SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

May 11, 2015

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name into

English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained

in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82- N/A

|

1Q15 Earnings

Release |

Banco Macro Announces Results

for the First Quarter of 2015

Buenos Aires, Argentina, May 11, 2015

– Banco Macro S.A. (NYSE: BMA; BCBA: BMA) (“Banco Macro” or “BMA” or the “Bank”) announced

today its results for the first quarter ended March 31, 2015 (“1Q15”). All figures are in Argentine pesos (Ps.) and

have been prepared in accordance with Argentine GAAP.

Summary

• The Bank’s net income totaled

Ps.1.1 billion in 1Q15. This result was 94% higher than the Ps.575 million reported in the fourth quarter of 2014 (“4Q14”)

and 6% lower than the Ps.1.2 billion posted in the first quarter of 2014 (“1Q14”). In 1Q15, the accumulated annualized

return on average equity (“ROAE”) and the accumulated annualized return on average assets (“ROAA”) were

36.6% and 5.9%, respectively.

• In 1Q15, Banco Macro’s

financing to the private sector grew 9% or Ps.3.8 billion quarter over quarter (“QoQ”) totaling Ps.48.1 billion. Among

commercial loans, overdrafts and pledge loans (mainly productive investments loans with pledge guarantee according to Communication

“A” 5319, “A” 5380, “A” 5449, “A” 5516, “A” 5600 and “A”

5681 and it´s corresponding modifications of BCRA), grew 67% and 4% QoQ, respectively. Meanwhile within consumer loans,

personal loans and credit cards rose 7% and 6% QoQ, respectively.

• In 1Q15, Banco Macro’s

total deposits grew 7% QoQ, totaling Ps.58.4 billion and representing 85% of the Bank’s total liabilities. Private sector

deposits grew 8% QoQ.

• Banco Macro continued showing

a strong solvency ratio, with excess capital of Ps.6.2 billion (23.6% capitalization ratio). In addition, the Bank’s liquid

assets remained at an adequate level, reaching 39.5% of its total deposits in 1Q15.

• In 1Q15, the Bank’s non-performing

to total financing ratio was 1.92% and the coverage ratio reached 131.94%.

| 1Q15 Earnings Release Conference Call |

IR Contacts in Buenos Aires: |

| |

|

| Tuesday, May 12, 2015 |

Jorge Scarinci |

| Time: 11:00 a.m. Eastern Time | 12:00 p.m. Buenos

Aires Time |

Finance & IR Manager |

| |

|

| Time: 11:00 a.m. Eastern Time | 1:00 p.m. Buenos

Aires Time |

Ines Lanusse |

| |

Investor Relations Officer |

| To participate, please dial: |

|

|

| Argentine Participants: (0800) 444 2930 |

Webcast Replay: click here |

Phone: (54 11) 5222 6682 |

| U.S. Participants: +1 (877) 317 6776 |

|

E-mail: investorelations@macro.com.ar |

| Participants from outside the U.S.: |

Available from 5/12/2015 through 5/26/2015 |

|

| +1 (412) 317 6776 |

|

Visit our website at: www.ri-macro.com.ar |

| |

|

|

| Conference ID: Banco Macro |

|

|

| Webcast: click here |

|

|

With the presence of: Jorge Pablo Brito (Member

of the Executive Committee), Guillermo Goldberg (Commercial Deputy General Manager), Jorge Scarinci (Finance and IR Manager) and

Ines Lanusse (Investor Relations Officer).

|

1Q15 Earnings

Release |

Disclaimer

This press release includes forward-looking

statements. We have based these forward-looking statements largely on our current beliefs, expectations and projections about future

events and financial trends affecting our business. Many important factors could cause our actual results to differ substantially

from those anticipated in our forward-looking statements, including, among other things: inflation; changes in interest rates and

the cost of deposits; government regulation; adverse legal or regulatory disputes or proceedings; credit and other risks of lending,

such as increases in defaults by borrowers; fluctuations and declines in the value of Argentine public debt; competition in banking

and financial services; deterioration in regional and national business and economic conditions in Argentina; and fluctuations

in the exchange rate of the peso.

The words “believe,” “may,”

“will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,”

“expect” and similar words are intended to identify forward-looking statements. Forward-looking statements include

information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive

position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition.

Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or to revise

any forward-looking statements after we distribute this press release because of new information, future events or other factors.

In light of the risks and uncertainties described above, the forward-looking events and circumstances discussed in this press release

might not occur and are not guarantees of future performance.

This report is a summary analysis of Banco

Macro's financial condition and results of operations as of and for the period indicated. For a correct interpretation, this report

must be read in conjunction with all other material periodically filed with the Comisión Nacional de Valores (www.cnv.gob.ar),

the Securities and Exchange Commission (www.sec.gov), the Bolsa de Comercio de Buenos Aires (www.bolsar.com) and the New York Stock

Exchange (www.nyse.com). In addition, the Central Bank (www.bcra.gov.ar) may publish information related to Banco Macro as of a

date subsequent to the last date for which the Bank has published information.

Readers of this report must note that this

is a translation made from an original version written and expressed in Spanish. Consequently, any matters of interpretation should

be referred to the original version in Spanish.

|

1Q15 Earnings

Release |

Results

Earnings per outstanding share were Ps.1.91

in 1Q15, 94% higher than 4Q14´s level and 6% lower than in 1Q14.

| EARNINGS PER SHARE | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Net income (M $) | |

| 1,186.3 | | |

| 732.6 | | |

| 985.5 | | |

| 575.0 | | |

| 1,114.2 | |

| Average shares outstanding (M) | |

| 584.5 | | |

| 584.5 | | |

| 584.5 | | |

| 584.5 | | |

| 584.5 | |

| Average shares in portfolio (M) | |

| 10.0 | | |

| 10.0 | | |

| 10.0 | | |

| 8.4 | | |

| 0.0 | |

| Average shares issued (M) | |

| 594.5 | | |

| 594.5 | | |

| 594.5 | | |

| 592.9 | | |

| 584.5 | |

| Book value per issued share ($) | |

| 16.51 | | |

| 16.71 | | |

| 18.36 | | |

| 19.38 | | |

| 21.57 | |

| Earnings per outstanding share ($) | |

| 2.03 | | |

| 1.25 | | |

| 1.69 | | |

| 0.98 | | |

| 1.91 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Book value per issued ADS (USD) | |

| 20.61 | | |

| 20.54 | | |

| 21.69 | | |

| 22.66 | | |

| 24.45 | |

| Earning per outstanding ADS (USD) | |

| 2.53 | | |

| 1.54 | | |

| 1.99 | | |

| 1.15 | | |

| 2.16 | |

Banco Macro’s 1Q15 net income of

Ps.1.1 billion was 94% or Ps.539.2 million higher than the previous quarter and 6% or Ps.72.1 million lower year over year (“YoY”).

In 1Q15, the accumulated annualized return on average equity (“ROAE”) and the accumulated annualized return on average

assets (“ROAA”) were 36.6% and 5.9%, respectively.

Had FX result been excluded, the bank´s

net income would have been Ps.1.0 billion in 1Q15 and Ps.507.4 million in 1Q14.

The operating result for 1Q15 was Ps.1.9

billion increasing 99% or Ps.932.1 million in comparison with 4Q14 and rising 1% or Ps.11.3 million YoY. Had income from government

and private securities and guaranteed loans (including CER) been excluded, such growth would have been 37% or Ps.202.3 million

higher QoQ.

In addition, had FX results been excluded,

the bank´s operating result growth would have grown 97% QoQ and 52% YoY.

It is important to emphasize that this

result was obtained with the leverage of 6.5x assets to equity ratio.

| INCOME STATEMENT | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Net financial income | |

| 2,463.4 | | |

| 1,722.2 | | |

| 2,121.8 | | |

| 1,792.7 | | |

| 2,694.7 | |

| Provision for loan losses | |

| -131.3 | | |

| -167.7 | | |

| -151.5 | | |

| -214.4 | | |

| -201.7 | |

| Net fee income | |

| 754.3 | | |

| 828.0 | | |

| 927.6 | | |

| 930.2 | | |

| 968.9 | |

| | |

| 3,086.4 | | |

| 2,382.5 | | |

| 2,897.9 | | |

| 2,508.5 | | |

| 3,461.9 | |

| Administrative expenses | |

| -1,222.6 | | |

| -1,314.2 | | |

| -1,396.6 | | |

| -1,565.5 | | |

| -1,586.8 | |

| Operating result | |

| 1,863.8 | | |

| 1,068.3 | | |

| 1,501.3 | | |

| 943.0 | | |

| 1,875.1 | |

| Minority interest in subsidiaries | |

| -6.8 | | |

| -5.3 | | |

| -5.9 | | |

| -5.5 | | |

| -7.7 | |

| Net other income | |

| 21.7 | | |

| 59.2 | | |

| 54.9 | | |

| -47.0 | | |

| -81.5 | |

| Net income before income tax | |

| 1,878.7 | | |

| 1,122.1 | | |

| 1,550.3 | | |

| 890.6 | | |

| 1,785.9 | |

| Income tax | |

| -692.4 | | |

| -389.4 | | |

| -564.8 | | |

| -315.6 | | |

| -671.7 | |

| NET INCOME | |

| 1,186.3 | | |

| 732.7 | | |

| 985.5 | | |

| 575.0 | | |

| 1,114.2 | |

The Bank’s 1Q15 financial income

totaled Ps.4.6 billion, increasing 29% (Ps.1.0 billion) compared to the previous quarter and 17% (Ps.652.1 million) compared to

1Q14.

|

1Q15 Earnings

Release |

Interest on loans represented 73% of total

financial income in 1Q15. Interest on loans was 8% or Ps.245.6 million higher than 4Q14’s level due to higher average volume

of the loan portfolio. On an annual basis, interest on loans grew 24% or Ps.638.5 million.

In 1Q15, net income from government and

private securities increased 195% or Ps.730.5 million QoQ mainly due to higher income from private securities, due to the increase

in the market price of the bank´s equity portfolio in which the bank had invested in the previous quarters. On an annual

basis, net income from government and private securities increased Ps.834.4 million.

Also in this quarter, a decrease of 4%

in income from Guaranteed Loans and in CER Adjustment was observed, mainly due to the evolution of CER. On an annual basis, income

from Guaranteed Loans and in CER Adjustment also decreased 71% or Ps.40.8 million.

Income from differences in quoted prices

of gold and foreign currency increased 146% or Ps.46.1 million QoQ due to the revaluation of government securities denominated

in US dollars and higher FX position revaluation caused by the gradual depreciation of the Argentine Peso. On an annual basis,

a decrease of 89% or Ps.601.2 million was experienced.

Other financial income increased 12% or

Ps.4.4 million compared to 4Q14 higher premiums on reverse repurchase agreements. On an annual basis, a decrease of 81% or Ps.178.8

million was experienced.

| FINANCIAL INCOME | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Interest on cash and due from banks | |

| 0.1 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| Interest on loans to the financial sector | |

| 13.2 | | |

| 28.5 | | |

| 10.0 | | |

| 12.6 | | |

| 20.0 | |

| Interest on overdrafts | |

| 351.7 | | |

| 352.2 | | |

| 340.9 | | |

| 293.4 | | |

| 350.2 | |

| Interest on documents | |

| 248.0 | | |

| 244.0 | | |

| 216.2 | | |

| 252.2 | | |

| 248.9 | |

| Interest on mortgages loans | |

| 115.7 | | |

| 123.5 | | |

| 120.3 | | |

| 123.6 | | |

| 120.6 | |

| Interest on pledges loans | |

| 62.2 | | |

| 64.5 | | |

| 67.8 | | |

| 79.8 | | |

| 83.6 | |

| Interest on credit cards loans | |

| 408.1 | | |

| 466.3 | | |

| 497.4 | | |

| 558.3 | | |

| 603.4 | |

| Interest on financial leases | |

| 20.3 | | |

| 19.7 | | |

| 18.6 | | |

| 17.7 | | |

| 18.8 | |

| Interest on other loans | |

| 1,468.7 | | |

| 1,493.4 | | |

| 1,567.1 | | |

| 1,743.2 | | |

| 1,880.9 | |

| Net Income from government & private securities (1) | |

| 271.0 | | |

| 567.2 | | |

| 761.1 | | |

| 374.9 | | |

| 1,105.4 | |

| Interest on other receivables from financial interm. | |

| 0.9 | | |

| 0.7 | | |

| 0.5 | | |

| 1.4 | | |

| 1.3 | |

| Income from Guaranteed Loans - Decree 1387/01 | |

| 20.3 | | |

| 6.3 | | |

| 6.7 | | |

| 6.9 | | |

| 7.1 | |

| CER adjustment | |

| 36.9 | | |

| 19.6 | | |

| 11.6 | | |

| 10.2 | | |

| 9.3 | |

| CVS adjustment | |

| 0.3 | | |

| 0.1 | | |

| 0.1 | | |

| 0.2 | | |

| 0.0 | |

| Difference in quoted prices of gold and foreign currency | |

| 678.9 | | |

| 35.1 | | |

| 82.0 | | |

| 31.6 | | |

| 77.7 | |

| Other | |

| 220.0 | | |

| 49.6 | | |

| 52.5 | | |

| 36.8 | | |

| 41.2 | |

| Total financial income | |

| 3,916.3 | | |

| 3,470.7 | | |

| 3,752.8 | | |

| 3,542.8 | | |

| 4,568.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) Net Income from government & private securities | |

| | | |

| | | |

| | | |

| | | |

| | |

| LEBAC / NOBAC | |

| 141.7 | | |

| 461.3 | | |

| 566.7 | | |

| 506.7 | | |

| 353.1 | |

| Other | |

| 129.3 | | |

| 105.9 | | |

| 194.4 | | |

| -131.8 | | |

| 752.3 | |

| Total | |

| 271.0 | | |

| 567.2 | | |

| 761.1 | | |

| 374.9 | | |

| 1,105.4 | |

The Bank’s 1Q15 financial expense

totaled Ps.1.9 billion, increasing by 7% (Ps.123.6 million) compared to the previous quarter and increasing by 29% (Ps.420.8 million)

compared to 1Q14.

In 1Q15, interest on deposits represented

75% of the Bank’s total financial expense. Interest on deposits increased 6% or Ps.76.9 million QoQ due to an increase of

the average time deposit rates of 100bp and an increase of 4% of average volume of deposits. On a yearly basis, interest on deposits

grew 24% or Ps.273.9 million.

Other financial expense grew 15% or Ps.41.4

million QoQ mainly due to higher gross income tax and 28% or Ps.68.9 million YoY.

|

1Q15 Earnings

Release |

| FINANCIAL EXPENSE | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Interest on checking accounts | |

| 0.1 | | |

| 0.2 | | |

| 0.2 | | |

| 0.0 | | |

| 0.0 | |

| Interest on saving accounts | |

| 11.1 | | |

| 12.1 | | |

| 12.5 | | |

| 13.6 | | |

| 14.1 | |

| Interest on time deposits | |

| 1,120.4 | | |

| 1,421.5 | | |

| 1,280.3 | | |

| 1,315.0 | | |

| 1,391.4 | |

| Interest on interfinancing received loans | |

| 0.0 | | |

| 0.0 | | |

| 0.3 | | |

| 0.9 | | |

| 3.1 | |

| Interest on subordinated bonds | |

| 29.2 | | |

| 29.1 | | |

| 30.6 | | |

| 31.5 | | |

| 31.9 | |

| Other Interest | |

| 0.8 | | |

| 0.8 | | |

| 0.8 | | |

| 0.7 | | |

| 0.7 | |

| Interest on other liabilities from fin intermediation | |

| 22.1 | | |

| 23.3 | | |

| 24.1 | | |

| 22.2 | | |

| 22.4 | |

| CER adjustment | |

| 3.2 | | |

| 2.8 | | |

| 1.7 | | |

| 1.5 | | |

| 1.2 | |

| Contribution to Deposit Guarantee Fund | |

| 19.0 | | |

| 20.2 | | |

| 21.6 | | |

| 90.2 | | |

| 93.0 | |

| Other | |

| 247.0 | | |

| 238.5 | | |

| 258.9 | | |

| 274.5 | | |

| 315.9 | |

| Total financial expense | |

| 1,452.9 | | |

| 1,748.5 | | |

| 1,631.0 | | |

| 1,750.1 | | |

| 1,873.7 | |

As of 1Q15, the Bank’s net interest

margin was 20.8%, wider than the 15.7% posted in 4Q14 and in 1Q14. Had income from government and private securities and guaranteed

loans been excluded, the Bank’s net interest margin would have been 15.9% in 1Q15, still larger than the 14.7% posted in

4Q14 and the 15% posted in 1Q14.

| ASSETS & LIABILITIES PERFORMANCE | |

MACRO consolidated | |

| In MILLON $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| Yields & rates in annualized nominal % | |

AVERAGE BALANCE | | |

INT | | |

AVERAGE BALANCE | | |

INT | | |

AVERAGE BALANCE | | |

INT | | |

AVERAGE BALANCE | | |

INT | | |

AVERAGE BALANCE | | |

INT | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-earning assets | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Goverment Securities | |

| 5,947.2 | | |

| 14.8 | % | |

| 11,524.7 | | |

| 18.4 | % | |

| 13,004.5 | | |

| 21.2 | % | |

| 11,517.9 | | |

| 19.8 | % | |

| 9,944.3 | | |

| 33.5 | % |

| Loans | |

| 39,178.0 | | |

| 28.4 | % | |

| 38,908.0 | | |

| 29.0 | % | |

| 39,220.9 | | |

| 28.9 | % | |

| 41,796.5 | | |

| 29.4 | % | |

| 45,633.1 | | |

| 29.7 | % |

| Private Sector | |

| 38,551.6 | | |

| 28.0 | % | |

| 38,275.2 | | |

| 29.0 | % | |

| 38,613.0 | | |

| 29.0 | % | |

| 41,219.3 | | |

| 29.5 | % | |

| 45,088.3 | | |

| 29.8 | % |

| Public Sector | |

| 626.4 | | |

| 51.9 | % | |

| 632.8 | | |

| 32.0 | % | |

| 607.9 | | |

| 25.4 | % | |

| 577.2 | | |

| 22.0 | % | |

| 544.8 | | |

| 20.5 | % |

| Financial trusts | |

| 538.9 | | |

| 32.0 | % | |

| 393.8 | | |

| 26.3 | % | |

| 364.7 | | |

| 24.5 | % | |

| 227.8 | | |

| 36.2 | % | |

| 225.7 | | |

| 23.5 | % |

| Other interest-earning assets | |

| 3,197.0 | | |

| 10.1 | % | |

| 2,664.5 | | |

| 11.5 | % | |

| 2,228.3 | | |

| 14.2 | % | |

| 2,773.0 | | |

| -26.0 | % | |

| 3,125.3 | | |

| 40.7 | % |

| Total interest-earning

assets | |

| 48,861.1 | | |

| 25.6 | % | |

| 53,491.0 | | |

| 25.9 | % | |

| 54,818.4 | | |

| 26.5 | % | |

| 56,315.2 | | |

| 24.7 | % | |

| 58,928.4 | | |

| 30.9 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non interest-earning assets | |

| 14,196.8 | | |

| | | |

| 14,876.5 | | |

| | | |

| 15,478.6 | | |

| | | |

| 16,866.7 | | |

| | | |

| 17,046.2 | | |

| | |

| Total Average Assets | |

| 63,057.9 | | |

| | | |

| 68,367.5 | | |

| | | |

| 70,297.0 | | |

| | | |

| 73,181.9 | | |

| | | |

| 75,974.6 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Checking accounts (*) | |

| 1,083.2 | | |

| 0.1 | % | |

| 1,546.6 | | |

| 0.0 | % | |

| 1,413.1 | | |

| 0.1 | % | |

| 1,397.1 | | |

| 0.0 | % | |

| 1,426.2 | | |

| 0.0 | % |

| Saving accounts (*) | |

| 7,384.4 | | |

| 0.6 | % | |

| 7,484.6 | | |

| 0.7 | % | |

| 8,458.2 | | |

| 0.6 | % | |

| 9,030.4 | | |

| 0.6 | % | |

| 9,796.6 | | |

| 0.6 | % |

| Time deposits (*) | |

| 23,617.4 | | |

| 19.2 | % | |

| 25,912.7 | | |

| 22.0 | % | |

| 26,107.6 | | |

| 19.5 | % | |

| 26,524.6 | | |

| 19.7 | % | |

| 27,231.9 | | |

| 20.7 | % |

| Corporate Bonds | |

| 1,950.2 | | |

| 9.8 | % | |

| 2,065.3 | | |

| 9.2 | % | |

| 2,127.3 | | |

| 9.2 | % | |

| 2,183.1 | | |

| 9.3 | % | |

| 2,227.6 | | |

| 9.4 | % |

| BCRA | |

| 17.0 | | |

| 8.8 | % | |

| 15.7 | | |

| 8.8 | % | |

| 14.3 | | |

| 8.8 | % | |

| 13.2 | | |

| 8.5 | % | |

| 11.5 | | |

| 8.6 | % |

| Other interest-bearing liabilities | |

| 405.5 | | |

| 6.7 | % | |

| 487.0 | | |

| 6.5 | % | |

| 625.4 | | |

| 7.1 | % | |

| 186.1 | | |

| 16.1 | % | |

| 209.5 | | |

| 15.2 | % |

| Total interest-bearing

liabilities | |

| 34,457.7 | | |

| 14.0 | % | |

| 37,511.9 | | |

| 15.9 | % | |

| 38,745.9 | | |

| 13.9 | % | |

| 39,334.5 | | |

| 14.0 | % | |

| 40,903.3 | | |

| 14.5 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non interest-bearing

liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Demand deposits (*) | |

| 13,929.2 | | |

| | | |

| 15,361.2 | | |

| | | |

| 17,373.9 | | |

| | | |

| 18,462.5 | | |

| | | |

| 19,156.9 | | |

| | |

| Other non interest-bearing

libilities | |

| 14,671.0 | | |

| | | |

| 15,494.4 | | |

| | | |

| 14,177.2 | | |

| | | |

| 15,385.0 | | |

| | | |

| 15,914.4 | | |

| | |

| Total

non interest-bearing liabilities | |

| 28,600.2 | | |

| | | |

| 30,855.6 | | |

| | | |

| 31,551.1 | | |

| | | |

| 33,847.4 | | |

| | | |

| 35,071.3 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Average Liabilities | |

| 63,057.9 | | |

| | | |

| 68,367.5 | | |

| | | |

| 70,297.0 | | |

| | | |

| 73,181.9 | | |

| | | |

| 75,974.6 | | |

| | |

(*) The average cost of funds is calculated only considering

deposits with and without interest-bearnig cost.

In 1Q15, Banco Macro’s net fee income

totaled Ps.968.9 million, 4% or Ps.38.7 million higher than 4Q14, and 28% or Ps.214.6 million higher than 1Q14. This growth was

mainly driven by fee charges on deposit accounts which increased 4% or Ps.31.8 million. On a yearly basis, fee charges on deposit

accounts and debit and credit card fees, increased 25% and 41%, respectively.

|

1Q15 Earnings

Release |

| NET FEE INCOME | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Fee charges on deposit accounts | |

| 622.2 | | |

| 678.0 | | |

| 750.9 | | |

| 747.9 | | |

| 779.7 | |

| Debit and credit card fees | |

| 239.5 | | |

| 267.8 | | |

| 296.7 | | |

| 343.7 | | |

| 336.6 | |

| Other fees related to foreign trade | |

| 14.6 | | |

| 16.2 | | |

| 17.3 | | |

| 19.0 | | |

| 18.5 | |

| Credit-related fees | |

| 17.2 | | |

| 20.2 | | |

| 26.0 | | |

| 28.7 | | |

| 21.0 | |

| Lease of safe-deposit boxes | |

| 19.2 | | |

| 20.5 | | |

| 22.0 | | |

| 22.5 | | |

| 22.0 | |

| Other | |

| 106.5 | | |

| 110.5 | | |

| 126.6 | | |

| 122.1 | | |

| 130.8 | |

| Total fee income | |

| 1,019.2 | | |

| 1,113.2 | | |

| 1,239.5 | | |

| 1,283.9 | | |

| 1,308.6 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total fee expense | |

| 264.9 | | |

| 285.2 | | |

| 311.9 | | |

| 353.7 | | |

| 339.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net fee income | |

| 754.3 | | |

| 828.0 | | |

| 927.6 | | |

| 930.2 | | |

| 968.9 | |

In 1Q15 Banco Macro’s administrative

expenses reached Ps.1.6 billion, 1% or Ps.21.3 million higher than the previous quarter mainly due to higher personnel expenses

and other professional fees. Administrative expenses increased 30% or Ps.364.2 million YoY due to an increase in personnel

expenses (mainly higher salaries) and other operating expenses.

Personnel expenses grew 2% or Ps.15.6 million

QoQ, basically due to the net effect resulting from the provisions accounted for bonuses in the previous quarter, the new provisions

accounted in this quarter for the payment of future salary increases and a one-time payment also accounted in this quarter. Personal

expenses increased 36% or Ps.247.8 million compared to 1Q14.

As of March 2015, the accumulated efficiency

ratio reached 43.3%, improving from the 47.7% posted in 4Q14. Administrative expenses grew 1% in 1Q15, while net financial income

and net fee income grew 35% as a whole, evidencing an improvement in efficiency.

| ADMINISTRATIVE EXPENSES | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Personnel expenses | |

| 697.7 | | |

| 743.1 | | |

| 820.1 | | |

| 929.9 | | |

| 945.5 | |

| Directors & statutory auditors´fees | |

| 71.2 | | |

| 58.7 | | |

| 11.7 | | |

| 21.8 | | |

| 52.0 | |

| Other professional fees | |

| 38.7 | | |

| 50.1 | | |

| 46.1 | | |

| 46.5 | | |

| 46.9 | |

| Advertising & publicity | |

| 21.0 | | |

| 26.8 | | |

| 31.8 | | |

| 48.8 | | |

| 37.8 | |

| Taxes | |

| 68.9 | | |

| 82.1 | | |

| 84.7 | | |

| 87.8 | | |

| 88.7 | |

| Depreciation of equipment | |

| 30.4 | | |

| 31.9 | | |

| 33.1 | | |

| 35.3 | | |

| 38.5 | |

| Amortization of organization costs | |

| 27.6 | | |

| 29.8 | | |

| 31.6 | | |

| 33.7 | | |

| 35.0 | |

| Other operating expenses | |

| 179.6 | | |

| 191.3 | | |

| 216.2 | | |

| 225.5 | | |

| 221.5 | |

| Other | |

| 87.5 | | |

| 100.4 | | |

| 121.3 | | |

| 136.2 | | |

| 120.9 | |

| Total Administrative Expenses | |

| 1,222.6 | | |

| 1,314.2 | | |

| 1,396.6 | | |

| 1,565.5 | | |

| 1,586.8 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Employees | |

| 8,675 | | |

| 8,701 | | |

| 8,688 | | |

| 8,693 | | |

| 8,686 | |

| Branches | |

| 429 | | |

| 431 | | |

| 431 | | |

| 434 | | |

| 434 | |

| Efficiency ratio | |

| 38.0 | % | |

| 40.8 | % | |

| 43.4 | % | |

| 57.5 | % | |

| 43.3 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Accumulated efficiency ratio | |

| 38.0 | % | |

| 44.0 | % | |

| 44.6 | % | |

| 47.7 | % | |

| 43.3 | % |

In 1Q15, the Bank’s net other loss

totaled a loss of Ps.81.5 million, increasing such negative result 73% or Ps.34.5 million QoQ. This increase was based on the net

effect resulting from lower total other income (mainly recovered loans and reversed allowances) of Ps.20.1 million and higher total

other expenses for Ps.14.4 million.

|

1Q15 Earnings

Release |

| NET OTHER INCOME/LOSSES | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Other Income | |

| | | |

| | | |

| | | |

| | | |

| | |

| Penalty interest | |

| 12.6 | | |

| 14.3 | | |

| 20.1 | | |

| 13.8 | | |

| 15.2 | |

| Recovered loans and reversed allowances | |

| 20.6 | | |

| 32.8 | | |

| 29.5 | | |

| 43.6 | | |

| 25.8 | |

| Other | |

| 28.6 | | |

| 55.6 | | |

| 56.8 | | |

| 22.9 | | |

| 19.2 | |

| Total Other Income | |

| 61.8 | | |

| 102.7 | | |

| 106.4 | | |

| 80.3 | | |

| 60.2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Expense | |

| | | |

| | | |

| | | |

| | | |

| | |

| Charges for other receivables uncollectibility and other allowances | |

| 12.7 | | |

| 14.2 | | |

| 7.5 | | |

| 8.3 | | |

| 12.5 | |

| Goodwill amortization | |

| 3.5 | | |

| 3.5 | | |

| 3.5 | | |

| 3.6 | | |

| 3.5 | |

| Other Expense | |

| 23.9 | | |

| 25.8 | | |

| 40.5 | | |

| 115.4 | | |

| 125.7 | |

| Total Other Expense | |

| 40.1 | | |

| 43.5 | | |

| 51.5 | | |

| 127.3 | | |

| 141.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Other Income/Losses | |

| 21.7 | | |

| 59.2 | | |

| 54.9 | | |

| -47.0 | | |

| -81.5 | |

In 1Q15, Banco Macro's effective income

tax rate was 37.6%, compared to 36.9% in 1Q14.

Financial

Assets

Private sector financing

The volume of “core” financing

to the private sector (including loans, financial trust and leasing portfolio) totaled Ps.48.1 billion, increasing 9% or Ps.3.8

billion QoQ and 20% or Ps.8.0 billion YoY.

Within commercial loans, growth was driven

by overdrafts and pledge loans (mainly productive investments loans), which grew 67% and 4% QoQ, respectively.

The main growth in consumer loans was driven

by personal loans and credit card loans which grew 7% and 6% QoQ, respectively.

Within financing to the private sector,

productive investments loans reached Ps.4.9 billion in 1Q15, representing 10% of the total financing to the private sector.

| FINANCING TO THE

PRIVATE SECTOR | |

MACRO

consolidated | | |

Variation | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Overdrafts | |

| 4,622.5 | | |

| 4,692.4 | | |

| 5,152.0 | | |

| 3,385.6 | | |

| 5,670.1 | | |

| 67 | % | |

| 23 | % |

| Discounted documents | |

| 4,333.9 | | |

| 4,061.4 | | |

| 4,144.3 | | |

| 4,627.4 | | |

| 4,633.9 | | |

| 0 | % | |

| 7 | % |

| Mortgages loans | |

| 2,292.1 | | |

| 2,319.5 | | |

| 2,361.4 | | |

| 2,466.1 | | |

| 2,401.3 | | |

| -3 | % | |

| 5 | % |

| Pledges loans | |

| 1,416.5 | | |

| 1,513.3 | | |

| 1,688.3 | | |

| 1,857.1 | | |

| 1,924.2 | | |

| 4 | % | |

| 36 | % |

| Personal loans | |

| 13,875.1 | | |

| 14,051.5 | | |

| 15,040.5 | | |

| 16,120.9 | | |

| 17,243.9 | | |

| 7 | % | |

| 24 | % |

| Credit Card loans | |

| 7,157.5 | | |

| 7,298.7 | | |

| 7,447.4 | | |

| 9,189.5 | | |

| 9,702.8 | | |

| 6 | % | |

| 36 | % |

| Others | |

| 5,260.8 | | |

| 5,035.0 | | |

| 5,235.0 | | |

| 5,835.2 | | |

| 5,637.3 | | |

| -3 | % | |

| 7 | % |

| Total loan portfolio | |

| 38,958.4 | | |

| 38,971.8 | | |

| 41,068.9 | | |

| 43,481.8 | | |

| 47,213.5 | | |

| 9 | % | |

| 21 | % |

| Financial trusts | |

| 771.0 | | |

| 563.9 | | |

| 516.6 | | |

| 413.4 | | |

| 500.6 | | |

| 21 | % | |

| -35 | % |

| Leasing | |

| 379.2 | | |

| 376.2 | | |

| 360.6 | | |

| 383.7 | | |

| 391.5 | | |

| 2 | % | |

| 3 | % |

| Total financing to the private sector | |

| 40,108.6 | | |

| 39,911.9 | | |

| 41,946.1 | | |

| 44,278.9 | | |

| 48,105.6 | | |

| 9 | % | |

| 20 | % |

|

1Q15 Earnings

Release |

Public Sector Assets

In 1Q15, the Bank’s public sector

assets (excluding LEBAC / NOBAC) to total assets ratio was 4.4%, lower than the 4.7% posted in 4Q14 and higher than the 3.7% posted

in 1Q14.

In 1Q15, government securities increased

33%, from which 75% are LEBAC/NOBAC from BCRA.

The Bank’s exposure to the public

sector remained below the Argentine system’s average (9%).

| PUBLIC SECTOR ASSETS | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| LEBAC / NOBAC B.C.R.A. | |

| 5,053.0 | | |

| 7,881.6 | | |

| 9,284.0 | | |

| 5,696.8 | | |

| 8,531.5 | |

| Other | |

| 1,660.6 | | |

| 2,227.7 | | |

| 2,726.2 | | |

| 2,873.8 | | |

| 2,894.9 | |

| Government securities | |

| 6,713.6 | | |

| 10,109.3 | | |

| 12,010.2 | | |

| 8,570.6 | | |

| 11,426.4 | |

| Guaranteed loans | |

| 363.5 | | |

| 383.8 | | |

| 396.4 | | |

| 407.7 | | |

| 418.0 | |

| Provincial loans | |

| 329.8 | | |

| 288.4 | | |

| 242.5 | | |

| 196.7 | | |

| 152.3 | |

| Government securities loans | |

| 0.0 | | |

| 0.0 | | |

| 1.5 | | |

| 0.0 | | |

| 0.0 | |

| Loans | |

| 693.3 | | |

| 672.2 | | |

| 640.4 | | |

| 604.4 | | |

| 570.3 | |

| Purchase of government bonds | |

| 23.1 | | |

| 23.4 | | |

| 24.0 | | |

| 24.2 | | |

| 24.7 | |

| Other receivables | |

| 23.1 | | |

| 23.4 | | |

| 24.0 | | |

| 24.2 | | |

| 24.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR ASSETS | |

| 7,430.0 | | |

| 10,804.9 | | |

| 12,674.6 | | |

| 9,199.2 | | |

| 12,021.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR LIABILITIES | |

| 44.5 | | |

| 43.3 | | |

| 42.1 | | |

| 40.4 | | |

| 38.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net exposure | |

| 7,385.5 | | |

| 10,761.6 | | |

| 12,632.5 | | |

| 9,158.8 | | |

| 11,983.0 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR ASSETS (net of

LEBAC / NOBAC ) | |

| 2,377.0 | | |

| 2,923.3 | | |

| 3,390.6 | | |

| 3,502.4 | | |

| 3,489.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR ASSETS (net of

LEBAC / NOBAC) /TOTAL ASSETS | |

| 3.7 | % | |

| 4.2 | % | |

| 4.7 | % | |

| 4.7 | % | |

| 4.4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net exposure (net of LEBAC/NOBAC) /

TOTAL ASSETS | |

| 3.6 | % | |

| 4.2 | % | |

| 4.6 | % | |

| 4.6 | % | |

| 4.3 | % |

Funding

Deposits

Banco Macro’s deposit base totaled

Ps.58.4 billion in 1Q15, growing 7% or Ps.3.7 billion QoQ and 24% or Ps.11.5 billion YoY and representing 85% of the Bank’s

total liabilities.

On a quarterly basis, private sector deposits

increased 8% or Ps.3.5 billion while public sector deposits grew 2% or Ps.141.9 million. Within private sector deposits, a slight

increase of Ps.53 million in foreign currency deposits was observed, while peso deposits increased 8% or Ps.3.5 billion.

The increase in private sector deposits

was led by time deposits, which grew 14% or Ps.3.1 billion QoQ. In addition, transactional deposits decreased 1% or Ps.170.5 million

QoQ.

|

1Q15 Earnings

Release |

| DEPOSITS | |

MACRO consolidated | | |

Variation | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Public sector | |

| 7,529.2 | | |

| 9,203.6 | | |

| 10,178.9 | | |

| 8,570.1 | | |

| 8,712.0 | | |

| 2 | % | |

| 16 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial sector | |

| 25.2 | | |

| 27.6 | | |

| 29.2 | | |

| 38.7 | | |

| 30.1 | | |

| -22 | % | |

| 19 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Private sector | |

| 39,359.4 | | |

| 42,047.1 | | |

| 42,943.4 | | |

| 46,107.8 | | |

| 49,655.8 | | |

| 8 | % | |

| 26 | % |

| Checking accounts | |

| 8,607.3 | | |

| 10,003.8 | | |

| 10,419.5 | | |

| 11,896.3 | | |

| 12,047.9 | | |

| 1 | % | |

| 40 | % |

| Savings accounts | |

| 7,954.8 | | |

| 9,467.0 | | |

| 9,262.1 | | |

| 11,013.9 | | |

| 10,691.8 | | |

| -3 | % | |

| 34 | % |

| Time deposits | |

| 21,306.7 | | |

| 20,933.1 | | |

| 21,574.6 | | |

| 21,510.8 | | |

| 24,610.8 | | |

| 14 | % | |

| 16 | % |

| Other | |

| 1,490.6 | | |

| 1,643.2 | | |

| 1,687.2 | | |

| 1,686.8 | | |

| 2,305.3 | | |

| 37 | % | |

| 55 | % |

| Total | |

| 46,913.8 | | |

| 51,278.3 | | |

| 53,151.5 | | |

| 54,716.6 | | |

| 58,397.9 | | |

| 7 | % | |

| 24 | % |

Other

sources of funds

In 1Q15, the total amount of other sources

of funds increased 9% or Ps.1.3 billion compared to 4Q14, as a result of a 10% increase in the shareholder’s equity (totaling

Ps.1.1 billion) and an increase in financing received from Argentine financial institutions (Ps.122.9 million).

| OTHER FUNDING | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Central Bank of Argentina | |

| 22.3 | | |

| 22.8 | | |

| 18.8 | | |

| 17.0 | | |

| 16.1 | |

| Banks and international institutions | |

| 308.2 | | |

| 421.2 | | |

| 211.9 | | |

| 88.3 | | |

| 39.2 | |

| Financing received from Argentine financial institutions | |

| 65.1 | | |

| 58.9 | | |

| 66.5 | | |

| 53.2 | | |

| 176.1 | |

| Subordinated corporate bonds | |

| 1,235.0 | | |

| 1,223.9 | | |

| 1,304.7 | | |

| 1,287.3 | | |

| 1,359.9 | |

| Non-subordinated corporate bonds | |

| 864.3 | | |

| 895.7 | | |

| 913.1 | | |

| 942.1 | | |

| 951.7 | |

| Shareholders´ equity | |

| 9,813.8 | | |

| 9,931.2 | | |

| 10,916.8 | | |

| 11,491.8 | | |

| 12,606.1 | |

| Total other Funding | |

| 12,308.6 | | |

| 12,553.7 | | |

| 13,431.8 | | |

| 13,879.7 | | |

| 15,149.1 | |

As of March 2015 Banco Macro’s consolidated

average cost of funds reached 9.9%. Banco Macro’s transactional deposits represented approximately 46% of its deposit base.

These accounts are low cost and are not sensitive to interest rate increases.

Liquid Assets

In 1Q15, the Bank’s liquid assets

amounted to Ps.23.1 billion, showing an increase of 4% or Ps.892.5 million QoQ and an increase of 22% or Ps.4.2 billion on a yearly

basis.

In 1Q15, Banco Macro experienced an increase

in Reverse Repos from Lebac/Nobac and as well as in LEBAC/NOBAC own portfolio of 401% and 54% QoQ, respectively, which was partially

offset by a 23% decrease in Cash.

In 1Q15 Banco Macro’s liquid assets

to total deposits ratio reached 39.5%.

|

1Q15 Earnings

Release |

| LIQUID ASSETS | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Cash | |

| 9,434.9 | | |

| 9,993.0 | | |

| 12,175.9 | | |

| 15,434.2 | | |

| 11,808.7 | |

| Guarantees for compensating chambers | |

| 614.3 | | |

| 629.0 | | |

| 668.0 | | |

| 810.9 | | |

| 932.4 | |

| Call | |

| 256.0 | | |

| 778.0 | | |

| 333.4 | | |

| 105.0 | | |

| 391.0 | |

| Reverse repos from other securities | |

| 221.0 | | |

| 102.4 | | |

| 277.7 | | |

| 117.9 | | |

| 80.2 | |

| Reverse repos from LEBAC/NOBAC | |

| 3,433.2 | | |

| 3,543.0 | | |

| 436.5 | | |

| 307.5 | | |

| 1,541.9 | |

| LEBAC / NOBAC own portfolio | |

| 4,948.4 | | |

| 7,682.6 | | |

| 8,984.5 | | |

| 5,422.4 | | |

| 8,336.2 | |

| Total | |

| 18,907.8 | | |

| 22,728.0 | | |

| 22,876.0 | | |

| 22,197.9 | | |

| 23,090.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liquid assets to total deposits | |

| 40.3 | % | |

| 44.3 | % | |

| 43.0 | % | |

| 40.6 | % | |

| 39.5 | % |

Solvency

Banco Macro continued showing high solvency

levels in 1Q15 with an integrated capital (RPC) of Ps.12.4 billion over a total capital requirement of Ps.6.2 billion. Banco Macro´s

excess capital in 1Q15 was 101% or Ps.6.2 billion.

As of January 2014, total capital requirement

is fully based on BCRA “Communication “A” 5369 methodology.

The capitalization ratio (as a percentage

of risk-weighted assets- RWA) was 23.6% in 1Q15, above the minimum required by the Central Bank.

Within the bank´s policy to protect

the bank´s shareholder´s equity, Banco Macro decided to create portfolio of a publicly traded share.

The Bank´s aim is to make the best use of this excess

capital.

| MINIMUM CAPITAL REQUIREMENT | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Credit risk requirement | |

| 3,490.1 | | |

| 3,516.8 | | |

| 3,609.7 | | |

| 3,991.7 | | |

| 4,336.5 | |

| Market risk requirement | |

| 148.6 | | |

| 212.1 | | |

| 270.0 | | |

| 388.1 | | |

| 452.2 | |

| Operational risk requirement | |

| 1,041.2 | | |

| 1,113.5 | | |

| 1,201.4 | | |

| 1,278.0 | | |

| 1,370.8 | |

| Interest rate risk requirement | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| Total capital requirement | |

| 4,679.8 | | |

| 4,842.4 | | |

| 5,081.1 | | |

| 5,657.9 | | |

| 6,159.5 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ordinary Capital Level 1 (COn1) | |

| 9,220.6 | | |

| 9,531.4 | | |

| 10,421.0 | | |

| 11,204.3 | | |

| 12,048.9 | |

| Deductible concepts COn1 | |

| -375.7 | | |

| -395.0 | | |

| -407.3 | | |

| -432.0 | | |

| -446.7 | |

| Aditional Capital Level 1 (CAn1) | |

| 366.8 | | |

| 366.8 | | |

| 366.8 | | |

| 366.8 | | |

| 321.0 | |

| Capital level 2 (COn2) | |

| 392.9 | | |

| 392.3 | | |

| 414.9 | | |

| 441.5 | | |

| 476.7 | |

| Integrated capital - RPC (*) (i) | |

| 9,604.6 | | |

| 9,895.5 | | |

| 10,795.4 | | |

| 11,580.7 | | |

| 12,399.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Risk-weighted assets - RWA (ii) | |

| 42,317.5 | | |

| 42,628.6 | | |

| 43,773.5 | | |

| 48,208.1 | | |

| 52,449.0 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Excess capital | |

| 4,924.8 | | |

| 5,053.2 | | |

| 5,714.3 | | |

| 5,922.8 | | |

| 6,240.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Capitalization ratio [(i)/(ii)] | |

| 22.7 | % | |

| 23.2 | % | |

| 24.7 | % | |

| 24.0 | % | |

| 23.6 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ratio TIER 1 | |

| 21.8 | % | |

| 22.3 | % | |

| 23.7 | % | |

| 23.1 | % | |

| 22.7 | % |

(*) Aditionally, the RPC of the Bank, acting as custodian

of securties representing investments of FGS, must also exceed an equivalent of 0.25% of the total securities under custody, based

in which, the Bank has successully fullfilled with this requirement.

|

1Q15 Earnings

Release |

Asset Quality

In 1Q15, Banco Macro’s non-performing

to total financing ratio reached a level of 1.92% similar to the one posted in 4Q14.

The coverage ratio reached 131.94% in 1Q15.

The Bank is committed to continue working

in this area to maintain excellent asset quality standards.

| ASSET QUALITY | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Commercial portfolio | |

| 16,933.1 | | |

| 17,384.5 | | |

| 16,923.7 | | |

| 16,310.1 | | |

| 18,780.0 | |

| Non-performing | |

| 300.7 | | |

| 298.6 | | |

| 235.0 | | |

| 330.3 | | |

| 388.6 | |

| Consumer portfolio | |

| 24,854.6 | | |

| 24,965.4 | | |

| 27,063.3 | | |

| 30,150.2 | | |

| 31,783.4 | |

| Non-performing | |

| 484.1 | | |

| 556.6 | | |

| 580.8 | | |

| 560.2 | | |

| 580.4 | |

| Total portfolio | |

| 41,787.7 | | |

| 42,349.9 | | |

| 43,987.0 | | |

| 46,460.3 | | |

| 50,563.4 | |

| Non-performing | |

| 784.8 | | |

| 855.2 | | |

| 815.8 | | |

| 890.5 | | |

| 969.0 | |

| Total non-performing/ Total portfolio | |

| 1.88 | % | |

| 2.02 | % | |

| 1.85 | % | |

| 1.92 | % | |

| 1.92 | % |

| Total allowances | |

| 1,076.8 | | |

| 1,138.0 | | |

| 1,131.4 | | |

| 1,205.0 | | |

| 1,278.5 | |

| Coverage ratio w/allowances | |

| 137.21 | % | |

| 133.07 | % | |

| 138.69 | % | |

| 135.32 | % | |

| 131.94 | % |

|

1Q15 Earnings

Release |

CER Exposure

and Foreign Currency Position

| CER EXPOSURE | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| CER adjustable ASSETS | |

| | | |

| | | |

| | | |

| | | |

| | |

| Guaranteed loans | |

| 350.3 | | |

| 369.6 | | |

| 381.0 | | |

| 391.1 | | |

| 400.3 | |

| Private sector loans | |

| 4.5 | | |

| 3.9 | | |

| 3.3 | | |

| 2.8 | | |

| 2.2 | |

| Other loans | |

| 0.3 | | |

| 0.2 | | |

| 0.2 | | |

| 0.2 | | |

| 0.3 | |

| Loans | |

| 355.1 | | |

| 373.7 | | |

| 384.5 | | |

| 394.1 | | |

| 402.8 | |

| Other receivables | |

| 2.3 | | |

| 1.8 | | |

| 1.3 | | |

| 1.0 | | |

| 0.8 | |

| Total CER adjustable assets | |

| 357.4 | | |

| 375.5 | | |

| 385.8 | | |

| 395.1 | | |

| 403.6 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| CER adjustable LIABILITIES | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| 0.3 | | |

| 0.3 | | |

| 0.3 | | |

| 0.0 | | |

| 0.3 | |

| Other liabilities from financial intermediation | |

| 43.2 | | |

| 43.2 | | |

| 42.0 | | |

| 40.3 | | |

| 38.3 | |

| Total CER adjustable liabilities | |

| 43.5 | | |

| 43.5 | | |

| 42.3 | | |

| 40.3 | | |

| 38.6 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET CER EXPOSURE | |

| 313.9 | | |

| 332.0 | | |

| 343.5 | | |

| 354.8 | | |

| 365.0 | |

| FOREIGN CURRENCY POSITION | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| | |

| | |

| | |

| | |

| | |

| |

| Cash | |

| 4,609.1 | | |

| 5,264.7 | | |

| 5,817.3 | | |

| 5,804.4 | | |

| 5,201.4 | |

| Government and private securities | |

| 1,392.8 | | |

| 1,828.0 | | |

| 1,486.9 | | |

| 1,454.5 | | |

| 2,316.7 | |

| Loans | |

| 2,435.3 | | |

| 2,428.7 | | |

| 2,048.8 | | |

| 1,939.3 | | |

| 2,002.4 | |

| Other receivables from financial intermediation | |

| 917.6 | | |

| 552.5 | | |

| 690.2 | | |

| 449.2 | | |

| 659.7 | |

| Other assets | |

| 83.0 | | |

| 93.3 | | |

| 85.7 | | |

| 89.5 | | |

| 103.9 | |

| Total Assets | |

| 9,437.8 | | |

| 10,167.2 | | |

| 10,128.9 | | |

| 9,736.9 | | |

| 10,284.1 | |

| Deposits | |

| 4,350.1 | | |

| 4,863.9 | | |

| 4,858.2 | | |

| 4,652.3 | | |

| 4,672.1 | |

| Other liabilities from financial intermediation | |

| 1,372.0 | | |

| 1,437.1 | | |

| 1,043.8 | | |

| 718.7 | | |

| 879.3 | |

| Non-subordinated corporate bonds | |

| 864.3 | | |

| 895.7 | | |

| 913.1 | | |

| 942.1 | | |

| 951.7 | |

| Subordinated corporate bonds | |

| 1,235.0 | | |

| 1,223.9 | | |

| 1,304.7 | | |

| 1,287.3 | | |

| 1,359.9 | |

| Other liabilities | |

| -63.2 | | |

| 10.5 | | |

| 5.8 | | |

| 5.5 | | |

| 2.7 | |

| Total Liabilities | |

| 7,758.2 | | |

| 8,431.1 | | |

| 8,125.6 | | |

| 7,605.9 | | |

| 7,865.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET FX POSITION | |

| 1,679.6 | | |

| 1,736.1 | | |

| 2,003.3 | | |

| 2,131.0 | | |

| 2,418.4 | |

|

1Q15 Earnings

Release |

Relevant

and Recent Events

| · | As of March 2015, Banco Macro satisfactorily

extended 30% of the loans regarding the productive investment program assigned for small & mid-sized companies (MiPyMES) required

by BCRA Communication “A” 5681 and it´s modifications. |

| · | On April 23th 2015, the Shareholders'

Meeting resolved to distribute as cash dividend to the Shareholders up to the amount of Ps.596,254,288.56, which amount represents

Ps.1.02 per outstanding share. The above mentioned Shareholders' Meeting further authorized the Board of Directors to make available

to the Shareholders the cash dividend in proportion to their shareholdings upon receipt of the relevant authorization from the

Central Bank (BCRA). |

Up to date, the BCRA has yet

not pronounced it´s decision regarding this matter.

| · | According to Communication “A”

5689, the Bank must account provisions for administrative and/or disciplinary sanctions, which are applied or initiated by BCRA,

UIF and CNV. Such provisions totaled Ps.11.4 million as of 1Q15 and were imposed by UIF. These sanctions have still not been paid,

since they are under appeal. |

|

1Q15 Earnings

Release |

| QUARTERLY BALANCE SHEET | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| ASSETS | |

| 68,241.1 | | |

| 72,858.7 | | |

| 72,730.3 | | |

| 74,995.6 | | |

| 81,641.8 | |

| Cash | |

| 9,434.9 | | |

| 9,993.0 | | |

| 12,175.9 | | |

| 15,434.2 | | |

| 11,808.7 | |

| Government and Private Securities | |

| 10,930.3 | | |

| 14,842.0 | | |

| 13,436.0 | | |

| 10,312.5 | | |

| 14,745.5 | |

| -LEBAC/NOBAC | |

| 8,381.6 | | |

| 11,225.6 | | |

| 9,421.0 | | |

| 5,729.9 | | |

| 9,878.1 | |

| -Other | |

| 2,548.7 | | |

| 3,616.4 | | |

| 4,015.0 | | |

| 4,582.6 | | |

| 4,867.4 | |

| Loans | |

| 39,507.8 | | |

| 39,916.8 | | |

| 41,586.7 | | |

| 43,740.3 | | |

| 47,704.6 | |

| to the non-financial government sector | |

| 693.3 | | |

| 672.5 | | |

| 639.5 | | |

| 604.4 | | |

| 570.3 | |

| to the financial sector | |

| 295.4 | | |

| 804.3 | | |

| 401.7 | | |

| 213.9 | | |

| 483.4 | |

| to the non-financial private sector and foreign residents | |

| 39,573.5 | | |

| 39,553.6 | | |

| 41,659.4 | | |

| 44,108.1 | | |

| 47,909.6 | |

| -Overdrafts | |

| 4,622.5 | | |

| 4,692.4 | | |

| 5,152.0 | | |

| 3,385.6 | | |

| 5,670.1 | |

| -Documents | |

| 4,333.9 | | |

| 4,061.4 | | |

| 4,144.3 | | |

| 4,627.4 | | |

| 4,633.9 | |

| -Mortgage loans | |

| 2,292.1 | | |

| 2,319.5 | | |

| 2,361.4 | | |

| 2,466.1 | | |

| 2,401.3 | |

| -Pledge loans | |

| 1,416.5 | | |

| 1,513.3 | | |

| 1,688.3 | | |

| 1,857.1 | | |

| 1,924.2 | |

| -Personal loans | |

| 13,875.1 | | |

| 14,051.5 | | |

| 15,040.5 | | |

| 16,120.9 | | |

| 17,243.9 | |

| -Credit cards | |

| 7,157.5 | | |

| 7,298.7 | | |

| 7,447.4 | | |

| 9,189.5 | | |

| 9,702.8 | |

| -Other | |

| 5,260.8 | | |

| 5,035.0 | | |

| 5,235.0 | | |

| 5,835.2 | | |

| 5,637.3 | |

| -Accrued interest, adjustments, price differences receivables and unearned discount | |

| 615.1 | | |

| 581.8 | | |

| 590.5 | | |

| 626.3 | | |

| 696.1 | |

| Allowances | |

| -1,054.4 | | |

| -1,113.6 | | |

| -1,113.9 | | |

| -1,186.1 | | |

| -1,258.7 | |

| Other receivables from financial intermediation | |

| 5,923.2 | | |

| 5,502.0 | | |

| 2,659.0 | | |

| 2,349.1 | | |

| 3,990.5 | |

| Receivables from financial leases | |

| 380.2 | | |

| 376.5 | | |

| 361.5 | | |

| 384.4 | | |

| 393.0 | |

| Investments in other companies | |

| 13.7 | | |

| 13.6 | | |

| 11.1 | | |

| 11.2 | | |

| 11.3 | |

| Other receivables | |

| 453.3 | | |

| 513.5 | | |

| 545.8 | | |

| 605.4 | | |

| 639.4 | |

| Other assets | |

| 1,597.8 | | |

| 1,701.4 | | |

| 1,954.3 | | |

| 2,158.5 | | |

| 2,348.8 | |

| LIABILITIES | |

| 58,427.3 | | |

| 62,927.5 | | |

| 61,813.5 | | |

| 63,503.8 | | |

| 69,035.7 | |

| Deposits | |

| 46,913.8 | | |

| 51,278.3 | | |

| 53,151.5 | | |

| 54,716.6 | | |

| 58,397.9 | |

| From the non-financial government sector | |

| 7,529.2 | | |

| 9,203.6 | | |

| 10,178.9 | | |

| 8,570.1 | | |

| 8,712.0 | |

| From the financial sector | |

| 25.2 | | |

| 27.6 | | |

| 29.2 | | |

| 38.7 | | |

| 30.1 | |

| From the non-financial private sector and foreign residents | |

| 39,359.4 | | |

| 42,047.1 | | |

| 42,943.4 | | |

| 46,107.8 | | |

| 49,655.8 | |

| -Checking accounts | |

| 8,607.3 | | |

| 10,003.8 | | |

| 10,419.5 | | |

| 11,896.3 | | |

| 12,047.9 | |

| -Savings accounts | |

| 7,954.8 | | |

| 9,467.0 | | |

| 9,262.1 | | |

| 11,013.9 | | |

| 10,691.8 | |

| -Time deposits | |

| 21,306.7 | | |

| 20,933.1 | | |

| 21,574.6 | | |

| 21,510.8 | | |

| 24,610.8 | |

| -Other | |

| 1,490.6 | | |

| 1,643.2 | | |

| 1,687.2 | | |

| 1,686.8 | | |

| 2,305.3 | |

| Other liabilities from financial intermediation | |

| 8,114.2 | | |

| 8,306.5 | | |

| 5,350.4 | | |

| 5,356.7 | | |

| 6,660.2 | |

| Subordinated corporate bonds | |

| 1,235.0 | | |

| 1,223.9 | | |

| 1,304.7 | | |

| 1,287.3 | | |

| 1,359.9 | |

| Other liabilities | |

| 2,164.3 | | |

| 2,118.9 | | |

| 2,006.9 | | |

| 2,143.2 | | |

| 2,617.7 | |

| SHAREHOLDERS' EQUITY | |

| 9,813.8 | | |

| 9,931.2 | | |

| 10,916.8 | | |

| 11,491.8 | | |

| 12,606.1 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| LIABILITIES + SHAREHOLDERS' EQUITY | |

| 68,241.1 | | |

| 72,858.7 | | |

| 72,730.3 | | |

| 74,995.6 | | |

| 81,641.8 | |

|

1Q15 Earnings

Release |

| QUARTERLY INCOME STATEMENT | |

MACRO consolidated | |

| In MILLION $ | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| Financial income | |

| 3,916.3 | | |

| 3,470.7 | | |

| 3,752.8 | | |

| 3,542.8 | | |

| 4,568.4 | |

| Interest on cash and due from banks | |

| 0.1 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| Interest on loans to the financial sector | |

| 13.2 | | |

| 28.5 | | |

| 10.0 | | |

| 12.6 | | |

| 20.0 | |

| Interest on overdrafts | |

| 351.7 | | |

| 352.2 | | |

| 340.9 | | |

| 293.4 | | |

| 350.2 | |

| Interest on documents | |

| 248.0 | | |

| 244.0 | | |

| 216.2 | | |

| 252.2 | | |

| 248.9 | |

| Interest on mortgage loans | |

| 115.7 | | |

| 123.5 | | |

| 120.3 | | |

| 123.6 | | |

| 120.6 | |

| Interest on pledge loans | |

| 62.2 | | |

| 64.5 | | |

| 67.8 | | |

| 79.8 | | |

| 83.6 | |

| Interest on credit card loans | |

| 408.1 | | |

| 466.3 | | |

| 497.4 | | |

| 558.3 | | |

| 603.4 | |

| Interest on financial leases | |

| 20.3 | | |

| 19.7 | | |

| 18.6 | | |

| 17.7 | | |

| 18.8 | |

| Interest on other loans | |

| 1,468.7 | | |

| 1,493.4 | | |

| 1,567.1 | | |

| 1,743.2 | | |

| 1,880.9 | |

| Income from government & private securities, net | |

| 271.0 | | |

| 567.2 | | |

| 761.1 | | |

| 374.9 | | |

| 1,105.4 | |

| Interest on other receivables from fin. intermediation | |

| 0.9 | | |

| 0.7 | | |

| 0.5 | | |

| 1.4 | | |

| 1.3 | |

| Income from Guaranteed Loans - Decree 1387/01 | |

| 20.3 | | |

| 6.3 | | |

| 6.7 | | |

| 6.9 | | |

| 7.1 | |

| CER adjustment | |

| 36.9 | | |

| 19.6 | | |

| 11.6 | | |

| 10.2 | | |

| 9.3 | |

| CVS adjustment | |

| 0.3 | | |

| 0.1 | | |

| 0.1 | | |

| 0.2 | | |

| 0.0 | |

| Difference in quoted prices of gold and foreign currency | |

| 678.9 | | |

| 35.1 | | |

| 82.0 | | |

| 31.6 | | |

| 77.7 | |

| Other | |

| 220.0 | | |

| 49.6 | | |

| 52.5 | | |

| 36.8 | | |

| 41.2 | |

| Financial expense | |

| -1,452.9 | | |

| -1,748.5 | | |

| -1,631.0 | | |

| -1,750.1 | | |

| -1,873.7 | |

| Interest on checking accounts | |

| -0.1 | | |

| -0.2 | | |

| -0.2 | | |

| 0.0 | | |

| 0.0 | |

| Interest on saving accounts | |

| -11.1 | | |

| -12.1 | | |

| -12.5 | | |

| -13.6 | | |

| -14.1 | |

| Interest on time deposits | |

| -1,120.4 | | |

| -1,421.5 | | |

| -1,280.3 | | |

| -1,315.0 | | |

| -1,391.4 | |

| Interest on interfinancing received loans | |

| 0.0 | | |

| 0.0 | | |

| -0.3 | | |

| -0.9 | | |

| -3.1 | |

| Interest on subordinated bonds | |

| -29.2 | | |

| -29.1 | | |

| -30.6 | | |

| -31.5 | | |

| -31.9 | |

| Other Interest | |

| -0.8 | | |

| -0.8 | | |

| -0.8 | | |

| -0.7 | | |

| -0.7 | |

| Interests on other liabilities from fin. intermediation | |

| -22.1 | | |

| -23.3 | | |

| -24.1 | | |

| -22.2 | | |

| -22.4 | |

| CER adjustment | |

| -3.2 | | |

| -2.8 | | |

| -1.7 | | |

| -1.5 | | |

| -1.2 | |

| Contribution to Deposit Guarantee Fund | |

| -19.0 | | |

| -20.2 | | |

| -21.6 | | |

| -90.2 | | |

| -93.0 | |

| Other | |

| -247.0 | | |

| -238.5 | | |

| -258.9 | | |

| -274.5 | | |

| -315.9 | |

| Net financial income | |

| 2,463.4 | | |

| 1,722.2 | | |

| 2,121.8 | | |

| 1,792.7 | | |

| 2,694.7 | |

| Provision for loan losses | |

| -131.3 | | |

| -167.7 | | |

| -151.5 | | |

| -214.4 | | |

| -201.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fee income | |

| 1,019.2 | | |

| 1,113.2 | | |

| 1,239.5 | | |

| 1,283.9 | | |

| 1,308.6 | |

| Fee expense | |

| -264.9 | | |

| -285.2 | | |

| -311.9 | | |

| -353.7 | | |

| -339.7 | |

| Net fee income | |

| 754.3 | | |

| 828.0 | | |

| 927.6 | | |

| 930.2 | | |

| 968.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Administrative expenses | |

| -1,222.6 | | |

| -1,314.2 | | |

| -1,396.6 | | |

| -1,565.5 | | |

| -1,586.8 | |

| Minority interest in subsidiaries | |

| -6.8 | | |

| -5.3 | | |

| -5.9 | | |

| -5.5 | | |

| -7.7 | |

| Net other income | |

| 21.7 | | |

| 59.2 | | |

| 54.9 | | |

| -47.0 | | |

| -81.5 | |

| Earnings before income tax | |

| 1,878.7 | | |

| 1,122.1 | | |

| 1,550.3 | | |

| 890.6 | | |

| 1,785.9 | |

| Income tax | |

| -692.4 | | |

| -389.4 | | |

| -564.8 | | |

| -315.6 | | |

| -671.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 1,186.3 | | |

| 732.7 | | |

| 985.5 | | |

| 575.0 | | |

| 1,114.2 | |

|

1Q15 Earnings

Release |

| QUARTER ANNUALIZED RATIOS | |

MACRO consolidated | |

| | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| Profitability & performance | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest margin (1) | |

| 15.7 | % | |

| 14.7 | % | |

| 16.7 | % | |

| 15.0 | % | |

| 20.8 | % |

| Net interest margin adjusted (2) | |

| 15.0 | % | |

| 13.3 | % | |

| 14.7 | % | |

| 15.5 | % | |

| 15.9 | % |

| Net fee income ratio | |

| 23.4 | % | |

| 32.5 | % | |

| 30.4 | % | |

| 34.2 | % | |

| 26.4 | % |

| Efficiency ratio | |

| 38.0 | % | |

| 51.5 | % | |

| 45.8 | % | |

| 57.5 | % | |

| 43.3 | % |

| Net fee income as a percentage of adm expenses | |

| 61.7 | % | |

| 63.0 | % | |

| 66.4 | % | |

| 59.4 | % | |

| 61.1 | % |

| Return on average assets | |

| 7.6 | % | |

| 4.3 | % | |

| 5.6 | % | |

| 3.1 | % | |

| 5.9 | % |

| Return on average equity | |

| 50.4 | % | |

| 28.8 | % | |

| 37.0 | % | |

| 20.1 | % | |

| 36.6 | % |

| Liquidity | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans as a percentage of total deposits | |

| 86.5 | % | |

| 80.0 | % | |

| 80.3 | % | |

| 82.1 | % | |

| 83.8 | % |

| Liquid assets as a percentage of total deposits | |

| 40.3 | % | |

| 44.3 | % | |

| 43.0 | % | |

| 40.6 | % | |

| 39.5 | % |

| Capital | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total equity as a percentage of total assets | |

| 14.4 | % | |

| 13.6 | % | |

| 15.0 | % | |

| 15.3 | % | |

| 15.4 | % |

| Regulatory capital as a percentage of risk weighted assets | |

| 22.7 | % | |

| 23.2 | % | |

| 24.7 | % | |

| 24.0 | % | |

| 23.6 | % |

| Asset Quality | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allowances over total loans | |

| 2.6 | % | |

| 2.7 | % | |

| 2.6 | % | |

| 2.6 | % | |

| 2.6 | % |

| Non-performing financing as a percentage of total financing | |

| 1.9 | % | |

| 2.0 | % | |

| 1.9 | % | |

| 1.9 | % | |

| 1.9 | % |

| Allowances as a percentage of non-performing financing | |

| 137.2 | % | |

| 133.1 | % | |

| 138.7 | % | |

| 135.3 | % | |

| 131.9 | % |

(1) Net interest margin excluding difference in quote

in foreign currency

(2) Net interest margin (excluding difference in quote

in foreign currency) except income from government

securities and guaranteed loans

| ACCUMULATED ANNUALIZED RATIOS | |

MACRO consolidated | |

| | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

I15 | |

| Profitability & performance | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest margin (1) | |

| 15.7 | % | |

| 15.2 | % | |

| 15.7 | % | |

| 15.7 | % | |

| 20.8 | % |

| Net interest margin adjusted (2) | |

| 15.0 | % | |

| 14.2 | % | |

| 14.3 | % | |

| 14.7 | % | |

| 15.9 | % |

| Net fee income ratio | |

| 23.4 | % | |

| 27.4 | % | |

| 28.5 | % | |

| 29.8 | % | |

| 26.4 | % |

| Efficiency ratio | |

| 38.0 | % | |

| 44.0 | % | |

| 44.6 | % | |

| 47.7 | % | |

| 43.3 | % |

| Net fee income as a percentage of adm expenses | |

| 61.7 | % | |

| 62.4 | % | |

| 63.8 | % | |

| 62.6 | % | |

| 61.1 | % |

| Return on average assets | |

| 7.6 | % | |

| 5.9 | % | |

| 5.8 | % | |

| 5.1 | % | |

| 5.9 | % |

| Return on average equity | |

| 50.4 | % | |

| 39.2 | % | |

| 38.4 | % | |

| 33.4 | % | |

| 36.6 | % |

| Liquidity | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans as a percentage of total deposits | |

| 86.5 | % | |

| 80.0 | % | |

| 80.3 | % | |

| 82.1 | % | |

| 83.8 | % |

| Liquid assets as a percentage of total deposits | |

| 40.3 | % | |

| 44.3 | % | |

| 43.0 | % | |

| 40.6 | % | |

| 39.5 | % |

| Capital | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total equity as a percentage of total assets | |

| 14.4 | % | |

| 13.6 | % | |

| 15.0 | % | |

| 15.3 | % | |

| 15.4 | % |

| Regulatory capital as a percentage of risk weighted assets | |

| 22.7 | % | |

| 23.2 | % | |

| 24.7 | % | |

| 24.0 | % | |

| 23.6 | % |

| Asset Quality | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allowances over total loans | |

| 2.6 | % | |

| 2.7 | % | |

| 2.6 | % | |

| 2.6 | % | |

| 2.6 | % |

| Non-performing financing as a percentage of total financing | |

| 1.9 | % | |

| 2.0 | % | |

| 1.9 | % | |

| 1.9 | % | |

| 1.9 | % |

| Allowances as a percentage of non-performing financing | |

| 137.2 | % | |

| 133.1 | % | |

| 138.7 | % | |

| 135.3 | % | |

| 131.9 | % |

(1) Net interest margin excluding difference in quote

in foreign currency

(2) Net interest margin (excluding difference in quote

in foreign currency) except income from government

securities and guaranteed loans

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: May 11, 2015

| |

MACRO BANK INC. |

|

| |

|

|

|

| |

By: |

/s/ Luis Cerolini |

|

| |

Name: Luis Cerolini |

|

| |

Title: Director |

|

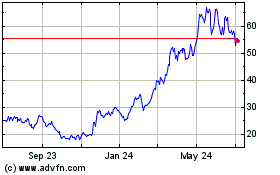

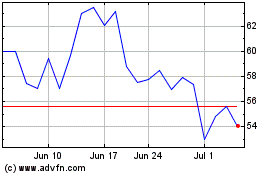

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024