UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2015

Or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-13619

BROWN & BROWN, INC.

(Exact name of Registrant as specified in its charter)

|

| | | | |

Florida | | | | 59-0864469 |

(State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification Number) |

220 South Ridgewood Avenue, Daytona Beach, FL | | | 32114 |

(Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (386) 252-9601

Registrant’s Website: www.bbinsurance.com

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | ý | | Accelerated filer | | ¨ |

| | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The number of shares of the Registrant’s common stock, $0.10 par value, outstanding as of October 29, 2015 was 140,965,344.

BROWN & BROWN, INC.

INDEX

|

| | |

| | |

| | PAGE NO. |

| |

| | |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| |

| |

| | |

Item 1. | | |

Item 1A. | | |

Item 2. | | |

Item 6. | | |

| |

| |

Disclosure Regarding Forward-Looking Statements

Brown & Brown, Inc., together with its subsidiaries (collectively, “we,” “Brown & Brown” or the “Company”), makes “forward-looking statements” within the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995, as amended, throughout this report and in the documents we incorporate by reference into this report. You can identify these statements by forward-looking words such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “intend,” “estimate,” “plan” and “continue” or similar words. We have based these statements on our current expectations about potential future events. Although we believe the expectations expressed in the forward-looking statements included in this Quarterly Report on Form 10-Q and the reports, statements, information and announcements incorporated by reference into this report are based on reasonable assumptions within the bounds of our knowledge of our business, a number of factors could cause actual results to differ materially from those expressed in any forward-looking statements, whether oral or written, made by us or on our behalf. Many of these factors have previously been identified in filings or statements made by us or on our behalf. Important factors which could cause our actual results to differ materially from the forward-looking statements in this report include but are not limited to the following items, in addition to those matters described in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations”:

| |

• | Material adverse changes in economic conditions in the markets we serve and in the general economy; |

| |

• | Future regulatory actions and conditions in the states in which we conduct our business; |

| |

• | The occurrence of adverse economic conditions, an adverse regulatory climate, or a disaster in California, Florida, Georgia, Illinois, Indiana, Kansas, Massachusetts, Michigan, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Texas, Virginia and Washington, because a significant portion of business written by us is for customers located in these states; |

| |

• | Our ability to attract, retain and enhance qualified personnel; |

| |

• | Competition from others in the insurance agency, wholesale brokerage, insurance programs and service business; |

| |

• | Risks that could negatively affect our acquisition strategy, including continuing consolidation among insurance intermediaries and the increasing presence of private equity investors driving up valuations; |

| |

• | Exposure units, and premium rates set by insurance companies which have traditionally varied and are difficult to predict; |

| |

• | Our ability to forecast liquidity needs through at least the end of 2016; |

| |

• | Our ability to renew or replace expiring leases; |

| |

• | Outcomes of existing or future legal proceedings and governmental investigations; |

| |

• | Policy cancellations, which can be unpredictable; |

| |

• | Potential changes to the tax rate that would affect the value of deferred tax assets and liabilities and the impact on income available for investment or distributable to shareholders; |

| |

• | The inherent uncertainty in making estimates, judgments, and assumptions in the preparation of financial statements in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”); |

| |

• | Our ability to effectively apply technology in providing improved value for our customers as well as applying effective internal controls and efficiencies in operations; and |

| |

• | Other risks and uncertainties as may be detailed from time to time in our public announcements and Securities and Exchange Commission (“SEC”) filings. |

Assumptions as to any of the foregoing and all statements are not based on historical fact, but rather reflect our current expectations concerning future results and events. Forward-looking statements that we make or that are made by others on our behalf are based on a knowledge of our business and the environment in which we operate, but because of the factors listed above, among others, actual results may differ from those in the forward-looking statements. Consequently, these cautionary statements qualify all of the forward-looking statements we make herein. We cannot assure you that the results or developments anticipated by us will be realized or, even if substantially realized, that those results or developments will result in the expected consequences for us or affect us, our business or our operations in the way we expect. We caution readers not to place undue reliance on these forward-looking statements, which speak only as of their dates. We assume no obligation to update any of the forward-looking statements.

PART I — FINANCIAL INFORMATION

ITEM 1 — FINANCIAL STATEMENTS (UNAUDITED)

BROWN & BROWN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

|

| | | | | | | | | | | | | | | |

(in thousands, except per share data) | For the three months

ended September 30, | | For the nine months

ended September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

REVENUES | | | | | | | |

Commissions and fees | $ | 431,863 |

| | $ | 420,615 |

| | $ | 1,252,888 |

| | $ | 1,177,312 |

|

Investment income | 228 |

| | 225 |

| | 708 |

| | 522 |

|

Other income, net | 76 |

| | 578 |

| | 2,316 |

| | 4,942 |

|

Total revenues | 432,167 |

| | 421,418 |

| | 1,255,912 |

| | 1,182,776 |

|

EXPENSES | | | | | | | |

Employee compensation and benefits | 211,267 |

| | 203,126 |

| | 628,071 |

| | 583,633 |

|

Non-cash stock-based compensation | 4,889 |

| | 5,640 |

| | 17,348 |

| | 19,149 |

|

Other operating expenses | 66,121 |

| | 64,916 |

| | 191,591 |

| | 177,923 |

|

Gain on disposal | (654 | ) | | — |

| | (1,259 | ) | | — |

|

Amortization | 22,158 |

| | 21,983 |

| | 65,406 |

| | 60,482 |

|

Depreciation | 5,215 |

| | 5,456 |

| | 15,635 |

| | 15,338 |

|

Interest | 9,882 |

| | 7,298 |

| | 29,404 |

| | 18,374 |

|

Change in estimated acquisition earn-out payables | 459 |

| | 314 |

| | 2,194 |

| | 6,574 |

|

Total expenses | 319,337 |

| | 308,733 |

| | 948,390 |

| | 881,473 |

|

Income before income taxes | 112,830 |

| | 112,685 |

| | 307,522 |

| | 301,303 |

|

Income taxes | 45,403 |

| | 44,354 |

| | 122,139 |

| | 118,802 |

|

Net income | $ | 67,427 |

| | $ | 68,331 |

| | $ | 185,383 |

| | $ | 182,501 |

|

Net income per share: | | | | | | | |

Basic | $ | 0.48 |

| | $ | 0.47 |

| | $ | 1.31 |

| | $ | 1.26 |

|

Diluted | $ | 0.47 |

| | $ | 0.47 |

| | $ | 1.29 |

| | $ | 1.24 |

|

Dividends declared per share | $ | 0.11 |

| | $ | 0.10 |

| | $ | 0.33 |

| | $ | 0.30 |

|

See accompanying notes to Condensed Consolidated Financial Statements.

BROWN & BROWN, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

|

| | | | | | | |

(in thousands, except per share data) | September 30,

2015 | | December 31,

2014 |

ASSETS | | | |

Current Assets: | | | |

Cash and cash equivalents | $ | 448,818 |

| | $ | 470,048 |

|

Restricted cash and investments | 217,646 |

| | 259,769 |

|

Short-term investments | 10,545 |

| | 11,157 |

|

Premiums, commissions and fees receivable | 424,416 |

| | 424,547 |

|

Reinsurance recoverable | 37,205 |

| | 13,028 |

|

Prepaid reinsurance premiums | 329,777 |

| | 320,586 |

|

Deferred income taxes | 17,152 |

| | 25,431 |

|

Other current assets | 58,290 |

| | 45,542 |

|

Total current assets | 1,543,849 |

| | 1,570,108 |

|

Fixed assets, net | 81,338 |

| | 84,668 |

|

Goodwill | 2,559,005 |

| | 2,460,611 |

|

Amortizable intangible assets, net | 758,096 |

| | 784,642 |

|

Investments | 22,943 |

| | 19,862 |

|

Other assets | 36,961 |

| | 36,567 |

|

Total assets | $ | 5,002,192 |

| | $ | 4,956,458 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

Current Liabilities: | | | |

Premiums payable to insurance companies | $ | 531,004 |

| | $ | 568,184 |

|

Losses and loss adjustment reserve | 37,205 |

| | 13,028 |

|

Unearned premiums | 329,777 |

| | 320,586 |

|

Premium deposits and credits due customers | 96,030 |

| | 83,313 |

|

Accounts payable | 56,877 |

| | 57,261 |

|

Accrued expenses and other liabilities | 172,404 |

| | 181,156 |

|

Current portion of long-term debt | 41,250 |

| | 45,625 |

|

Total current liabilities | 1,264,547 |

| | 1,269,153 |

|

Long-term debt | 1,118,589 |

| | 1,152,846 |

|

Deferred income taxes, net | 347,615 |

| | 341,497 |

|

Other liabilities | 85,706 |

| | 79,217 |

|

Shareholders’ Equity: | | | |

Common stock, par value $0.10 per share; authorized 280,000 shares; issued 146,414 shares and outstanding 140,970 shares at 2015, issued 145,871 shares and outstanding 143,486 shares at 2014 | 14,641 |

| | 14,587 |

|

Additional paid-in capital | 439,335 |

| | 405,982 |

|

Treasury stock, at cost 5,444 and 2,385 shares at 2015 and 2014, respectively | (175,025 | ) | | (75,025 | ) |

Retained earnings | 1,906,744 |

| | 1,768,201 |

|

Accumulated other comprehensive income, net of tax effect of $40 at 2015, of $0 at 2014 | 40 |

| | — |

|

Total shareholders’ equity | 2,185,735 |

| | 2,113,745 |

|

Total liabilities and shareholders’ equity | $ | 5,002,192 |

| | $ | 4,956,458 |

|

See accompanying notes to Condensed Consolidated Financial Statements.

BROWN & BROWN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS(UNAUDITED) |

| | | | | | | |

| For the nine months

ended September 30, |

(in thousands) | 2015 | | 2014 |

Cash flows from operating activities: | | | |

Net income | $ | 185,383 |

| | $ | 182,501 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Amortization | 65,406 |

| | 60,482 |

|

Depreciation | 15,635 |

| | 15,338 |

|

Non-cash stock-based compensation | 17,348 |

| | 19,149 |

|

Change in estimated acquisition earn-out payables | 2,194 |

| | 6,574 |

|

Deferred income taxes | 16,974 |

| | 17,200 |

|

Amortization of debt discount | 118 |

| | — |

|

Income tax benefit from exercise of shares from the stock benefit plans | (2,502 | ) | | (2,983 | ) |

Net gain on sales of investments, fixed assets and customer accounts | (830 | ) | | (2,654 | ) |

Payments on acquisition earn-outs in excess of original estimated payables | (4,917 | ) | | (2,539 | ) |

Changes in operating assets and liabilities, net of effect from acquisitions and divestitures: | | | |

Restricted cash and investments decrease (increase) | 42,123 |

| | (25,837 | ) |

Premiums, commissions and fees receivable decrease | 2,277 |

| | 21,078 |

|

Reinsurance recoverables (increase) decrease | (24,177 | ) | | 2,052 |

|

Prepaid reinsurance premiums (increase) | (9,191 | ) | | (56,923 | ) |

Other assets (increase) | (13,076 | ) | | (4,957 | ) |

Premiums payable to insurance companies (decrease) | (37,845 | ) | | (24,749 | ) |

Premium deposits and credits due customers increase | 12,717 |

| | 18,504 |

|

Losses and loss adjustment reserve increase (decrease) | 24,177 |

| | (2,052 | ) |

Unearned premiums increase | 9,191 |

| | 56,923 |

|

Accounts payable increase | 27,793 |

| | 26,375 |

|

Accrued expenses and other liabilities (decrease) increase | (11,547 | ) | | 321 |

|

Other liabilities (decrease) | (26,610 | ) | | (18,453 | ) |

Net cash provided by operating activities | 290,641 |

| | 285,350 |

|

Cash flows from investing activities: | | | |

Additions to fixed assets | (12,773 | ) | | (20,189 | ) |

Payments for businesses acquired, net of cash acquired | (109,926 | ) | | (694,816 | ) |

Proceeds from sales of fixed assets and customer accounts | 4,794 |

| | 3,392 |

|

Purchases and proceeds from sales of investments | (2,415 | ) | | (89 | ) |

Net cash used in investing activities | (120,320 | ) | | (711,702 | ) |

Cash flows from financing activities: | | | |

Payments on acquisition earn-outs | (22,020 | ) | | (9,353 | ) |

Proceeds from long-term debt | — |

| | 1,048,432 |

|

Payments on long-term debt | (38,750 | ) | | (330,000 | ) |

Borrowings on revolving credit facilities | — |

| | 475,000 |

|

Payments on revolving credit facilities | — |

| | (475,000 | ) |

Income tax benefit from exercise of shares from the stock benefit plans | 2,502 |

| | 2,983 |

|

Issuances of common stock for employee stock benefit plans | 15,854 |

| | 14,753 |

|

Repurchase stock benefit plan shares for employees to fund tax withholdings | (2,297 | ) | | (2,751 | ) |

Purchase of treasury stock | (100,000 | ) | | (67,525 | ) |

Prepayment of accelerated share repurchase program | — |

| | (7,500 | ) |

Cash dividends paid | (46,840 | ) | | (43,547 | ) |

Net cash (used in) provided by financing activities | (191,551 | ) | | 605,492 |

|

Net (decrease) increase in cash and cash equivalents | (21,230 | ) | | 179,140 |

|

Cash and cash equivalents at beginning of period | 470,048 |

| | 202,952 |

|

Cash and cash equivalents at end of period | $ | 448,818 |

| | $ | 382,092 |

|

See accompanying notes to Condensed Consolidated Financial Statements.

BROWN & BROWN, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1· Nature of Operations

Brown & Brown, Inc., a Florida corporation, and its subsidiaries (collectively, “Brown & Brown” or the “Company”) is a diversified insurance agency, wholesale brokerage, insurance programs and services organization that markets and sells to its customers, insurance products and services, primarily in the property and casualty area. Brown & Brown’s business is divided into four reportable segments: the Retail Segment provides a broad range of insurance products and services to commercial, public entity, professional and individual customers; the National Programs Segment, acting as a managing general agent (“MGA”), provides professional liability and related package products for certain professionals, a range of insurance products for individuals, flood coverage, and targeted products and services designated for specific industries, trade groups, governmental entities and market niches, all of which are delivered through nationwide networks of independent agents, and Brown & Brown retail agents; the Wholesale Brokerage Segment markets and sells excess and surplus commercial insurance, primarily through independent agents and brokers, as well as Brown & Brown Retail offices; and the Services Segment provides insurance-related services, including third-party claims administration and comprehensive medical utilization management services in both the workers’ compensation and all-lines liability arenas, as well as Medicare Set-aside services, Social Security disability and Medicare benefits advocacy services, and catastrophe claims adjusting services. In addition, as the result of our acquisition of The Wright Insurance Group, LLC (“Wright”) in May 2014, we own a flood insurance carrier, Wright National Flood Insurance Company (“Wright Flood”), that is a Wright subsidiary. Wright Flood's business consists of policies written pursuant to the National Flood Insurance Program (“NFIP”), the program administered by the Federal Emergency Management Agency (“FEMA”), and several excess flood insurance policies, all of which are fully reinsured.

NOTE 2· Basis of Financial Reporting

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with U.S. GAAP for interim financial information and with the instructions for Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. These unaudited Condensed Consolidated Financial Statements should be read in conjunction with the audited Consolidated Financial Statements and the notes thereto set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014.

The preparation of these financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, as well as disclosures of contingent assets and liabilities, at the date of the Consolidated Financial Statements, and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates.

Segment results for prior periods have been recast to reflect the current year segmental structure. Certain reclassifications have been made to the prior-year amounts reported in this Quarterly Report on Form 10-Q in order to conform to the current-year presentation.

Recently Issued Accounting Pronouncements

In September 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2015-16, “Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period Adjustments” (“ASU 2015-16”), which requires that an acquirer recognize adjustments to provisional amounts that are identified during the measurement period in the reporting period in which the adjustment amounts are determined. ASU 2015-16 is effective for fiscal years, and interim reporting periods within those fiscal years, beginning after December 15, 2015. The Company is currently evaluating the impact of the adoption of this guidance on the Consolidated Financial Statements.

In April 2015, FASB issued ASU No. 2015-05, "Intangibles-Goodwill and Other-Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement" ("ASU 2015-05"), which issues guidance on determining whether a cloud computing arrangement contains a software license that should be accounted for as internal-use software. If a cloud computing arrangement does not contain a software license, it should be accounted for as a service contract. This guidance is effective for fiscal years beginning after December 15, 2015 and for interim periods within those fiscal years, with early adoption permitted. The Company is currently evaluating the impact of the adoption of this guidance on the Consolidated Financial Statements.

In April 2015, FASB issued ASU No. 2015-03, "Simplifying the Presentation of Debt Issuance Costs" ("ASU 2015-03"), which requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts, and not recorded as separate assets. This update is effective for reporting periods beginning after December 15, 2015, and is to be applied on a retrospective basis. The Company plans to adopt ASU 2015-03 in the first quarter of 2016. As the Company's debt issuance costs are not material, implementation of this update is not expected to have a material impact on the Company's Consolidated Financial Statements.

In August 2014, FASB issued ASU No. 2014-15, “Disclosure of Uncertainties About an Entity’s Ability to Continue as a Going Concern” (“ASU 2014-15”), which addresses management’s responsibility in evaluating whether there is substantial doubt about a company’s ability to continue as a going concern and to provide related footnote disclosures. ASU 2014-15 is effective for fiscal years beginning after December 15, 2016 and for interim periods within those fiscal years, with early adoption permitted. The Company does not expect to early adopt this guidance, and it believes the adoption of this guidance will not have an impact on the Condensed Consolidated Financial Statements.

In May 2014, FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers” (“ASU 2014-09”), which provides guidance for revenue recognition. ASU 2014-09 affects any entity that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets, and supersedes the revenue recognition requirements in Topic 605, “Revenue Recognition,” and most industry-specific guidance. The standard’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which a company expects to be entitled in exchange for those goods or services. In doing so, companies will need to use more judgment and make more estimates than under the current guidance. These may include identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation. ASU 2014-09 is effective for the Company beginning January 1, 2018, after FASB voted to delay the effective date by one year. At that time, the Company may adopt the new standard under the full retrospective approach or the modified retrospective approach. The Company is currently evaluating its revenue streams against the requirements of this pronouncement.

NOTE 3· Net Income Per Share

Basic EPS is computed based on the weighted average number of common shares (including participating securities) issued and outstanding during the period. Diluted EPS is computed based on the weighted average number of common shares issued and outstanding plus equivalent shares, assuming the exercise of stock options. The dilutive effect of stock options is computed by application of the treasury-stock method. The following is a reconciliation between basic and diluted weighted average shares outstanding:

|

| | | | | | | | | | | | | | | |

| For the three months

ended September 30, | | For the nine months

ended September 30, |

(in thousands, except per share data) | 2015 | | 2014 | | 2015 | | 2014 |

Net income | $ | 67,427 |

| | $ | 68,331 |

| | $ | 185,383 |

| | $ | 182,501 |

|

Net income attributable to unvested awarded performance stock | (1,565 | ) | | (1,681 | ) | | (4,370 | ) | | (4,604 | ) |

Net income attributable to common shares | $ | 65,862 |

| | $ | 66,650 |

| | $ | 181,013 |

| | $ | 177,897 |

|

Weighted average number of common shares outstanding – basic | 140,955 |

| | 144,469 |

| | 141,517 |

| | 144,909 |

|

Less unvested awarded performance stock included in weighted average number of common shares outstanding – basic | (3,271 | ) | | (3,554 | ) | | (3,336 | ) | | (3,656 | ) |

Weighted average number of common shares outstanding for basic earnings per common share | 137,684 |

| | 140,915 |

| | 138,181 |

| | 141,253 |

|

Dilutive effect of stock options | 2,357 |

| | 2,049 |

| | 2,265 |

| | 1,849 |

|

Weighted average number of shares outstanding – diluted | 140,041 |

| | 142,964 |

| | 140,446 |

| | 143,102 |

|

Net income per share: | | | | | | | |

Basic | $ | 0.48 |

| | $ | 0.47 |

| | $ | 1.31 |

| | $ | 1.26 |

|

Diluted | $ | 0.47 |

| | $ | 0.47 |

| | $ | 1.29 |

| | $ | 1.24 |

|

NOTE 4· Business Combinations

During the nine months ended September 30, 2015, Brown & Brown acquired the assets and assumed certain liabilities of nine insurance intermediaries and four books of business (customer accounts). Additionally, miscellaneous adjustments were recorded to the purchase price allocation of certain prior acquisitions completed within the last twelve months as permitted by Accounting Standards Codification Topic 805 — Business Combinations (“ASC 805”). Such adjustments are presented in the "Other" category within the following two tables. All of these acquisitions were acquired primarily to expand Brown & Brown’s core business and to attract and hire high-quality individuals. The recorded purchase price for all acquisitions consummated after January 1, 2009 included an estimation of the fair value of liabilities associated with any potential earn-out provisions. Subsequent changes in the fair value of earn-out obligations will be recorded in the Condensed Consolidated Statement of Income when incurred.

The fair value of earn-out obligations is based on the present value of the expected future payments to be made to the sellers of the acquired businesses in accordance with the provisions outlined in the respective purchase agreements. In determining fair value, the acquired business’s future performance is estimated using financial projections developed by management for the acquired business and reflects market participant assumptions regarding revenue growth and/or profitability. The expected future payments are estimated on the basis of the earn-out formula and performance targets specified in each purchase agreement compared to the associated financial projections. These payments are then discounted to present value using a risk-adjusted rate that takes into consideration the likelihood that the forecasted earn-out payments will be made.

Based on the acquisition date and the complexity of the underlying valuation work, certain amounts included in the Company’s Condensed Consolidated Financial Statements may be provisional and thus subject to further adjustments within the permitted measurement period, as defined in ASC 805. For the nine months ended September 30, 2015, several adjustments were made within the permitted measurement period that resulted in a decrease in the aggregate purchase price of the affected acquisitions of $503,442 relating to the assumption of certain liabilities.

Cash paid for acquisitions was $109.9 million and $720.1 million in the nine-month periods ended September 30, 2015 and 2014, respectively. We completed nine acquisitions (excluding book of business purchases) in the nine-month period ended September 30, 2015. We completed six acquisitions (excluding book of business purchases) in the nine-month period ended September 30, 2014.

The following table summarizes the purchase price allocation made as of the date of each acquisition for current year acquisitions and significant adjustments made during the measurement period for prior year acquisitions:

|

| | | | | | | | | | | | | | | | | | | | | | | |

(in thousands) | | | | | | | | | | | | | |

Name | Business Segment | | Effective Date of Acquisition | | Cash Paid | | Other Payable | | Recorded Earn-Out Payable | | Net Assets Acquired | | Maximum Potential Earn- Out Payable |

Liberty Insurance Brokers, Inc. and Affiliates (Liberty) | Retail | | February 1, 2015 | | $ | 12,000 |

| | $ | — |

| | $ | 2,981 |

| | $ | 14,981 |

| | $ | 3,750 |

|

Spain Agency, Inc. | Retail | | March 1, 2015 | | 20,706 |

| | — |

| | 2,617 |

| | 23,323 |

| | 9,162 |

|

Bellingham Underwriters, Inc. | National Programs | | May 1, 2015 | | 9,007 |

| | 500 |

| | 3,322 |

| | 12,829 |

| | 4,400 |

|

Fitness Insurance, LLC | Retail | | June 1, 2015 | | 9,455 |

| | — |

| | 2,386 |

| | 11,841 |

| | 3,500 |

|

Strategic Benefit Advisors, Inc. | Retail | | June 1, 2015 | | 49,600 |

| | 400 |

| | 14,441 |

| | 64,441 |

| | 26,000 |

|

Other | Various | | Various | | 9,158 |

| | 95 |

| | 3,749 |

| | 13,002 |

| | 6,267 |

|

Total | | | | | $ | 109,926 |

| | $ | 995 |

| | $ | 29,496 |

| | $ | 140,417 |

| | $ | 53,079 |

|

The following table summarizes the estimated fair values of the aggregate assets and liabilities acquired as of the date of each acquisition. The data included in the ‘Other’ column shows a negative adjustment for purchased customer accounts. This is driven mainly by the final valuation adjustment for the acquisition of Wright.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in thousands) | Liberty | | Spain Agency, Inc. | | Bellingham Underwriters, Inc. | | Fitness Insurance, LLC | | Strategic Benefit Advisors, Inc. | | Other | | Total |

Other current assets | $ | 2,486 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 170 |

| | $ | 2,656 |

|

Fixed assets | 40 |

| | 50 |

| | 25 |

| | 17 |

| | 41 |

| | 32 |

| | 205 |

|

Goodwill | 10,010 |

| | 16,036 |

| | 9,608 |

| | 8,084 |

| | 39,865 |

| | 17,029 |

| | 100,632 |

|

Purchased customer accounts | 4,506 |

| | 7,430 |

| | 3,223 |

| | 3,740 |

| | 24,500 |

| | (4,105 | ) | | 39,294 |

|

Non-compete agreements | 24 |

| | 21 |

| | 21 |

| | — |

| | 21 |

| | 123 |

| | 210 |

|

Other assets | — |

| | — |

| | — |

| | — |

| | 14 |

| | — |

| | 14 |

|

Total assets acquired | 17,066 |

| | 23,537 |

| | 12,877 |

| | 11,841 |

| | 64,441 |

| | 13,249 |

| | 143,011 |

|

Other current liabilities | (42 | ) | | (214 | ) | | (48 | ) | | — |

| | — |

| | (3,458 | ) | | (3,762 | ) |

Deferred income tax, net | — |

| | — |

| | — |

| | — |

| | — |

| | 2,576 |

| | 2,576 |

|

Other liabilities | (2,043 | ) | | — |

| | — |

| | — |

| | — |

| | 635 |

| | (1,408 | ) |

Total liabilities assumed | (2,085 | ) | | (214 | ) | | (48 | ) | | — |

| | — |

| | (247 | ) | | (2,594 | ) |

Net assets acquired | $ | 14,981 |

| | $ | 23,323 |

| | $ | 12,829 |

| | $ | 11,841 |

| | $ | 64,441 |

| | $ | 13,002 |

| | $ | 140,417 |

|

The weighted average useful lives for the acquired amortizable intangible assets are as follows: purchased customer accounts, 15 years; and non-compete agreements, 5 years.

Goodwill of $100,632,000 was allocated to the Retail, National Programs and Wholesale Brokerage Segments in the amounts of $78,018,000, $18,009,000 and $4,605,000, respectively. Of the total goodwill of $100,632,000, $62,735,000 is currently deductible for income tax purposes and $8,401,000 is non-deductible. The remaining $29,496,000 relates to the recorded earn-out payables and will not be deductible until it is earned and paid.

For the acquisitions completed during 2015, the results of operations since the acquisition dates have been combined with those of the Company. The total revenues from the acquisitions completed through September 30, 2015, included in the Condensed Consolidated Statement of Income for the three and nine months ended September 30, 2015, were $9,218,000 and $16,640,000, respectively. The income before income taxes, including the intercompany cost of capital charge, from the acquisitions completed through September 30, 2015, included in the Condensed Consolidated Statement of Income for the three and nine months ended September 30, 2015, was $397,000 and $1,243,000, respectively. If the acquisitions had occurred as of the beginning of the respective periods, the Company’s results of operations would be as shown in the following table. These unaudited pro forma results are not necessarily indicative of the actual results of operations that would have occurred had the acquisitions actually been made at the beginning of the respective periods.

|

| | | | | | | | | | | | | | | |

(UNAUDITED) | For the three months

ended September 30, | | For the nine months

ended September 30, |

(in thousands, except per share data) | 2015 | | 2014 | | 2015 | | 2014 |

Total revenues | $ | 432,276 |

| | $ | 431,703 |

| | $ | 1,267,812 |

| | $ | 1,212,241 |

|

Income before income taxes | $ | 112,855 |

| | $ | 115,712 |

| | $ | 311,429 |

| | $ | 310,302 |

|

Net income | $ | 67,442 |

| | $ | 70,166 |

| | $ | 187,738 |

| | $ | 187,952 |

|

Net income per share: | | | | | | | |

Basic | $ | 0.48 |

| | $ | 0.49 |

| | $ | 1.33 |

| | $ | 1.30 |

|

Diluted | $ | 0.47 |

| | $ | 0.48 |

| | $ | 1.31 |

| | $ | 1.28 |

|

Weighted average number of shares outstanding: | | | | | | | |

Basic | 137,684 |

| | 140,915 |

| | 138,181 |

| | 141,253 |

|

Diluted | 140,041 |

| | 142,964 |

| | 140,446 |

| | 143,102 |

|

As of September 30, 2015 and 2014, the fair values of the estimated acquisition earn-out payables were re-evaluated and measured at fair value on a recurring basis using unobservable inputs (Level 3) as defined in ASC 820-Fair Value Measurement. The resulting additions, payments, and net changes, as well as the interest expense accretion on the estimated acquisition earn-out payables, for the three and nine months ended September 30, 2015 and 2014, were as follows:

|

| | | | | | | | | | | | | | | |

| For the three months

ended September 30, | | For the nine months

ended September 30, |

(in thousands) | 2015 | | 2014 | | 2015 | | 2014 |

Balance as of the beginning of the period | $ | 90,113 |

| | $ | 52,696 |

| | $ | 75,283 |

| | $ | 43,058 |

|

Additions to estimated acquisition earn-out payables | 2,363 |

| | (221 | ) | | 29,496 |

| | 14,586 |

|

Payments for estimated acquisition earn-out payables | (12,899 | ) | | (463 | ) | | (26,937 | ) | | (11,892 | ) |

Subtotal | 79,577 |

| | 52,012 |

| | 77,842 |

| | 45,752 |

|

Net change in earnings from estimated acquisition earn-out payables: | | | | | | | |

Change in fair value on estimated acquisition earn-out payables | (365 | ) | | (247 | ) | | (30 | ) | | 4,981 |

|

Interest expense accretion | 824 |

| | 561 |

| | 2,224 |

| | 1,593 |

|

Net change in earnings from estimated acquisition earn-out payables | 459 |

| | 314 |

| | 2,194 |

| | 6,574 |

|

Balance as of September 30, | $ | 80,036 |

| | $ | 52,326 |

| | $ | 80,036 |

| | $ | 52,326 |

|

Of the $80.0 million estimated acquisition earn-out payables as of September 30, 2015, $32.3 million was recorded as accounts payable and $47.7 million was recorded as other non-current liabilities. Included within additions to estimated acquisition earn-out payables are any adjustments to opening balance sheet items prior to the one-year anniversary date and may therefore differ from previously reported amounts.

NOTE 5· Goodwill

Goodwill is subject to at least an annual assessment for impairment by applying a fair value-based test. The Company completed its most recent annual assessment as of November 30, 2014, and identified no impairment as a result of the evaluation.

The changes in the carrying value of goodwill by reportable segment for the nine months ended September 30, 2015 are as follows:

|

| | | | | | | | | | | | | | | | | | | |

(in thousands) | Retail | | National Programs | | Wholesale Brokerage | | Services | | Total |

Balance as of January 1, 2015 | $ | 1,231,869 |

| | $ | 886,095 |

| | $ | 222,356 |

| | $ | 120,291 |

| | $ | 2,460,611 |

|

Goodwill of acquired businesses | 78,018 |

| | 18,009 |

| | 4,605 |

| | — |

| | 100,632 |

|

Goodwill disposed of relating to sales of businesses | — |

| | (2,238 | ) | | — |

| | — |

| | (2,238 | ) |

Balance as of September 30, 2015 | $ | 1,309,887 |

| | $ | 901,866 |

| | $ | 226,961 |

| | $ | 120,291 |

| | $ | 2,559,005 |

|

NOTE 6· Amortizable Intangible Assets

Amortizable intangible assets at September 30, 2015 and December 31, 2014 consisted of the following:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2015 | | December 31, 2014 |

(in thousands) | Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value | | Weighted Average Life (Years)(1) | | Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value | | Weighted Average Life (Years)(1) |

Purchased customer accounts | $ | 1,392,323 |

| | $ | (636,906 | ) | | $ | 755,417 |

| | 15.0 | | $ | 1,355,550 |

| | $ | (574,285 | ) | | $ | 781,265 |

| | 14.9 |

Non-compete agreements | 29,345 |

| | (26,666 | ) | | 2,679 |

| | 6.8 | | 29,139 |

| | (25,762 | ) | | 3,377 |

| | 6.8 |

Total | $ | 1,421,668 |

| | $ | (663,572 | ) | | $ | 758,096 |

| | | | $ | 1,384,689 |

| | $ | (600,047 | ) | | $ | 784,642 |

| | |

| |

(1) | Weighted average life calculated as of the date of acquisition. |

Amortization expense for amortizable intangible assets for the years ending December 31, 2015, 2016, 2017, 2018 and 2019 is estimated to be $87.5 million, $84.0 million, $81.1 million, $75.9 million, and $71.4 million, respectively.

NOTE 7· Long-Term Debt

Long-term debt at September 30, 2015 and December 31, 2014 consisted of the following:

|

| | | | | | | |

(in thousands) | September 30, 2015 | | December 31, 2014 |

Current portion of long-term debt: | | | |

Current portion of 5-year term loan facility expires 2019 | $ | 41,250 |

| | $ | 20,625 |

|

5.370% senior notes, Series D, quarterly interest payments, balloon due 2015 | — |

| | 25,000 |

|

Total current portion of long-term debt | 41,250 |

| | 45,625 |

|

Long-term debt: | | | |

Note agreements: | | | |

5.660% senior notes, Series C, semi-annual interest payments, balloon due 2016 | 25,000 |

| | 25,000 |

|

4.500% senior notes, Series E, quarterly interest payments, balloon due 2018 | 100,000 |

| | 100,000 |

|

4.200% senior notes, semi-annual interest payments, balloon due 2024 | 498,589 |

| | 498,471 |

|

Total notes | 623,589 |

| | 623,471 |

|

Credit agreements: | | | |

5-year term-loan facility, periodic interest and principal payments, currently LIBOR plus 1.375%, expires May 20, 2019 | 495,000 |

| | 529,375 |

|

5-year revolving-loan facility, periodic interest payments, currently LIBOR plus 1.175%, plus commitment fees of 0.20%, expires May 20, 2019 | — |

| | — |

|

Revolving credit loan, quarterly interest payments, LIBOR plus up to 1.40% and availability fee up to 0.25%, expires December 31, 2016 | — |

| | — |

|

Total credit agreements | 495,000 |

| | 529,375 |

|

Total long-term debt | 1,118,589 |

| | 1,152,846 |

|

Current portion of long-term debt | 41,250 |

| | 45,625 |

|

Total debt | $ | 1,159,839 |

| | $ | 1,198,471 |

|

On December 22, 2006, the Company entered into a Master Shelf and Note Purchase Agreement (the “Master Agreement”) with a national insurance company (the “Purchaser”). The initial issuance of notes under the Master Agreement occurred on December 22, 2006, through the issuance of $25.0 million in Series C Senior Notes due December 22, 2016, with a fixed interest rate of 5.66% per year. On February 1, 2008, $25.0 million in Series D Senior Notes due January 15, 2015, with a fixed interest rate of 5.37% per year, were issued. On September 15, 2011, and pursuant to a Confirmation of Acceptance (the “Confirmation”), dated January 21, 2011, in connection with the Master Agreement, $100.0 million in Series E Senior Notes were issued and are due September 15, 2018, with a fixed interest rate of 4.50% per year. The Series E Senior Notes were issued for the sole purpose of retiring existing senior notes. On January 15, 2015 the Series D Notes were redeemed at maturity using cash proceeds to pay off the principal of $25.0 million plus any remaining accrued interest. As of September 30, 2015, there was an outstanding debt balance issued under the provisions of the Master Agreement of $125.0 million.

On July 1, 2013, in conjunction with the acquisition of Beecher Carlson Holdings, Inc., the Company entered into a revolving loan agreement (the “Wells Fargo Agreement”) with Wells Fargo Bank, N.A. that provided for a $50.0 million revolving line of credit (the “Wells Fargo Revolver”). The maturity date for the Wells Fargo Revolver is December 31, 2016, at which time all outstanding principal and unpaid interest will be due. On April 16, 2014, in connection with the signing of the Credit Facility (as defined below) an amendment to the agreement was established to reduce the total revolving loan commitment from $50.0 million to $25.0 million. The Wells Fargo Revolver may be increased by up to $50.0 million (bringing the total amount available to $75.0 million). The calculation of interest and fees for the Wells Fargo Agreement is generally based on the Company’s funded debt-to-EBITDA ratio. Interest is charged at a rate equal to 1.00% to 1.40% above LIBOR or 1.00% below the Base Rate, each as more fully described in the Wells Fargo Agreement. Fees include an up-front fee, an availability fee of 0.175% to 0.25%, and a letter of credit margin fee of 1.00% to 1.40%. The obligations under the Wells Fargo Revolver are unsecured and the Wells Fargo Agreement includes various covenants, limitations and events of default that are customary for similar facilities for similar borrowers. There were no borrowings against the Wells Fargo Revolver as of September 30, 2015 and December 31, 2014.

On October 12, 2012, the Company entered into a Master Note Facility Agreement (the “New Master Agreement”) with another national insurance company (the “New Purchaser”). The New Master Agreement provides for a $125.0 million private uncommitted “shelf” facility for the issuance of unsecured senior notes over a three-year period, with interest rates that may be fixed or floating and with such maturity dates, not to exceed ten years, as the parties may determine. The New Master Agreement includes various covenants, limitations, and events of default similar to the Master Agreement. At September 30, 2015 and December 31, 2014, there were no borrowings against this facility.

On April 17, 2014, the Company entered into a credit agreement with JPMorgan Chase Bank, N.A. as administrative agent and certain other banks as co-syndication agents and co-documentation agents (the “Credit Agreement”). The Credit Agreement in the amount of $1,350.0 million provides for an unsecured revolving credit facility (the “Credit Facility”) in the initial amount of $800.0 million and unsecured term loans in the initial amount of $550.0 million, either or both of which may, subject to lenders’ discretion, potentially be increased by up to $500.0 million. The Credit Facility was funded on May 20, 2014 in conjunction with the closing of the Wright acquisition, with the $550.0 million term loan being funded as well as a drawdown of $375.0 million on the revolving loan facility. Use of these proceeds was to retire existing term loan debt and to facilitate the closing of the Wright acquisition as well as other acquisitions. The Credit Facility terminates on May 20, 2019, but either or both of the revolving credit facility and the term loans may be extended for two additional one-year periods at the Company’s request and at the discretion of the respective lenders. Interest and facility fees in respect to the Credit Facility are based on the better of the Company’s net debt leverage ratio or a non-credit enhanced senior unsecured long-term debt rating. Based on the Company’s net debt leverage ratio, the rates of interest charged on the term loan are 1.00% to 1.75%, and the revolving loan is 0.85% to 1.50% above the adjusted LIBOR rate for outstanding amounts drawn. There are fees included in the facility which include a facility fee based on the revolving credit commitments of the lenders (whether used or unused) at a rate of 0.15% to 0.25% and letter of credit fees based on the amounts of outstanding secured or unsecured letters of credit. The Credit Facility includes various covenants, limitations and events of default customary for similar facilities for similarly rated borrowers. As of September 30, 2015 and December 31, 2014, there was an outstanding debt balance issued under the provisions of the Credit Facility in total of $536.3 million and $550.0 million respectively, with no borrowings outstanding relative to the revolving loan. Per the terms of the agreement, a scheduled principal payment of $6.9 million is due on December 31, 2015.

On September 18, 2014, the Company issued $500.0 million of 4.200% unsecured senior notes due in 2024. The senior notes were given investment grade ratings of BBB-/Baa3 with a stable outlook. The notes are subject to certain covenant restrictions and regulations which are customary for credit rated obligations. At the time of funding, the proceeds were offered at a discount of the original note amount which also excluded an underwriting fee discount. The net proceeds received from the issuance were used to repay the outstanding balance of $475.0 million on the revolving Credit Facility and for other general corporate purposes. As of September 30, 2015 and December 31, 2014, there was an outstanding debt balance of $500.0 million exclusive of the associated discount balance.

The Master Agreement, Wells Fargo Agreement and the Credit Agreement all require the Company to maintain certain financial ratios and comply with certain other covenants. The Company was in compliance with all such covenants as of September 30, 2015 and December 31, 2014.

The 30-day Adjusted LIBOR Rate as of September 30, 2015 was 0.25%.

NOTE 8· Supplemental Disclosures of Cash Flow Information and Non-Cash Financing and Investing Activities

Our Restricted Cash balance is comprised of funds held in separate premium trust accounts as required by state law or, in some cases, per agreement with our carrier partners. In the second quarter of 2015, certain balances that had previously been reported as held in restricted premium trust accounts were reclassified as non-restricted as they were not restricted by state law or by contractual agreement with a carrier. The resulting impact of this change was a reduction in the balance reported on our Condensed Consolidated Balance Sheet as Restricted Cash and Investments and a corresponding increase in the balance reported as Cash and Cash Equivalents of approximately $41.0 million as of June 30, 2015 and $27.6 million as of September 30, 2015 as compared to the corresponding account balances as of December 31, 2014 of $32.2 million which was reflected as Restricted Cash. While these referenced funds are not restricted, they do represent premium payments from customers to be paid to insurance carriers and this change in classification should not be viewed as a source of operating cash.

|

| | | | | | | |

| For the nine months

ended September 30, |

(in thousands) | 2015 | | 2014 |

Cash paid during the period for: | | | |

Interest | $ | 33,091 |

| | $ | 19,940 |

|

Income taxes | $ | 96,579 |

| | $ | 92,018 |

|

Brown & Brown’s significant non-cash investing and financing activities are summarized as follows:

|

| | | | | | | |

| For the nine months

ended September 30, |

(in thousands) | 2015 | | 2014 |

Other payable issued for purchased customer accounts | $ | 995 |

| | $ | 1,623 |

|

Estimated acquisition earn-out payables and related charges | $ | 29,497 |

| | $ | 12,937 |

|

Notes received on the sale of fixed assets and customer accounts | $ | 544 |

| | $ | 296 |

|

NOTE 9· Legal and Regulatory Proceedings

The Company is involved in numerous pending or threatened proceedings by or against Brown & Brown, Inc. or one or more of its subsidiaries that arise in the ordinary course of business. The damages that may be claimed against the Company in these various proceedings are in some cases substantial, including in many instances claims for punitive or extraordinary damages. Some of these claims and lawsuits have been resolved, others are in the process of being resolved and others are still in the investigation or discovery phase. The Company will continue to respond appropriately to these claims and lawsuits and to vigorously protect its interests.

Although the ultimate outcome of such matters cannot be ascertained and liabilities in indeterminate amounts may be imposed on Brown & Brown, Inc. or its subsidiaries, on the basis of present information and the availability of insurance and legal advice, it is the opinion of management that the disposition or ultimate determination of such claims will not have a material adverse effect on the Company’s consolidated financial position. However, as (i) one or more of the Company’s insurance carriers could take the position that portions of these claims are not covered by the Company’s insurance, (ii) to the extent that payments are made to resolve claims and lawsuits, applicable insurance policy limits are eroded, and (iii) the claims and lawsuits relating to these matters are continuing to develop, it is possible that future results of operations or cash flows for any particular quarterly or annual period could be materially affected by the unfavorable resolution of these matters.

NOTE 10· Segment Information

Brown & Brown’s business is divided into four reportable segments: (1) the Retail Segment, which provides a broad range of insurance products and services to commercial, public and quasi-public entities, and to professional and individual customers; (2) the National Programs Segment, which acts as a MGA, provides professional liability and related package products for certain professionals, a range of insurance products for individuals, flood coverage, and targeted products and services designated for specific industries, trade groups, governmental entities and market niches, all of which are delivered through nationwide networks of independent agents, and Brown & Brown retail agents; (3) the Wholesale Brokerage Segment, which markets and sells excess and surplus commercial and personal lines insurance, primarily through independent agents and brokers, as well as Brown & Brown Retail offices; and (4) the Services Segment, which provides insurance-related services, including third-party claims administration and comprehensive medical utilization management services in both the workers’ compensation and all-lines liability arenas, as well as Medicare Set-aside services, Social Security disability and Medicare benefits advocacy services and catastrophe claims adjusting services.

Brown & Brown conducts all of its operations within the United States of America, except for one wholesale brokerage operation based in London, England, and retail operations in Bermuda and the Cayman Islands. These non-United States operations earned $3.2 million and $3.2 million of total revenues for the three months ended September 30, 2015 and 2014, respectively. These operations earned $9.3 million and $10.2 million of total revenues for the nine months ended September 30, 2015 and 2014, respectively. Long-lived assets held outside of the United States as of September 30, 2015 and 2014 were not material.

The accounting policies of the reportable segments are the same as those described in Note 1 of the Company’s Annual Report on Form 10-K for the year ended December 31, 2014. The Company evaluates the performance of its segments based upon revenues and income before income taxes. Inter-segment revenues are eliminated.

Summarized financial information concerning the Company’s reportable segments is shown in the following table. The “Other” column includes any income and expenses not allocated to reportable segments and corporate-related items, including the inter-company interest expense charge to the reporting segment.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2015 |

(in thousands) | Retail | | National Programs | | Wholesale Brokerage | | Services | | Other | | Total |

Total revenues | $ | 216,249 |

| | $ | 116,966 |

| | $ | 61,374 |

| | $ | 37,980 |

| | $ | (402 | ) | | $ | 432,167 |

|

Investment income | $ | 19 |

| | $ | 49 |

| | $ | 3 |

| | $ | — |

| | $ | 157 |

| | $ | 228 |

|

Amortization | $ | 11,552 |

| | $ | 7,133 |

| | $ | 2,441 |

| | $ | 1,022 |

| | $ | 10 |

| | $ | 22,158 |

|

Depreciation | $ | 1,632 |

| | $ | 1,850 |

| | $ | 506 |

| | $ | 474 |

| | $ | 753 |

| | $ | 5,215 |

|

Interest expense | $ | 10,121 |

| | $ | 13,398 |

| | $ | 200 |

| | $ | 1,527 |

| | $ | (15,364 | ) | | $ | 9,882 |

|

Income before income taxes | $ | 41,785 |

| | $ | 25,281 |

| | $ | 22,276 |

| | $ | 6,022 |

| | $ | 17,466 |

| | $ | 112,830 |

|

Total assets | $ | 3,400,407 |

| | $ | 2,542,619 |

| | $ | 880,454 |

| | $ | 296,659 |

| | $ | (2,117,947 | ) | | $ | 5,002,192 |

|

Capital expenditures | $ | 1,637 |

| | $ | 1,754 |

| | $ | 425 |

| | $ | 233 |

| | $ | 127 |

| | $ | 4,176 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2014 |

(in thousands) | Retail | | National Programs | | Wholesale Brokerage | | Services | | Other | | Total |

Total revenues | $ | 206,504 |

| | $ | 117,926 |

| | $ | 61,620 |

| | $ | 35,492 |

| | $ | (124 | ) | | $ | 421,418 |

|

Investment income | $ | 16 |

| | $ | 48 |

| | $ | 9 |

| | $ | — |

| | $ | 152 |

| | $ | 225 |

|

Amortization | $ | 10,920 |

| | $ | 7,343 |

| | $ | 2,676 |

| | $ | 1,034 |

| | $ | 10 |

| | $ | 21,983 |

|

Depreciation | $ | 1,632 |

| | $ | 2,143 |

| | $ | 640 |

| | $ | 555 |

| | $ | 486 |

| | $ | 5,456 |

|

Interest expense | $ | 10,882 |

| | $ | 15,915 |

| | $ | 299 |

| | $ | 1,937 |

| | $ | (21,735 | ) | | $ | 7,298 |

|

Income before income taxes | $ | 39,823 |

| | $ | 20,694 |

| | $ | 21,750 |

| | $ | 5,145 |

| | $ | 25,273 |

| | $ | 112,685 |

|

Total assets | $ | 3,163,014 |

| | $ | 2,508,815 |

| | $ | 895,943 |

| | $ | 285,307 |

| | $ | (1,907,331 | ) | | $ | 4,945,748 |

|

Capital expenditures | $ | 1,320 |

| | $ | 5,243 |

| | $ | 492 |

| | $ | 325 |

| | $ | 232 |

| | $ | 7,612 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

| For the nine months ended September 30, 2015 |

(in thousands) | Retail | | National Programs | | Wholesale Brokerage | | Services | | Other | | Total |

Total revenues | $ | 657,314 |

| | $ | 319,577 |

| | $ | 168,619 |

| | $ | 111,128 |

| | $ | (726 | ) | | $ | 1,255,912 |

|

Investment income | $ | 62 |

| | $ | 150 |

| | $ | 148 |

| | $ | 1 |

| | $ | 347 |

| | $ | 708 |

|

Amortization | $ | 33,671 |

| | $ | 21,343 |

| | $ | 7,296 |

| | $ | 3,067 |

| | $ | 29 |

| | $ | 65,406 |

|

Depreciation | $ | 4,908 |

| | $ | 5,372 |

| | $ | 1,630 |

| | $ | 1,533 |

| | $ | 2,192 |

| | $ | 15,635 |

|

Interest expense | $ | 30,841 |

| | $ | 42,306 |

| | $ | 645 |

| | $ | 4,722 |

| | $ | (49,110 | ) | | $ | 29,404 |

|

Income before income taxes | $ | 137,249 |

| | $ | 48,567 |

| | $ | 53,150 |

| | $ | 16,062 |

| | $ | 52,494 |

| | $ | 307,522 |

|

Total assets | $ | 3,400,407 |

| | $ | 2,542,619 |

| | $ | 880,454 |

| | $ | 296,659 |

| | $ | (2,117,947 | ) | | $ | 5,002,192 |

|

Capital expenditures | $ | 4,410 |

| | $ | 5,004 |

| | $ | 2,087 |

| | $ | 774 |

| | $ | 498 |

| | $ | 12,773 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

| For the nine months ended September 30, 2014 |

(in thousands) | Retail | | National Programs | | Wholesale Brokerage | | Services | | Other | | Total |

Total revenues | $ | 626,194 |

| | $ | 288,087 |

| | $ | 165,894 |

| | $ | 102,891 |

| | $ | (290 | ) | | $ | 1,182,776 |

|

Investment income | $ | 48 |

| | $ | 119 |

| | $ | 20 |

| | $ | 2 |

| | $ | 333 |

| | $ | 522 |

|

Amortization | $ | 31,812 |

| | $ | 17,512 |

| | $ | 8,028 |

| | $ | 3,101 |

| | $ | 29 |

| | $ | 60,482 |

|

Depreciation | $ | 4,850 |

| | $ | 5,503 |

| | $ | 1,890 |

| | $ | 1,646 |

| | $ | 1,449 |

| | $ | 15,338 |

|

Interest expense | $ | 33,000 |

| | $ | 33,803 |

| | $ | 1,060 |

| | $ | 5,878 |

| | $ | (55,367 | ) | | $ | 18,374 |

|

Income before income taxes | $ | 129,213 |

| | $ | 47,640 |

| | $ | 47,863 |

| | $ | 12,977 |

| | $ | 63,610 |

| | $ | 301,303 |

|

Total assets | $ | 3,163,014 |

| | $ | 2,508,815 |

| | $ | 895,943 |

| | $ | 285,307 |

| | $ | (1,907,331 | ) | | $ | 4,945,748 |

|

Capital expenditures | $ | 5,016 |

| | $ | 12,369 |

| | $ | 1,205 |

| | $ | 860 |

| | $ | 739 |

| | $ | 20,189 |

|

NOTE 11· Investments

At September 30, 2015, the Company’s amortized cost and fair values of fixed maturity securities are summarized as follows:

|

| | | | | | | | | | | | | | | |

(in thousands) | Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value |

U.S. Treasury securities, obligations of U.S. Government agencies and Municipals | $ | 15,640 |

| | $ | 74 |

| | $ | — |

| | $ | 15,714 |

|

Foreign government | 50 |

| | — |

| | — |

| | 50 |

|

Corporate debt | 5,280 |

| | 14 |

| | (5 | ) | | 5,289 |

|

Short duration fixed income fund | 1,860 |

| | 30 |

| | — |

| | 1,890 |

|

Total | $ | 22,830 |

| | $ | 118 |

| | $ | (5 | ) | | $ | 22,943 |

|

For securities in a loss position, the following table shows the investments’ gross unrealized loss and fair value, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position as of September 30, 2015:

|

| | | | | | | | | | | | | | | | | | | | | | | |

(in thousands) | Less than 12 Months | | 12 Months or More | | Total |

| Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses |

Corporate debt | 1,498 |

| | 3 |

| | 485 |

| | 2 |

| | 1,983 |

| | 5 |

|

Total | $ | 1,498 |

| | $ | 3 |

| | $ | 485 |

| | $ | 2 |

| | $ | 1,983 |

| | $ | 5 |

|

The unrealized losses from corporate issuers were caused by interest rate increases. At September 30, 2015, the Company had 15 securities in an unrealized loss position. The corporate securities are highly rated securities with no indicators of potential impairment. Based on the ability and intent of the Company to hold these investments until recovery of fair value, which may be maturity, the bonds were not considered to be other-than-temporarily impaired at September 30, 2015.

At December 31, 2014, the Company’s amortized cost and fair values of fixed maturity securities are summarized as follows:

|

| | | | | | | | | | | | | | | |

(in thousands) | Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value |

U.S. Treasury securities, obligations of U.S. Government agencies and Municipals | $ | 10,774 |

| | $ | 7 |

| | $ | (1 | ) | | $ | 10,780 |

|

Foreign government | 50 |

| | — |

| | — |

| | 50 |

|

Corporate debt | 5,854 |

| | 9 |

| | (11 | ) | | 5,852 |

|

Short duration fixed income fund | 3,143 |

| | 37 |

| | | | 3,180 |

|

Total | $ | 19,821 |

| | $ | 53 |

| | $ | (12 | ) | | $ | 19,862 |

|

The following table shows the investments’ gross unrealized loss and fair value, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position as of December 31, 2014:

|

| | | | | | | | | | | | | | | | | | | | | | | |

(in thousands) | Less than 12 Months | | 12 Months or More | | Total |

| Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses |

U.S. Treasury securities, obligations of U.S. Government agencies and Municipals | $ | 3,994 |

| | $ | 1 |

| | $ | — |

| | $ | — |

| | $ | 3,994 |

| | $ | 1 |

|

Foreign Government | 50 |

| | — |

| | — |

| | — |

| | 50 |

| | — |

|

Corporate debt | 4,439 |

| | 11 |

| | — |

| | — |

| | 4,439 |

| | 11 |

|

Total | $ | 8,483 |

| | $ | 12 |

| | $ | — |

| | $ | — |

| | $ | 8,483 |

| | $ | 12 |

|

The unrealized losses from corporate issuers were caused by interest rate increases. At December 31, 2014, the Company had 38 securities in an unrealized loss position. The contractual cash flows of the U.S. Treasury Securities and obligations of the U.S. Government agencies investments are either guaranteed by the U.S. Government or an agency of the U.S. Government. Accordingly, it is expected that the securities would not be settled at a price less than the amortized cost of the Company’s investment. The corporate securities are highly rated securities with no indicators of potential impairment. Based on the ability and intent of the Company to hold these investments until recovery of fair value, which may be maturity, the bonds were not considered to be other-than-temporarily impaired at December 31, 2014.

The amortized cost and estimated fair value of the fixed maturity securities at September 30, 2015 by contractual maturity are set forth below:

|

| | | | | | | |

(in thousands) | Amortized Cost | | Fair Value |

Years to maturity: | | | |

Due in one year or less | $ | 9,034 |

| | $ | 9,039 |

|

Due after one year through five years | 13,466 |

| | 13,569 |

|

Due after five years through ten years | 330 |

| | 335 |

|

Total | $ | 22,830 |

| | $ | 22,943 |

|

The amortized cost and estimated fair value of the fixed maturity securities at December 31, 2014 by contractual maturity are set forth below:

|

| | | | | | | |

(in thousands) | Amortized Cost | | Fair Value |

Years to maturity: | | | |

Due in one year or less | $ | 5,628 |

| | $ | 5,628 |

|

Due after one year through five years | 13,863 |

| | 13,897 |

|

Due after five years through ten years | 330 |

| | 337 |

|

Total | $ | 19,821 |

| | $ | 19,862 |

|

The expected maturities in the foregoing table may differ from the contractual maturities because certain borrowers have the right to call or prepay obligations with or without penalty.

Proceeds from sales of the Company’s investment in fixed maturity securities were $2.2 million including maturities from the period January 1, 2015 to September 30, 2015. The gains and losses realized on those sales for the period from January 1, 2015 to September 30, 2015 were insignificant.

Realized gains and losses are reported on the Condensed Consolidated Statements of Income, with the cost of securities sold determined on a specific identification basis.

At September 30, 2015, investments with a fair value of approximately $4.0 million were on deposit with state insurance departments to satisfy regulatory requirements.

NOTE 12· Losses and Loss Adjustment Reserve

Although the reinsurers are liable to the Company for amounts reinsured, Wright Flood remains primarily liable to its policyholders for the full amount of the policies written whether or not the reinsurers meet their obligations to Wright Flood when they become due. The effects of reinsurance on premiums written and earned are as follows:

|

| | | | | | | |

(in thousands) | Period from January 1, 2015 to

September 30, 2015 |

| Written | | Earned |

Direct premiums | $ | 468,761 |

| | $ | 459,552 |

|

Assumed premiums | — |

| | 18 |

|

Ceded premiums | 468,750 |

| | 459,559 |

|

Net premiums | $ | 11 |

| | $ | 11 |

|

All premiums written by Wright Flood under the National Flood Insurance Program are 100% ceded to FEMA, for which Wright Flood received a 30.8% expense allowance from January 1, 2015 through September 30, 2015. For the period from January 1, 2015 through September 30, 2015, the Company ceded $467.8 million of written premiums.

Effective April 1, 2014, Wright Flood is also a party to a quota share agreement whereby it cedes 100% of its gross excess flood premiums, which excludes fees, to Arch Reinsurance Company and receives a 30.5% commission. Wright Flood ceded $0.9 million for the period from January 1, 2015 through September 30, 2015. No loss data exists on this agreement.

Wright Flood also ceded 100% of the Homeowners, Private Passenger Auto Liability, and Other Liability Occurrence to Stillwater Insurance Company, formerly known as Fidelity National Insurance Company. This business is in runoff. Therefore, only loss data still exists on this business. As of September 30, 2015, ceded unpaid losses and loss adjustment expenses for Homeowners, Private Passenger Auto Liability and Other Liability Occurrence was $8,698, $48,254 and $756, respectively. The incurred but not reported balance was $102 for Homeowners and $39,424 for Private Passenger Auto Liability.

The reinsurance recoverable balance as of September 30, 2015 was $367.0 million and was comprised of recoverables on unpaid losses and loss expenses of $37.2 million and prepaid reinsurance premiums of $329.8 million. There was no net activity in the reserve for losses and loss adjustment expense during the period January 1, 2015 through September 30, 2015, as Wright Flood's direct premiums written were 100% ceded to three reinsurers. The balance of the reserve for losses and loss adjustment expense, excluding related reinsurance recoverable, as of September 30, 2015 was $37.2 million.

NOTE 13· Statutory Financial Information

Wright Flood is required to maintain minimum amounts of statutory capital and surplus of $7.5 million as required by regulatory authorities. Wright Flood’s statutory capital and surplus exceeded their respective minimum statutory requirements. The unaudited statutory capital and surplus of Wright Flood was $14.2 million at September 30, 2015. For the period from January 1, 2015 through September 30, 2015, Wright Flood generated statutory net income of $3.2 million.

NOTE 14· Subsidiary Dividend Restrictions

Under the insurance regulations of Texas, the maximum amount of ordinary dividends that Wright Flood can pay to shareholders in a rolling twelve month period is limited to the greater of 10% of statutory adjusted capital and surplus as shown on Wright Flood’s last annual statement on file with the superintendent of the Texas Department of Insurance or 100% of adjusted net income. The maximum dividend payout that may be made in 2015 without prior approval is $2.3 million.

NOTE 15· Shareholders’ Equity

On July 21, 2014, the Company’s Board of Directors authorized the repurchase of up to $200.0 million of its shares of common stock. This was in addition to the $25.0 million that was authorized in the first quarter and executed in the second quarter of 2014. On September 2, 2014, the Company entered into an accelerated share repurchase agreement (“ASR”) with an investment bank to purchase an aggregate $50.0 million of the Company’s common stock. The total number of shares purchased under the ASR of 1,539,760 was determined upon settlement of the final delivery and was based on the Company’s volume weighted average price per its common share over the ASR period less a discount.

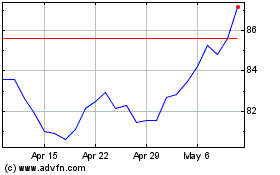

On March 5, 2015, the Company entered into a second ASR with an investment bank to purchase an aggregate $100.0 million of the Company’s common stock. As part of the ASR, the Company received an initial delivery of 2,667,992 shares of the Company’s common stock with a fair market value of approximately $85.0 million. The initial delivery of 2,667,992 shares reduced the outstanding shares used to determine the Company’s weighted average shares outstanding for purposes of calculating basic and diluted earnings per share. On August 6, 2015, the Company was notified by its investment bank that the March 5, 2015 ASR agreement between the Company and the investment bank had been completed in accordance with the terms of the agreement. The investment bank delivered to the Company an additional 391,637 shares of the Company’s common stock for a total of 3,059,629 shares repurchased under the agreement. The delivery of the remaining 391,637 shares occurred on August 11, 2015. With the latest delivery of 391,637 shares, a total of 5,444,389 shares have been repurchased since the first quarter of 2014.

On July 20, 2015, the Company’s Board of Directors authorized the repurchase of up to an additional $400.0 million of the Company's outstanding common stock. With this authorization, the Company has approval to repurchase up to $450.0 million, in the aggregate, of the Company's outstanding common stock. The shares may be purchased from time to time, at the Company’s discretion and subject to the availability of stock, market conditions, the trading price of the stock, alternative uses for capital, the Company’s financial performance and other potential factors. These purchases may be carried out through open market purchases, block trades, accelerated share repurchase plans of up to $100.0 million each (unless otherwise approved by the Board of Directors), negotiated private transactions or pursuant to any trading plan that may be adopted in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934.

ITEM 2 — MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

THE FOLLOWING DISCUSSION UPDATES THE MD&A CONTAINED IN THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014, AND THE TWO DISCUSSIONS SHOULD BE READ TOGETHER.

GENERAL

Company Overview — Third Quarter of 2015

The following discussion should be read in conjunction with our Condensed Consolidated Financial Statements and the related Notes to those Financial Statements included elsewhere in this Quarterly Report on Form 10-Q.

We are a diversified insurance agency, wholesale brokerage, insurance programs and services organization headquartered in Daytona Beach, Florida. As an insurance intermediary, our principal sources of revenue are commissions paid by insurance companies and, to a lesser extent, fees paid directly by customers. Commission revenues generally represent a percentage of the premium paid by an insured and are affected by fluctuations in both premium rate levels charged by insurance companies and the insureds’ underlying “insurable exposure units,” which are units that insurance companies use to measure or express insurance exposed to risk (such as property values, or sales and payroll levels) to determine what premium to charge the insured. Insurance companies establish these premium rates based upon many factors, including reinsurance rates paid by such insurance companies, none of which we control.

The volume of business from new and existing customers, fluctuations in insurable exposure units, changes in premium rate levels, and changes in general economic and competitive conditions all affect our revenues. For example, level rates of inflation or a general decline in economic activity could limit increases in the values of insurable exposure units. Conversely, the increasing costs of litigation settlements and awards have caused some customers to seek higher levels of insurance coverage. We foster a strong, decentralized sales and service culture with the goal of consistent, sustained growth over the long term. Historically, our revenues have typically grown as a result of our focus on net new business growth and acquisitions.

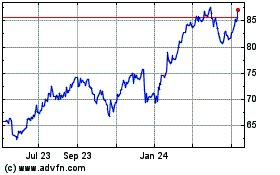

We increased revenues every year from 1993 to 2014, with the exception of 2009, when our revenues dropped 1.0%. Our revenues grew from $95.6 million in 1993 to $1.6 billion in 2014, reflecting a compound annual growth rate of 14.2%. In the same 21-year period, we increased net income from $8.1 million to $206.9 million in 2014, a compound annual growth rate of 16.7%.