SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

March 18, 2016

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

BANCO MACRO S.A.

NOTICE OF MEETING

A General and Special Shareholders’

Meeting is called to be held on April 26th 2016, at 11 am, at the principal place of business of the company located

at Sarmiento 447, Capital Federal, in order to discuss the following:

AGENDA

1) Appoint two shareholders to sign the

Minutes of the Shareholders’ Meeting.

2) Evaluate the documentation provided

for in section 234, subsection 1 of Law No. 19550, for the fiscal year ended December 31st 2015.

3) Evaluate the application of the retained

earnings for the fiscal year ended 31 December 2015. Total Retained Earnings: AR$ 5,133,481,933.66 which the Board proposes

may be applied as follows: a) AR$ 1,001,682,786.73 to Legal Reserve Fund; b) AR$ 190,198,125 to Statutory Reserve

Fund – Special Statutory Reserve Fund for Subordinated Debt Instruments under the global program of Negotiable Obligations

approved by the general shareholders’ meeting held on September 1st 2006; c) AR$ 38,009,241.64 to tax

on corporate personal assets and participating interests; d) AR$ 3,903,591,780.29 to the optional reserve fund for future

profit distributions, pursuant to Communication “A” 5273 issued by the Central Bank of the Republic of Argentina.

4) Separate a portion of the optional reserve

fund for future profit distributions in order to allow the application of AR$ 643,019,330.80 to the payment of a cash dividend,

subject to prior authorization of the Central Bank of the Republic of Argentina.

5) Full reorganization of the Board of

Directors. Establish the new composition of the Board with 13 Regular Directors and 3 Alternate Directors.

6) Appoint five regular directors and three

alternate directors who shall hold office for three fiscal years.

7) Appoint five regular directors who shall

hold office for two fiscal years.

8) Appoint three regular directors who

shall hold office for one fiscal year.

9) Designate regular and alternate members

of the Supervisory Committee who shall hold office for one fiscal year.

10) Evaluate the remunerations of the members

of the Board of Directors for the fiscal year ended December 31st 2015 within the limits as to profits, pursuant to

section 261 of Law 19550 and the Rules of the Comisión Nacional de Valores (Argentine Securities Exchange Commission).

11) Evaluate the remunerations of the members

of the Supervisory Committee for the fiscal year ended December 31st 2015.

12) Evaluate both the management of the

Board of Directors and the Supervisory Committee.

13) Extension of the term of rotation of

the audit company Pistrelli, Henry Martin y Asociados S.R.L. to three years, for the fiscal years ending December 31st

2016, 2017 and 2018, as provided for in section 28, subsection c), Article IV, Chapter III, Title II, of the Rules of the Comisión

Nacional de Valores (Argentine Securities Exchange Commission) (Revised 2013), as amended and supplemented by the General Resolution

No 639/2015. Appoint the regular and alternate independent auditor for the fiscal year ending December 31st 2016.

14) Evaluate the remuneration of the independent

auditor for the fiscal year ended December 31st 2015.

15) Define the audit committee’s

budget.

16) Evaluate the authorization to extend

the Bank’s Global Program of Negotiable Obligations. Delegate to the Board of Directors the necessary powers to (i) define

and establish all the terms and conditions of the Program, of each of the series to be duly issued and of the negotiable obligations

to be issued under such Program; (ii) carry out before the CNV (Argentine Securities Exchange Commission) and/or any similar foreign

entities all necessary proceedings to obtain the authorization for the Program’s extension; (iii) carry out before MERVAL,

MAE and/or any market of Argentina and/or foreign market all necessary proceedings to obtain the authorization for the Program’s

extension, for the possible listing and/or negotiation of the negotiable obligations issued under such Program; (iv) if applicable,

negotiate with the entity to be determined in the relevant Price Supplement, the terms and conditions (including the determination

of the fees for its services) for it to act as payment agent and/or registration agent and, ultimately, as depository of the global

certificate; and (v) the hiring of one or more independent rating companies to rate the Program and/or series to be issued thereunder.

Authorize the Board to sub-delegate to one or more of its members, or to whom they deem convenient, the exercise of the powers

described above.

THE BOARD OF DIRECTORS

NOTES: (i) When considering items 3 and

4 of the Agenda, the Shareholders’ Meeting shall be held as a Special Meeting. (ii) In order to attend the Shareholders’

Meeting, all Shareholders shall deposit evidence or proof of their book-entry shares issued for such purpose by Caja de Valores

S.A. and provide sufficient evidence of identity and legal capacity, as the case may be, at Sarmiento 447, Capital Federal, from

10 am to 3 pm, by April 20th 2016. (iii) We remind all Shareholders that are foreign companies that they must register with the

Public Registry of Commerce (Registro Público de Comercio) of the City of Buenos Aires under the terms of section 123 of

the Argentine Business Company Law No. 19550, as amended. (iv) Pursuant to the provisions set forth in the rules issued by the

Argentine Securities Exchange Commission, the holders of the shares shall include the following information in the notice of attendance

to the Shareholders’ Meeting: holder’s name and last name or complete corporate name, identity card type and number

of individuals or, if the shareholder is a legal entity, then it shall furnish all registration data expressly stating the registry

with which such legal entity filed all its organizational documents and the jurisdiction and domicile thereof. All persons attending

the Shareholders’ Meeting in the name and on behalf of any shareholder shall provide identical information. (v) In order

to comply with the Recommendation included in item V.2.5 of Exhibit IV, Chapter IV of the Rules of the Argentine Securities Exchange

Commission, attendants shall be requested to disclose, before putting the matter to a vote, the decision of each of the candidates

to be elected as directors regarding the adoption or not of a Code of Corporate Governance and the reasons for taking such stand.

Jorge Horacio Brito

Chairman of the Board

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: March 18, 2016

| |

MACRO BANK INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Jorge H. Brito |

|

| |

Name: Jorge H. Brito |

|

| |

Title: Chief executive officer |

|

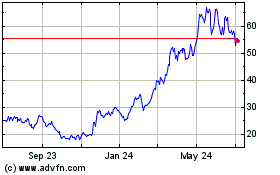

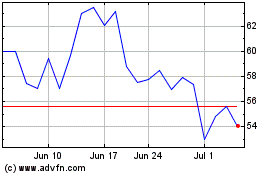

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024