Current Report Filing (8-k)

July 08 2016 - 4:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 1, 2016

Brown & Brown, Inc.

(Exact Name of Registrant Specified in Charter)

Florida

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

001-13619

(Commission File Number)

|

59-0864469

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

220 South Ridgewood Avenue, Daytona Beach, FL

(Address of principal executive offices)

|

32114

(Zip Code)

|

|

Registrant’s telephone number, including area code

(386) 252-9601

|

|

N/A

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

q

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

q

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

q

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

q

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On July 1, 2016, Brown & Brown, Inc. (the “Company”) and Charles H. Lydecker, a Regional President of the Company’s Retail Division and a named executive officer in the Company’s most recent proxy statement filed on March 24, 2016, entered into a Transition Agreement (the “Transition Agreement”) in connection with his resignation from the Company effective on July 1, 2016. Pursuant to the Transition Agreement, Mr. Lydecker agreed to a one-year covenant not to compete with the Company and a two-year covenant not to solicit customers and employees of the Company. With respect to unvested equity grants made to Mr. Lydecker, all rights with respect to all such grants were forfeited upon Mr. Lydecker’s departure, except for the portions of seven grants made to Mr. Lydecker in 2003, 2008, 2010, 2011, 2013, 2014, and 2015, respectively, as to which there only remained a time-based employment condition of vesting and, if applicable, the specified performance targets required as conditions for vesting have already been achieved, a total of 111,000 shares; with respect to these shares, the remaining time-based employment conditions of vesting (which would otherwise require continued employment for time periods ranging from approximately two to seven more years) were waived, and Mr. Lydecker agreed not to sell or transfer more than 50% of such shares prior to September 30, 2016. The Company did not waive any performance-based vesting criteria applicable to any of Mr. Lydecker’s unvested equity grants. In addition, as part of the Transition Agreement, Mr. Lydecker entered into a customary release of claims.

The Company also entered into a Consulting Agreement with Mr. Lydecker on July 1, 2016 (the “Consulting Agreement”) pursuant to which the Company agreed to pay to Mr. Lydecker the following in exchange for consulting services consisting of new business referrals, retention of accounts and talent identification: (i) a one-time consulting fee of $750,000; (ii) a monthly consulting fee of $41,667 during a 12-month term; and (iii) a one-time payment equal to 30% of the net first-year agency commissions earned by the Company from new commercial insurance lines client accounts referred by Mr. Lydecker to the Company during a 12-month term. The Consulting Agreement provides that in the event of Mr. Lydecker’s death or disability during the term, the balance of any consulting fee payments will be paid in a lump sum.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 8, 2016

BROWN & BROWN, INC.

By:

/s/ Robert W. Lloyd

Executive Vice President, Secretary and

General Counsel

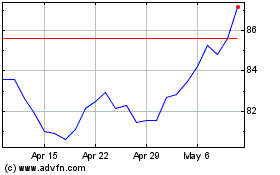

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

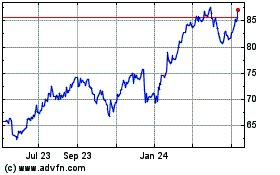

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Apr 2023 to Apr 2024