SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

May 4, 2016

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-

N/A

INDEX

|

|

1.

|

Summary of a resolutions adopted by the General and Special Shareholders’

Meeting held on April 26, 2016.

|

RESOLUTIONS ADOPTED BY THE GENERAL

AND SPECIAL SHAREHOLDERS’ MEETING HELD ON 04/26/2016

ITEM # 1:

For a majority

of 589,056,875 votes for, 2,256,930 abstentions and 15,620 votes against this motion, the Shareholders decided to appoint Dr. Saturnino

Jorge Funes, acting in the name of the shareholder Mr. Jorge Horacio Brito, Mr. Fernando Ledesma Padilla, acting in the name of

the shareholder The Bank of New York Mellon and Mr. Martín Juan Lanfranco, acting in the name of the shareholder ANSES FGS,

to sign the minutes of this meeting.

ITEM # 2

:

For a majority

of 588,014,005 votes for, 2,284,060 abstentions and 1,031,360 votes against this motion, the Shareholders resolved to approve the

documents under Section 234, subsection 1, of Law 19550, for the fiscal year of the Company ended December 31, 2015.

ITEM # 3

:

For a majority

of 589,073,565 votes for, 2,252,080 abstentions and 3,780 votes against this motion, to apply the accumulated retained earnings

as of December 31, 2015 totaling AR $ 5,133,481,933.66 as follows:

a) the

amount of AR $ 1,001,682,786.73 to the Legal Reserve Fund;

b) the

amount of AR $ 190,198,125 to the Statutory Reserve Fund – Special Reserve for Subordinated Corporate Bonds (Pursuant to

the provisions set forth in the terms of issuance of Series 1 of Class 1 Subordinated Corporate Bonds issued under the Global Program

approved by the Shareholders’ Meeting dated 09/01/2006 and the provisions of Communication A 4576 issued by the BCRA this

amount shall be applied to the creation of a special reserve for interest payable on the due dates occurring in June and December

2016);

c) the

amount of AR$ 38,009,241.64 to personal asset tax corresponding to the company’s shareholders and also payable

on the shares or participating interests held by the company, as substitute taxpayer for the year 2014;

d) the

amount of AR $ 3,903,591,780.29 to the optional reserve fund for future distribution of profits under Communication “A”

5273 issued by the Central Bank of the Republic of Argentina.

ITEM # 4

:

For a majority

of 589,078,735 votes for, 2,250,430 abstentions and 260 votes against this motion, the Shareholders resolved to approve the separation

of AR $ 643,019,330.80 from the optional reserve fund for the payment of a cash dividend, subject to prior authorization of the

Central Bank of the Republic of Argentina (BCRA) and delegated to the Board the power to determine the effective availability to

the Shareholders of the approved cash dividend, pursuant to their respective shareholdings, upon receipt of the applicable authorization

from de BCRA.

ITEM # 5

:

For a majority

of 586,802,935 votes for, 4,503,160 abstentions and 23,330 votes against this motion, the Shareholders approved the integral reorganization

of the Board of Directors, the complete renewal of the composition of the Board (except those directors re-elected in this shareholders’

meeting) establishing the Board shall be composed of 13 regular directors and 3 alternate directors. In addition, in order to comply

with the renewal by thirds provided for in Section 14 of the Corporate Bylaws, the Shareholders resolved that (i) 5 directors shall

hold office for 3 fiscal years, (ii) 5 directors shall hold office for 2 fiscal years and (iii) the remaining 3 directors shall

hold office for 1 fiscal year.

ITEM # 6

:

Since the shareholder

ANSES-FGS has notified its intention to exercise its right of cumulative voting for the appointment of the regular and alternate

directors, the shareholders were informed that all shareholders present are authorized to exercise their right of cumulative voting

under section 263 of law 19550.

ANSES-FGS waived its right to exercise

the cumulative voting with respect to the appointment of regular and alternate directors, since the proposal submitted by the representative

of Mr. Jorge Horacio Brito contemplated the designation of the candidates proposed by ANSES-FGS.

The rest of the shareholders did not exercise

their right of cumulative voting.

For a majority of 576,989,455 votes for,

2,774,110 abstentions and 12,065,860 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Jorge Horacio

Brito as non-independent regular director to hold office for three fiscal years.

For a majority of 578,862,205 votes for,

5,454,520 abstentions and 7,012,700 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Carlos Giovanelli

as non-independent regular director to hold office for three fiscal years.

For a majority of 578,862,205 votes for,

5,454,520 abstentions and 7,012,700 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Damián

Pozzoli as non-independent regular director to hold office for three fiscal years.

For a majority of 578,862,155 votes for,

5,454,520 abstentions and 7,012,750 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. José

Sánchez as independent regular director to hold office for three fiscal years.

For a majority of 574,483,765 votes for,

5,454,530 abstentions and 11,391,130 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Martín

Gorosito as independent regular director to hold office for three fiscal years.

Then the Shareholders’ Meeting considered

the appointment of three alternate directors who shall hold office for three fiscal years.

For a majority of 582,147,305 votes for,

3,187,340 abstentions and 5,994,780 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Delfín

Federico Ezequiel Carballo as non-independent alternate director to hold office for three fiscal years.

For a majority of 583,087,565 votes for,

2,245,360 abstentions and 5,996,500 votes against this motion, the Shareholders’ Meeting resolved to appoint Ms. Constanza

Brito as non-independent alternate director to hold office for three fiscal years.

For a majority of 574,636,795 votes for,

11,565,660 abstentions and 5,126,970 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Eliseo

Feliz Santi as independent alternate director to hold office for three fiscal years.

ITEM # 7

:

For a majority

of 582,095,415 votes for, 2,274,060 abstentions and 6,959,950 votes against this motion, the Shareholders’ Meeting resolved

to appoint Mr. Jorge Horacio Brito as non-independent regular director to hold office for two fiscal years.

For a majority of 531,521,315 votes for,

5,454,520 abstentions and 54,353,590 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Delfín

Jorge Ezequiel Carballo as non-independent regular director to hold office for two fiscal years.

For a majority of 579,792,535 votes for,

4,524,190 abstentions and 7,012,700 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Roberto

Eilbaum as independent regular director to hold office for two fiscal years.

For a majority of 578,862,105 votes for,

5,454,470 abstentions and 7,012,850 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Mario Vicens

as independent regular director to hold office for two fiscal years.

For a majority of 574,486,745 votes for,

5,454,470 abstentions and 11,388,210 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Luis María

Blaquier as independent regular director to hold office for two fiscal years.

ITEM # 8

:

For a majority

of 575,415,645 votes for, 4,524,150 abstentions and 11,389,630 votes against this motion, the Shareholders’ Meeting resolved

to appoint Mr. Marcos Brito as non-independent regular director to hold office for one fiscal year.

For a majority of 578,862,255 votes for,

5,454,470 abstentions and 7,012,700 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Ariel Sigal

as independent regular director to hold office for one fiscal year.

For a majority of 574,486,885 votes for,

5,454,470 abstentions and 11,388,070 votes against this motion, the Shareholders’ Meeting resolved to appoint Mr. Alejandro

Fargosi as independent regular director to hold office for one fiscal year.

Therefore, pursuant to the above, the Board

shall hereinafter be composed as follows: Regular Directors: Messrs. Jorge Horacio Brito, Delfín Jorge Ezequiel Carballo,

Jorge Pablo Brito, Carlos Giovanelli, Damián Pozzoli, José Sanchez, Roberto Eilbaum, Mario Vicens, Marcos Brito,

Ariel Sigal, Luís María Balquier, Martín Gorosito and Alejandro Fargosi; and Alternate Directors: Messrs.

Delfín Federico Ezequiel Carballo, Constanza Brito and Eliseo Feliz Santi. The regular directors Jorge Horacio Brito, Jorge

Pablo Brito, Marcos Brito, Delfín Jorge Ezequiel Carballo, Carlos Giovanelli, Damián Pozzoli, and the alternate directors

Delfín Federico Ezequiel Carballo and Constanza Brito shall act as non-independent directors, while the regular directors

Roberto Eilbaum, Mario Vicens, Ariel Sigal, José Sanchez, Martín Gorosito, Luis María Blaquier and Alejandro

Fargosi, and the alternate director Eliseo Feliz Santi shall act as independent directors under the Argentine law. Since the BCRA

(Central Bank of the Republic of Argentina) has not yet issued its decision under paragraph 5.2.3 of Section 5, Chapter I of Circular

CREFI-2 (Communication “A” 2241, as amended and supplemented) regarding the approval of the appointment of seven of

the elected regular Directors and one of the alternate Directors, in order to allow the normal operation of the management and

the composition of the audit committee with directors acting as independent directors, pursuant to the rules of the CNV (Argentine

Securities Exchange Commission) and the New York Stock Exchange, (i) the alternate directors already approved by the BCRA shall

temporarily act as regular directors; and (ii) the three independent directors whose term of office has already expired, shall

continue to hold office as independent directors under the provisions of the second paragraph of section 257, in both cases for

the time it is necessary.

ITEM # 9

:

Since the shareholder

ANSES-FGS has notified its intention to exercise its right of cumulative voting for the appointment of the regular and alternate

members of the Supervisory Committee, the shareholders were informed that all shareholders present are authorized to exercise their

right of cumulative voting under section 289 of law 19550.

ANSES-FGS waived its right to exercise

the cumulative voting with respect to the appointment of regular and alternate members of the Supervisory Committee, since the

proposal submitted by the representative of Mr. Jorge Horacio Brito contemplated the designation of the candidates proposed by

ANSES-FGS.

The rest of the shareholders did not exercise

their right of cumulative voting.

For a majority of 572,518,705 votes for,

15,032,960 abstentions and 3,777,760 votes against this motion, the Shareholders’ Meeting resolved to appoint the Accountants

Alejandro Almarza, Carlos Javier Piazza and Enrique Alfredo Fila as regular members of the Supervisory Committee and the Accountants

Alejandro Carlos Piazza, Leonardo Pablo Cortigiani and Silvana María Gentile as alternate members of the Supervisory Committee,

to hold office for one fiscal year.

All the members of the Supervisory Committee

shall act as independent members.

ITEM # 10

:

For a majority

of 400,244,845 votes for, 186,436,610 abstentions and 4,647,970 votes against this motion, the Shareholders’ Meeting resolved

to approve the remunerations payable to the members of the Board of Directors for the fiscal year ended December 31, 2015, on the

amount of AR$ 207,714,294.46, this amount representing 4.93% of the computable profit, i.e., after deducting the legal reserve

fund from the net profit for the year. In addition, the Shareholders’ Meeting resolved to delegate to the Board of Directors

the allocation to each member of the Board of the approved remunerations.

ITEM # 11

:

For a majority

of 567,944,025 votes for, 15,056,250 abstentions and 8,329,150 votes against this motion, the Shareholders’ Meeting resolved

to approve an amount of fees for the Supervisory Committee equal to AR$ 981,604.80, such amount being reported in the statement

of income for the fiscal year ended December 31, 2015, and to delegate to the Board of Directors the allocation of the approved

remunerations to each member of the Supervisory Committee.

ITEM # 12

:

For a majority

of 588,983,635 votes for, 2,311,440 abstentions and 34,350 votes against this motion, and with the abstentions, in each case with

respect to their own administration, of the shareholders who are members of the Company’s Board of Directors, the Shareholders’

Meeting resolved to approve the administration of the Board and any and all the acts and actions taken by the Supervisory Committee

up to the date hereof.

ITEM # 13

:

For a majority

of 588,907,665 votes for, 2,296,570 abstentions and 125,190 votes against this motion, the Shareholders’ Meeting approved:

(i) the renewal for three additional years of the designation as independent auditor of the accounting firm Pistrelli, Henry Martin

y Asociados; and (ii) the designation as regular Independent Auditor, for the fiscal year to end 31 December 2016, of the Accountant

Norberto M. Nacuzzi and Ernesto Mario San Gil as alternate Independent Auditor.

ITEM # 14

:

For a majority

of 573,406,795 votes for, 14,984,720 abstentions and 2,937,910 votes against this motion, the Shareholders resolved to approve

the Auditor’s remuneration of AR$ 9,448,800, payable for such Auditor’s work related to the audit of the Company’s

financial statements for the fiscal year ended December 31, 2015.

ITEM # 15

:

For a majority

of 567,330,465 votes for, 15,010,850 abstentions and 8,988,110 votes against this motion, the Shareholders’ Meeting resolved

to establish the budget for the Audit Committee in AR$ 700,000.

ITEM # 16

:

For a majority

of 589,057,805 votes for, 2,254,660 abstentions and 16,960 votes against this motion, the Shareholders approved the delegation

to the Board of the necessary powers to (i) determine and establish all terms and conditions of the Global Program of Negotiable

Obligations, of each of the series to be issued at the appropriate time and of the negotiable obligations to be issued under such

Program, which have not been expressly determined by the General Shareholders’ Meetings held on September 1st 2006 and April

26th 2011, including, without limitation, the amount (within the authorized maximum amount of US$ 1,000,000,000 or any lower amount,

as the Board of the Bank may determine), the subordination level (being able, if applicable, to adjust to the terms and conditions

of the rules of the Central Bank of the Republic of Argentina and any supplementary rules or any future rules that may replace

it), time of issuance, the term, price, placement method and payment terms thereof, the interest rate, the possibility that the

negotiable obligations be issued as registered or book-entry obligations, or in the form of a global certificate, that the same

be nominative or to bearer, that they be issued in one or several classes and/or series, that they be listed or traded in stock

exchanges and/or over-the-counter markets within the country and/or abroad, and any other aspect that the Board may, at its own

discretion, deem appropriate to determine; (ii) perform before the Argentine Securities Exchange Commission and/or before any similar

foreign entities any necessary acts and proceedings in connection with the authorization of the extension of such Program, with

sufficient powers to start a new authorization proceedings for the Program, provided the terms and conditions initially approved

remain unchanged and apply to the extended Program; (iii) perform before the Mercado de Valores de Buenos Aires (MERVAL), the Mercado

Abierto Electrónico (MAE) and/or any other stock exchange or self-regulatory markets of the Republic of Argentina and/or

abroad all the necessary acts and proceedings aimed at obtaining the authorization of the extension of the Program or the commencement

of new proceedings, for the potential listing and/or trading of the negotiable obligations issued within the scope of the above

mentioned Program; (iv) if applicable, negotiate with the entity to be defined in the relevant Price Supplement, the terms and

conditions (including the determination of the fees for the services rendered thereby) so that it may act as payment and/or registration

agent and, eventually, as depository of the global certificate; and (v) hire one or more independent and different risk rating

companies in order to rate the Program and/or the series to be issued thereunder. In addition, the Board was authorized to sub-delegate

to one or more of its members, or to the person they consider appropriate, the exercise of the powers described in the preceding

paragraph.

Signed: Jorge Horacio Brito (chairman);

Saturnino Jorge Funes (representing the shareholder Jorge Horacio Brito); Fernando Ledesma Padilla (representing The Bank of New

York Mellon); Martín Juan Lanfranco (representing ANSES FGS); Alejandro Almarza (member of the Supervisory Committee).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: May 4, 2016

|

|

MACRO BANK INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge F. Scarinci

|

|

|

|

Name: Jorge F. Scarinci

|

|

|

|

Title: Finance and Invertor Relations

Manager

|

|

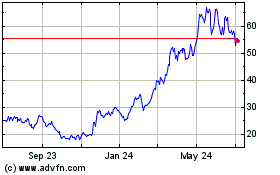

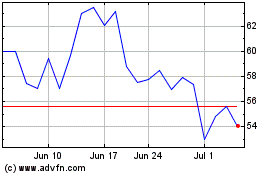

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024