Securities Registration: Employee Benefit Plan (s-8)

June 17 2016 - 5:09PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on June 17, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BROWN & BROWN, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

FLORIDA

|

59-0864469

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

220 SOUTH RIDGEWOOD AVENUE

DAYTONA BEACH, FLORIDA

|

32114

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

BROWN & BROWN, INC. 2010 STOCK INCENTIVE PLAN

(Full title of the plan)

Robert W. Lloyd, Esq.

Executive Vice President, Secretary and General Counsel

Brown & Brown, Inc.

220 S. Ridgewood Avenue

Daytona Beach, Florida 32114

(Name and address of agent for service)

(386) 239-5752

(Telephone number, including area code, of agent for service)

Copies of all communications to:

Tom McAleavey, Esq.

Holland & Knight LLP

200 South Orange Avenue, Suite 2600

Orlando, Florida 32801

(407) 425-8500

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

Large accelerated filer

x

|

|

Accelerated filer

|

o

|

|

|

|

|

|

|

Non-accelerated filer

o

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

o

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of securities to be registered (1)

|

Amount to be

registered (1)

|

Proposed maximum

offering price per

share (2)

|

Proposed maximum

aggregate offering

price (2)

|

Amount of

registration

fee (2)

|

|

Common Stock

Par Value-$0.10 per share

|

1,200,000 shares

|

$35.85

|

$43,020,000

|

$4,332.11

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, this Registration Statement includes an indeterminate number of additional shares of Common Stock which may be offered and issued to prevent dilution from stock splits, stock dividends or similar transactions as provided in the Brown & Brown, Inc. 2010 Stock Incentive Plan.

|

|

|

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and (h) under the Securities Act of 1933, based on the average of the high and low prices reported for the registrant’s common stock traded on The New York Stock Exchange on June 14, 2016.

|

EXPLANATORY NOTE

Pursuant to General Instruction E to Form S-8, this Registration Statement on Form S-8 registers additional securities of the same class as other securities for which a registration statement, also filed on Form S-8 and relating to the Brown & Brown, Inc. 2010 Stock Incentive Plan (the “Plan”), is effective. Accordingly, this Registration Statement hereby incorporates by reference the contents of the Registrant’s earlier registration statement on Form S-8, Registration No. 333-200146, filed with the Securities and Exchange Commission (the “Commission”) on November 12, 2014. After giving effect to this filing, an aggregate of 9,864,843 shares of the Registrant’s common stock, par value $0.10 per share, have been registered and are authorized for issuance pursuant to the Plan.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

|

|

|

ITEM 3.

|

INCORPORATION OF DOCUMENTS BY REFERENCE.

|

The SEC allows us to “incorporate by reference” the information we file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this Registration Statement, and information that we file in the future with the SEC will automatically update and supersede this information. The documents incorporated by reference are:

|

|

|

|

•

|

our Annual Report on Form 10-K for the year ended December 31, 2015 (including information specifically incorporated by reference into our Form 10-K from our definitive proxy statement relating to our 2016 annual meeting of shareholders, filed on March 24, 2016);

|

|

|

|

|

•

|

our Form 10-K/A filed with the SEC on February 29, 2016;

|

|

|

|

|

•

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016;

|

|

|

|

|

•

|

our Current Reports on Form 8-K filed with the SEC on February 24, 2016, March 23, 2016 and May 5, 2016;

|

|

|

|

|

•

|

the description of our common stock set forth under the caption “Description of Capital Stock” in our Registration Statement on Form S-3ASR (Registration Statement No. 333-198503) filed with the SEC on September 2, 2014, including any amendment or report filed for the purpose of updating such description, which description is amended by the description contained in this prospectus; and

|

|

|

|

|

•

|

all documents filed under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and before the termination of the offering of the securities described in this prospectus (other than any information furnished pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K, unless we specifically state in such Current Report that such information is to be considered “filed” under the Exchange Act, or we incorporate it by reference into a filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

|

|

|

|

|

ITEM 6.

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS.

|

Brown & Brown is a Florida corporation. Reference is made to Section 607.0850 of the Florida Business Corporation Act, which permits, and in some cases requires, indemnification of directors, officers, employees, and agents of Brown & Brown under certain circumstances and subject to certain limitations.

Under Article VII of Brown & Brown’s Bylaws, Brown & Brown is required to indemnify its officers and directors, and officers and directors of certain other corporations serving as such at the request of Brown & Brown, against all costs and liabilities incurred by such persons by reason of their having been an officer or director of Brown & Brown or such other corporation, provided that such indemnification shall not apply with respect to any matter as to which such officer or director shall be finally adjudged to have been individually guilty of gross negligence or willful malfeasance in the performance of his or her duties as a director or officer, and provided further that the indemnification shall, with respect to any settlement of any suit, proceeding, or claim, include reimbursement of any amounts paid and expenses reasonably incurred in settling any such suit, proceeding, or claim when, in the judgment of the board of directors, such settlement and reimbursement appeared to be in the best interests of Brown & Brown.

Under Section 9 of the Brown & Brown, Inc. 2010 Stock Incentive Plan, Brown & Brown is required to indemnify directors, members of the Compensation Committee of its board of directors, and any officer or employee of Brown & Brown to whom authority to act for the board of directors or its Compensation Committee is delegated for any action, suit or proceeding in connection with the Brown & Brown, Inc. 2010 Stock Incentive Plan or any award or right granted thereunder.

Brown & Brown has purchased insurance with respect to, among other things, liabilities that may arise under the statutory and Bylaw provisions referred to above and the Brown & Brown, Inc. 2010 Stock Incentive Plan.

The general effect of the foregoing provisions may be to reduce the circumstances in which an officer or director may be required to bear the economic burden of the foregoing liabilities and expense.

The following exhibits are filed as part of this Registration Statement:

|

|

|

|

4.1

|

Brown & Brown 2010 Stock Incentive Plan, as amended (incorporated by reference to Exhibit 10.1 to Form 8-K filed on May 5, 2016)

|

5.1 Opinion of Holland & Knight LLP

23.1 Consent of Holland & Knight (included in Exhibit 5.1)

23.2 Consent of Deloitte & Touche LLP

24.1 Powers of Attorney

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement.

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the registration statement is on Form S-8, and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities

Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions (see Item 6) or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Daytona Beach, state of Florida, on this 17

th

day of June, 2016.

BROWN & BROWN, INC.

By:

/s/ R. Andrew Watts

R. Andrew Watts

Executive Vice President, Treasurer and Chief Financial Officer

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on June 17

th

, 2016.

|

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

*

|

|

|

|

J. Powell Brown

|

|

President and Chief Executive Officer

(Principal Executive Officer), Director

|

|

/s/ R. ANDREW WATTS

|

|

|

|

R. Andrew Watts

|

|

Executive Vice President, Treasurer and

Chief Financial Officer (Principal Financial and Accounting Officer)

|

|

*

|

|

|

|

J. Hyatt Brown

|

|

Chairman, Director

|

|

*

|

|

|

|

Samuel P. Bell, III

|

|

Director

|

|

*

|

|

|

|

Hugh M. Brown

|

|

Director

|

|

*

|

|

|

|

Bradley Currey, Jr.

|

|

Director

|

|

*

|

|

|

|

Theodore J. Hoepner

|

|

Director

|

|

*

|

|

|

|

James S. Hunt

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

*

|

|

|

|

Toni Jennings

|

|

Director

|

|

*

|

|

|

|

Timothy R.M. Main

|

|

Director

|

|

*

|

|

|

|

H. Palmer Proctor, Jr.

|

|

Director

|

|

*

|

|

|

|

Wendell S. Reilly

|

|

Director

|

|

*

|

|

|

|

Chilton D. Varner

|

|

Director

|

|

|

|

|

|

|

|

*By: /s/ R. Andrew Watts

|

|

R. Andrew Watts

|

|

Attorney-In-Fact

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

4.1

|

|

Brown & Brown, Inc. 2010 Stock Incentive Plan, as amended (incorporated by reference to Exhibit 10.1 to Form 8-K filed on May 5, 2016)

|

|

|

|

|

|

5.1

|

|

Opinion of Holland & Knight LLP

|

|

|

|

|

|

23.1

|

|

Consent of Holland & Knight LLP (included in Exhibit 5.1)

|

|

|

|

|

|

23.2

|

|

Consent of Deloitte & Touche LLP

|

|

|

|

|

|

24.1

|

|

Powers of Attorney

|

|

|

|

|

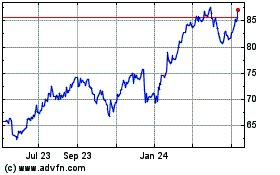

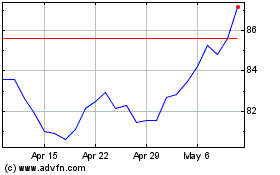

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Apr 2023 to Apr 2024