |

$ | (0.23 | ) | |

$ | (0.37 | ) |

| Add: depreciation of properties | |

| 0.37 | | |

| 0.23 | | |

| 0.66 | | |

| 0.46 | |

| Add: our share of depreciation in unconsolidated joint ventures | |

| - | | |

| - | | |

| - | | |

| - | |

| Add: amortization of deferred leasing costs | |

| - | | |

| - | | |

| - | | |

| - | |

| Deduct: gain on sale of real estate asset | |

| (0.20 | ) | |

| - | | |

| (0.20 | ) | |

| - | |

| Adjustments for non-controlling interests - depreciation of properties | |

| (0.09 | ) | |

| (0.05 | ) | |

| (0.16 | ) | |

| (0.12 | ) |

| Adjustments for non-controlling interests - deferred leasing costs | |

| - | | |

| - | | |

| - | | |

| - | |

| Adjustment for non-controlling interest - gain on sale of real estate | |

| 0.09 | | |

| - | | |

| 0.09 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Funds from operations per common share basic and diluted | |

| 0.12 | | |

| 0.00 | | |

| 0.16 | | |

| (0.03 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Adjust for straight line rents | |

| (0.01 | ) | |

| (0.01 | ) | |

| (0.01 | ) | |

| (0.02 | ) |

| Add: amortization of restricted stock compensation | |

| 0.02 | | |

| 0.02 | | |

| 0.03 | | |

| 0.03 | |

| Add: amortization of deferred financing costs | |

| 0.04 | | |

| 0.03 | | |

| 0.09 | | |

| 0.06 | |

| Adjustments for non-controlling interests - straight line rents | |

| 0.01 | | |

| - | | |

| 0.01 | | |

| - | |

| Adjustments for non-controlling interests - deferred financing costs | |

| (0.02 | ) | |

| - | | |

| (0.04 | ) | |

| (0.02 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted funds from operations per common share basic and diluted | |

$ | 0.16 | | |

$ | 0.04 | | |

$ | 0.24 | | |

$ | 0.02 | |

5

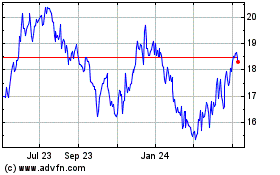

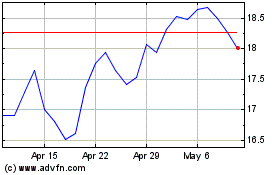

BRT Apartments (NYSE:BRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

BRT Apartments (NYSE:BRT)

Historical Stock Chart

From Apr 2023 to Apr 2024