UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 11-K

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

| |

ý | Annual Report Pursuant to Section 15(d) of The Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2014

OR

|

| |

c | Transition Report Pursuant to Section 15(d) of The Securities Exchange Act of 1934 |

For The Transition Period From To .

Commission file number 001-13619

| |

A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

BROWN & BROWN, INC.

EMPLOYEE SAVINGS PLAN AND TRUST

| |

B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

BROWN & BROWN, INC.

220 SOUTH RIDGEWOOD AVENUE

DAYTONA BEACH, FLORIDA 32114

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE

TABLE OF CONTENTS

|

| |

| |

| Page |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| |

FINANCIAL STATEMENTS: | |

| |

Statements of Net Assets Available for Benefits as of December 31, 2014 and 2013 | |

| |

Statement of Changes in Net Assets Available for Benefits for the Year Ended December 31, 2014 | |

| |

Notes to Financial Statements | |

| |

SUPPLEMENTAL SCHEDULE: | |

| |

Form 5500, Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2014 | |

| |

SIGNATURE | |

| |

EXHIBIT INDEX | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees

Brown & Brown, Inc. Employee Savings Plan and Trust

Daytona Beach, Florida

We have audited the accompanying statements of net assets available for benefits of the Brown & Brown, Inc. Employee Savings Plan and Trust (the Plan) as of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of the Plan’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis of designing audit procedures that are appropriate in the circumstances, but not for expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan at December 31, 2014 and 2013, and the changes in net assets available for benefits for the year ended December 31, 2014, in conformity with accounting principles generally accepted in the United States of America.

The accompanying supplemental schedule of assets (held at end of year) as of and for the year ended December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

Respectfully submitted,

|

|

|

/s/ Hancock Askew & Co., LLP |

|

|

Norcross, Georgia |

June 25, 2015 |

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

AS OF DECEMBER 31, 2014 AND 2013

|

| | | | | | | |

| | | |

| 2014 | | 2013 |

ASSETS | | | |

CASH | $ | 3,451 |

| | $ | — |

|

INVESTMENTS: | | | |

Participant directed—at fair value: | | | |

Registered investment companies (mutual funds) | 340,717,332 |

| | 307,368,187 |

|

Pooled separate account | 53,595,461 |

| | 51,529,552 |

|

Employer common stock | 34,167,658 |

| | 39,476,772 |

|

Personal choice retirement account | 14,421,839 |

| | 13,033,997 |

|

Total investments, at fair value | 442,902,290 |

| | 411,408,508 |

|

NOTES RECEIVABLES FROM PARTICIPANTS | 9,619,162 |

| | 9,280,622 |

|

RECEIVABLES: | | | |

Employer contributions | 1,017,373 |

| | 6,154,438 |

|

Participant contributions | 3,294 |

| | 13,923 |

|

Total receivables | 1,020,667 |

| | 6,168,361 |

|

TOTAL ASSETS REFLECTING INVESTMENTS AT FAIR VALUE | 453,545,570 |

| | 426,857,491 |

|

PAYABLE TO PARTICIPANTS FOR EXCESS CONTRIBUTIONS | — |

| | (408,207 | ) |

NET ASSETS AVAILABLE FOR BENEFITS, before adjustment | 453,545,570 |

| | 426,449,284 |

|

Adjustment from fair value to contract value for fully benefit-responsive investment contracts | (739,977 | ) | | (408,967 | ) |

NET ASSETS AVAILABLE FOR BENEFITS | $ | 452,805,593 |

| | $ | 426,040,317 |

|

See notes to financial statements.

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

FOR THE YEAR ENDED DECEMBER 31, 2014

|

| | | |

| |

ADDITIONS: | |

Investment income: | |

Dividend income | $ | 15,944,432 |

|

Interest income | 1,150,179 |

|

Other income | 675,604 |

|

Net appreciation in fair value of investments | 7,547,295 |

|

Total investment income | 25,317,510 |

|

Interest on note receivables from participants | 352,001 |

|

Contributions: | |

Participants | 29,110,655 |

|

Employer | 15,623,511 |

|

Rollovers from other qualified plans | 5,357,206 |

|

Total contributions | 50,091,372 |

|

Total additions | 75,760,883 |

|

DEDUCTIONS: | |

Benefits paid to participants | 48,233,278 |

|

Administrative expenses | 765,042 |

|

Total deductions | 48,998,320 |

|

NET INCREASE IN ASSETS AVAILABLE FOR BENEFITS | 26,762,563 |

|

TRANSFERS IN | 2,713 |

|

NET ASSETS AVAILABLE FOR BENEFITS—Beginning of year | 426,040,317 |

|

NET ASSETS AVAILABLE FOR BENEFITS —End of year | $ | 452,805,593 |

|

See notes to financial statements.

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2014 AND 2013, AND FOR THE YEAR ENDED DECEMBER 31, 2014

| |

1. | DESCRIPTION OF THE PLAN |

The following brief description of the Brown & Brown, Inc. Employee Savings Plan and Trust (the “Plan”) is provided for general information purposes only. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General —The Plan is a defined contribution plan. Substantially all employees who are at least 18 years of age and who are expected to complete a year of service (1,000 hours) are eligible to participate in the Plan effective the first full payroll period after one month of service. The Plan is intended to assist Brown & Brown, Inc. and its subsidiaries (the “Employer”) in its efforts to attract and retain employees by enabling eligible employees who are U.S. citizens with the opportunity to invest a portion of their annual compensation in the Plan, augmented by employer contributions, to supplement the employees' retirement income. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Benefit Payments —Benefits under the Plan are payable upon normal (after age 65) or early (after age 59-1/2) retirement, death, disability, severe financial hardship, or termination of service and are based on the vested balance in the participant’s account. Distributions of vested account balances will be made in the form of a single lump-sum payment or in some other optional form of payment, as defined in the Plan. If the participant’s vested account is $5,000 or less, the participant will be prompted to distribute his or her funds to another qualified plan in a timely fashion or be subject to an immediate lump-sum distribution.

Administration —The Plan is administered by a designated Plan Administrator (the “Administrator”), which has been appointed by the Board of Directors (the “Board”) of the Employer. Information about the Plan document, such as provisions for allocations to participants’ accounts, vesting, benefits, and withdrawals, is contained in the Summary Plan Description. Copies of this document are available on the employee benefits Web site accessible to employees of the Employer or from the Administrator. Schwab Retirement Plan Services, Inc (“Schwab”) serves as the recordkeeper of the Plan and Charles Schwab Trust Company, a division of Charles Schwab Bank (the “Trustee”) serves as the trustee of the Plan.

Administrative Expenses — All investment-related expenses are charged against Plan earnings or are paid by the Plan. All other expenses are paid by the Employer.

Contributions —Participants may elect to contribute, subject to certain limitations, any percentage of annual compensation as contributions to the Plan, up to the allowable limits specified in the Internal Revenue Code. Effective for Plan years beginning on or after January 1, 2014, the Plan has been amended to provide that the Employer will make a fully vested safe harbor matching contribution for each participant equal to the sum of (1) 100% of the participant’s elective deferrals that do not exceed 3% of compensation for the allocation period, plus (2) 50% of the participant’s elective deferrals that exceed 3% of compensation for the allocation period but do not exceed 5% of compensation for the allocation period. For plan years beginning before January 1, 2014, the Employer made matching contributions to the Plan of 100% of each participant’s contribution, not to exceed 2.5% of each participant’s eligible compensation on a pay-period basis.

The Plan permits the Board of Directors of the Employer to authorize discretionary profit-sharing contributions allocated to participants based on 1.5% of eligible compensation, up to a maximum of $255,000 of eligible compensation. No profit-sharing contributions were made in 2014.

Vesting —Participants are immediately vested in their voluntary contributions plus actual earnings thereon. Vesting in the Employer matching contributions for plan years beginning before January 1, 2014, and for discretionary profit-sharing contributions are based on years of credited service and are subject to the following vesting schedule:

|

| | | |

Years of

Credited Service | | Vested

Interest |

| | |

Less than 1 | | 0 | % |

1 | | 20 |

|

2 | | 40 |

|

3 | | 60 |

|

4 | | 80 |

|

5 or more | | 100 |

|

For Plan years starting on or after January 1, 2014, the forfeited balances of terminated participants’ non-vested accounts are no longer available to reduce employer matching contribution amounts. As of December 31, 2014, forfeited employee amounts available to offset future Plan expenses totaled approximately $499,000. No forfeitures were used in 2014 to offset Plan expenses.

For Plan years ending on or before December 31, 2013, forfeited balances of terminated participants’ non-vested accounts are available to offset Plan expenses and to reduce future Employer contributions. As of December 31, 2013, forfeited amounts available to offset future Employer contributions totaled approximately $575,000. During 2014, approximately $850,000 of forfeited amounts was used to offset Employer contributions receivable, relating predominately to the employer profit sharing contributions authorized in 2013 and funded in 2014.

Investment Income and Expenses —Each participant’s account shall be allocated the investment income and expenses of each fund based on the value of each participant’s account invested in each fund, in proportion to the total value of all accounts in each fund, taking into account any contributions to or distributions from the participant’s account in each fund. General expenses of the Plan not paid by the Employer and not attributable to any particular fund shall be allocated among participants’ accounts in proportion to the value of each account, taking into consideration each participant’s contributions and distributions.

The agreement between the Trustee and the Plan includes a revenue-sharing arrangement whereby the Trustee shares revenue generated by the Plan in excess of the Trustee's fee. These deposits are included in the "Other Income" amount in the Statement of Changes to Net Assets Available for Benefits. These funds are used to pay other plan expenses with any remaining amounts being reallocated to participants. During 2014, revenue of approximately $174,000 was deposited into the Plan related to this revenue sharing arrangement. Additionally $5,000 was deposited in 2014 due to a prior year adjustment. At December 31, 2014 and 2013, approximately $80,000 and $45,000, respectively, was available to be reallocated or pay plan expenses. During 2014, Plan expenses of approximately $144,000 were paid by these funds and $0 was reallocated to participants. The remaining $80,000 available as of December 31, 2014 was allocated to all participant accounts on or around February 5, 2015

Notes Receivable from Participants —A participant may borrow from his or her own account a minimum of $1,000, up to a maximum equal to the lesser of $50,000 or 50% of the participant’s vested account balance. Participants may not have more than two loans outstanding at any time, with a limited exception for grandfathered outstanding loans transferred to the Plan as a result of mergers of plans maintained by acquired companies. Loans, which are repayable each pay period for periods ranging generally up to five years (and up to 15 years for the purchase of a principal residence), are collateralized by a security interest in the borrower’s vested account balance. The loans bear interest at the rate of prime plus 1%, determined at the time the loan is approved. As of December 31, 2014, interest rates applicable to such loans ranged from 4.25% to 9.25%.

| |

2. | USE OF ESTIMATES AND SIGNIFICANT ACCOUNTING POLICIES |

Use of Estimates —The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of net assets available for benefits and changes therein. Actual results could differ from those estimates.

Basis of Accounting —The accompanying financial statements of the Plan are presented on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Notes Receivable from Participants - Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expenses when they are incurred. No allowance for credit losses has been recorded as of December 31, 2014 and 2013. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

Payment of Benefits – Benefits are recorded when paid.

Valuation of Investments —The Plan’s investments in money market funds, mutual funds, Employer common stock, and the personal choice retirement account, which includes investments in mutual funds and common stock, are stated at fair value based on quoted market prices at year-end. The fair value of the pooled separate accounts is based upon the value of the underlying assets as determined by the Trustee’s valuation. The contract value of participation units owned in the pooled separate accounts is based on quoted redemption values, as determined by the Trustee, on the last business day of the Plan year. Participant loans are valued at cost, which approximates fair value.

The Plan invests in fully benefit-responsive investment contracts held in the Wells Fargo Stable Return Fund G as of December 31, 2014 and 2013. Investment contracts held in a defined-contribution plan are required to be reported at fair value. However, contract value is the relevant measurement attribute for that portion of the net assets available for benefits of a defined-contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount

participants would receive if they were to initiate permitted transactions under terms of the Plan. The Statements of Net Assets Available for Benefits presents the fair value of these investment contracts as well as their adjustment from fair value to contract value. The Statement of Changes in Net Assets Available for Benefits is prepared on a contract value basis.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on an accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation includes the Plan's gains and losses on investments bought and sold as well as investments held during the year.

Fair Value Measurements—The Plan adopted a fair value measurement method that establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are described below:

Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 - Quoted prices in markets that are not considered to be active or financial instruments for which all significant inputs are observable, either directly or indirectly;

Level 3 - Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

The fair values estimated and derived from each fair value calculation may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with those utilized by other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following tables set forth by level within the fair value hierarchy the Plan investment assets and investment liabilities at fair value, as of December 31, 2014 and 2013. As required by Accounting Standards Codification Topic 820—Fair Value Measurements and Disclosures, assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

|

| | | | | | | | | | | | | | | |

| Investment Assets at Fair

Value as of December 31, 2014 | | |

| Level 1 | | Level 2 | | Level 3 | | Total |

Registered investment companies (mutual funds): | | | | | | | |

Index funds | $ | 93,380,732 |

| | $ | — |

| | $ | — |

| | $ | 93,380,732 |

|

Value funds | 61,578,891 |

| | — |

| | — |

| | 61,578,891 |

|

Growth funds | 54,131,527 |

| | — |

| | — |

| | 54,131,527 |

|

Bond funds | 56,162,539 |

| | — |

| | — |

| | 56,162,539 |

|

Growth and Income funds | 39,110,723 |

| | — |

| | — |

| | 39,110,723 |

|

Asset Allocation/Retirement Strategy funds | 36,352,920 |

| | — |

| | — |

| | 36,352,920 |

|

Total - Registered investment companies(mutual funds): | 340,717,332 |

| | — |

| | — |

| | 340,717,332 |

|

Pooled separate accounts | | | | | | | |

Stable Value Fund | — |

| | 53,595,461 |

| | — |

| | 53,595,461 |

|

Employer common stock | 34,167,658 |

| | — |

| | — |

| | 34,167,658 |

|

Personal choice accounts | | | | | | | |

Cash | 58,347 |

| | — |

| | — |

| | 58,347 |

|

Money market funds | 2,015,292 |

| | — |

| | — |

| | 2,015,292 |

|

Registered investment companies (mutual funds | 2,363,491 |

| | — |

| | — |

| | 2,363,491 |

|

Common stock | 6,242,076 |

| | — |

| | — |

| | 6,242,076 |

|

Preferred stock | 5,979 |

| | — |

| | — |

| | 5,979 |

|

Pooled separate accounts | — |

| | 3,736,654 |

| | — |

| | 3,736,654 |

|

Total –Personal choice accounts | 10,685,185 |

| | 3,736,654 |

| | — |

| | 14,421,839 |

|

Total investments at fair value | $ | 385,570,175 |

| | $ | 57,332,115 |

| | $ | — |

| | $ | 442,902,290 |

|

|

| | | | | | | | | | | | | | | |

| Investment Assets at Fair

Value as of December 31, 2013 | | |

| Level 1 | | Level 2 | | Level 3 | | Total |

Registered investment companies (mutual funds): | | | | | | | |

Index funds | $ | 77,317,034 |

| | $ | — |

| | $ | — |

| | $ | 77,317,034 |

|

Value funds | 55,715,216 |

| | — |

| | — |

| | 55,715,216 |

|

Growth funds | 53,637,527 |

| | — |

| | — |

| | 53,637,527 |

|

Bond funds | 53,250,520 |

| | — |

| | — |

| | 53,250,520 |

|

Growth and Income funds | 37,074,715 |

| | — |

| | — |

| | 37,074,715 |

|

Asset Allocation/Retirement Strategy funds | 30,373,175 |

| | — |

| | — |

| | 30,373,175 |

|

Total - Registered investment companies(mutual funds): | 307,368,187 |

| | — |

| | — |

| | 307,368,187 |

|

Pooled separate accounts | | | | | | | |

Stable Value Fund | — |

| | 51,529,552 |

| | — |

| | 51,529,552 |

|

Employer common stock | 39,476,772 |

| | — |

| | — |

| | 39,476,772 |

|

Personal choice accounts | | | | | | | |

Cash | 44,843 |

| | — |

| | — |

| | 44,843 |

|

Money market funds | 1,916,055 |

| | — |

| | — |

| | 1,916,055 |

|

Registered investment companies (mutual funds | 2,228,576 |

| | — |

| | — |

| | 2,228,576 |

|

Common stock | 5,371,866 |

| | — |

| | — |

| | 5,371,866 |

|

Preferred stock | 4,543 |

| | — |

| | — |

| | 4,543 |

|

Pooled separate accounts | — |

| | 3,468,114 |

| | — |

| | 3,468,114 |

|

Total –Personal choice accounts | 9,565,883 |

| | 3,468,114 |

| | — |

| | 13,033,997 |

|

Total investments at fair value | $ | 356,410,842 |

| | $ | 54,997,666 |

| | $ | — |

| | $ | 411,408,508 |

|

Risks and Uncertainties—Investments —The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

The fair value of individual investments that represent five percent or more of the Plan’s net assets available for benefits as of December 31, 2014 and 2013, respectively, are summarized as follows:

|

| | | | | | | |

| 2014 | | 2013 |

| | | |

Employer common stock | $ | 34,167,658 |

| | $ | 39,476,772 |

|

Harbor Capital Appreciation Fund | 36,641,960 |

| | 33,805,865 |

|

Invesco Growth and Income R5 Fund | 37,516,472 |

| | 33,676,544 |

|

Pimco Total Return Bond Administration Fund | 28,547,805 |

| | 29,305,120 |

|

Vanguard Institutional Index Fund | 64,077,672 |

| | 54,643,927 |

|

Wells Fargo Stable Return Fund G* | 53,595,461 |

| | 51,529,552 |

|

| |

* | Wells Fargo Stable Return Fund G is shown at fair value. Contract Value was $52,855,484 and $51,120,585 at December 31, 2014 and 2013, respectively. |

During the year ended December 31, 2014, the fair value of the Plan’s investments appreciated (depreciated) in the amounts shown:

|

| | | |

| Amount |

| |

Mutual funds | $ | 5,225,733 |

|

Employer common stock | 1,649,276 |

|

Pooled separate accounts | 672,523 |

|

Personal choice retirement accounts | (237 | ) |

Net appreciation in fair value of investments | $ | 7,547,295 |

|

As of December 31, 2014, contributions to the Plan were invested in one or more of various investment fund options, including money market funds, mutual funds and Employer Company stock, at the direction of each participant. The Plan also allows participants to invest in the Charles Schwab & Co. Personal Choice Retirement Account, which enables each participant to self-direct his or her money into a full range of investment options, including individual stocks and bonds, as well as allowing access to over 800 additional mutual funds. The Charles Schwab & Co. Personal Choice Retirement Account is presented as “self-directed investments” in the accompanying statements of net assets available for benefits.

One investment in the Plan is a guaranteed pooled separate account managed by Wells Fargo Bank called the Stable Return Fund G (the “Stable Return Fund”), which invests in a variety of investment contracts such as guaranteed investment contracts (“GICs”) issued by insurance companies and other financial institutions and other investment products (such as separate account contracts and synthetic GICs) with similar characteristics. The Stable Return Fund investment in each contract is presented at fair value. The fair value of a GIC is based on the present value of future cash flows using the current discount rate. The fair value of a security-backed contract includes the value of the underlying securities and the value of the wrapper contract. The fair value of a wrapper contract provided by a security-backed contract issuer is the present value of the difference between the current wrapper fee and the contracted wrapper fee.

An adjustment is made to the fair value in the statements of net assets available for benefits to present the investment at contract value. Contract value is based upon contributions made under the contract, plus interest credited, less participant withdrawals. There are no reserves against contract value for credit risk of the contract issuer or otherwise. The crediting interest rate is effective for a 12-month period and is set annually. The crediting interest rate is determined based on (i) the projected market yield-to-maturity of the market value of assets, net of expenses, (ii) the timing and amounts of deposits, transfers, and withdrawals expected to be made during the interest crediting period, and (iii) the amortization of the difference between the fair value of the pooled separate account and the balance of the Stable Return Fund. The crediting interest rate for the Stable Return Fund for the years ended December 31, 2014 and 2013, was 1.64% and 1.52%, respectively. The average yield for the Stable Return Fund for the years ended December 31, 2014 and 2013, was 1.40% and 1.36%, respectively.

There is no event that limits the ability of the Plan to transact at contract value with the issuer. There are also no events or circumstances that would allow the issuer to terminate the fully benefit-responsive investment contract with the Plan and settle at an amount different from contract value.

| |

5. | PARTY-IN-INTEREST TRANSACTIONS |

The Plan’s investments include Brown & Brown, Inc. common stock, which represents party-in-interest transactions that qualify as exempt prohibited transactions. Additionally, through the personal choice retirement account, certain investments are managed by affiliates of the Trustee of the Plan.

The Plan issues notes to participants, which are secured by the balances in the participants’ accounts. These transactions qualify as party-in-interest transactions.

Although it has not expressed any intent to do so, the Employer may terminate the Plan at any time, either wholly or partially, by notice in writing to the participants and the Trustee. Upon termination, the rights of participants in their accounts will become 100% vested. The Employer may temporarily discontinue contributions to the Plan, either wholly or partially, without terminating the Plan.

| |

7. | FEDERAL INCOME TAX STATUS |

Effective July 1, 2009, the sponsor adopted the 401(k) non-standardized prototype plan sponsored by the Charles Schwab Company. Prior to January 1, 2011, the Plan was entitled to limited reliance on the opinion letter received by Schwab from the Internal Revenue Service with respect to compliance with the form requirements of the Internal Revenue Code of 1986, as amended (“IRC”). Effective January 1, 2011, the Plan was amended and restated as an individually-designed plan with a portion of the Plan designated as an employee stock ownership plan. An application for a determination letter from the Internal Revenue Service was submitted on August 9, 2012 and is pending. The Plan’s management believes that the Plan is designed and is currently being operated in compliance with applicable requirements of the IRC and regulations issued thereunder and, therefore, believes the Plan, as amended and restated, is qualified and the related trust is tax exempt.

Accounting principles generally accepted in the United States of America require Plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes the Plan is not subject to income tax examinations for years prior to 2011.

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Participant directed: | | |

Mutual funds: | | |

American Beacon Small Cap Value Fund | | $ | 11,462,762 |

|

American Funds Europacific Growth Fund | | 19,003,501 |

|

Harbor Capital Appreciation Fund | | 36,641,960 |

|

Harbor International Fund | | 18,809,847 |

|

Invesco Growth and Income Fund | | 37,516,472 |

|

JP Morgan Mid Cap Value Fund | | 12,599,658 |

|

Loomis Sayles Small Cap Growth Fund | | 8,532,785 |

|

Morgan Stanley Mid Cap Growth Fund | | 8,956,782 |

|

PIMCO Real Return Bond Administration Fund | | 14,779,828 |

|

PIMCO Total Return Bond Administration Fund | | 28,547,805 |

|

Vanguard Institutional Index Fund | | 64,077,672 |

|

Vanguard Mid Cap Index Fund | | 11,377,253 |

|

Vanguard Small Cap Index Fund | | 9,427,780 |

|

Vanguard Target Retirement 2015 Fund | | 3,715,553 |

|

Vanguard Target Retirement 2020 Fund | | 6,917,582 |

|

Vanguard Target Retirement 2025 Fund | | 6,895,722 |

|

Vanguard Target Retirement 2030 Fund | | 6,154,097 |

|

Vanguard Target Retirement 2035 Fund | | 4,727,651 |

|

Vanguard Target Retirement 2040 Fund | | 2,375,284 |

|

Vanguard Target Retirement 2045 Fund | | 3,321,278 |

|

Vanguard Target Retirement 2050 Fund | | 2,245,752 |

|

Vanguard Target Retirement Income Fund | | 1,297,374 |

|

Vanguard Total Bond Market Index Fund | | 12,834,906 |

|

Vanguard Total International Stock Index Fund | | 8,498,028 |

|

Total mutual funds | | $ | 340,717,332 |

|

Pooled separate account—at fair value— Wells Fargo Stable Return Fund G | | $ | 53,595,461 |

|

* Employer common stock—at fair value | | $ | 34,167,658 |

|

Self-directed: | | |

Personal choice retirement account: | | |

* Money market fund—at fair value— Charles Schwab Money Market Funds | | $ | 2,015,293 |

|

Non-interest-bearing cash | | $ | 58,346 |

|

(Continued)

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Corporate common stocks—at fair value: | | |

AT&T Inc | | $ | 27,248 |

|

Abattis Bioceuticals | | 4,425 |

|

Abbott Laboratories | | 2,505 |

|

AFLAC | | 1,743 |

|

Alamo Group Inc | | 19,544 |

|

Ablemarle Corp | | 421 |

|

Alibaba Group Hldg A | | 216,715 |

|

Alliant Energy Corp | | 14,945 |

|

Allianz SE ADR | | 1,160 |

|

Alpha Natural Resources | | 2,505 |

|

Amazon Com Inc | | 14,586 |

|

Ambarella Inc | | 7,608 |

|

Ambev SA ADR | | 3,110 |

|

American Diversified Holdings Inc | | 1,972 |

|

American Axel & Manufacturing Hldg | | 1,355 |

|

American Capital Agency | | 3,476 |

|

American Express Co | | 27,912 |

|

American International Group | | 28,005 |

|

Apple Inc | | 310,641 |

|

Arch Cap Group Ltd New F | | 47,280 |

|

Archer Daniels Midland Co | | 2,375 |

|

Axxess Phara Inc. | | 62 |

|

B C E Inc New | | 13,758 |

|

Baidu Com Inc ADR. | | 11,399 |

|

Baker Hughes Inc | | 5 |

|

Banco Latinoamericano | | 2,184 |

|

Banco Santander Cent ADRF | | 950 |

|

Bancolumbia S.A. ADR | | 144 |

|

Bank of America Corp | | 254,226 |

|

Bank of New York Co New | | 2,693 |

|

BASF SE ADR | | 1,668 |

|

Bayerische Motoren Werke A G | | 1,069 |

|

BBX Capital Corp | | 263 |

|

Berkshire Hathaway B New | | 206,456 |

|

Bioadpatives Inc | | 1 |

|

Blackrock Inc | | 103,692 |

|

Block H & R Inc | | 1,010 |

|

Blue Nile Inc | | 7,202 |

|

Boeing Co | | 7,506 |

|

BP PLC ADR | | 162,010 |

|

Brinker International Inc | | 22,947 |

|

| | (Continued)

|

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Corporate common stocks—at fair value: | | |

Buffalo Wild Wings Inc | | $ | 18,038 |

|

Calamp Corp | | 10,065 |

|

California Res Corp | | 849 |

|

Canadian Natl Ry Co | | 70,977 |

|

Cara Therapeutics Inc | | 997 |

|

Cardinal Health Inc | | 24,219 |

|

Caterpillar Inc | | 2,195 |

|

Cheniere Energy Inc New | | 3,520 |

|

Chevron Corp | | 37,527 |

|

China Precision Stl New | | 53 |

|

Chinacache Intl Hldg ADRF | | 4,595 |

|

Chipotle Mexican Grill | | 34,226 |

|

Cincinnati Financial CP | | 13,673 |

|

Cinedigm Corp CL A | | 65 |

|

Cisco System Inc | | 15,249 |

|

Citigroup Inc | | 41,283 |

|

Citrix Systems Inc | | 63,800 |

|

Clearsign Combustion | | 15,393 |

|

Coca Cola Company | | 6,333 |

|

Comcast Corp A | | 53,253 |

|

Conagra Foods Inc | | 17,996 |

|

ConocoPhillips | | 24,856 |

|

Continental Resources | | 1,343 |

|

Cooper Tire & Rubber Co | | 10,926 |

|

Corning Inc | | 18,001 |

|

Costco Whsl Corp New | | 16,638 |

|

Cracker Barrel Old Ctry | | 5,630 |

|

Cray Inc | | 379 |

|

CSX Corp | | 36,230 |

|

Cyberark Software Ltd F | | 15,860 |

|

Delta Air Lines Inc New | | 5,411 |

|

Deutche Bank New | | 1,651 |

|

DHT Holdings Inc New | | 1,213 |

|

Diageo PCL | | 5,705 |

|

Disney Walt Hldg Co | | 6,782 |

|

Dow Chemical Company | | 1,157 |

|

Dryships Inc | | 530 |

|

Du Pont E I De Nemours & Co | | 1,500 |

|

Dunkin Brands Group Inc | | 4,474 |

|

E M C Corp Mass | | 28,253 |

|

E O G Resources Inc | | 27,621 |

|

Eaton Corp PLC | | 33,980 |

|

| | (Continued) |

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Corporate common stocks—at fair value: | | |

El Capitan Precious Metal | | $ | 10 |

|

El Pollo Loco Hldgs | | 12,481 |

|

Elephant Talk Communications Corp New | | 42 |

|

Endexx Corporation | | 370 |

|

Energous Corp | | 5,480 |

|

Energy Focus Inc New | | 4,126 |

|

Envision Healthcare | | 69,380 |

|

Eworld Companies Inc New | | 36 |

|

Express Scripts Holding Company | | 33,868 |

|

Extreme Networks Inc | | 6,531 |

|

Exxon Mobil Corporation | | 170 |

|

Facebook Inc Class A | | 166,729 |

|

Fiat Chrysler Automobiles New | | 266 |

|

Figo Ventures Inc | | 8 |

|

Fireeye Inc | | 37,107 |

|

Ford Motor Company New | | 52,884 |

|

Freddie Mac Voting Shs | | 2,060 |

|

Freeport-McMoran Copper & Gold | | 11,516 |

|

Fresh Market Inc | | 8,240 |

|

Gale Force Pete | | 6 |

|

General Electric Company | | 39,739 |

|

Generex Biotechnology Corp Del | | 165 |

|

Gilead Science Inc | | 3,770 |

|

Glaxosmithkline PLC ADRF | | 1,069 |

|

Glemark Capital Cor | | 532 |

|

Globalstar Inc | | 4,744 |

|

Gogo Inc | | 5,786 |

|

Goldman Sachs Group Inc | | 1,378 |

|

Google Inc | | 11,054 |

|

Google Inc Class A | | 40,861 |

|

GoPro Inc | | 59,111 |

|

Grainger W W Inc | | 25,489 |

|

Greenbrier Co | | 1,075 |

|

Groupon Inc Cl A | | 1,239 |

|

GT Advanced Techs Inc | | 166 |

|

GW Pharmaceutic PLC | | 10,152 |

|

Hain Celestial Group | | 29,145 |

|

Halliburton Co Holding Co | | 257,612 |

|

Hangover Joes Holding Co | | 1,807 |

|

Harley Davidson Co | | 6,591 |

|

Harman Intl Industries Inc New | | 10,671 |

|

Hartford Financial Services Group Inc | | 417 |

|

Health Care Real Estate Invt Trust | | 6,779 |

|

Helmerich & Payne Inc | | 1,379 |

|

Herbalife Ltd | | 1,885 |

|

| | (Continued) |

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Corporate common stocks—at fair value: | | |

Hertz Global Hldgs Inc | | $ | 2,494 |

|

Highbank Resources | | 271 |

|

Home Depot Inc | | 89,225 |

|

Homeinns Hotel Group ADR F | | 6,004 |

|

Honda Motor Co Ltd ADR | | 1,033 |

|

Honeywell International | | 4,996 |

|

Hormel Foods Corp | | 8,890 |

|

Imageware Systems Inc | | 12,000 |

|

Infineon Tech AG ADR | | 1,331 |

|

Infinite Group Inc New | | 80 |

|

Intel Corp | | 22,942 |

|

JP Morgan Chase & Co | | 22,122 |

|

JA Energy | | 25 |

|

Jack in the Box Inc | | 7,996 |

|

JD.Com Inc | | 18,512 |

|

Johnson & Johnson | | 27,201 |

|

Joint Corp | | 638 |

|

K L A Tencor Corp | | 1,055 |

|

Kandi Technologies Corp | | 1,401 |

|

Kinder Morgan Holdco LLC | | 82,170 |

|

Kirin International Holdings | | 50 |

|

Kraft Foods Group Inc | | 1,253 |

|

Kroger Co | | 5,615 |

|

Landec Corp | | 6,905 |

|

Las Vegas Sands Corp | | 363,450 |

|

Leapfrog Enterprises Inc | | 4,720 |

|

Lendingclub Corp | | 2,530 |

|

Lighting Science Group New | | 276 |

|

Limelight Networks Inc | | 404 |

|

Lorillard Inc | | 1,038 |

|

Lowes Companies | | 16,856 |

|

Maiden Holding Ltd | | 806 |

|

Main Str Cap Corp | | 29,359 |

|

Mannkind Corp | | 50,325 |

|

Marathon Oil Corp | | 1,132 |

|

Mastercard Inc | | 25,848 |

|

McDonalds Corp | | 12,533 |

|

MCIG Inc | | 129 |

|

McKesson Corporation | | 72,653 |

|

Medical Marijuana Inc | | 1,139 |

|

Medicines Company | | 13,835 |

|

Medley Capital Corp | | 3,959 |

|

Medtronic Inc | | 1,904 |

|

Melco Public Entertainment Ltd ADR | | 2,540 |

|

| | (Continued) |

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Merck & Co Inc New | | $ | 13,914 |

|

Microchip Technology | | 29,322 |

|

Micron Technology Inc | | 3,501 |

|

Microsoft Corp | | 92,183 |

|

Mobileye N V Amstelveen | | 101,400 |

|

Mol Global Inc ADR | | 305 |

|

Molycorp Inc | | 528 |

|

Monster Beverage Corp | | 10,835 |

|

Mosaic Co | | 18,285 |

|

National Grid Plc ADR | | 2,544 |

|

Netflix Inc | | 17,422 |

|

New York Cmnty Bancorp | | 13,187 |

|

Next Generation Mgmt | | 23 |

|

Nextera Energy Inc | | 31,887 |

|

Nike Inc | | 19,230 |

|

Noble Corp Plc | | 18,543 |

|

Noble Energy Inc | | 1,662 |

|

Nordic American Tanker Shipping | | 10,070 |

|

Nordic American Offshore Ltd | | 98 |

|

Northeastern Utilities | | 14,718 |

|

Novartis AG | | 13,899 |

|

NRG Energy Inc New | | 167 |

|

NXP Semiconductors NV | | 45,840 |

|

Oasis Petroleum Inc | | 4,962 |

|

Occidental Pete Corp | | 23,135 |

|

Ocean Rig Underwater Inc F | | 28 |

|

On Deck Cap Inc | | 2,243 |

|

Oracle Corporation | | 29,231 |

|

Orbit Intl Corp | | 79 |

|

Orbit Worldwide Inc | | 14,172 |

|

Paragon Offshore PLC | | 922 |

|

PEI Worldwide Holdings | | 20 |

|

Penn West Pete Ltd New F | | 10,400 |

|

Pennantpark Investment Grp | | 4,886 |

|

PepsiCo Inc | | 14,184 |

|

Perk International | | 3,370 |

|

Petron Energy II Inc New | | 54 |

|

Pfizer Incorporated | | 36,446 |

|

Philip Morris Intl Inc | | 42,122 |

|

Phillips 66 | | 6,460 |

|

Pioneer Natural Res Co | | 1,191 |

|

PNC Financial Services Gp Inc | | 29,650 |

|

PositiveID Corp New | | 239 |

|

Potash Corp of Saskatchewan Inc | | 10,596 |

|

Premium Brands Holdings | | 3,151 |

|

Procter & Gamble | | 15,941 |

|

Prospect Energy Corp | | 18,407 |

|

| | (Continued) |

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Corporate common stocks—at fair value: | | |

Qualcomm Inc | | $ | 33,851 |

|

R P C Inc | | 11,084 |

|

Rare Element Resources | | 190 |

|

Realty Income Corporation | | 6,761 |

|

Renren Inc ADR F | | 628 |

|

Restaurant Brands Intl | | 4,685 |

|

Revolution Lighting Technologies Inc | | 24,300 |

|

Rock-Tenn Co Cl A | | 6,098 |

|

Rockwell Automation Inc | | 30,580 |

|

Royal Bank of Canada MontrealQue | | 12,087 |

|

Schlumberger LTD | | 42,705 |

|

SeaWorld Entertainment | | 5,692 |

|

Siemens A G ADR | | 1,120 |

|

Sina Corporation | | 7,482 |

|

Smith & Wesson Holding Corp | | 616 |

|

Sodastream International | | 2.012 |

|

Sony Corp ADR | | 1,433 |

|

Southern Co | | 8,625 |

|

Southwest Airlines Co | | 131,192 |

|

Spongetech Delivery Sys | | 2 |

|

Sprint Corporation | | 8,354 |

|

Starbucks Corp | | 16,410 |

|

Statoil Asa ADR | | 1,215 |

|

Stryker Corp | | 34,430 |

|

SunTrust Banks Inc | | 4,357 |

|

Target Corporation | | 2,951 |

|

Taser International Inc | | 18,536 |

|

TCP Capital Corp | | 12,300 |

|

Telestone Technologies | | 5 |

|

Telupay International Inc | | 11 |

|

Terra Nitrogen Co LP | | 7,310 |

|

Terra Energy Res Ltd | | 380 |

|

Tesla Motors Inc | | 36,698 |

|

Textmunication Holdings | | 15 |

|

Theralase Technologies | | 108,843 |

|

Tital Medical Inc | | 576 |

|

Titan International Inc | | 77,944 |

|

Tonix Pharma Hldgs New | | 1,168 |

|

Toronto Dominion Bank | | 13,140 |

|

Travelers Companies Inc | | 3,804 |

|

TravelZoo Inc New | | 5,048 |

|

Trilliant Expl Corp | | 2 |

|

Twitter Inc | | 153,990 |

|

Tyson Foods Inc Class A | | 9,872 |

|

| | (Continued) |

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Corporate common stocks—at fair value: | | |

Under Armor Inc CL A | | $ | 169,750 |

|

Uni Pixel Inc New | | 5,121 |

|

Unilever PLC ADR New | | 8,096 |

|

United Parcel Service B | | 55,585 |

|

United States Steel Corp | | 2,677 |

|

United Technologies Corp | | 28,750 |

|

Unitek Global Svcs New | | 204 |

|

V F Corporation | | 7,490 |

|

Valero Energy Corp New | | 440 |

|

Vape Holdings Inc | | 178 |

|

Vapor Group Inc | | 96 |

|

Venaxis Inc | | 1,901 |

|

Verizon Communications | | 119,889 |

|

Vipshop Holdings Ltd ADR | | 9,770 |

|

Virnetx Holding Corp | | 1,098 |

|

Visa Inc Cl A | | 58,995 |

|

Vivus | | 432 |

|

VMWare Inc Cl A | | 24,756 |

|

Wal-Mart Stores Inc | | 1,750 |

|

Walter Industries Inc | | 690 |

|

Waste Management Inc Del | | 2,651 |

|

Wells Fargo & Co New | | 7,387 |

|

Western Lithium USA | | 253 |

|

Whole Foods Market Inc | | 2,723 |

|

Windstream Holdings Inc | | 165 |

|

Wynn Resorts | | 14,876 |

|

XL Group PLC | | 3,437 |

|

Xoma Corp | | 3,590 |

|

Yahoo Inc | | 25,255 |

|

Yelp Inc Class A | | 1,861 |

|

Youku.com Inc ADR F | | 7,112 |

|

Zoned Properties Inc New | | 12 |

|

Zynga Inc | | 9,975 |

|

1st NRG Corp New | | 400 |

|

| | |

| | |

Total corporate common stocks | | $ | 6,242,092 |

|

| | (Continued) |

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Mutual funds: | | |

Advisorone Cls Domestic Eqty New | | $ | 478 |

|

Advisorone Cls Glbl Aggr Eqty New | | 1,034 |

|

Advisorone Cls Glbl Divers Eqty New | | 1,559 |

|

Advisorone Cls Glbl Gwth Eqty New | | 600 |

|

Advisorone Cls Intl Eqty New | | 317 |

|

American Funds Washington Mutual F-1 | | 15,853 |

|

American Century One Choice 2025 Inv | | 51,395 |

|

AMG Yacktman Fund Service Class. | | 8,349 |

|

AMG Yacktman Focused Fund Service Class | | 16,471 |

|

Apollo Investment Corp | | 1,195 |

|

Artisan Global Eqty Fd Inv | | 11,274 |

|

Artisan International Fund Inv | | 10,960 |

|

Blackrock Strat Inc Oppty Port Inv A | | 80,684 |

|

Brown Advisory Growth Equity Investor | | 15,498 |

|

Delafield Fund | | 36,131 |

|

DFA Intl Small Cap Value Port Instl | | 8,592 |

|

DNP Select Income Fund | | 21,212 |

|

Doubleline Total Return Bond Fund N | | 26,918 |

|

Eaton Vance Floating Rate Fund A | | 56,687 |

|

Federated Short-Term Income Fund Instl | | 19,032 |

|

Fidelity Low Priced Stock | | 35,571 |

|

Fidelity New Millenium Fund | | 20,445 |

|

Fidelity Small Cap Discovery | | 4,668 |

|

GAMCO Global Gold Natural | | 11,561 |

|

Goldman Sachs N-11 Equity Fund Class A | | 10,904 |

|

Goldman Sachs Strategic | | 30,281 |

|

Hennessy Gas Utility Index Fd Inv CL | | 3,755 |

|

Janus Global Life Sciences T | | 42,303 |

|

JHancock Disciplined Value Mid Cap A | | 17,317 |

|

Matthews Asia Dividend Fund | | 9,698 |

|

Matthews Japan Fund | | 13,944 |

|

Meridian Growth Fund Legacy | | 31,657 |

|

Nicholas Fund, Class I | | 3,390 |

|

Oakmark Equity Income Fund I | | 121,490 |

|

Oakmark International Fund I | | 38,705 |

|

Pacific Financial Core Eqty FD Inv CL | | 152,873 |

|

Pacific Financial Explorer FD Inv CL | | 91,447 |

|

Pacific Financial Strat Cons Inv C | | 58,802 |

|

| | (Continued)

|

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Mutual funds: | | |

Parnassus Equity Income Fund Inv | | $ | 42,833 |

|

Perkins Global Value Fund Class T | | 9,790 |

|

Permanent Portfolio | | 2,458 |

|

PIMCO Real Estate Real | | 49,984 |

|

Principal Real Estate I | | 653 |

|

Prudential Jennison Health Sciences A | | 24,548 |

|

Ridgeworth Large Cap Value Equity I | | 19,588 |

|

Rydex Biotechnology FD Inv Class | | 51,431 |

|

* Schwab AMT Taxfree Money Fund | | 487,000 |

|

* Schwab Core Equity Fund | | 58,312 |

|

* Schwab Dividend Equity Fund | | 73,763 |

|

* Schwab Health Care Fund | | 42,169 |

|

* Schwab Hedged Equity Fund | | 38,869 |

|

* Schwab International Core Equity Fund | | 62,504 |

|

* Schwab Large-Cap Growth | | 39,341 |

|

* Schwab S & P 500 Index Fund – Select S | | 61,372 |

|

* Schwab Short Term Bond Market Index Fund | | 29,523 |

|

* Schwab Small Cap Index Select | | 37,373 |

|

* Schwab 1000 Index Fund | | 21,072 |

|

T Rowe Price Personal Strat Balanced | | 159 |

|

Thornburg Ltd Term Income A | | 61,360 |

|

Vanguard Equity Income Fund | | 19,316 |

|

Vanguard Global Equity Fund Investor | | 17,204 |

|

Vanguard Inflation Protected Sec Fund | | 11,434 |

|

Voya Corporate Leaders Trust Fund | | 2,993 |

|

Wells Fargo Advantage Discovery Fund | | 15,392 |

|

Total mutual funds | | $ | 2,363,491 |

|

Personal choice retirement account (continued): | | |

Preferred Stock: | | |

Gabelli Equity Trust Inc. | | $ | 4,961 |

|

Magnum Hunter Res 8% Pfd. | | 1,018 |

|

Total preferred stock funds | | $ | 5,979 |

|

| | (Continued)

|

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Unit Trust: | | |

Barclays Bank PLC iPath ETN | | $ | 71,276 |

|

Claymore Exchange Traded Fund | | 224 |

|

Direxion Large Cap Bull 3X Shares (ETF) | | 4,386 |

|

EGA Emerging Global | | 9,984 |

|

EGShares Beyond BRIC’sETF | | 12,930 |

|

ETFS Physical Silver Tr | | 772 |

|

iShares Floating Rate Note Fund | | 81,420 |

|

iShares Emerging Markets Dividend Index Fund | | 73,269 |

|

iShares Aaa A Rated Corporate Bond Fund | | 14,809 |

|

iShares Enhanced US Large-Cap ETF | | 113,730 |

|

iShares MSCI USA Momentum Factor ETF | | 27,224 |

|

iShares Enhanced US Small-Cap ETF | | 175,747 |

|

iShares Enhanced Short Maturity Bonds ETF | | 190,626 |

|

iShares Global ex USD High Yield Corporate Bond ETF | | 75,704 |

|

iShares High Dividend Equity Fund | | 137,160 |

|

iShares MSCI EAFE Minimum Volatility ETF | | 133,334 |

|

iShares MSCI USA Minimum Volatility ETF | | 174,955 |

|

iShares MSCI Emerging Markets Minimum Volatility ETF | | 76,734 |

|

iShares MSCI Germany Index Fund | | 27,903 |

|

iShares MSCI Hong Kong Index Fund | | 26,969 |

|

iShares Russell 2000 Index Fund | | 37,441 |

|

iShares Russell Midcap Growth Index Fund | | 14,730 |

|

iShares S&P US Preferred Stock Index Fund | | 136,778 |

|

iShares Silver Trust | | 1,130 |

|

iShares Gold Trust | | 28,314 |

|

iShares Dow Jones Select Dividend Index Fund | | 115,686 |

|

iShares Core US Aggregate Bond ETF | | 137,865 |

|

iShares Barclays Aggregate Bond Fund | | 137,799 |

|

iShares Barclays 7-10 Year Treasury | | 22,682 |

|

iShares Barclays Intermediate Credit Bond ETF | | 245,446 |

|

iShares Dow Jones EPAC Select Dividend Index Fund | | 150,123 |

|

iShares Russell 1000 Growth Index Fund | | 169,899 |

|

iShares JP Morgan Emerging Markets Bond Fund | | 131,871 |

|

iShares iBoxx $ High Yield Corporate Bond Fund | | 131,981 |

|

PowerShares QQQ Trust, Series 1 ETF | | 173,667 |

|

PowerShares Exchange-Traded Fund Trust II | | 30,292 |

|

PowerShares DB Commodity Index Tracking Fund | | 34,354 |

|

ProShares Ultra Bloomberg Crude Oil Index Fund | | 342 |

|

* Schwab US Broad Market ETF | | 16,129 |

|

| | (Continued)

|

|

BROWN & BROWN, INC. EMPLOYEE SAVINGS PLAN AND TRUST

SCHEDULE H, PART IV, Line 4i- SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

EIN #59-0864469 PLAN #002

DECEMBER 31, 2014

|

| | | | |

Identity and Description of Issues | | Current Value |

Personal choice retirement account (continued): | | |

Unit Trust: | | |

SPDR Materials Select Sector Index Fund | | $ | 26,719 |

|

SPDR Gold Shares | | 56,790 |

|

SPDR Dow Jones Global Select Real Estate Securities Index Fund | | 13,555 |

|

SPDR S&P Dividend ETF | | 16,075 |

|

Spdr Trust Unit Ser 1 Exp 1/22/2118 | | 92,082 |

|

United States 12 Month Natural Gas ETF | | 28 |

|

Vanguard Total International Bond ETF | | 14,446 |

|

Vanguard Dividend Appreciation ETF | | 68,418 |

|

Vanguard Small Cap Value ETF | | 5,743 |

|

Vanguard Global ex-US Real Estate ETF | | 40,515 |

|

Vanguard MSCI Emerging Markets ETF | | 17,369 |

|

Vanguard S&P 500 Growth ETF | | 20,002 |

|

Vanguard S&P Small-Cap 600 Growth ETF | | 10,486 |

|

Vanguard Specialized Fds | | 46,413 |

|

Vanguard Tax-Managed MSCI EAFE ETF | | 35,077 |

|

Vanguard Total Stock Market ETF | | 79,500 |

|

WisdomTree Asia Local Debt ETF | | 13,608 |

|

WisdomTree India Earnings ETF | | 28,180 |

|

WisdomTree SmallCap Dividend | | 5,963 |

|

Total unit trust funds | | $ | 3,736,654 |

|

Market Value Adjustment | | (16 | ) |

Total personal choice retirement account | | $ | 14,421,839 |

|

* Notes Receivables from participants - Various maturities, interest rates from 4.25% to 9.25%................................. | | $ | 9,619,162 |

|

TOTAL ASSETS HELD FOR INVESTMENT | | $ | 452,521,452 |

|

| |

* | A party-in-interest (Note 5). |

Cost information is not required to be provided as these investments are participant-directed.

(Concluded)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Trustee (or other persons who administer the Plan) has duly caused this annual report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | |

| | |

| BROWN & BROWN, INC. |

| EMPLOYEE SAVINGS PLAN AND TRUST |

| | |

| By: | BROWN & BROWN, INC. |

| | |

Date: June 25, 2015 | By: | /S/ JAMES LANNI |

| | James Lanni |

| | Director of Taxation |

EXHIBIT INDEX

|

| |

| |

Exhibit | Document |

| |

23 | Consent of Independent Registered Public Accounting Firm |

| |

99.1 | Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. This Certification shall not be deemed to be “filed” with the Commission or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically requests that such Certification be incorporated by reference into a filing under the Securities Act of 1934, as amended, or the Exchange Act of 1933, as amended. |

| |

99.2 | Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. This Certification shall not be deemed to be “filed” with the Commission or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically requests that such Certification be incorporated by reference into a filing under the Securities Act of 1934, as amended, or the Exchange Act of 1933, as amended. |

Exhibit 23

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement (Form S-8 No. 33-1900) pertaining to the Brown & Brown, Inc. Employee Savings Plan and Trust of our report dated June 25, 2015, with respect to the financial statements and supplemental schedule of the Brown & Brown, Inc. Employee Savings Plan and Trust included in this Annual Report (Form 11-K) for the year ended December 31, 2014.

/s/ Hancock Askew & Co., LLP

Norcross, Georgia

June 25, 2015

Exhibit 99.1

Certification

Pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, the undersigned officer of Brown & Brown, Inc. (the “Company”) hereby certifies, in the undersigned’s capacity as an officer of the Company and to such officer’s actual knowledge, that:

(1) the Annual Report of the Brown & Brown, Inc. Employee Savings Plan and Trust (the “Plan”) on Form 11-K for the year ended December 31, 2014 (the “Report”) fully complies with the requirements of Section 13(a) or 15(d), as applicable, of the Securities Exchange Act of 1934, as amended; and

(2) the information contained in the Report fairly presents, in all material respects, the net assets available for benefits and changes in net assets available for benefits of the Plan.

IN WITNESS WHEREOF, the undersigned officer has executed this Certification on June 25, 2015.

|

|

|

/s/ J. Powell Brown |

J. Powell Brown |

Chief Executive Officer |

This written statement is being furnished to the Securities and Exchange Commission as an exhibit to the Report. A signed original of this written statement required by Section 906 has been provided to the Company and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request.

Exhibit 99.2

Certification

Pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, the undersigned officer of Brown & Brown, Inc. (the “Company”) hereby certifies, in the undersigned’s capacity as an officer of the Company and to such officer’s actual knowledge, that:

(1) the Annual Report of the Brown & Brown, Inc. Employee Savings Plan and Trust (the “Plan”) on Form 11-K for the year ended December 31, 2015 (the “Report”) fully complies with the requirements of Section 13(a) or 15(d), as applicable, of the Securities Exchange Act of 1934, as amended; and

(2) the information contained in the Report fairly presents, in all material respects, the net assets available for benefits and changes in net assets available for benefits of the Plan.

IN WITNESS WHEREOF, the undersigned officer has executed this Certification on June 25, 2015.

|

|

|

/s/ R. Andrew Watts |

R. Andrew Watts |

Chief Financial Officer |

This written statement is being furnished to the Securities and Exchange Commission as an exhibit to the Report. A signed original of this written statement required by Section 906 has been provided to the Company and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request.

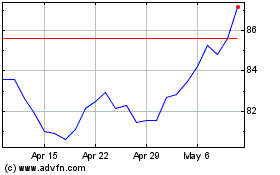

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

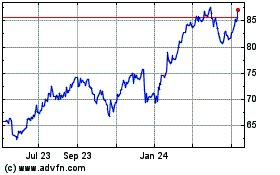

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Apr 2023 to Apr 2024