Table of Contents

UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to

Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant

☑

Filed by a Party other

than the Registrant ☐

Check the appropriate box:

| ☐ |

|

Preliminary Proxy

Statement |

| ☐ |

|

Confidential, For Use of the

Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ |

|

Definitive Proxy

Statement |

| ☐ |

|

Definitive Additional

Materials |

| ☐ |

|

Soliciting Material Pursuant to §

240.14a-12 |

| Brown & Brown,

Inc. |

| (Name of Registrant as

Specified In Its Charter) |

| |

(Name of Person(s) Filing Proxy Statement, if Other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ |

|

No fee

required. |

| ☐ |

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and

0-11. |

| |

|

(1) |

Title of each class of securities

to which transaction applies: |

|

|

|

|

|

|

|

|

|

|

(2) |

Aggregate number of securities to

which transaction applies: |

|

|

|

|

|

|

|

|

|

|

(3) |

Per unit price or other

underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state

how it was determined): |

|

|

|

|

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value

of transaction: |

|

|

|

|

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

| ☐ |

|

Fee paid previously with preliminary

materials. |

| ☐ |

|

Check box if any part of the fee is offset

as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of

its filing. |

|

|

|

|

|

|

(1) |

Amount Previously

Paid: |

|

|

|

|

|

|

|

|

|

|

(2) |

Form, Schedule or

Registration Statement No.: |

|

|

|

|

|

|

|

|

|

|

(3) |

Filing

Party: |

|

|

|

|

|

|

|

|

|

|

(4) |

Date

Filed: |

|

|

|

|

Table of Contents

Table of Contents

MESSAGE FROM OUR PRESIDENT AND CEO AND OUR LEAD

DIRECTOR

“Fiscal 2016 was an exciting year for Brown & Brown, reflected

by strong financial and operational performance in the face of a tough insurance

market”

March 22, 2017

Dear Fellow Shareholders:

On behalf of Brown & Brown, Inc.’s

Board of Directors, we are pleased to invite you to attend our Annual Meeting of

Shareholders on Wednesday, May 3, 2017. The attached Notice of Annual Meeting of

Shareholders and Proxy Statement include important information about the matters

to be voted upon at the meeting.

The proxy materials for the Annual Meeting,

which include the Proxy Statement and 2016 Annual Report, are available online,

in order to expedite shareholders’ receipt of proxy materials while lowering the costs

and reducing the environmental impact of the meeting.

Fiscal 2016 was an exciting year for

Brown & Brown, reflected by strong financial and operational performance in

the face of a tough insurance market. As part of our ongoing mission to align

our compensation practices with the long-term interests of our shareholders, our

Compensation Committee made several meaningful changes to our executive pay

framework for 2016, including re-designing the structure of our long-term equity

incentive awards and changing one of the performance metrics for our short-term

cash incentives. We believe these improvements continue to motivate our

executive officers to deliver results that benefit our shareholders, and we are

proud of our performance for the year. In 2016, we increased our revenues, net

income, earnings per share, and grew our organic revenue in all four of our

divisions, all while maintaining strong EBITDAC margins.

In addition, our Board of Directors

remains focused on our strategy to conservatively manage our capital in the

long-term interests of our shareholders. In spite of increasing acquisition

prices, we maintained our disciplined approach to sourcing acquisitions that fit

culturally and make sense financially, acquiring eight high-quality insurance

businesses this year with annual revenues of approximately $56 million. In

addition, we made key investments in technology that we believe position us for

future growth, including implementing a new Company-wide financial system and

introducing a standardized agency management system for our Retail Division.

Finally, we increased our dividend for the 23rd consecutive year, returning

approximately $70 million in dividends to shareholders.

Whether or not you expect to attend the

meeting, we encourage you to vote online or by phone, or by signing and

returning your proxy card promptly in the enclosed envelope to assure that your

shares will be represented at the meeting. If you decide to attend the meeting

and vote in person, you will, of course, have that opportunity.

On behalf of our Board of Directors,

our management team, and our teammates, thank you for your investment in Brown

& Brown. We look forward to seeing you at the Annual

Meeting.

|

| Wendell S.

Reilly J. Powell

Brown |

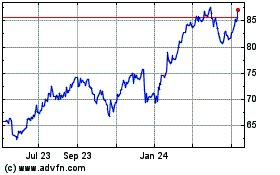

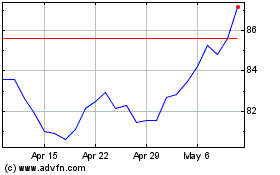

| 2016 Total Shareholder Return |

|

|

| |

|

|

| +45% |

|

|

| |

|

|

| Proxy Statement Highlights |

|

|

| Proxy Summary |

|

4 |

| Corporate Governance |

|

7 |

| Executive Compensation |

|

21 |

Sincerely,

|

|

| Wendell S. Reilly |

J. Powell Brown |

| Lead Independent Director |

President and Chief Executive

Officer |

Table of Contents

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS MAY 3, 2017

The Annual Meeting of Shareholders of

Brown & Brown, Inc. will be held in the Atlantic Room of The Shores Resort,

2637 South Atlantic Avenue, Daytona Beach, Florida 32118, on Wednesday, May 3,

2017 at 9:00 a.m. (EDT), for the following purposes:

| 1. |

To elect twelve (12) nominees to

the Company’s Board of Directors; |

| |

| 2. |

To ratify the appointment of

Deloitte & Touche LLP as Brown & Brown, Inc.’s independent

registered public accountants for the fiscal year ending December 31,

2017; |

| |

| 3. |

To approve, on an advisory basis,

the compensation of named executive officers; |

| |

| 4. |

To conduct an advisory vote on

the desired frequency of holding an advisory vote on the compensation of

named executive officers; |

| |

| 5. |

To approve an amendment to the

Company’s 2010 Stock Incentive Plan to increase the number of shares

available for issuance under the plan; and |

| |

| 6. |

To transact such other business

as may properly come before the meeting or any adjournment

thereof. |

The Board of Directors has fixed the close

of business on February 27, 2017 as the record date for the determination of

shareholders entitled to notice of and to vote at the meeting and any

postponements or adjournments.

|

By Order of the Board of

Directors |

|

| Robert W. Lloyd |

| Corporate

Secretary |

| |

| Daytona Beach, Florida |

| March 22,

2017 |

For your convenience, we are also offering

an audio webcast of the meeting. To access the webcast, please visit the

“Investor Relations” section of our website (www.bbinsurance.com) shortly before

the meeting time and follow the instructions provided. A replay of the webcast

will be available on our website beginning the afternoon of May 3, 2017, and

continuing for 30 days thereafter.

|

By Internet |

|

|

|

|

You can vote your shares online at

www.proxyvote.com. |

|

By Telephone |

|

|

|

|

In the U.S. or Canada, you can vote

your shares toll-free by calling 1-800-579-1639 |

|

By Mail |

|

|

|

|

Please vote, date, sign and promptly

return the enclosed proxy in the envelope provided for that purpose,

whether or not you intend to be present at the

meeting. |

Important Notice Regarding the Availability of Proxy

Materials for the Shareholder Meeting to be Held on May 3, 2017

The Proxy Statement and Annual Report to Shareholders

are available at: www.viewproxy.com/bbinsurance/2017

Table of Contents

TABLE OF CONTENTS

Table of Contents

PROXY SUMMARY

This summary highlights information

contained elsewhere in this Proxy Statement. This summary does not contain all

of the information you should consider. You should read the entire Proxy

Statement carefully before voting.

9:00 a.m. (EDT) on

Wednesday, May 3, 2017

The Shores Resort,

Atlantic Room, 2637 South Atlantic Avenue, Daytona Beach, Florida

32118

Monday, February 27, 2017

| Proposals |

|

Recommendation |

|

Page |

| Election of Directors |

|

FOR each nominee |

|

7 |

| Ratification of the Appointment of Deloitte & Touche

LLP |

|

FOR |

|

18 |

| Advisory Vote to Approve Executive Compensation |

|

FOR |

|

21 |

| Advisory Vote on Frequency of Advisory Votes on Executive

Compensation |

|

FOR “one year” |

|

37 |

| Approval of Amendment to the Company’s 2010 Stock

Incentive Plan to Increase Number of Shares Available for Issuance under

the Plan |

|

FOR |

|

44 |

|

|

|

|

|

|

|

|

|

Committees |

| Name

and Principal Employment |

|

Age |

|

Director

Since |

|

|

Independent |

|

Audit |

|

Compensation |

|

Nominating/

Corporate

Governance |

J. Hyatt Brown

Chairman, Brown & Brown, Inc. |

|

79 |

|

1993 |

|

|

|

|

|

|

|

|

|

Samuel P. Bell, III

Of Counsel to the law firm of Buchanan Ingersoll &

Rooney PC |

|

77 |

|

1993 |

|

|

✓ |

|

|

|

● |

|

|

Hugh M. Brown

Founder

and former President & Chief Executive Officer, BAMSI,

Inc. |

|

81 |

|

2004 |

|

|

✓ |

|

● |

|

|

|

● |

J. Powell Brown

President & Chief Executive Officer, Brown & Brown,

Inc. |

|

49 |

|

2007 |

|

|

|

|

|

|

|

|

|

Bradley Currey, Jr.

Former Chairman & Chief Executive Officer, Rock-Tenn

Company |

|

86 |

|

1995 |

|

|

✓ |

|

|

|

|

|

● |

Theodore J. Hoepner

Former Vice Chairman, SunTrust Bank Holding

Company |

|

75 |

|

1994 |

|

|

✓ |

|

● |

|

● |

|

|

James S. Hunt

Former Executive

Vice President and Chief Financial Officer, Walt Disney Parks and Resorts

Worldwide |

|

61 |

|

2013 |

|

|

✓ |

|

|

|

● |

|

|

Toni Jennings

Chairman, Jack

Jennings & Sons; Former Lieutenant Governor, State of

Florida |

|

67 |

|

2007 |

(1) |

|

✓ |

|

● |

|

|

|

|

Timothy R.M. Main

Chairman -

Global Financial Institutions Group, Barclays Plc |

|

51 |

|

2010 |

|

|

✓ |

|

|

|

|

|

|

H. Palmer Proctor, Jr.

President/Director, Fidelity Bank |

|

49 |

|

2012 |

|

|

✓ |

|

|

|

● |

|

|

Wendell S. Reilly**

Managing

Partner, Grapevine Partners, LLC |

|

59 |

|

2007 |

|

|

✓ |

|

|

|

|

|

|

Chilton D. Varner

Partner, King & Spalding LLP |

|

74 |

|

2004 |

|

|

✓ |

|

|

|

|

|

● |

| (1) |

Ms. Jennings previously served on our Board

of Directors from 1999 until April 2003. |

| ** |

Denotes Lead Independent

Director |

| ● |

= Committee Member |

|

= Committee

Chair |

Table of Contents

| Tenure Balance |

|

Gender |

|

Director Independence |

| |

|

|

|

|

|

|

|

|

|

| Corporate Governance

Highlights |

| Shareholder Rights |

|

● |

Annual election of directors |

|

|

● |

Majority voting for directors, with director resignation

policy |

| Board Independence |

|

● |

Strong role for Lead Independent

Director |

|

|

● |

10 of 12 directors are

independent |

|

|

● |

Periodic rotation of committee members,

committee chairs, and Lead Independent Director |

|

|

● |

Executive sessions at every in-person Board

meeting |

| Good Governance |

|

● |

Strong anti-hedging and anti-pledging

provisions |

|

|

● |

Annual Board and committee

self-evaluations |

|

|

● |

Strong stock ownership

guidelines |

|

|

● |

Robust clawback policy |

|

|

● |

Committee meetings generally open to, and attended by,

all directors |

Table of Contents

| Our Strategy and Performance |

The Company’s strategy is focused on

increasing our organic revenue growth,(1) while maintaining our strong,

industry-leading operating margins and cash conversion metrics. As part of our

goal to manage our capital in the long-term interests of our shareholders, we

generally invest our earnings in the following ways: (1) hiring new teammates

and expanding our capabilities, (2) returns to shareholders through the payment

of dividends and periodic share repurchases, and (3) making high quality

acquisitions.

In fiscal 2016, we delivered strong

results, as reflected in the following financial and operational

highlights:

|

|

2016 Performance |

|

2015 Performance |

| Revenues |

|

$1.767 billion |

|

$1.661 billion |

| Net income |

|

$257 million |

|

$243 million |

| Earnings per share |

|

$1.82 |

|

$1.70 |

| Company total commissions and fees

growth |

|

6.4% |

|

5.7% |

| Retail Division total

commissions and fees growth |

|

5.7% |

|

5.4% |

| National Programs Division

total commissions and fees growth |

|

4.5% |

|

7.8% |

| Wholesale Brokerage

Division total commissions and fees growth |

|

12.1% |

|

2.4% |

| Services Division Organic

total commissions and fees growth |

|

7.4% |

|

6.5% |

| Company Organic Revenue(1)

growth |

|

3.0% |

|

2.6% |

| Retail Division Organic

Revenue(1) growth |

|

1.9% |

|

1.4% |

| National Programs Division

Organic Revenue(1) growth |

|

4.2% |

|

1.8% |

| Wholesale Brokerage

Division Organic Revenue(1) growth |

|

4.3% |

|

5.9% |

| Services Division Organic

Revenue(1) growth |

|

3.8% |

|

6.8% |

| Income before income taxes

margin(2) |

|

24.0% |

|

24.2% |

| Adjusted EBITDAC Margin(1) |

|

32.7% |

|

33.3% |

| 23rd consecutive annual dividend increase,

returning approximately $70 million to shareholders through

dividends |

| Eight strategic agency acquisitions with aggregate

annual revenues of approximately $56 million |

| Technology improvements to support further

growth, including implementation of a new Company-wide financial system

and introduction of a standardized agency management system for our Retail

Division |

(1) See Annex A for additional

information regarding Organic Revenue, Organic Revenue growth and Adjusted

EBITDAC Margin, which are non-GAAP financial measures, including a

reconciliation to the most closely comparable GAAP financial measure.

(2) Income before income taxes margin is

calculated as the Company’s income before income taxes, as reported, divided by

total revenues, as reported.

Table of Contents

BOARD AND CORPORATE GOVERNANCE MATTERS

| Proposal

1 |

Election of

12 Directors |

|

At the Meeting, our 12 directors

will stand for re-election for a term expiring at the 2018 Annual Meeting

of Shareholders. Information about each nominee’s experience and

qualifications appears below.

✓The Board recommends a vote FOR each of the 12 Director

nominees. |

All nominees have consented to being named in the Proxy Statement and have agreed to serve if elected. If any director nominee becomes

unable or unwilling to serve, proxies will be voted for any substitute nominee(s) as the Board may nominate on the recommendation of the

Nominating/Corporate Governance Committee.

Vote Required; Majority Voting; Board Recommendation

Our Bylaws provide for a majority voting

standard for the election of our directors in uncontested elections. If the

director election were contested, the plurality standard would apply, which

means the nominees receiving the greatest numbers of votes would be elected to

serve as directors.

To be elected, a nominee must receive the affirmative vote of more than 50% of the

votes cast, either in person or by proxy, at the Meeting. If an incumbent director does not receive more than 50% of the

votes cast with respect to his or her election, he or she must promptly tender a conditional resignation following

certification of the vote. The Nominating/Corporate Governance Committee will then consider

the resignation and recommend to the Board whether to accept it, and the Board would be expected to act on the

recommendation within 90 days. Thereafter, the Board will promptly publicly disclose its decision concerning whether to

accept the director’s resignation offer (and, if applicable, the reasons for rejecting the offer). If the Board does

not accept the resignation, the director will continue to serve until the next annual meeting and until a successor has

been elected and qualified. If the Board accepts the resignation, then the Board may fill any resulting vacancy or may

decrease the size of the Board.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR” EACH OF THE 12 DIRECTOR NOMINEES

|

Table of Contents

| Board and Corporate

Governance Matters |

Director Nominees

Director Nominees and Qualifications

Set forth below is certain information

concerning our current directors, all of whom are director nominees. All

directors hold office for one-year terms or until their successors are elected

and qualified.

| J. Hyatt Brown |

|

Chairman

of the Board

Director since 1993

Committees served

None |

|

Skills and

Experience

Mr. Hyatt Brown was our Chief Executive Officer from

1993 to 2009 and our President from 1993 to December 2002, and served as

President and Chief Executive Officer of our predecessor corporation from

1961 to 1993. He was a member of the Florida House of Representatives from

1972 to 1980, and Speaker of the House from 1978 to 1980. Mr. Brown serves

on the Board of Directors of International Speedway Corporation, and

Verisk Analytics, Inc. (formerly Insurance Services Office), each a

publicly held company. Mr. Brown is a member of the Board of Trustees of

Stetson University, of which he is a past Chairman, and the Florida

Council of 100. Mr. Hyatt Brown’s son, J. Powell Brown, is employed by us

as President and Chief Executive Officer, and has served as a director

since October 2007.

Nominee

Attributes

Mr. Hyatt Brown’s extensive business and industry

experience, knowledge of our company, service on boards of other publicly

traded companies and proven leadership ability are just a few of the

attributes that make him uniquely qualified to serve on, and chair, our

Board. |

| |

|

|

| Samuel P. Bell, III |

|

Independent Director

Director since 1993

Committees served

Acquisition

Compensation |

|

Skills and

Experience

Mr. Bell has served as Of Counsel to the law firm of

Buchanan Ingersoll & Rooney PC since March 2015. From November 2013

until March 2015, he served as Of Counsel to the law firm of Pennington,

Moore, Wilkinson, Bell & Dunbar, P.A., and prior to that, had been a

shareholder of the firm since January 1998. Prior to that, he was a

shareholder and managing partner of Cobb Cole & Bell (now Cobb &

Cole, P.A.), and he served as Of Counsel to Cobb Cole & Bell until

August 2002. Mr. Bell was a member of the Florida House of Representatives

from 1974 to 1988. He is Chairman of the Advisory Board for the College of

Public Health at the University of South Florida, Member of the Florida

Public Health Institute, and a member of the Board of Directors of the

Florida Children’s Home Society.

Nominee

Attributes

Mr. Bell’s extensive legal experience and familiarity

with issues relating to Florida legislative and regulatory matters, along

with his contributions in the form of service as a current member of the

Compensation and Acquisition Committees and a past Chair of the

Compensation Committee, are among the factors that were considered with

respect to his nomination for re-election to the Board. |

| |

|

|

| Hugh M. Brown |

|

Independent Director

Director since 2004

Committees served

Acquisition

Audit

Nominating/Corporate

Governance |

|

Skills and

Experience

Mr. Brown, who is unrelated to Mr. Hyatt Brown and Mr. Powell Brown, founded BAMSI, Inc., a

full-service engineering and technical services company, in 1978 and served as its Chief Executive Officer

until his retirement in 1998. Mr. Brown currently serves as a member of the Advisory Board of Directors

of SunTrust Bank of Orlando and a member of the Board of Managers (BOM), Nemours Children’s

Hospital, Orlando, Florida.

Nominee

Attributes

Mr. Brown’s business experience, leadership abilities and proven value in leading the Audit Committee,

of which he is a past chair and a current member, and his service on the Nominating/Corporate

Governance Committee and Acquisition Committee are among the features considered in his

nomination for re-election to the Board. |

| |

|

|

Table of Contents

| Board and Corporate

Governance Matters |

| J. Powell Brown |

|

Director

and Chief Executive

Officer

Director since 2004

Committees served

None |

|

Skills and

Experience

Mr. Powell Brown was named Chief Executive Officer in

July 2009. He has been our President since January 2007 and was appointed

to be a director in October 2007. Prior to 2007, he served as one of our

Regional Executive Vice Presidents since 2002. Mr. Brown was previously

responsible for overseeing certain or all parts of all of our divisions

over the years, and worked in various capacities throughout the Company

since joining us in 1995. Mr. Brown has served on the Board of Directors

of WestRock Company (formerly RockTenn Company), a publicly held company,

since January 2010. He is the son of our Chairman, J. Hyatt Brown.

Nominee

Attributes

Mr. Powell Brown’s work in all divisions of our

Company, leadership experience at every level of our Company and current

position as President and Chief Executive Officer are among the qualities

considered in connection with his nomination for re-election to the Board.

|

| |

|

|

| Bradley Currey, Jr. |

|

Independent Director

Director since 1995

Committees served

Nominating/Corporate

Governance |

|

Skills and

Experience

Mr. Currey served as Chief Executive Officer of

RockTenn Company, a publicly held manufacturer of packaging and recycled

paperboard products, from 1989 to 1999 and as Chairman of the Board of

RockTenn Company from 1993 to 2000, when he retired. He also previously

served as President (1978-1995) and Chief Operating Officer (1978-1989) of

RockTenn Company. Mr. Currey previously served as a member of the Board of

Directors and Executive Committee of RockTenn Company, and is currently

Director Emeritus of Genuine Parts Company, a publicly traded company. Mr.

Currey is Trustee Emeritus and a past Chairman of the Board of Trustees of

Emory University. He is a Trustee Emeritus and past Chairman of the Board

of the Woodruff Arts Center and the Atlanta Symphony Orchestra, a division

of the Woodruff Arts Center in Atlanta, Georgia.

Nominee

Attributes

Mr. Currey’s business experience, proven leadership

abilities, financial accounting and management expertise, as well as

contributions in his years of service as Chairman of the

Nominating/Corporate Governance Committee, our former Lead Independent

Director, and a past member of our Audit Committee, were all considered in

connection with his nomination for re-election to the

Board. |

| |

|

|

|

Theodore J.

Hoepner |

|

Independent Director

Director since 1994

Committees served

Audit

Compensation |

|

Skills and

Experience

Mr. Hoepner served as Vice Chairman of SunTrust Bank,

Inc. from January 2000 to December 2004 and as Vice Chairman of SunTrust

Bank Holding Company from January 2005 until June 2005, when he retired.

From 1995 to 2000, Mr. Hoepner was Executive Vice President of SunTrust

Bank, Inc. and Chairman of the Board, President and Chief Executive

Officer of SunTrust Banks of Florida, Inc.

Nominee

Attributes

Mr. Hoepner’s years of experience in the banking

industry, including extensive experience in management, make him a

valuable addition to the Board. He previously chaired our Audit,

Compensation and Acquisition Committees and currently serves as a member

of the Audit Committee and the Compensation Committee. All of these

attributes were among the factors considered in connection with his

nomination for re-election to the Board. |

| |

|

|

Table of Contents

| Board and Corporate

Governance Matters |

| James S. Hunt |

|

Independent Director

Director since 2013

Committees served

Acquisition

Audit

(Chair)

Compensation |

|

Skills and

Experience

Mr. Hunt served as Executive Vice President and Chief

Financial Officer of Walt Disney Parks and Resorts Worldwide from 2003

until his retirement in 2012. During that period, he was a member of the

Boards of Directors of Disney’s Hong Kong International Theme Park Company

Limited, Shanghai International Theme Park Company Limited and Shanghai

International Associated Facilities Company, Limited, as well as Disney’s

Alameda Insurance and Buena Vista Insurance companies. Prior to that,

between 1992 and 2003 he held senior finance positions with Walt Disney

World Resort. Before that time, Mr. Hunt was a Partner with Ernst &

Young. Mr. Hunt is a member of the Boards of Trustees of Penn Mutual Life,

a mutual life insurance company, where he serves on the Investment and

Executive Committees and as Chair of the Audit Committee, and the

Children’s Hospital Los Angeles, where he chairs the Compensation

Committee and is a member of the Executive Committee, and he is a member

of the Board of Directors of The Nemours Foundation, where he serves as

Chairman of the Audit and Finance Committee. Mr. Hunt is a Certified

Public Accountant (CPA). Mr. Hunt chairs our Audit Committee and serves as

a member of our Compensation and Acquisition Committees.

Nominee

Attributes

Mr. Hunt’s 39 years of increasingly responsible

executive and senior executive finance, strategy and related operational

roles, financial expertise and significant international experience were

factors considered in connection with his nomination for re-election to

the Board. |

| |

|

|

| Toni Jennings |

|

Independent Director

Director since 2007

Committees served

Audit

Compensation

(Chair) |

|

Skills and

Experience

Ms. Jennings serves as Chairman of the Board of Jack

Jennings & Sons, Inc., a commercial construction firm based in

Orlando, Florida, and Jennings & Jennings, Inc., an architectural

millwork firm based in Orlando, Florida. Ms. Jennings previously served on

our Board of Directors from 1999 until April 2003. From 2003 through 2006,

Ms. Jennings served as Lieutenant Governor of the State of Florida. She

was the President of Jack Jennings & Sons, Inc. and Secretary and

Treasurer of Jennings & Jennings, Inc. from 1982 to 2003. Ms. Jennings

was a member of the Florida Senate from 1980 to 2000, and President of the

Florida Senate from 1996 to 2000. She served in the Florida House of

Representatives from 1976 to 1980. She is a member of the Board of

Directors of Next Era Energy, Inc., a publicly held company, Mid-America

Apartment Communities, Inc., a publicly traded real estate investment

trust (REIT), The Nemours Foundation, and the Foundation for Florida’s

Future.

Nominee

Attributes

Ms. Jennings’ experience as owner and operator of a

successful business, and her years of service in the legislative and

executive branches of the State of Florida are features considered in

concluding that she should continue to serve as a director of the Company.

Ms. Jennings chairs our Compensation Committee and serves on our Audit

Committee. |

| |

|

|

| Timothy R.M. Main |

|

Independent Director

Director since 2010

Committees served

Acquisition |

|

Skills and

Experience

Mr. Main has served as the Chairman of the Global

Financial Institutions Group at Barclays Plc since September 2016. From

October 2011 until September 2016, he was a Senior Managing Director of

Evercore Partners. Prior to joining Evercore, Mr. Main worked at JPMorgan

Chase, a global investment bank, for 23 years, most recently as a Managing

Director and Head of the Financial Institutions Group.

Nominee

Attributes

Mr. Main’s extensive experience with complex

financial transactions and acquisitions, as well as his broad knowledge of

the insurance industry acquired throughout his career, are key components

considered in nominating Mr. Main for re-election to the Board. Mr. Main

serves on our Acquisition Committee. |

| |

|

|

Table of Contents

| Board and Corporate

Governance Matters |

| H. Palmer Proctor, Jr. |

|

Independent Director

Director since 2012

Committees served

Acquisition

(Chair)

Compensation |

|

Skills and

Experience

Mr. Proctor is President and Director of Fidelity

Bank and its holding company, Fidelity Southern Corporation, a publicly

held company in Atlanta, Georgia. He currently serves on the bank’s Loan

& Discount Committee and serves on the Executive Committee for the

bank and the holding company. He also serves as a member of the Board of

Directors of Callanwolde Fine Arts Center. He is a member of the Advisory

Board of Allied Financial. Mr. Proctor serves as a director of the Georgia

Bankers Association.

Nominee

Attributes

Mr. Proctor’s business experience, leadership

abilities and management expertise were factors considered in connection

with his nomination for re-election to the Board. He chairs our

Acquisition Committee and serves on our Compensation Committee and is a

past member of the Audit Committee. |

| |

|

|

| Wendell S. Reilly |

|

Lead

Independent Director

Director since 2007

Committees served

Nominating/Corporate

Governance (Chair) |

|

Skills and

Experience

Mr. Reilly is the Chairman of Berman Capital Advisors

and Managing Partner of Grapevine Partners, LLC, of Atlanta, Georgia, a

private company. He is also a General Partner of Peachtree Equity Partners

II. Previously, he was Chairman and Chief Executive Officer of Grapevine

Communications, LLC, a group of local television stations. Earlier, he was

the Chief Financial Officer of The Lamar Corporation and Haas Publishing

Companies. Mr. Reilly currently serves on the Board of Directors of Lamar

Advertising Company, a publicly traded company. He is also on the Board of

Trustees of Emory University and The Carter Center. Mr. Reilly is a

graduate of Emory College and earned his MBA in Finance from Vanderbilt

University.

Nominee

Attributes

Mr. Reilly’s business background and experience,

including years of service with The Lamar Corporation, a publicly traded

company in which the families of the founders hold significant ownership

interests, enhance his ability to analyze and contribute valuable and

unique insights on matters including those relating to capital structure,

financing and acquisition structure.

Mr. Reilly’s contributions as a past

Chairman of our Acquisition Committee, current Chairman of our

Nominating/Corporate Governance Committee and his role as Lead Independent

Director were also taken into consideration in connection with his nomination for re-election to the Board.

|

| |

|

|

| Chilton D. Varner |

|

Independent Director

Director since 2004

Committees served

Nominating/Corporate

Governance |

|

Skills and

Experience

Ms. Varner has been a member of the law firm of King

& Spalding in Atlanta, Georgia since 1976 and a partner since 1983. A

graduate of Smith College, where she was named to membership in Phi Beta

Kappa, and Emory University School of Law, Ms. Varner was honored with

Emory University School of Law’s Distinguished Alumni Award in 1998. In

2001, the National Law Journal profiled Ms. Varner as one of the

nation’s top ten women litigators. With more than 30 years of courtroom

experience, she specializes in defending corporations in product

liability, commercial and other civil disputes. She was a Trustee of Emory

University from 1995 until 2014 and currently continues her services as a

Trustee Emeritus.

Nominee

Attributes

As a practicing attorney and partner of one of the

nation’s premier law firms, and a counselor to businesses, their directors

and management concerning risk and risk control, Ms. Varner brings a depth

of experience and a wealth of unique and valuable perspectives to our

Board. She serves on the Nominating/Corporate Governance Committee, which

she previously chaired, and previously chaired the Compensation Committee

and served as our Lead Independent Director.

|

| |

|

|

Table of Contents

| Board and Corporate

Governance Matters |

Director Independence

New York Stock Exchange (“NYSE”) listing

standards require directors to satisfy certain criteria to be deemed

“independent.” The Board applies these standards in determining whether any

director has a material relationship with the Company that would impair his or

her independence, as discussed below. As required by the NYSE listing standards,

the Board considers all material relevant facts and circumstances known to it in

making an independence determination, from the standpoints of both the director

and persons or organizations with which the director has an

affiliation.

The Board has considered the independence

of our nominees in light of these NYSE standards and has affirmatively

determined that the following 10 of the 12 director nominees have no material

relationship with us other than service as a director, and are therefore

independent: Samuel P. Bell, III; Hugh M. Brown; Bradley Currey, Jr.; Theodore

J. Hoepner; James S. Hunt; Toni Jennings; Timothy R.M. Main; H. Palmer Proctor,

Jr.; Wendell S. Reilly; and Chilton D. Varner. The following factors were

relevant to the Board’s determination of independence:

| ● |

The Board considered the

relationships described below in “Relationships and Transactions with

Affiliated Parties.”

|

| ● |

In each case, the Board considered

the fact that from time to time, in the ordinary course of business and on

usual commercial terms, we and our subsidiaries may provide services in

our capacities as insurance intermediaries to various directors of the

Company, and to entities in which various directors of the Company have

direct or indirect interests.

|

| ● |

In the case of Mr. Main, the Board

considered the fact that Mr. Main is the Chairman of Global Financial

Institutions Group at Barclays Plc. The Board considered that

(i) Mr.

Main’s ownership interest in Barclays does not exceed ten percent, and he

is not an executive officer of Barclays; (ii) there are no existing projects or

transactions between Barclays’ investment banking division (i.e., the

division in which Mr. Main holds his position) and the Company;

(iii) in his

role at Barclays, Mr. Main (a) is not permitted to cover the insurance

brokerage sector, (b) is required to recuse himself from any conversations

with clients or Barclays employees regarding the insurance business

sector, (c) is prohibited from appearing as the coverage person for the

Company on any Barclays books, records, or systems, and may not supervise

any activity in relation to the Company or the insurance brokerage sector

generally, (d) is prohibited from selling the Company’s common stock while

it is on Barclays’ “watch” or “restricted” list, except in accordance with

Barclays’ personal investment policy; and (iv) during 2015 and 2016, the

interest amounts the Company paid to Barclays in connection with the

Company’s borrowings from Barclays were less than one percent of the

Company’s annual revenue, and less than one percent of Barclays’s annual

revenue.

|

| ● |

In the case of Messrs. Currey and

Hoepner, the Board considered the fact that these two directors are

investors in a bank holding company in which Messrs. Hyatt Brown and

Powell Brown also are investors, in which a checking account with a

balance of approximately $3 million was maintained by the Company in 2016

and for which a subsidiary of the Company provides insurance

services and concluded that the investment, which in the aggregate comprised

less than five percent of the outstanding stock of the bank holding

company, was not material. |

Director Nominee Selection Process

The Nominating/Corporate Governance

Committee is responsible for identifying and evaluating director nominees and

for recommending to the Board a slate of nominees for election at each Annual

Meeting of Shareholders. The Committee has not established “minimum

qualifications” for director nominees because it believes that rigid “minimum

qualifications” might preclude the consideration of otherwise desirable

candidates for election to the Board. The Committee evaluates director

candidates based on a number of factors, including: (a) the need or desirability

of maintaining or expanding the size of the Board; (b) independence; (c)

credentials, including, without limitation, business experience, experience

within the insurance industry, educational background, professional training,

designations and certifications; (d) interest in, and willingness to serve on,

the Board; (e) ability to contribute by way of participation as a member of

Board committees; (f) financial expertise and sophistication; (g) basic

understanding of the Company’s principal operational and financial objectives,

plans and strategies, results of operations and financial condition, and

relative standing in relation to the Company’s competitors; and (h) willingness

to commit requisite time and attention to Board service, including preparation

for and attendance at regular quarterly meetings, special meetings, committee

meetings and periodic Board “retreats” and director education programs. With respect to diversity, while no formal policy has

been proposed or adopted, heterogeneity of points of view, background,

experience, credentials, gender and ethnicity are considered desirable, and

characterize the current composition of our Board.

The Committee and the Board consider a

variety of sources when identifying individuals as potential Board members,

including other enterprises with which current Board members are or have

previously been involved and through which they have become acquainted with

qualified candidates. The Company does not pay any third party a fee to assist

in the identification or evaluation of candidates.

The Committee will consider director

nominations that are submitted in writing by shareholders in accordance with our

procedures for shareholder proposals. See “Proposals of Shareholders” below.

Such proposals must contain all information with respect to a proposed candidate

as required by the SEC’s proxy rules, must address the manner in which the

proposed candidate meets the criteria described above, and must be accompanied

by the consent of such proposed candidate to serve as a director, if

elected.

Table of Contents

| Board and Corporate

Governance Matters |

The Board’s Role and

Responsibilities

Overview

The role of the Board of Directors is to

oversee the affairs of the Company for the benefit of our shareholders and other

constituencies, including our employees, customers, suppliers, and the

communities in which we do business. The Board strives to ensure the success and continuity of the Company’s business through

the selection of qualified management and through ongoing monitoring designed to

assure the Company’s activities are conducted in a legal, responsible and

ethical manner.

Risk Oversight

The Board and its committees actively

oversee management of the Company’s risks. They receive regular reports from

senior management on areas of material risk to the Company, including

operational, financial, strategic, technological, competitive, reputational,

legal and regulatory risks.

The Board believes that risk oversight is

a responsibility of the entire Board, and it does not look to any individual

director or committee to lead it in discharging this responsibility. However,

our Board committees have specific oversight responsibilities relating to

certain aspects of risk management:

|

|

|

|

|

|

|

|

|

|

|

| |

Our Audit Committee regularly

reviews our financial statements, and our financial and other internal

controls, and regularly receives reports from management, including the

Company’s Chief Information Officer,on the Company’s cybersecurity risks.

Additionally, our independent registered public accountants regularly

identify and discuss with the Committee risks and related mitigation

measures that may arise during their regular reviews of the Company’s

financial statements, audit work and executive compensation policies and

practices, as applicable. |

|

|

|

Our Compensation

Committee

regularly reviews our executive

compensation policies and practices, and employee benefits, and the risks

associated with each. We believe that our compensation policies and

principles in conjunction with our internal oversight of those policies

and principles reduce the possibility of imprudent risk-taking. We do not

believe that our compensation policies and principles are reasonably

likely to have a material adverse effect on the Company. |

|

|

|

Our Nominating/Corporate

Governance Committee considers issues

associated with the independence of our Board, corporate governance and

potential conflicts of interest. |

|

|

|

|

|

|

|

|

|

|

|

|

While each committee is responsible for evaluating certain risks and

overseeing the management of such risks, the entire Board of Directors is

regularly informed through attendance at committee meetings or through committee

reports about such risks.

We believe that the Board’s approach to

risk oversight, as described above, helps assess various risks, make informed

decisions, and evaluate emerging risks in a proactive manner for the Company.

Further, our Financial Operations Review

Team is responsible for the performance of the internal audit function and for

monitoring compliance with policies and procedures relating to our financial

control environment, and was previously responsible for monitoring our data

security and selected general information technology controls. In early 2017, we

formed a dedicated Information Technology Review Team with responsibility for

monitoring our data security and information technology controls. Our Insurance

Operations Review Team is responsible for the monitoring of our operational

internal controls. Our Team Resources Review Team monitors compliance with

internal guidelines and state and federal employment law requirements relating

to compensation and human resources, regularly

assess risks and potential risks associated with our operations. These

departments support the integration of our acquisitions and report to our Audit

Committee on a quarterly basis, unless more frequent reports are

necessary.

Our General Counsel is primarily

responsible for enterprise risk management for the Company. On a quarterly

basis, our General Counsel presents an enterprise risk management analysis to

our Board of Directors, which includes an assessment of overall risk, risk

mitigation and elimination priorities, anonymous ethics hotline reports and

claims liabilities. Also, our Chief Executive Officer and General Counsel

annually deliver a detailed presentation to our Board of Directors about risks

associated with our business. This presentation includes extensive discussion,

analysis and categorization of risks with respect to likelihood of occurrence,

severity and frequency, as well as consideration of mitigating factors that

contribute to lessening the potential adverse consequences associated with such

risks (which can never, in any business, be fully eliminated). This presentation

is prepared with input from the Company’s executive officers, including our

division leaders and our Chief Information Officer.

Table of Contents

| Board and Corporate Governance

Matters |

Talent Management and Succession Planning

The Chairman of the Board, as well as our

Chief Executive Officer, routinely discuss with the Board, generally in

executive sessions, the Company’s management development and succession

activities.

Communication with Directors

Interested parties, including

shareholders, may communicate with our Board of Directors, with specified

members or committees of our Board, with non-management directors as a group or

with the Lead Independent Director, Wendell S. Reilly, by sending correspondence

to our Corporate Secretary at 220 S. Ridgewood Ave., Daytona Beach, Florida 32114, and specifying in such correspondence

that the message is for our Board or for one or more of its members or

committees. Communications will be relayed to directors no later than the next

regularly scheduled quarterly meeting of the Board and Board

Committees.

Corporate Governance Principles; Code of Business Conduct and

Ethics; Code of Ethics for Chief Executive Officer and Senior Financial

Officers

The Board of Directors has adopted

Corporate Governance Principles, a Code of Business Conduct and Ethics, and a

Code of Ethics for Chief Executive Officer and Senior Financial Officers, the

full text of each of which can be found in the “Corporate Governance” section, under “Key Documents” on our website

(www.bbinsurance.com), and each of which is available in print to any

shareholder who requests a copy by writing our Corporate Secretary at 220 S.

Ridgewood Ave., Daytona Beach, Florida 32114.

Related Party Transactions Policy

Under our Related Party Transactions

Policy, our General Counsel (or our Chief Executive Officer if the related party

is our General Counsel or an immediate family member of our General Counsel)

will review any potential Related Party Transaction to determine if it is

subject to the Policy. If so, the transaction will be referred to the

Nominating/Corporate Governance Committee for approval or ratification. If,

however, the General Counsel determines that it is not practical to wait until

the next meeting of the Nominating/Corporate Governance Committee, the Chair of

the Nominating/Corporate Governance Committee shall have the authority to act on

behalf of the Nominating/Corporate Governance Committee on whether to approve or

ratify a Related Party Transaction (unless the Chair of the Nominating/Corporate

Governance Committee is a Related Party in the Related Party Transaction). In

determining whether to approve or ratify a Related Party Transaction, the

Nominating/Corporate Governance Committee (or, as applicable, the Chair of the

Nominating/Corporate Governance Committee) will consider, among other things,

the benefits of the transaction to the Company, the potential effect of entering

into the transaction on a director’s independence, the availability of other sources for the products or

services, the terms of the transaction and the terms available to unrelated

third parties generally. The Nominating/Corporate Governance Committee has

authority to administer the Policy and to amend it as appropriate from time to

time.

For purposes of our Policy, “Related Party

Transactions” are transactions in which the Company is a participant, the amount

involved exceeds $120,000 when all such transactions are aggregated with respect

to an individual, and a “related party” had, has or will have a direct or

indirect material interest. “Related parties” are our directors (including any

nominees for election as directors), our executive officers, any shareholder who

beneficially owns more than five percent (5%) of our outstanding common stock,

and any firm, corporation, charitable organization or other entity in which any

of the persons listed above is an officer, general partner or principal or in a

similar position or in which the person has a beneficial ownership interest of

ten percent (10%) or more.

Relationships and Transactions with Affiliated

Parties

J. Hyatt Brown, who is one of our

directors and the father of J. Powell Brown, received compensation of $212,351,

consisting of $180,000 for services rendered to the Company in 2016, including

assistance with acquisitions and recruitment, $6,480 in matching contributions

made by the Company to his 401(k) Plan account, $24,076 for reimbursement of

amounts earned by the Company for personal lines insurance he purchased through

the Company or its subsidiaries, and $1,795 for the cost of certain club

membership dues. Mr. Hyatt Brown serves as Chairman of the Board of the

Company.

P. Barrett Brown, who is the son of Mr.

Hyatt Brown and the brother of Mr. Powell Brown, serves as Senior Vice President

of the Company and as a Regional President of the Company’s Retail Division. He

received compensation of $925,800, including relocation expenses totaling

$15,200, for services rendered in 2016, as well as grants under our SIP in March

2016 and February 2017 with values of $599,975 and $299,979, respectively. In

connection with his promotion and relocation in 2014, Mr. Barrett Brown received

a loan of $500,000 from the Company in November 2014, which is

subject

Table of Contents

| Board and Corporate Governance

Matters |

to the terms of a Promissory Note

providing that the principal and interest amounts of such loan are forgivable in

increments of one-seventh each year, so long as Mr. Barrett Brown remains

employed by the Company and/or its affiliates. Mr. Barrett Brown is not an

executive officer of the Company.

Carrie Brown, who is married to P. Barrett

Brown, was employed by us as Corporate Counsel until February 2016. Effective

February 1, 2016, Ms. Brown entered into a Consulting Agreement (the “Consulting

Agreement”) with us to provide legal services to us as an independent contractor

for a term of one year. Ms. Brown received payments of $154,813 for services

rendered in 2016, which included $37,949 for her service as an employee of the

Company during 2016 and $116,864 pursuant to the Consulting

Agreement.

Zambezi, LLC (“Zambezi”), a Florida

limited liability company whose Members and Managers are J. Hyatt Brown and his

wife, Cici Brown, owns a Cessna Citation Sovereign aircraft (the “Aircraft”),

which the Company leases pursuant to an Aircraft Dry Lease Agreement (the

“Agreement”) with Zambezi. In 2016, the Company paid Zambezi $138,215 under the

Agreement to lease the Aircraft. Pursuant to the Agreement, subject to

availability of the Aircraft and other specified conditions, Mr. Hyatt Brown has

the right to use the Aircraft for personal use subject to reimbursement paid to

the Company at the maximum rate permitted by law. Mr. Hyatt Brown paid

$104,730.75 to the Company for such personal use of the Aircraft in 2016. The

Company and Zambezi also are party to an Airside Sub-Lease Agreement and

Services Agreement, pursuant to which Zambezi leases hangar space from the

Company and pursuant to which pilots and mechanics employed by the Company are

available to pilot and service the Aircraft as provided therein. In 2016,

Zambezi paid the Company $19,170 for the lease of hangar space for the Aircraft,

and $20,412.45 for the services of pilots and

mechanics employed by the Company and for parts, equipment, and supplies related

to the Aircraft’s maintenance and operation.

Richard A. Freebourn, Jr., who is the son

of Richard A. Freebourn, Sr., is employed by us as an insurance sales executive

(i.e., a “producer”) in the Lisle, Illinois office of Brown & Brown of

Illinois, Inc., one of our Retail Division subsidiaries, and received

compensation of $284,998 for services rendered in 2016, as well as grants under

our 2010 Stock Incentive Plan (the “SIP”) in March 2016 and February 2017 with

values of $49,977 and $49,968, respectively.

Chris L. Walker was a shareholder and

employee of Arrowhead General Insurance Agency Superholding Corporation

(“Arrowhead”) prior to the Company’s acquisition of Arrowhead in 2012. In

connection with the acquisition, certain shareholder employees of Arrowhead at

the time of the acquisition (the “Earn-Out Equityholders”), including Mr.

Walker, were eligible to receive contingent earn-out payments of $5 million on a

pro rata basis, in accordance with their respective ownership interests. This

represented a “holdback” from the purchase price amount otherwise payable to the

Earn-Out Equityholders based upon their respective ownership interests in

Arrowhead, rather than an additional amount over and above the purchase price

payments to which the shareholders were entitled based on their ownership

interests. In February 2015, the Company made an earn-out payment of $2.5

million to the Earn-Out Equityholders, of which amount Mr. Walker received

$1,181,152. Following the resolution of an indemnification claim the Company

asserted in connection with the Arrowhead acquisition, in August 2016, the

Company made the remaining $2.5 million earn-out payment to the Earn-Out Equity

Holders, of which amount Mr. Walker received $1,181,152. Mr. Walker presently

serves as an Executive Vice President of the Company and the President of the

National Programs Division.

| Board Structure and

Process |

Board Leadership

Our Board has the flexibility to determine

whether the roles of Chairman of the Board and Chief Executive Officer should be

separated or combined. The Board makes this decision based on its evaluation of

the circumstances and the specific needs of the Company. Mr. Hyatt Brown, who

retired from the position of Chief Executive Officer in 2009, continues to serve

as Chairman of the Board, while Mr. Powell Brown serves as Chief Executive

Officer.

We believe that our leadership structure is desirable because it allows

Mr. Powell Brown to focus his efforts on running our business and managing the

Company in the best interests of our shareholders, while we continue to realize the benefits

of Mr. Hyatt Brown’s extensive business and industry experience, knowledge of

our company, current and past service on boards of other publicly traded

companies and proven leadership ability.

The Board conducts executive sessions of

non-management directors in connection with each regularly scheduled meeting of

the Board. Our Lead Independent Director, Wendell S. Reilly, presides over these

executive sessions.

Table of Contents

| Board and Corporate Governance

Matters |

Board and Board Committee

Matters

Our Board of Directors has an Audit Committee,

Compensation Committee, and Nominating/Corporate Governance Committee. The charters of each of these Board committees are

available in the “Corporate Governance” section, under “Key Documents” on our website

(www.bbinsurance.com) and are also available in print to any shareholder who requests a copy from the Corporate Secretary at

220 S. Ridgewood Ave., Daytona Beach, Florida 32114. Our committee meetings are generally attended by all Board members,

subject to the availability of each director, which we believe enables our Board to function in a more collaborative,

transparent, and effective manner, and which we believe promotes collegiality among the Board.

| Audit Committee |

The Audit

Committee is composed of independent directors as defined in the NYSE

listing standards and includes at least one audit committee financial

expert, James S. Hunt, among its members. The duties of the Audit

Committee are to recommend to the Board of Directors the selection of

independent registered public accountants, to meet with our independent

registered public accountants to review and discuss the scope and results

of the annual audit, and to consider various accounting and auditing

matters related to the Company, including our system of internal controls

and financial management practices. |

|

Members

James S. Hunt

(Chair)

Hugh M. Brown

Theodore J. Hoepner

Toni

Jennings

Six Meetings Held in

2016 |

Compensation

Committee |

Each member of the Compensation

Committee is independent as defined in the NYSE listing standards. The

Compensation Committee sets the compensation for our Chief Executive

Officer, and reviews and approves the compensation for our other

executive officers, including the Named Executive Officers. See “Executive

Compensation - Compensation Committee Report” and “Compensation Discussion

and Analysis.” The Compensation Committee also reviews and makes

recommendations with respect to our existing and proposed compensation

plans, and is responsible for administering our 1990 Employee Stock

Purchase Plan, our Performance Stock Plan (“PSP”), which was suspended in

April 2010, our ISO Plan, which expired December 31, 2008, and our 2010

Stock Incentive Plan. The Compensation Committee is authorized by its

charter to form and delegate authority to subcommittees when

appropriate. |

|

Members

Toni

Jennings (Chair),

Samuel P. Bell, III

Theodore J. Hoepner

James

S. Hunt

H. Palmer Proctor, Jr.

Nine Meetings Held in

2016 |

Nominating/Corporate

Governance

Committee |

Each member of the

Nominating/Corporate Governance Committee is independent as defined in the

NYSE listing standards. This Committee’s duties include responsibilities

associated with corporate governance, as well as the nomination of persons

to stand for election to the Board at our Annual Meeting of Shareholders

and recommendation of nominees to the Board of Directors to fill vacancies

on, or as additions to, the Board. |

|

Members

Wendell S. Reilly (Chair)

Hugh M.

Brown

Bradley Currey, Jr.

Chilton D. Varner

Six Meetings Held in

2016 |

Director Tenure and Board

Refreshment

The Nominating/Corporate Governance

Committee regularly considers the composition of the Board. However, we have not

established a mandatory retirement age or other term limits because we believe

longer-tenured directors can bring important experience and institutional

knowledge that are critical to the success of our Board and the long-term

interests of our shareholders. Consideration is given to rotating committee

members, committee chairs, and the Lead Independent Director position every

three to five years because we believe fresh perspectives facilitate enhanced Board and committee performance. Our

Nominating/Corporate Governance Committee evaluates the performance of each

incumbent director at least annually before recommending his or her nomination

for an additional term. In addition, any director who has a job change must

submit a letter of resignation resigning from the Board. The submission of a

letter of resignation provides an opportunity for the Board to review the

continued appropriateness of the director’s membership on the Board under the

circumstances.

Table of Contents

| Board and Corporate Governance

Matters |

Board

Evaluations

The Nominating/Corporate Governance

Committee conducts an annual evaluation of the Board and its committees, as well

as the individual performance of each director. As part of this process, all

directors complete detailed confidential questionnaires to provide feedback on

the effectiveness of the Board, the committees and the performance of individual

directors. The results of the questionnaires are compiled anonymously by the

Chair of the Nominating/Corporate Governance Committee in the form

of summaries, and the feedback is reviewed and discussed by the Nominating/Corporate Governance Committee and subsequently reported to the full Board. We

believe these assessments allow us to continually improve the effectiveness of

our Board and committee meetings throughout the year.

During 2016, our Board of Directors held

eight meetings. Each incumbent director serving during 2016 attended 100% of the

total number of Board meetings, and 100% of the total number of meetings of

committees of which such director is a member. The Board expects, but does not

require, directors, all of whom are director nominees, to attend the Annual

Meeting of Shareholders. All members of the Board attended the 2016 Annual

Meeting of Shareholders.

| |

|

Director

Attendance |

|

|

|

100% |

| |

|

at

all Board meetings, committee meetings, and the 2016 Annual Meeting of

Shareholders |

During 2016, non-employee directors were paid an annual retainer of $80,000, payable

in quarterly installments. We also pay an additional $1,500 for each meeting attended by such director in excess of 12. In

addition, the Chair of the Audit Committee is paid a $5,000 retainer, and the Chairs of the Compensation, Nominating/Corporate Governance and Acquisition Committees each receive $3,000 retainers, for services associated with those

positions. Also, each director who is not an employee of ours received in January 2016 a grant of $50,000 worth of shares of

our common stock under our SIP, valued as of the close of business on the last business day before the regular January

meeting of the Compensation Committee. All directors receive reimbursement of reasonable

out-of-pocket expenses incurred in connection with meetings of the Board. No director who is an employee receives separate

compensation for services rendered as a director.

The following table sets forth cash and

other compensation earned during 2016 by directors who are not Named Executive

Officers.

2016 Director Compensation

| Name |

|

Fees Earned or

Paid in

Cash

($) |

|

Stock

Awards

($) |

|

All Other

Compensation

($) |

|

|

Total

($) |

| Samuel P. Bell, III |

|

80,000 |

|

49,973 |

|

– |

|

|

129,973 |

| Hugh M. Brown |

|

80,000 |

|

49,973 |

|

– |

|

|

129,973 |

| J. Hyatt Brown |

|

– |

|

– |

|

212,351 |

(1) |

|

212,351 |

| Bradley Currey, Jr. |

|

80,000 |

|

49,973 |

|

– |

|

|

129,973 |

| Theodore J. Hoepner |

|

80,000 |

|

49,973 |

|

– |

|

|

129,973 |

| James S. Hunt |

|

85,000 |

|

49,973 |

|

– |

|

|

135,973 |

| Toni Jennings |

|

83,000 |

|

49,973 |

|

– |

|

|

132,973 |

| Timothy R.M. Main |

|

80,000 |

|

49,973 |

|

– |

|

|

129,973 |

| H. Palmer Proctor, Jr. |

|

83,000 |

|

49,973 |

|

– |

|

|

132,973 |

| Wendell S. Reilly |

|

83,000 |

|

49,973 |

|

– |

|

|

132,973 |

| Chilton D. Varner |

|

80,000 |

|

49,973 |

|

– |

|

|

129,973 |

| (1) |

See “Relationships and

Transactions with Affiliated Parties” for information on additional

payments to Mr. Hyatt Brown. |

Table of Contents

AUDIT

MATTERS

| Proposal

2 |

Ratification

of the Appointment of Deloitte & Touche LLP as the Company’s

Independent Registered Public Accountants |

|

The Audit Committee of the Board of

Directors has selected Deloitte & Touche LLP as the Company’s

independent registered public accounting firm for the fiscal year ending

December 31, 2017. Deloitte & Touche LLP has served as our independent

registered public accounting firm since the fiscal year ended December 31,

2002.

✓The Board recommends a vote

FOR the ratification of Deloitte &

Touche LLP for 2017 |

The Committee and the Board are requesting

that shareholders ratify this appointment as a means of soliciting shareholders’

opinions and as a matter of good corporate governance. If the shareholders do

not ratify the selection, the appointment of the independent registered public

accountants will be reconsidered by the Committee. Even if the selection is

ratified, the Committee, in its discretion, may direct the appointment of a

different independent registered public

accounting firm at any time during the year if it determines that such change

would be in the best interests of the Company and its shareholders.

One or more representatives of Deloitte

& Touche LLP are expected to be present at the Meeting, will have the

opportunity to make a statement and will be available to respond to appropriate

questions from shareholders.

Vote Required;

Board Recommendation

In order to be ratified, this Proposal 2

must receive the affirmative vote of a majority of the votes cast on the

Proposal. The Board of Directors believes that the ratification of Proposal 2 is

in the best interests of the Company and its shareholders.

| THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THIS PROPOSAL. |

Table of Contents

Report of the Audit Committee

The Audit Committee of the Board of

Directors operates pursuant to an Audit Committee Charter, which was most

recently reviewed by the Committee in January 2017. The Charter is posted on the

Company’s website (www.bbinsurance.com) in the “Corporate Governance” section,

under “Key Documents.”

Each member of the Audit Committee qualifies as

“independent” (as that term is defined in the NYSE listing standards, as well as

other statutory, regulatory and other requirements applicable to the Company’s

Audit Committee members).

With respect to the fiscal year ended

December 31, 2016, the Audit Committee:

| |

(1) |

|

has reviewed and

discussed the Company’s audited financial statements with management and

the independent registered public accountants; |

|

(2) |

|

has discussed with the

independent registered public accountants of the Company the matters

required to be discussed by the standards of the Public Company Accounting

Oversight Board, including those described in Auditing Standard No.

16, Communications with Audit

Committees; |

|

(3) |

|

has received and

reviewed the written disclosures and the letter from the independent

registered public accountants required by the applicable requirements of

the Public Company Accounting Oversight Board (United States) regarding

the independent registered public accountants’ communications with the

Audit Committee concerning independence, and has discussed with the

independent registered public accountants the independent registered

public accountants’ independence; and |

|

(4) |

|

based on the review

and discussions with management and the independent registered public

accountants referenced above, recommended to the Board of Directors that

the audited financial statements be included in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2016, for

filing with the Securities and Exchange

Commission. |

It is not the duty or responsibility of

the Audit Committee to conduct auditing or accounting reviews or procedures. In

performing its oversight responsibility, members of the Audit Committee rely

without independent verification on the information provided to them and on the

representations made by management and the independent registered public

accountants. Accordingly, the Audit Committee’s considerations and discussions

do not assure that the audit of the Company’s financial statements has been

carried out in accordance with the standards of the Public Company Accounting

Oversight Board (United States) or that the financial statements are presented

in accordance with generally accepted accounting principles in the United States

of America (“GAAP”).

AUDIT COMMITTEE

James S. Hunt (Chair)

Hugh M.

Brown

Theodore J. Hoepner

Toni Jennings

Table of Contents

INFORMATION CONCERNING INDEPENDENT REGISTERED PUBLIC

ACCOUNTANTS

Fees Paid to Deloitte & Touche

LLP

We incurred the following fees for

services performed by Deloitte & Touche LLP for fiscal years 2016 and

2015:

|

|

2015 |

|

|

2016 |

|

| Audit

Fees:(1) |

|

$1,465,595 |

|

|

$1,647,468 |

|

| Audit-Related

Fees:(2) |

|

$0 |

|

|

$3,501 |

(3) |

| Tax

Fees:(4) |

|

$0 |

|

|

$0 |

|

| All Other

Fees:(5) |

|

$0 |

|

|

$0 |

|

| Total: |

|

$1,465,595 |

|

|

$1,650,969 |

|

| (1) |

Audit Fees were the aggregate

fees billed to us by Deloitte & Touche LLP for professional audit

services rendered for the audit of our annual financial statements, the

review of financial statements included in our Forms 10-Q and the audit of

our internal control over financial reporting for the fiscal years ended

December 31, 2016 and 2015, including any out-of-pocket

expense. |

| (2) |

Audit-Related Fees were the fees

billed to us by Deloitte & Touche LLP for assurance and related

services reasonably related to the performance of the audit or review of

our financial statements that are not reported above under the caption

“Audit Fees” for the fiscal years ended December 31, 2015 or

2016. |

| (3) |

These fees were billed primarily

in connection with the sale of the Company’s Colonial Claims