SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

November 14, 2016

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-

N/A

NOTICE OF

REDEMPTION

To the Holders,

regarding

BANCO

MACRO S.A.

9.75

%

Fixed/Floating Rate Non-Cumulative Junior Subordinated Series 1 Notes Due 2036

Common Code:

027847510 (Reg. S) / 031805350 (Registered)

CUSIP: P1047VAB3*

(Reg. S) / 05963GAB4* (Registered)

ISIN: USP1047VAB38*

(Reg. S) / US05963GAB41* (Registered)

NOTICE

IS HEREBY GIVEN that, pursuant to Paragraph 7 (

Early Redemption

) on the reverse side of Banco Macro S.A.'s (the “

Issuer

”)

U.S.$150,000,000 9.75% Fixed/Floating Rate Non-Cumulative Junior Subordinated Series 1 Notes Due 2036 (the “

Notes

”)

and Section 4.1(a) of the First Supplemental Indenture, dated as of December 18, 2006, among Banco Macro S.A. (the “

Issuer

”),

HSBC Bank USA, National Association (the “

Former Trustee

”), as trustee, co-registrar, principal paying agent

and transfer agent, and HSBC Bank Argentina S.A. (the “

Former Representative of the Trustee in Argentina

”),

as Argentine registrar, paying agent, transfer agent and representative of the trustee in Argentina (the “

Indenture Supplement

”),

supplemental to the Indenture, dated as of December 18, 2006, between the Issuer, the Former Trustee and the Former Representative

of the Trustee in Argentina (the “

Base Indenture

” and together with the Indenture Supplement, the “

Indenture

”)

governing the Notes, the Issuer has elected to redeem the outstanding principal amount (U.S.$150,000,000) of the Notes (the “

Redeemed

Notes

”). Reference is made to the Agreement of Resignation, Appointment and Acceptance, dated as of December 19, 2014,

by and among the Issuer, the Former Trustee, the Former Representative of the Trustee in Argentina, Deutsche Bank Trust Company

Americas and Deutsche Bank S.A. pursuant to which,

inter alia

, Deutsche Bank Trust Company Americas (the “

Trustee

”)

became the successor trustee, co-registrar, principal paying agent, transfer agent and calculation agent in respect of the Notes

under the Indenture. The Redeemed Notes will be redeemed on December 18, 2016 (the “

Redemption Date

”) at a redemption

price of 100%, or U.S.$1,000 per U.S.$1,000, of the principal amount of the Notes, together with accrued and unpaid interest to

but excluding the Redemption Date of U.S.$48.75 per U.S.$1,000 principal amount of the Notes (the “

Redemption Price

”).

As the Redemption Date will not be a business day, the Redemption Price will be paid to holders of the notes on December 19, 2016,

the first business day immediately succeeding the Redemption Date (the “

Payment Date

”). In accordance with Paragraph

3 of the face of the Notes and Section 12.7 of the Base Indenture, no additional interest shall accrue during the period from and

after the Redemption Date to the Payment Date unless the Issuer defaults in the payment of the Redemption Price.

No representation

is made as to the correctness or accuracy of the Common Code, CUSIP, ISIN or other identifying codes either as printed on the Notes

or as contained in this Notice of Redemption.

The Trustee

is the Paying Agent with respect to the Notes. The Trustees' address is:

DB

Services Americas, Inc

5022

Gate Parkway Suite 200

MS

JCK01-0218

Jacksonville,

FL 32256

For

information call 1-800-735-7777

Payment of

the Redemption Price with respect to any certificated Note will be made only upon presentation and surrender thereof to the Paying

Agent at the address set forth above.

On the Redemption

Date, the Redemption Price will become due and payable in respect of the Redeemed Notes. Unless the Issuer defaults in paying the

Redemption Price, interest on the Redeemed Notes ceases to accrue on and after the Redemption Date.

Immediately

after the Redemption Date and subsequent to the payment of the Redemption Price, all redeemed Notes shall be cancelled by the Trustee

and none of the Notes originally issued will remain outstanding.

Banco Macro

S.A.

Dated: November

14, 2016

IMPORTANT TAX

INFORMATION

Please Read

This Notice Carefully

EXISTING FEDERAL

INCOME TAX LAW MAY REQUIRE THE WITHHOLDING OF 28% OF ANY PAYMENTS TO HOLDERS PRESENTING THEIR (SECURITIES) FOR PAYMENTS WHO HAVE

FAILED TO FURNISH A TAXPAYER IDENTIFICATION NUMBER, CERTIFIED TO BE CORRECT UNDER PENALTY OF PERJURY. HOLDERS MAY ALSO BE SUBJECT

TO ADDITIONAL PENALTIES FOR FAILURE TO PROVIDE SUCH NUMBER. CERTIFICATION MAY BE MADE TO THE PAYING AGENT ON A SUBSTITUTE FORM

W-9 OR W-8.

*This

CUSIP/ISIN number has been assigned to this issue by Standard and Poor's Corporation and is included solely for the convenience

of the holders. Neither the Issuer, the Trustee nor the Paying Agent or any of their agents shall be responsible for the selection

or use of this CUSIP number, nor is any representation made as to its correctness on the bonds or as indicated in any redemption

notice

Banco Macro S.A.

Sarmiento 447, Buenos Aires-C104AAI,

Argentina

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: November 14, 2016

|

|

MACRO BANK INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge Francisco Scarinci

|

|

|

|

Name: Jorge Francisco Scarinci

|

|

|

|

Title: Finance Manager

|

|

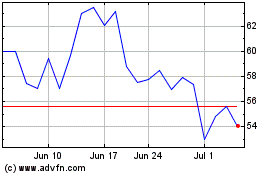

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

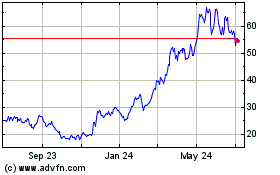

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024