UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 20, 2015

BROWN & BROWN, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Florida | | 001-13619 | | 59-0864469 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

220 South Ridgewood Avenue, Daytona Beach, Florida 32114

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (386) 252-9601

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On April 20, 2015, Brown & Brown, Inc. issued a press release announcing its results of operations for the first quarter ended March 31, 2015. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information furnished herewith pursuant to Item 2.02 of this Current Report, including Exhibit 99.1, shall not be deemed to be filed for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

The following exhibit is furnished herewith:

|

| | |

| | |

Exhibit No. | | Description |

99.1 | | Press Release dated April 20, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | |

BROWN & BROWN, INC. (Registrant) |

| |

By: | | /S/ R. ANDREW WATTS |

| | R. Andrew Watts, Chief Financial Officer |

Date: April 20, 2015

News Release

R. Andrew Watts

April 20, 2015 Chief Financial Officer

(386) 239-5770

BROWN & BROWN, INC. ANNOUNCES QUARTERLY REVENUES OF $404.3 MILLION, AN INCREASE OF 11.2%; ORGANIC REVENUE GROWTH OF 3.8% AND EARNINGS PER SHARE OF $0.39, GROWING 8.3%

(Daytona Beach, Florida) . . . Brown & Brown, Inc. (NYSE:BRO) (the "Company") today announced its unaudited financial results for the first quarter of 2015.

Revenues for the first quarter of 2015 under U.S. generally accepted accounting principles (“GAAP”) were $404.3 million, increasing $40.7 million, or 11.2%, as compared to the first quarter of the prior year, with organic revenues (as defined below) increasing by 3.8%, as compared to the first quarter of the prior year. Diluted earnings per share under GAAP were $0.39 compared to $0.36 in the first quarter of the prior year, representing an 8.3% increase.

J. Powell Brown, President and Chief Executive Officer of the Company noted, "We are pleased with our results for the quarter, growing organically just under 4.0% and delivering over 8.0% earnings per share growth."

In the first quarter of 2015, we entered into an accelerated share repurchase program ("ASR") with JPMorgan Chase Bank, National Association, for up to $100 million of the Company's common stock. The ASR is part of the Company's board-approved $200 million share repurchase plan announced on July 21, 2014. Completion of the ASR is expected in the second quarter of 2015. After the completion of this ASR, there is expected to be $50 million remaining of the $200 million repurchase plan approved by the Board.

In addition, today the Board of Directors has declared a regular quarterly cash dividend of $0.11 per share. The dividend is payable on May 13, 2015, to shareholders of record on May 4, 2015.

Brown & Brown, Inc.

INTERNAL GROWTH SCHEDULE

Organic Revenue Growth(1)

Three Months Ended March 31, 2015

(in millions, unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Change | | Acquisition | | Organic Revenue Growth(1) |

| 3/31/2015 |

| | 3/31/2014 |

| | $ | | % | | Revenues | | $ |

| | % |

|

| | | | | | | | | | | | | |

Retail(2) | $ | 196.4 |

| | $ | 183.3 |

| | $ | 13.1 |

| | 7.1 | % | | $ | 10.2 |

| | $ | 2.9 |

| | 1.6 | % |

National | | | | | | | | | | | | | |

Programs | 93.3 |

| | 65.0 |

| | 28.3 |

| | 43.5 | % | | 25.4 |

| | 2.9 |

| | 4.4 | % |

Wholesale | | | | | | | | | | | | | |

Brokerage | 46.1 |

| | 42.5 |

| | 3.6 |

| | 8.5 | % | | 0.5 |

| | 3.1 |

| | 7.3 | % |

| | | | | | | | | | | | | |

Services | 34.8 |

| | 31.5 |

| | 3.3 |

| | 10.5 | % | | — |

| | 3.3 |

| | 10.5 | % |

Total Core | | | | | | | | | | | | | |

Comm. and Fees | $ | 370.6 |

| | $ | 322.3 |

| | $ | 48.3 |

| | 15.0 | % | | $ | 36.1 |

| | $ | 12.2 |

| | 3.8 | % |

(1)"Organic Revenue" is defined as total commissions and fees less (i) the first twelve months of net commission and fee revenues generated from acquisitions accounted for as purchases less (ii) profit-sharing contingent commissions (revenues from insurance companies based upon the volume and the growth and/or profitability of the business placed with such companies during the prior year - “Contingents”), less (iii) guaranteed supplemental commissions (commissions from insurance companies based solely upon the volume of the business placed with such companies during the current year - “GSCs”), and less (iv) divested business (net commissions and fees generated from offices, books of business or niche businesses sold by the Company) with the associated revenue removed from the corresponding period of the prior year.

(2)The Retail Segment includes commissions and fees, which will be reported in the “Other” column of the Segment Information in the Notes to the Condensed Consolidated Financial Statements on our Form 10-Q, which includes corporate and consolidation items.

Brown & Brown, Inc.

RECONCILIATION OF INTERNAL GROWTH SCHEDULE

TO TOTAL COMMISSIONS AND FEES

Included in the Consolidated Statements of Income

Three Months Ended March 31, 2015 and 2014

(in millions, unaudited)

|

| | | | | | | |

| Quarter Ended |

| 3/31/2015 | | 3/31/2014 |

| | | |

Total Core Commissions and Fees | $ | 370.6 |

| | $ | 322.3 |

|

Profit-Sharing Contingent Commissions | 29.8 |

| | 31.7 |

|

Guaranteed Supplemental Commissions | 3.4 |

| | 3.0 |

|

Divested Businesses | — |

| | 5.0 |

|

| | | |

Total Commissions and Fees | $ | 403.8 |

| | $ | 362.0 |

|

| | | |

We believe it is appropriate to adjust for the change in estimated acquisition earn-out payables in order to arrive at results that are more comparable to the prior year. Our diluted earnings per share - adjusted (as defined in the table below) were $0.40 for the three months ended March 31 2015, increasing 5.3% over the first quarter of the prior year.

Brown & Brown, Inc.

GAAP EARNINGS PER SHARE RECONCILIATION TO

EARNINGS PER SHARE - ADJUSTED

Three Months Ended March 31, 2015 and 2014

(unaudited)

|

| | | | | | | | | | | | | |

| Quarter Ended | | Change |

| 3/31/2015 | | 3/31/2014 | | $ | % |

GAAP earnings per share - as reported | $ | 0.39 |

| | $ | 0.36 |

| | $ | 0.03 |

| 8.3 | % |

Change in estimated acquisition earn-out payables | 0.01 |

| | 0.02 |

| | (0.01 | ) | |

Earnings per share - adjusted | $ | 0.40 |

| | $ | 0.38 |

| | $ | 0.02 |

| 5.3 | % |

In order to provide a better understanding of underlying business performance, we evaluate EBITDAC (defined below). EBITDAC for the first quarter of 2015 was $131.8 million, an increase of $12.3 million or 10.3%, compared to the first quarter of the prior year. The associated EBITDAC margin decreased to 32.6%.

Brown & Brown, Inc.

GAAP RECONCILIATION -

INCOME BEFORE INCOME TAXES TO EBITDAC(3)

Three Months Ended March 31, 2015 and 2014

(in millions, unaudited)

|

| | | | | | | |

| Quarter Ended |

| 3/31/2015 | | 3/31/2014 |

Income before income taxes | $ | 93.7 |

| | $ | 86.8 |

|

Amortization | 21.6 |

| | 17.9 |

|

Depreciation | 5.2 |

| | 4.6 |

|

Interest | 9.9 |

| | 4.1 |

|

Change in estimated acquisition earn-out payables | 1.4 |

| | 6.1 |

|

EBITDAC | $ | 131.8 |

| | $ | 119.5 |

|

EBITDAC margin | 32.6 | % | | 32.9 | % |

| |

(3) | "EBITDAC" is defined as net income before interest, income taxes, depreciation, amortization and the change in estimated acquisition earn-out payables. |

The decrease in EBITDAC margin was primarily driven by the seasonal nature of the business of the Wright Insurance Group, LLC, which we acquired in May 2014 and for which there are no comparable financial results for the first quarter of 2014.

Brown & Brown, Inc.

CONSOLIDATED STATEMENTS OF INCOME

(in millions, except per share data; unaudited)

|

| | | | | | | |

| For the three months

ended March 31, |

| 2015 | | 2014 |

REVENUES | | | |

Commissions and fees | $ | 403.8 |

| | $ | 362.0 |

|

Investment income | 0.2 |

| | 0.1 |

|

Other income, net | 0.3 |

| | 1.5 |

|

Total revenues | 404.3 |

| | 363.6 |

|

| | | |

EXPENSES | | | |

Employee compensation and benefits | 205.3 |

| | 184.1 |

|

Non-cash stock-based compensation | 6.4 |

| | 7.5 |

|

Other operating expenses | 61.1 |

| | 52.5 |

|

Gain on disposal | (0.3 | ) | | — |

|

Amortization | 21.6 |

| | 17.9 |

|

Depreciation | 5.2 |

| | 4.6 |

|

Interest | 9.9 |

| | 4.1 |

|

Change in estimated acquisition earn-out payables | 1.4 |

| | 6.1 |

|

Total expenses | 310.6 |

| | 276.8 |

|

| | | |

Income before income taxes | 93.7 |

| | 86.8 |

|

| | | |

Income taxes | 36.8 |

| | 34.4 |

|

| | | |

Net income | $ | 56.9 |

| | $ | 52.4 |

|

| | | |

Net income per share: | | | |

Basic | $ | 0.40 |

| | $ | 0.36 |

|

Diluted | $ | 0.39 |

| | $ | 0.36 |

|

| | | |

Weighted average number of shares outstanding: | | | |

Basic | 139,360 |

| | 141,610 |

|

Diluted | 141,487 |

| | 143,309 |

|

| | | |

Dividends declared per share | $ | 0.11 |

| | $ | 0.10 |

|

Brown & Brown, Inc.

CONSOLIDATED BALANCE SHEETS

(in millions, except per share data, unaudited)

|

| | | | | | | |

| March 31,

2015 | | December 31,

2014 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 340.7 |

| | $ | 470.0 |

|

Restricted cash and investments | 284.8 |

| | 259.8 |

|

Short-term investments | 10.9 |

| | 11.2 |

|

Premiums, commissions and fees receivable | 431.2 |

| | 424.6 |

|

Reinsurance recoverable | 13.0 |

| | 13.0 |

|

Prepaid reinsurance premiums | 291.0 |

| | 321.0 |

|

Deferred income taxes | 13.9 |

| | 25.4 |

|

Other current assets | 47.8 |

| | 45.5 |

|

Total current assets | 1,433.3 |

| | 1,570.5 |

|

| | | |

Fixed assets, net | 83.2 |

| | 84.7 |

|

Goodwill | 2,487.8 |

| | 2,460.6 |

|

Amortizable intangible assets, net | 774.9 |

| | 784.6 |

|

Investments | 18.8 |

| | 19.9 |

|

Other assets | 40.9 |

| | 36.6 |

|

Total assets | $ | 4,838.9 |

| | $ | 4,956.9 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Premiums payable to insurance companies | $ | 587.5 |

| | $ | 568.1 |

|

Losses and loss adjustment reserve | 13.0 |

| | 13.0 |

|

Unearned premiums | 291.0 |

| | 321.0 |

|

Premium deposits and credits due customers | 80.4 |

| | 83.3 |

|

Accounts payable | 82.9 |

| | 57.3 |

|

Accrued expenses and other liabilities | 127.1 |

| | 181.3 |

|

Current portion of long-term debt | 27.5 |

| | 45.6 |

|

Total current liabilities | 1,209.4 |

| | 1,269.6 |

|

| | | |

Long-term debt | 1,146.0 |

| | 1,152.8 |

|

| | | |

Deferred income taxes, net | 336.6 |

| | 341.5 |

|

| | | |

Other liabilities | 85.4 |

| | 79.2 |

|

| | | |

Shareholders’ equity: | | | |

Common stock, par value $0.10 per share; authorized 280,000 shares; issued 145,866 shares and outstanding 140,814 shares at 2015, issued 145,871 shares and outstanding 143,486 shares at 2014 - in thousands | 14.6 |

| | 14.6 |

|

Additional paid-in capital | 397.5 |

| | 406.0 |

|

Treasury stock, at cost 5,053 and 2,385 shares at 2015 and 2014, respectively - in thousands | (160.0 | ) | | (75.0 | ) |

Retained earnings | 1,809.4 |

| | 1,768.2 |

|

Total shareholders’ equity | 2,061.5 |

| | 2,113.8 |

|

Total liabilities and shareholders’ equity | $ | 4,838.9 |

| | $ | 4,956.9 |

|

Conference call, webcast and slide presentation

A conference call to discuss the results of the first quarter of 2015 will be held on Tuesday, April 21, 2015 at 8:00 AM (EDT). The Company may refer to a slide presentation during its conference call. You can access the webcast and the slides from the “Investor Relations” section of the Company’s website at www.bbinsurance.com.

About Brown & Brown

Brown & Brown, Inc., through its subsidiaries, offers a broad range of insurance products and services. Additionally, certain Brown & Brown subsidiaries offer a variety of risk management, third-party administration, and other services. Serving business, public entity, individual, trade and professional association clients nationwide, the Company is ranked by Business Insurance magazine as the United States’ sixth largest independent insurance intermediary. The Company’s Web address is www.bbinsurance.com.

Forward-looking statements

This press release may contain certain statements relating to future results which are forward-looking statements, including those relating to the Company's anticipated financial results for the first quarter of 2015 and those relating to potential repurchases of our common stock. These statements are not historical facts, but instead represent only the Company’s current belief regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results, financial condition and achievements may differ, possibly materially, from the anticipated results, financial condition and achievements contemplated by these forward-looking statements. These risks and uncertainties include, but are not limited to, the Company's determination as it finalizes its financial results for the first quarter of 2015 that its financial results differ from the current preliminary unaudited numbers set forth herein; fluctuations in our stock’s market price; fluctuations in operating results and cash flows; material adverse changes in economic conditions in the markets we serve and in the general economy; downward commercial property and casualty premium pressures; future regulatory actions and conditions in the states in which the Company conducts business; competition from others in the insurance agency, wholesale brokerage, insurance programs and service business; the integration of the Company’s operations with those of businesses or assets the Company has acquired or may acquire in the future and the failure to realize the expected benefits of such integration; and the potential occurrence of a disaster that affects certain areas including, but not limited to, the States of California, Florida, Georgia, Illinois, Indiana, Kansas, Massachusetts, Michigan, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Texas, Virginia and/or Washington, where significant portions of the Company’s business are conducted; other factors that the Company may not have currently identified or quantified, and other risks, relevant factors and uncertainties identified in the Company's Annual Report on Form 10-K for the year ended December 31, 2014, and the Company’s other filings with the Securities and Exchange Commission. All forward-looking statements made herein are made only as of the date of this release, and the Company does not undertake any obligation to publicly update or correct any forward-looking statements to reflect events or circumstances that subsequently occur or of which the Company hereafter becomes aware.

Non-GAAP supplemental financial information

This press release contains references to non-GAAP financial measures as defined in Regulation G of SEC rules, including Organic Revenue, Earnings Per Share - adjusted, EBITDAC and EBITDAC margins. A reconciliation of this supplemental non-GAAP financial information to our GAAP information is contained in this earnings release. We present such non-GAAP supplemental financial information, as we believe such information is of interest to the investment community because it provides additional meaningful methods of evaluating certain aspects of the Company’s operating performance from period to period on a basis that may not be otherwise apparent on a GAAP basis. This supplemental financial information should be considered in addition to, not in lieu of, the Company’s condensed consolidated financial statements.

# # #

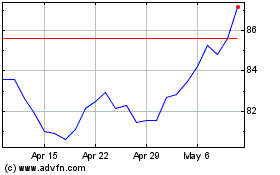

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

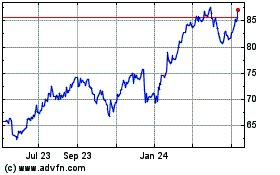

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Apr 2023 to Apr 2024