SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

February 18, 2015

Commission File Number: 333-130901

MACRO BANK INC.

(Translation of registrant’s name into

English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained

in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82- N/A

|

4Q14

Earnings Release |

Banco Macro Announces Results

for the Fourth Quarter of 2014

Buenos Aires, Argentina, February 18,

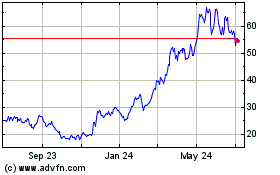

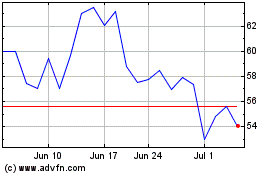

2015 – Banco Macro S.A. (NYSE: BMA; BCBA: BMA) (“Banco Macro” or “BMA” or the “Bank”)

announced today its results for the fourth quarter ended December 31, 2014 (“4Q14”). All figures are in Argentine pesos

(Ps.) and have been prepared in accordance with Argentine GAAP.

Summary

• The Bank’s net income

totaled Ps.575 million in 4Q14. This result was 42% lower than the Ps.985.5 million reported in the third quarter of 2014 (“3Q14”)

and 40% lower than the Ps.953.4 million posted in the fourth quarter of 2013 (“4Q13”). In 4Q14, the accumulated return

on average equity (“ROAE”) and the accumulated return on average assets (“ROAA”) were 33.4% and 5.1%, respectively.

Banco Macro´s net result for 2014 totaled Ps.3.5 billion, 42% higher than the in 2013.

• In 4Q14, Banco Macro’s

financing to the private sector grew 6% or Ps.2.3 billion quarter over quarter (“QoQ”) totaling Ps.44.3 billion. Among

commercial loans, documents and pledge loans (mainly productive investments loans through factoring and pledge guarantee loans

respectively, according to Communication “A” 5319, “A” 5380, “A” 5449, “A” 5516

and “A” 5600 and it´s corresponding modifications of BCRA), grew 12% and 10% QoQ, respectively. Meanwhile

within consumer loans, credit cards and personal loans rose 23% and 7% QoQ, respectively.

• In 4Q14, Banco Macro’s

total deposits grew 3% QoQ, totaling Ps.54.7 billion and representing 86% of the Bank’s total liabilities. Private sector

deposits grew 7% QoQ.

• Banco Macro continued showing

a strong solvency ratio, with excess capital of Ps.5.9 billion (24% capitalization ratio). In addition, the Bank’s liquid

assets remained at an adequate level, reaching 41% of its total deposits in 4Q14.

• In 4Q14, the Bank’s

non-performing to total financing ratio was 1.92% and the coverage ratio reached 135.32%.

| 4Q14 Earnings Release Conference Call |

IR Contacts in Buenos Aires: |

| |

|

| |

Jorge Scarinci |

| Thursday, February 19, 2015 |

Finance & IR Manager |

| Time: 11:00 a.m. Eastern Time | 1:00 p.m. Buenos Aires Time |

|

| |

|

| |

Webcast Replay: click here |

Ines Lanusse |

| To participate, please dial: |

|

Investor Relations |

| Argentine Participants: (0800) 444 2930 |

|

|

| U.S. Participants: +1 (877) 317 6776 |

Available from 2/19/2015 through 3/5/2015 |

Phone: (54 11) 5222 6682 |

| Participants from outside the U.S.: |

|

E-mail: investorelations@macro.com.ar |

| +1 (412) 317 6776 |

|

|

|

|

Visit our website at: www.ri-macro.com.ar |

| |

|

|

| Conference ID: Banco Macro |

|

|

| Webcast: click here |

|

|

With the presence of: Jorge Pablo Brito (Member of

the Executive Committee), Guillermo Goldberg (Commercial Deputy General Manager) and Jorge Scarinci (Finance and IR Manager).

|

4Q14

Earnings Release |

Disclaimer

This press release includes forward-looking

statements. We have based these forward-looking statements largely on our current beliefs, expectations and projections about future

events and financial trends affecting our business. Many important factors could cause our actual results to differ substantially

from those anticipated in our forward-looking statements, including, among other things: inflation; changes in interest rates and

the cost of deposits; government regulation; adverse legal or regulatory disputes or proceedings; credit and other risks of lending,

such as increases in defaults by borrowers; fluctuations and declines in the value of Argentine public debt; competition in banking

and financial services; deterioration in regional and national business and economic conditions in Argentina; and fluctuations

in the exchange rate of the peso.

The words “believe,” “may,”

“will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,”

“expect” and similar words are intended to identify forward-looking statements. Forward-looking statements include

information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive

position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition.

Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or to revise

any forward-looking statements after we distribute this press release because of new information, future events or other factors.

In light of the risks and uncertainties described above, the forward-looking events and circumstances discussed in this press release

might not occur and are not guarantees of future performance.

This report is a summary analysis of Banco

Macro's financial condition and results of operations as of and for the period indicated. For a correct interpretation, this report

must be read in conjunction with all other material periodically filed with the Comisión Nacional de Valores (www.cnv.gob.ar),

the Securities and Exchange Commission (www.sec.gov), the Bolsa de Comercio de Buenos Aires (www.bolsar.com) and the New York Stock

Exchange (www.nyse.com). In addition, the Central Bank (www.bcra.gov.ar) may publish information related to Banco Macro as of a

date subsequent to the last date for which the Bank has published information.

Readers of this report must note that this

is a translation made from an original version written and expressed in Spanish. Consequently, any matters of interpretation should

be referred to the original version in Spanish.

|

4Q14

Earnings Release |

Results

Earnings per outstanding share were Ps.0.98

in 4Q14, 42% lower than 3Q14´s level and 40% lower than in 4Q13.

| EARNINGS PER SHARE | |

MACRO consolidated | | |

| | |

| |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

2013 | | |

2014 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net income (M $) | |

| 953.4 | | |

| 1,186.3 | | |

| 732.6 | | |

| 985.5 | | |

| 575.0 | | |

| 2,443.6 | | |

| 3,479.5 | |

| Average shares outstanding (M) | |

| 584.5 | | |

| 584.5 | | |

| 584.5 | | |

| 584.5 | | |

| 584.5 | | |

| 584.5 | | |

| 584.5 | |

| Average shares in portfolio (M) | |

| 10.0 | | |

| 10.0 | | |

| 10.0 | | |

| 10.0 | | |

| 8.4 | | |

| 10.0 | | |

| 9.6 | |

| Average shares issued (M) | |

| 594.5 | | |

| 594.5 | | |

| 594.5 | | |

| 594.5 | | |

| 592.9 | | |

| 594.5 | | |

| 594.1 | |

| Book value per share ($) | |

| 14.51 | | |

| 16.51 | | |

| 16.71 | | |

| 18.36 | | |

| 19.38 | | |

| 14.51 | | |

| 19.34 | |

| Earnings per share ($) | |

| 1.63 | | |

| 2.03 | | |

| 1.25 | | |

| 1.69 | | |

| 0.98 | | |

| 4.18 | | |

| 5.95 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Book value per ADS (USD) | |

| 22.26 | | |

| 20.61 | | |

| 20.54 | | |

| 21.69 | | |

| 22.66 | | |

| 22.26 | | |

| 22.62 | |

| Earning per ADS (USD) | |

| 2.50 | | |

| 2.53 | | |

| 1.54 | | |

| 1.99 | | |

| 1.15 | | |

| 6.41 | | |

| 6.96 | |

Banco Macro’s 4Q14 net income of

Ps.575 million was 42% or Ps.410.5 million lower than the previous quarter and 40% or Ps.378.4 million lower year over year (“YoY”).

This result was influenced by less income form government securities, higher expenses provisions and higher provisions for loan

losses.

In 2014 Banco Macro´s net income

was Ps.3.5 billion, 42% higher than in 2013. Banco Macro´s 2014 net result represented an accumulated ROAE and an accumulated

ROAA of 33.4% and 5.1% respectively. In 4Q14, Banco Macro accounted additional provisions for the payment of bonuses, for a one-time

payment and for other provisions for Ps.182.4 million. Had these provisions been excluded, 4Q14 net income would have been Ps.757.4

million (35.1% ROAE and 5.3% ROAA).

The operating result for 2014 was Ps.5.4

billion increasing 46% in comparison with 2013.

It is important to emphasize that this

result was obtained with the leverage of 6.5x assets to equity ratio.

| INCOME STATEMENT | |

MACRO

consolidated | | |

| | |

| |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

2013 | | |

2014 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net financial income | |

| 1,818.4 | | |

| 2,463.4 | | |

| 1,722.2 | | |

| 2,121.8 | | |

| 1,792.7 | | |

| 5,732.0 | | |

| 8,100.1 | |

| Provision for loan losses | |

| -158.5 | | |

| -131.3 | | |

| -167.7 | | |

| -151.5 | | |

| -214.4 | | |

| -540.0 | | |

| -664.9 | |

| Net fee income | |

| 701.9 | | |

| 754.3 | | |

| 828.0 | | |

| 927.6 | | |

| 930.2 | | |

| 2,508.5 | | |

| 3,440.1 | |

| | |

| 2,361.8 | | |

| 3,086.4 | | |

| 2,382.5 | | |

| 2,897.9 | | |

| 2,508.5 | | |

| 7,700.5 | | |

| 10,875.3 | |

| Administrative expenses | |

| -1,104.9 | | |

| -1,222.6 | | |

| -1,314.2 | | |

| -1,396.6 | | |

| -1,565.5 | | |

| -4,015.4 | | |

| -5,498.9 | |

| Operating result | |

| 1,256.9 | | |

| 1,863.8 | | |

| 1,068.3 | | |

| 1,501.3 | | |

| 943.0 | | |

| 3,685.1 | | |

| 5,376.4 | |

| Minority interest in subsidiaries | |

| -5.4 | | |

| -6.8 | | |

| -5.3 | | |

| -5.9 | | |

| -5.5 | | |

| -18.1 | | |

| -23.5 | |

| Net other income | |

| 29.8 | | |

| 21.7 | | |

| 59.2 | | |

| 54.9 | | |

| -47.0 | | |

| 109.5 | | |

| 88.8 | |

| Net income before income tax | |

| 1,281.3 | | |

| 1,878.7 | | |

| 1,122.1 | | |

| 1,550.3 | | |

| 890.6 | | |

| 3,776.5 | | |

| 5,441.7 | |

| Income tax | |

| -327.9 | | |

| -692.4 | | |

| -389.4 | | |

| -564.8 | | |

| -315.6 | | |

| -1,332.9 | | |

| -1,962.2 | |

| NET INCOME | |

| 953.4 | | |

| 1,186.3 | | |

| 732.7 | | |

| 985.5 | | |

| 575.0 | | |

| 2,443.6 | | |

| 3,479.5 | |

The Bank’s 4Q14 financial income

totaled Ps.3.5 billion, decreasing by 6% (Ps.210 million) compared to the previous quarter and increasing 19% (Ps.555.1 million)

compared to 4Q13.

Interest on loans represented 87% of total

financial income in 4Q14, higher than 76% posted in 3Q14 and 81% posted in 4Q13. Interest on loans was 9% or Ps.242.5 million higher

than 3Q14’s level due to a 7% higher average volume of the loan portfolio and to an increase in the average interest lending

rates of 45bp. On an annual basis, interest on loans grew 28% or Ps.674.8 million.

|

4Q14

Earnings Release |

In 2014, interest on loans grew 39% or

Ps.3.2 billion compared to 2013.

In 4Q14, net income from government and

private securities decreased 51% or Ps.386.2 million QoQ mainly due to a fall in the market price of our share portfolio. On an

annual basis, net income from government and private securities increased 291% or Ps.279 million.

In 2014, net income from government and

private securities increased 383% or Ps.1.6 billion compared to 2013.

Income from differences in quoted prices

of gold and foreign currency decreased 61% or Ps.50.4 million QoQ due to a lower FX position revaluation caused by the deceleration

in the depreciation of the Argentine Peso. On an annual basis, the decrease was 91% or Ps.311 million.

In 2014, income from differences in quoted

prices of gold and foreign currency increased 2% or Ps.19.5 million compared to 2013.

Other financial income decreased 30% or

Ps.15.7 million compared to 3Q14 mainly due to lower income from on shore forward foreign currency transactions. On an annual basis,

the decrease was 70% or Ps.83.9 million.

| FINANCIAL INCOME | |

MACRO

consolidated | | |

| | |

| |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

2013 | | |

2014 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Interest on cash and due from banks | |

| 0.0 | | |

| 0.1 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.2 | | |

| 0.1 | |

| Interest on loans to the financial sector | |

| 16.7 | | |

| 13.2 | | |

| 28.5 | | |

| 10.0 | | |

| 12.6 | | |

| 51.5 | | |

| 64.3 | |

| Interest on overdrafts | |

| 327.9 | | |

| 351.7 | | |

| 352.2 | | |

| 340.9 | | |

| 293.4 | | |

| 1,074.9 | | |

| 1,338.2 | |

| Interest on documents | |

| 202.4 | | |

| 248.0 | | |

| 244.0 | | |

| 216.2 | | |

| 252.2 | | |

| 654.1 | | |

| 960.4 | |

| Interest on mortgages loans | |

| 100.0 | | |

| 115.7 | | |

| 123.5 | | |

| 120.3 | | |

| 123.6 | | |

| 333.9 | | |

| 483.1 | |

| Interest on pledges loans | |

| 58.6 | | |

| 62.2 | | |

| 64.5 | | |

| 67.8 | | |

| 79.8 | | |

| 197.1 | | |

| 274.3 | |

| Interest on credit cards loans | |

| 316.0 | | |

| 408.1 | | |

| 466.3 | | |

| 497.4 | | |

| 558.3 | | |

| 1,022.2 | | |

| 1,930.1 | |

| Interest on financial leases | |

| 18.4 | | |

| 20.3 | | |

| 19.7 | | |

| 18.6 | | |

| 17.7 | | |

| 68.4 | | |

| 76.3 | |

| Interest on other loans | |

| 1,366.0 | | |

| 1,468.7 | | |

| 1,493.4 | | |

| 1,567.1 | | |

| 1,743.2 | | |

| 4,782.7 | | |

| 6,272.4 | |

| Net Income from government & private

securities (1) | |

| 95.9 | | |

| 271.0 | | |

| 567.2 | | |

| 761.1 | | |

| 374.9 | | |

| 409.1 | | |

| 1,974.2 | |

| Interest on other receivables from financial interm. | |

| 0.9 | | |

| 0.9 | | |

| 0.7 | | |

| 0.5 | | |

| 1.4 | | |

| 3.1 | | |

| 3.5 | |

| Income from Guaranteed Loans - Decree 1387/01 | |

| 9.5 | | |

| 20.3 | | |

| 6.3 | | |

| 6.7 | | |

| 6.9 | | |

| 26.0 | | |

| 40.2 | |

| CER adjustment | |

| 12.0 | | |

| 36.9 | | |

| 19.6 | | |

| 11.6 | | |

| 10.2 | | |

| 35.2 | | |

| 78.3 | |

| CVS adjustment | |

| 0.1 | | |

| 0.3 | | |

| 0.1 | | |

| 0.1 | | |

| 0.2 | | |

| 0.6 | | |

| 0.7 | |

| Difference in quoted prices of gold and foreign currency | |

| 342.6 | | |

| 678.9 | | |

| 35.1 | | |

| 82.0 | | |

| 31.6 | | |

| 808.1 | | |

| 827.6 | |

| Other | |

| 120.7 | | |

| 220.0 | | |

| 49.6 | | |

| 52.5 | | |

| 36.8 | | |

| 286.4 | | |

| 358.9 | |

| Total financial income | |

| 2,987.7 | | |

| 3,916.3 | | |

| 3,470.7 | | |

| 3,752.8 | | |

| 3,542.8 | | |

| 9,753.5 | | |

| 14,682.6 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) Net

Income from government & private securities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| LEBAC / NOBAC | |

| 5.2 | | |

| 141.7 | | |

| 461.3 | | |

| 566.7 | | |

| 506.7 | | |

| 57.6 | | |

| 1,676.4 | |

| Other | |

| 90.7 | | |

| 129.3 | | |

| 105.9 | | |

| 194.4 | | |

| -131.8 | | |

| 351.5 | | |

| 297.8 | |

| TOTAL | |

| 95.9 | | |

| 271.0 | | |

| 567.2 | | |

| 761.1 | | |

| 374.9 | | |

| 409.1 | | |

| 1,974.2 | |

The Bank’s 4Q14 financial expense

totaled Ps.1.8 billion, increasing by 7% (Ps.119.2 million) compared to the previous quarter and increasing by 50% (Ps.580.9 million)

compared to 4Q13.

In 4Q14, interest on deposits represented

76% of the Bank’s total financial expense. Interest on deposits increased 3% or Ps.35.6 million QoQ. During 4Q14 average

time deposit interest rates slightly increased (20bp), while the average volume of deposits grew 3%. On a yearly basis, interest

on deposits grew 46% or Ps.418.2 million.

In 2014, interest on deposits increased

67% or Ps.2.1 billion compared to 2013.

Other financial expense grew 6% or Ps.15.8

million QoQ and 38% or Ps.75.6 million YoY mainly due to higher gross income tax.

|

4Q14

Earnings Release |

| FINANCIAL EXPENSE | |

MACRO

consolidated | | |

| | |

| |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

2013 | | |

2014 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Interest on checking accounts | |

| 0.2 | | |

| 0.1 | | |

| 0.2 | | |

| 0.2 | | |

| 0.0 | | |

| 0.5 | | |

| 0.5 | |

| Interest on saving accounts | |

| 10.2 | | |

| 11.1 | | |

| 12.1 | | |

| 12.5 | | |

| 13.6 | | |

| 41.1 | | |

| 49.3 | |

| Interest on time deposits | |

| 900.0 | | |

| 1,120.4 | | |

| 1,421.5 | | |

| 1,280.3 | | |

| 1,315.0 | | |

| 3,065.8 | | |

| 5,137.2 | |

| Interest on interfinancing received loans | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.3 | | |

| 0.9 | | |

| 2.9 | | |

| 1.2 | |

| Interest on subordinated bonds | |

| 22.8 | | |

| 29.2 | | |

| 29.1 | | |

| 30.6 | | |

| 31.5 | | |

| 81.0 | | |

| 120.4 | |

| Other Interest | |

| 0.9 | | |

| 0.8 | | |

| 0.8 | | |

| 0.8 | | |

| 0.7 | | |

| 3.4 | | |

| 3.1 | |

| Interest on other liabilities from fin intermediation | |

| 17.0 | | |

| 22.1 | | |

| 23.3 | | |

| 24.1 | | |

| 22.2 | | |

| 61.7 | | |

| 91.7 | |

| CER adjustment | |

| 1.1 | | |

| 3.2 | | |

| 2.8 | | |

| 1.7 | | |

| 1.5 | | |

| 4.3 | | |

| 9.2 | |

| Contribution to Deposit Guarantee Fund | |

| 18.0 | | |

| 19.0 | | |

| 20.2 | | |

| 21.6 | | |

| 90.2 | | |

| 67.8 | | |

| 151.0 | |

| Other | |

| 199.1 | | |

| 247.0 | | |

| 238.5 | | |

| 258.9 | | |

| 274.5 | | |

| 693.0 | | |

| 1,018.9 | |

| Total financial expense | |

| 1,169.3 | | |

| 1,452.9 | | |

| 1,748.5 | | |

| 1,631.0 | | |

| 1,750.1 | | |

| 4,021.5 | | |

| 6,582.5 | |

As of 4Q14, the Bank’s net interest

margin was 15.5%, lower than the 15.7% posted in 3Q14 and higher than the 13.7% posted in 4Q13. Had income from government and

private securities and guaranteed loans been excluded, the Bank’s net interest margin would have been 14.7% in 4Q14, higher

than the 14.3% posted in 3Q14 and higher than the 13.9% posted in 4Q13.

In 4Q14, Banco Macro’s net fee income

totaled Ps.930.2 million, Ps.2.5 million higher than 3Q14, and 33% or Ps.228.2 million higher than 4Q13. This growth was mainly

driven by debit and credit card fees which increased 16% or Ps.47 million QoQ. On a yearly basis debit and credit card fees and

fee charges on deposit accounts increased 52% and 39%, respectively.

In 2014, net fee income grew 37%, among

which, debit and credit card fees and fee charges on deposit accounts stand out.

| NET FEE INCOME | |

MACRO

consolidated | | |

| | |

| |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

2013 | | |

2014 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Fee charges on deposit accounts | |

| 540.0 | | |

| 622.2 | | |

| 678.0 | | |

| 750.9 | | |

| 747.9 | | |

| 2,022.7 | | |

| 2,799.0 | |

| Debit and credit card fees | |

| 226.1 | | |

| 239.5 | | |

| 267.8 | | |

| 296.7 | | |

| 343.7 | | |

| 776.7 | | |

| 1,147.7 | |

| Other fees related to foreign trade | |

| 11.8 | | |

| 14.6 | | |

| 16.2 | | |

| 17.3 | | |

| 19.0 | | |

| 44.5 | | |

| 67.1 | |

| Credit-related fees | |

| 38.1 | | |

| 17.2 | | |

| 20.2 | | |

| 26.0 | | |

| 28.7 | | |

| 164.1 | | |

| 92.1 | |

| Lease of safe-deposit boxes | |

| 17.8 | | |

| 19.2 | | |

| 20.5 | | |

| 22.0 | | |

| 22.5 | | |

| 70.8 | | |

| 84.2 | |

| Other | |

| 95.0 | | |

| 106.5 | | |

| 110.5 | | |

| 126.6 | | |

| 122.1 | | |

| 347.5 | | |

| 465.7 | |

| Total fee income | |

| 928.8 | | |

| 1,019.2 | | |

| 1,113.2 | | |

| 1,239.5 | | |

| 1,283.9 | | |

| 3,426.3 | | |

| 4,655.8 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total fee expense | |

| 226.9 | | |

| 264.9 | | |

| 285.2 | | |

| 311.9 | | |

| 353.7 | | |

| 917.8 | | |

| 1,215.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net fee income | |

| 701.9 | | |

| 754.3 | | |

| 828.0 | | |

| 927.6 | | |

| 930.2 | | |

| 2,508.5 | | |

| 3,440.1 | |

In 4Q14 Banco Macro’s administrative

expenses reached Ps.1.6 billion, 12% or Ps.168.9 million higher than the previous quarter mainly due to higher personnel expenses

and advertising and publicity. Administrative expenses increased 42% or Ps.460.6 million YoY due to an increase in personnel

expenses (mainly higher salaries) and higher other operating expenses.

Personnel expenses grew 13% or Ps.109.8

million QoQ, basically due to the net effect resulting from the provisions accounted for Ps.182.4 million (including bonuses, other

provisions for salary compensations of Ps.7.500 per employee and other smaller provisions), plus other provisions accounted in

the previous quarter for Ps.72.8 million, which were not repeated in 4Q14. Had the above mentioned concepts been excluded, personnel

expenses would have remained stable.

In 2014, administrative expenses grew 37%,

mainly due to the salary increase arranged with the Banking Unions back in April 2014.

|

4Q14

Earnings Release |

As of December 2014, the accumulated efficiency

ratio reached 47.7%, improving from the 48.7% posted in 4Q13. Administrative expenses grew 37% in 2014, while net financial income

and net fee income grew 40% as a whole in the same year, evidencing an improvement in efficiency.

| ADMINISTRATIVE EXPENSES | |

MACRO

consolidated | | |

| | |

| |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

2013 | | |

2014 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Personnel expenses | |

| 641.2 | | |

| 697.7 | | |

| 743.1 | | |

| 820.1 | | |

| 929.9 | | |

| 2,351.9 | | |

| 3,190.8 | |

| Directors & statutory auditors´fees | |

| 46.5 | | |

| 71.2 | | |

| 58.7 | | |

| 11.7 | | |

| 21.8 | | |

| 117.1 | | |

| 163.4 | |

| Other professional fees | |

| 36.4 | | |

| 38.7 | | |

| 50.1 | | |

| 46.1 | | |

| 46.5 | | |

| 138.2 | | |

| 181.4 | |

| Advertising & publicity | |

| 14.0 | | |

| 21.0 | | |

| 26.8 | | |

| 31.8 | | |

| 48.8 | | |

| 103.4 | | |

| 128.4 | |

| Taxes | |

| 60.0 | | |

| 68.9 | | |

| 82.1 | | |

| 84.7 | | |

| 87.8 | | |

| 218.5 | | |

| 323.5 | |

| Depreciation of equipment | |

| 26.5 | | |

| 30.4 | | |

| 31.9 | | |

| 33.1 | | |

| 35.3 | | |

| 98.7 | | |

| 130.7 | |

| Amortization of organization costs | |

| 25.6 | | |

| 27.6 | | |

| 29.8 | | |

| 31.6 | | |

| 33.7 | | |

| 89.0 | | |

| 122.7 | |

| Other operating expenses | |

| 165.7 | | |

| 179.6 | | |

| 191.3 | | |

| 216.2 | | |

| 225.5 | | |

| 598.4 | | |

| 812.6 | |

| Other | |

| 89.0 | | |

| 87.5 | | |

| 100.4 | | |

| 121.3 | | |

| 136.2 | | |

| 300.2 | | |

| 445.4 | |

| Total Administrative Expenses | |

| 1,104.9 | | |

| 1,222.6 | | |

| 1,314.2 | | |

| 1,396.6 | | |

| 1,565.5 | | |

| 4,015.4 | | |

| 5,498.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Employees | |

| 8,613 | | |

| 8,675 | | |

| 8,701 | | |

| 8,688 | | |

| 8,693 | | |

| 8,613 | | |

| 8,693 | |

| Branches | |

| 430 | | |

| 429 | | |

| 431 | | |

| 431 | | |

| 434 | | |

| 430 | | |

| 434 | |

| Efficiency ratio | |

| 64.0 | % | |

| 38.0 | % | |

| 40.8 | % | |

| 43.4 | % | |

| 57.5 | % | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Accumulated efficiency ratio | |

| 48.7 | % | |

| 38.0 | % | |

| 44.0 | % | |

| 44.6 | % | |

| 47.7 | % | |

| 48.7 | % | |

| 47.7 | % |

In 4Q14, the Bank’s net other income

totaled a loss of Ps.47 million, decreasing Ps.101.9 million QoQ. This decrease was based on lower other income for Ps.26.1 million

and higher Other Expenses for Ps.75.8 million. Within other income, in the previous quarter, stands out the VISA dividend payment

for Ps.22.4 million and the sale of the Banelco shares for Ps.8.6 million which are not repeated in this quarter, while in other

expenses, the cancelation of contingent liabilities for Ps.72.2 million were accounted in 4Q14.

| NET OTHER INCOME | |

MACRO

consolidated | | |

| | |

| |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

2013 | | |

2014 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Other Income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Penalty interest | |

| 10.4 | | |

| 12.6 | | |

| 14.3 | | |

| 20.1 | | |

| 13.8 | | |

| 41.0 | | |

| 60.8 | |

| Recovered loans and reversed allowances | |

| 26.9 | | |

| 20.6 | | |

| 32.8 | | |

| 29.5 | | |

| 43.6 | | |

| 109.4 | | |

| 126.5 | |

| Other | |

| 20.2 | | |

| 28.6 | | |

| 55.6 | | |

| 56.8 | | |

| 22.9 | | |

| 102.8 | | |

| 163.9 | |

| Total Other Income | |

| 57.5 | | |

| 61.8 | | |

| 102.7 | | |

| 106.4 | | |

| 80.3 | | |

| 253.2 | | |

| 351.2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Expense | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Charges for other receivables uncollectibility and other allowances | |

| 9.1 | | |

| 12.7 | | |

| 14.2 | | |

| 7.5 | | |

| 8.3 | | |

| 50.6 | | |

| 42.7 | |

| Goodwill amortization | |

| 3.6 | | |

| 3.5 | | |

| 3.5 | | |

| 3.5 | | |

| 3.6 | | |

| 14.1 | | |

| 14.1 | |

| Other Expense | |

| 15.0 | | |

| 23.9 | | |

| 25.8 | | |

| 40.5 | | |

| 115.4 | | |

| 79.0 | | |

| 205.6 | |

| Total Other Expense | |

| 27.7 | | |

| 40.1 | | |

| 43.5 | | |

| 51.5 | | |

| 127.3 | | |

| 143.7 | | |

| 262.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Other Income | |

| 29.8 | | |

| 21.7 | | |

| 59.2 | | |

| 54.9 | | |

| -47.0 | | |

| 109.5 | | |

| 88.8 | |

In 2014, Banco Macro's effective income

tax rate was 36.1%, compared to 35.3% in 2013.

|

4Q14

Earnings Release |

Financial

Assets

Private sector financing

The volume of “core” financing

to the private sector (including loans, financial trust and leasing portfolio) totaled Ps.44.3 billion, increasing 6% or Ps.2.3

billion QoQ and 12% or Ps.4.7 billion YoY.

Within consumer loans, credit card loans

grew 23% QoQ, and personal loans increased 7% QoQ. The increase of this type of financing totaled Ps.2.8 billion QoQ.

The main growth in commercial loans was

driven by documents and pledge loans, which grew 12% and 10% QoQ respectively. Within this loan portfolio, productive investments

loans through factoring and pledge guarantee loans respectively (according to Communication “A” 5319, “A”

5380 and “A” 5449, “A” 5516 and “A” 5600 and it´s modifications of BCRA) have been included.

The increase of this type of financing totaled Ps.651.9 million QoQ, while overdrafts decreased 34% QoQ.

As of December 2014, Banco Macro´s

loans for productive investment totaled Ps.4.5 billion, including the three years of this credit line (five segments).

In 2014, within consumer loans, credit

cards and personal loans rose 34% and 16% respectively.

In 2014, within commercial loans, documents

and pledge loans stand out, increasing 30% and 7% respectively.

| FINANCING TO THE PRIVATE SECTOR | |

MACRO

consolidated | | |

Variation | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Overdrafts | |

| 4,450.0 | | |

| 4,622.5 | | |

| 4,692.4 | | |

| 5,152.0 | | |

| 3,385.6 | | |

| -34 | % | |

| -24 | % |

| Discounted documents | |

| 4,320.8 | | |

| 4,333.9 | | |

| 4,061.4 | | |

| 4,144.3 | | |

| 4,627.4 | | |

| 12 | % | |

| 7 | % |

| Mortgages loans | |

| 2,308.9 | | |

| 2,292.1 | | |

| 2,319.5 | | |

| 2,361.4 | | |

| 2,466.1 | | |

| 4 | % | |

| 7 | % |

| Pledges loans | |

| 1,429.4 | | |

| 1,416.5 | | |

| 1,513.3 | | |

| 1,688.3 | | |

| 1,857.1 | | |

| 10 | % | |

| 30 | % |

| Personal loans | |

| 13,873.8 | | |

| 13,875.1 | | |

| 14,051.5 | | |

| 15,040.5 | | |

| 16,120.9 | | |

| 7 | % | |

| 16 | % |

| Credit Card loans | |

| 6,841.4 | | |

| 7,157.5 | | |

| 7,298.7 | | |

| 7,447.4 | | |

| 9,189.5 | | |

| 23 | % | |

| 34 | % |

| Others | |

| 5,206.6 | | |

| 5,260.8 | | |

| 5,035.0 | | |

| 5,235.0 | | |

| 5,835.2 | | |

| 11 | % | |

| 12 | % |

| Total loan portfolio | |

| 38,430.9 | | |

| 38,958.4 | | |

| 38,971.8 | | |

| 41,068.9 | | |

| 43,481.8 | | |

| 6 | % | |

| 13 | % |

| Financial trusts | |

| 722.1 | | |

| 771.0 | | |

| 563.9 | | |

| 516.6 | | |

| 413.4 | | |

| -20 | % | |

| -43 | % |

| Leasing | |

| 385.7 | | |

| 379.2 | | |

| 376.2 | | |

| 360.6 | | |

| 383.7 | | |

| 6 | % | |

| -1 | % |

| Total financing to the private sector | |

| 39,538.7 | | |

| 40,108.6 | | |

| 39,911.9 | | |

| 41,946.1 | | |

| 44,278.9 | | |

| 6 | % | |

| 12 | % |

Public Sector Assets

In 4Q14, the Bank’s public sector

assets (excluding LEBAC / NOBAC) to total assets ratio was 4.7%, similar to the 4.7% posted in 3Q14 and higher than the 3% in 4Q13.

The Bank’s exposure to the public

sector remained below the Argentine systems, which is around 9%.

|

4Q14

Earnings Release |

| PUBLIC SECTOR ASSETS | |

MACRO

consolidated | | |

Variation | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| LEBAC / NOBAC B.C.R.A. | |

| 48.6 | | |

| 5,053.0 | | |

| 7,881.6 | | |

| 9,284.0 | | |

| 5,696.8 | | |

| -39 | % | |

| 11622 | % |

| Other | |

| 1,099.6 | | |

| 1,660.6 | | |

| 2,227.7 | | |

| 2,726.2 | | |

| 2,873.8 | | |

| 5 | % | |

| 161 | % |

| Government securities | |

| 1,148.2 | | |

| 6,713.6 | | |

| 10,109.3 | | |

| 12,010.2 | | |

| 8,570.6 | | |

| -29 | % | |

| 646 | % |

| Guaranteed loans | |

| 311.8 | | |

| 363.5 | | |

| 383.8 | | |

| 396.4 | | |

| 407.7 | | |

| 3 | % | |

| 31 | % |

| Provincial loans | |

| 328.4 | | |

| 329.8 | | |

| 288.4 | | |

| 242.5 | | |

| 196.7 | | |

| -19 | % | |

| -40 | % |

| Government securities loans | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 1.5 | | |

| 0.0 | | |

| -100 | % | |

| 0 | % |

| Loans | |

| 640.2 | | |

| 693.3 | | |

| 672.2 | | |

| 640.4 | | |

| 604.4 | | |

| -6 | % | |

| -6 | % |

| Purchase of government bonds | |

| 8.9 | | |

| 23.1 | | |

| 23.4 | | |

| 24.0 | | |

| 24.2 | | |

| 1 | % | |

| 172 | % |

| Other receivables | |

| 8.9 | | |

| 23.1 | | |

| 23.4 | | |

| 24.0 | | |

| 24.2 | | |

| 1 | % | |

| 172 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR ASSETS | |

| 1,797.3 | | |

| 7,430.0 | | |

| 10,804.9 | | |

| 12,674.6 | | |

| 9,199.2 | | |

| -27 | % | |

| 412 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR LIABILITIES | |

| 42.1 | | |

| 44.5 | | |

| 43.3 | | |

| 42.1 | | |

| 40.4 | | |

| -4 | % | |

| -4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net exposure | |

| 1,755.2 | | |

| 7,385.5 | | |

| 10,761.6 | | |

| 12,632.5 | | |

| 9,158.8 | | |

| -27 | % | |

| 422 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR ASSETS (net of LEBAC / NOBAC

) | |

| 1,748.7 | | |

| 2,377.0 | | |

| 2,923.3 | | |

| 3,390.6 | | |

| 3,502.4 | | |

| 3 | % | |

| 100 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR ASSETS (net of LEBAC / NOBAC)

/TOTAL ASSETS | |

| 3.0 | % | |

| 3.7 | % | |

| 4.2 | % | |

| 4.7 | % | |

| 4.7 | % | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net exposure (net of LEBAC/NOBAC) / TOTAL ASSETS | |

| 2.9 | % | |

| 3.6 | % | |

| 4.2 | % | |

| 4.6 | % | |

| 4.6 | % | |

| | | |

| | |

Funding

Deposits

Banco Macro’s deposit base totaled

Ps.54.7 billion in 4Q14, growing 3% or Ps.1.6 billion QoQ and 26% or Ps.11.3 billion YoY and representing 86% of the Bank’s

total liabilities.

On a quarterly basis, private sector deposits

increased 7% or Ps.3.2 billion while public sector deposits decreased 16% or Ps.1.6 billion. Within private sector deposits, an

increase in peso deposits of 9% was experienced, while foreign currency deposits decreased 5%.

The increase in private sector deposits

was led by transactional deposits, which grew 16% or Ps.3.2 billion QoQ. In addition, time deposits decreased Ps.63.8 million QoQ.

In 2014, transactional deposits increased

34%, while time deposits grew 17%.

| DEPOSITS | |

MACRO consolidated | | |

Variation | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Public sector | |

| 6,580.0 | | |

| 7,529.2 | | |

| 9,203.6 | | |

| 10,178.9 | | |

| 8,570.1 | | |

| -16 | % | |

| 30 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial sector | |

| 26.9 | | |

| 25.2 | | |

| 27.6 | | |

| 29.2 | | |

| 38.7 | | |

| 33 | % | |

| 44 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Private sector | |

| 36,820.1 | | |

| 39,359.4 | | |

| 42,047.1 | | |

| 42,943.4 | | |

| 46,107.8 | | |

| 7 | % | |

| 25 | % |

| Checking accounts | |

| 8,602.7 | | |

| 8,607.3 | | |

| 10,003.8 | | |

| 10,419.5 | | |

| 11,896.3 | | |

| 14 | % | |

| 38 | % |

| Savings accounts | |

| 8,440.7 | | |

| 7,954.8 | | |

| 9,467.0 | | |

| 9,262.1 | | |

| 11,013.9 | | |

| 19 | % | |

| 30 | % |

| Time deposits | |

| 18,416.5 | | |

| 21,306.7 | | |

| 20,933.1 | | |

| 21,574.6 | | |

| 21,510.8 | | |

| 0 | % | |

| 17 | % |

| Other | |

| 1,360.2 | | |

| 1,490.6 | | |

| 1,643.2 | | |

| 1,687.2 | | |

| 1,686.8 | | |

| 0 | % | |

| 24 | % |

| TOTAL | |

| 43,427.0 | | |

| 46,913.8 | | |

| 51,278.3 | | |

| 53,151.5 | | |

| 54,716.6 | | |

| 3 | % | |

| 26 | % |

|

4Q14

Earnings Release |

Other

sources of funds

In 4Q14, the total amount of other sources

of funds increased 3% or Ps.447.9 million compared to 3Q14, as a result of an increase in shareholder’s equity (totaling

Ps.575 million), driven by a positive 4Q14 results. This result was partially compensated with a decrease in financing from Banks

and International institutions.

| OTHER FUNDING | |

MACRO

consolidated | | |

Variation | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Central Bank of Argentina | |

| 22.0 | | |

| 22.3 | | |

| 22.8 | | |

| 18.8 | | |

| 17.0 | | |

| -10 | % | |

| -23 | % |

| Banks and international institutions | |

| 326.5 | | |

| 308.2 | | |

| 421.2 | | |

| 211.9 | | |

| 88.3 | | |

| -58 | % | |

| -73 | % |

| Financing received from Argentine financial institutions | |

| 56.9 | | |

| 65.1 | | |

| 58.9 | | |

| 66.5 | | |

| 53.2 | | |

| -20 | % | |

| -7 | % |

| Subordinated corporate bonds | |

| 981.1 | | |

| 1,235.0 | | |

| 1,223.9 | | |

| 1,304.7 | | |

| 1,287.3 | | |

| -1 | % | |

| 31 | % |

| Non-subordinated corporate bonds | |

| 718.0 | | |

| 864.3 | | |

| 895.7 | | |

| 913.1 | | |

| 942.1 | | |

| 3 | % | |

| 31 | % |

| Shareholders´ equity | |

| 8,627.4 | | |

| 9,813.8 | | |

| 9,931.2 | | |

| 10,916.8 | | |

| 11,491.8 | | |

| 5 | % | |

| 33 | % |

| Total other Funding | |

| 10,732.0 | | |

| 12,308.6 | | |

| 12,553.7 | | |

| 13,431.8 | | |

| 13,879.7 | | |

| 3 | % | |

| 29 | % |

As of December 2014 Banco Macro’s

average cost of funds reached 10.1%. Banco Macro’s transactional deposits represented approximately 50% of its deposit base.

These accounts are low cost and are not sensitive to interest rate increases.

Liquid Assets

In 4Q14, the Bank’s liquid assets

amounted to Ps.22.2 billion, showing a decrease of 3% QoQ and an increase of 53% on a yearly basis.

Also in 4Q14, Banco Macro experienced decreased

in Lebac/Nobac own portfolio and in Call, which was partially offset with an increase in Cash.

In December 2014 Banco Macro’s liquid

assets to total deposits ratio reached 40.6%.

| LIQUID ASSETS | |

MACRO

consolidated | | |

Variation | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Cash | |

| 12,860.5 | | |

| 9,434.9 | | |

| 9,993.0 | | |

| 12,175.9 | | |

| 15,434.2 | | |

| 27 | % | |

| 20 | % |

| Guarantees for compensating chambers | |

| 582.4 | | |

| 614.3 | | |

| 629.0 | | |

| 668.0 | | |

| 810.9 | | |

| 21 | % | |

| 39 | % |

| Call | |

| 308.0 | | |

| 256.0 | | |

| 778.0 | | |

| 333.4 | | |

| 105.0 | | |

| -69 | % | |

| -66 | % |

| Reverse repos from other securities | |

| 554.1 | | |

| 221.0 | | |

| 102.4 | | |

| 277.7 | | |

| 117.9 | | |

| -58 | % | |

| -79 | % |

| Reverse repos from LEBAC/NOBAC | |

| 124.4 | | |

| 3,433.2 | | |

| 3,543.0 | | |

| 436.5 | | |

| 307.5 | | |

| -30 | % | |

| 147 | % |

| LEBAC / NOBAC own portfolio | |

| 48.6 | | |

| 4,948.4 | | |

| 7,682.6 | | |

| 8,984.5 | | |

| 5,422.4 | | |

| -40 | % | |

| 11057 | % |

| TOTAL | |

| 14,478.0 | | |

| 18,907.8 | | |

| 22,728.0 | | |

| 22,876.0 | | |

| 22,197.9 | | |

| -3 | % | |

| 53 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liquid assets to total deposits | |

| 33.3 | % | |

| 40.3 | % | |

| 44.3 | % | |

| 43.0 | % | |

| 40.6 | % | |

| | | |

| | |

Solvency

Banco Macro continued showing high solvency

levels in 4Q14 with an integrated capital (RPC) of Ps.11.6 billion over a total capital requirement of Ps.5.7 billion. Banco Macro´s

excess capital in 4Q14 was 105% or Ps.5.9 billion.

According to Communication “A”

5369 of BCRA from November 2012, substantial changes regarding minimum capital requirements for all financial entities were incorporated.

These adjustments include variations in capital requirements categories and in Integration Capital (RPC). Within these changes,

outstands the fact that interest rate risk requirement has been excluded from the total capital requirement since February 2013,

being January 2013 the last month where interest risk requirement should be contemplated.

|

4Q14

Earnings Release |

Since January 2014, total capital requirement

will be based on the new regulations (Communication “A” 5369).

The capitalization ratio (as a percentage

of risk-weighted assets) was 24% in 4Q14, above the minimum required by the Central Bank.

The Bank´s aim is to make the best

use of this excess capital.

| MINIMUM CAPITAL REQUIREMENT | |

MACRO

consolidated | | |

Variation | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Credit risk requirement | |

| 2,752.5 | | |

| 3,490.1 | | |

| 3,516.8 | | |

| 3,609.7 | | |

| 3,991.7 | | |

| 11 | % | |

| 45 | % |

| Market risk requirement | |

| 52.0 | | |

| 148.6 | | |

| 212.1 | | |

| 270.0 | | |

| 388.1 | | |

| 44 | % | |

| 646 | % |

| Operational risk requirement | |

| 709.9 | | |

| 1,041.2 | | |

| 1,113.5 | | |

| 1,201.4 | | |

| 1,278.0 | | |

| 6 | % | |

| 80 | % |

| Interest rate risk requirement | |

| 838.2 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0 | % | |

| -100 | % |

| Total capital requirement | |

| 4,352.6 | | |

| 4,679.8 | | |

| 4,842.4 | | |

| 5,081.1 | | |

| 5,657.9 | | |

| 11 | % | |

| 30 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ordinary Capital Level 1 (COn1) | |

| 8,150.7 | | |

| 9,220.6 | | |

| 9,531.4 | | |

| 10,421.0 | | |

| 11,204.3 | | |

| 8 | % | |

| 37 | % |

| Deductible concepts COn1 | |

| -363.5 | | |

| -375.7 | | |

| -395.0 | | |

| -407.3 | | |

| -432.0 | | |

| 6 | % | |

| 19 | % |

| Aditional Capital Level 1 (CAn1) | |

| 412.7 | | |

| 366.8 | | |

| 366.8 | | |

| 366.8 | | |

| 366.8 | | |

| 0 | % | |

| -11 | % |

| Capital level 2 (COn2) | |

| 388.9 | | |

| 392.9 | | |

| 392.3 | | |

| 414.9 | | |

| 441.5 | | |

| 6 | % | |

| 14 | % |

| Integrated capital (RPC) (*) | |

| 8,588.8 | | |

| 9,604.6 | | |

| 9,895.5 | | |

| 10,795.4 | | |

| 11,580.7 | | |

| 7 | % | |

| 35 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Excess capital | |

| 4,236.3 | | |

| 4,924.8 | | |

| 5,053.2 | | |

| 5,714.3 | | |

| 5,922.8 | | |

| 4 | % | |

| 40 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Capitalization ratio | |

| 25.3 | % | |

| 22.7 | % | |

| 23.2 | % | |

| 24.7 | % | |

| 24.0 | % | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ratio TIER 1 | |

| 24.1 | % | |

| 21.8 | % | |

| 22.3 | % | |

| 23.7 | % | |

| 23.1 | % | |

| | | |

| | |

(*) Aditionally, the RPC of the Bank, acting as custodian of securties representing investments of FGS, must also exceed an equivalent of 0.25% of the total securities under custody, based in which, the Bank has successully fullfilled with this requirement.

In January 2015, Communication “A”

5694 of BCRA, established that those entities considered as domestic systemically important (D-SIBs), must consider an extra minimum

capital requirement equivalent to 1% of the total risk-weighted assets (RWA) according the schedule that follows (currently, RWA

arises from multiplying by 12.5 the minimum capital requirements):

| EXTRA MIN.CAPITAL REQUIREMENT | |

| | |

| | |

| | |

| |

| (as % of RWA) | |

January/March | | |

April/ June | | |

July/ September | | |

October/ December | |

| | |

| | | |

| | | |

| | | |

| | |

| 2016 | |

| 0.075 | | |

| 0.15 | | |

| 0.225 | | |

| 0.3 | |

| 2017 | |

| 0.375 | | |

| 0.45 | | |

| 0.525 | | |

| 0.6 | |

| 2018 | |

| 0.675 | | |

| 0.75 | | |

| 0.825 | | |

| 0.9 | |

| As of January 2019 | |

| 1 | |

|

4Q14

Earnings Release |

Asset Quality

In 4Q14, Banco Macro’s non-performing

to total financing ratio reached a level of 1.92% compared to 1.85% posted in 3Q14.

The coverage ratio reached 135.32% in 4Q14.

The Bank is committed to continue working in

this area to maintain excellent asset quality standards.

| ASSET QUALITY | |

MACRO

consolidated | | |

Variation | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Commercial portfolio | |

| 16,513.3 | | |

| 16,933.1 | | |

| 17,384.5 | | |

| 16,923.7 | | |

| 16,310.1 | | |

| -4 | % | |

| -1 | % |

| Non-performing | |

| 253.1 | | |

| 300.7 | | |

| 298.6 | | |

| 235.0 | | |

| 330.3 | | |

| 41 | % | |

| 31 | % |

| Consumer portfolio | |

| 24,669.0 | | |

| 24,854.6 | | |

| 24,965.4 | | |

| 27,063.3 | | |

| 30,150.2 | | |

| 11 | % | |

| 22 | % |

| Non-performing | |

| 435.6 | | |

| 484.1 | | |

| 556.6 | | |

| 580.8 | | |

| 560.2 | | |

| -4 | % | |

| 29 | % |

| Total portfolio | |

| 41,182.3 | | |

| 41,787.7 | | |

| 42,349.9 | | |

| 43,987.0 | | |

| 46,460.3 | | |

| 6 | % | |

| 13 | % |

| Non-performing | |

| 688.7 | | |

| 784.8 | | |

| 855.2 | | |

| 815.8 | | |

| 890.5 | | |

| 9 | % | |

| 29 | % |

| Total non-performing/ Total portfolio | |

| 1.70 | % | |

| 1.88 | % | |

| 2.02 | % | |

| 1.85 | % | |

| 1.92 | % | |

| | | |

| | |

| Total allowances | |

| 1,026.6 | | |

| 1,076.8 | | |

| 1,138.0 | | |

| 1,131.4 | | |

| 1,205.0 | | |

| 7 | % | |

| 17 | % |

| Coverage ratio w/allowances | |

| 149.06 | % | |

| 137.21 | % | |

| 133.07 | % | |

| 138.69 | % | |

| 135.32 | % | |

| | | |

| | |

|

4Q14

Earnings Release |

CER Exposure and Foreign Currency Position

| CER EXPOSURE | |

MACRO

consolidated | | |

Variation | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| CER adjustable ASSETS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Guaranteed loans | |

| 331.4 | | |

| 350.3 | | |

| 369.6 | | |

| 381.0 | | |

| 391.1 | | |

| 3 | % | |

| 18 | % |

| Private sector loans | |

| 4.9 | | |

| 4.5 | | |

| 3.9 | | |

| 3.3 | | |

| 2.8 | | |

| -15 | % | |

| -43 | % |

| Other loans | |

| 0.4 | | |

| 0.3 | | |

| 0.2 | | |

| 0.2 | | |

| 0.2 | | |

| 0 | % | |

| -50 | % |

| Loans | |

| 336.7 | | |

| 355.1 | | |

| 373.7 | | |

| 384.5 | | |

| 394.1 | | |

| 2 | % | |

| 17 | % |

| Other receivables | |

| 2.8 | | |

| 2.3 | | |

| 1.8 | | |

| 1.3 | | |

| 1.0 | | |

| -23 | % | |

| -64 | % |

| Total CER adjustable assets | |

| 339.5 | | |

| 357.4 | | |

| 375.5 | | |

| 385.8 | | |

| 395.1 | | |

| 2 | % | |

| 16 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| CER adjustable LIABILITIES | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| 0.2 | | |

| 0.3 | | |

| 0.3 | | |

| 0.3 | | |

| 0.0 | | |

| -100 | % | |

| -100 | % |

| Other liabilities from financial intermediation | |

| 42.0 | | |

| 43.2 | | |

| 43.2 | | |

| 42.0 | | |

| 40.3 | | |

| -4 | % | |

| -4 | % |

| Total CER adjustable liabilities | |

| 42.2 | | |

| 43.5 | | |

| 43.5 | | |

| 42.3 | | |

| 40.3 | | |

| -5 | % | |

| -5 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET CER EXPOSURE | |

| 297.3 | | |

| 313.9 | | |

| 332.0 | | |

| 343.5 | | |

| 354.8 | | |

| 3 | % | |

| 19 | % |

| FOREIGN CURRENCY POSITION | |

MACRO

consolidated | | |

Variation | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | | |

Quarterly | | |

Annualy | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Cash | |

| 5,977.6 | | |

| 4,609.1 | | |

| 5,264.7 | | |

| 5,817.3 | | |

| 5,804.4 | | |

| 0 | % | |

| -3 | % |

| Government and private securities | |

| 911.7 | | |

| 1,392.8 | | |

| 1,828.0 | | |

| 1,486.9 | | |

| 1,454.5 | | |

| -2 | % | |

| 60 | % |

| Loans | |

| 1,917.1 | | |

| 2,435.3 | | |

| 2,428.7 | | |

| 2,048.8 | | |

| 1,939.3 | | |

| -5 | % | |

| 1 | % |

| Other receivables from financial intermediation | |

| 833.2 | | |

| 917.6 | | |

| 552.5 | | |

| 690.2 | | |

| 449.2 | | |

| -35 | % | |

| -46 | % |

| Other assets | |

| 82.8 | | |

| 83.0 | | |

| 93.3 | | |

| 85.7 | | |

| 89.5 | | |

| 4 | % | |

| 8 | % |

| TOTAL ASSETS | |

| 9,722.4 | | |

| 9,437.8 | | |

| 10,167.2 | | |

| 10,128.9 | | |

| 9,736.9 | | |

| -4 | % | |

| 0 | % |

| Deposits | |

| 3,759.1 | | |

| 4,350.1 | | |

| 4,863.9 | | |

| 4,858.2 | | |

| 4,652.3 | | |

| -4 | % | |

| 24 | % |

| Other liabilities from financial intermediation | |

| 1,432.8 | | |

| 1,372.0 | | |

| 1,437.1 | | |

| 1,043.8 | | |

| 718.7 | | |

| -31 | % | |

| -50 | % |

| Non-subordinated corporate bonds | |

| 718.0 | | |

| 864.3 | | |

| 895.7 | | |

| 913.1 | | |

| 942.1 | | |

| 3 | % | |

| 31 | % |

| Subordinated corporate bonds | |

| 981.1 | | |

| 1,235.0 | | |

| 1,223.9 | | |

| 1,304.7 | | |

| 1,287.3 | | |

| -1 | % | |

| 31 | % |

| Other liabilities | |

| 18.5 | | |

| -63.2 | | |

| 10.5 | | |

| 5.8 | | |

| 5.5 | | |

| -5 | % | |

| -70 | % |

| TOTAL LIABILITIES | |

| 6,909.5 | | |

| 7,758.2 | | |

| 8,431.1 | | |

| 8,125.6 | | |

| 7,605.9 | | |

| -6 | % | |

| 10 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET FX POSITION | |

| 2,812.9 | | |

| 1,679.6 | | |

| 1,736.1 | | |

| 2,003.3 | | |

| 2,131.0 | | |

| 6 | % | |

| -24 | % |

|

4Q14

Earnings Release |

Relevant and Recent Events

| · | In December 2014, the Bank paid semi-annual

interest on Class 1 Notes in an amount of USD7.3 million. |

| · | In February 2015, the Bank paid semi-annual

interest on Class 2 Notes in an amount of USD4.5 million. |

| · | As of December 2014, Banco Macro satisfactorily

extended loans regarding the fifth productive investment program (LIP) assigned for small & mid-sized companies (MiPyMES) required

by BCRA Communication “A” 5449. |

| · | In December 2014, according to Communication

“A” 5681 of BCRA new features for the productive investment program (LIP) were released for the first semester of 2015. |

| · | In January 2015, according to Communication

“A” 5694 of BCRA of minimum capital requirements, the regulation established that those entities considered as domestic

systemically important (D-SIBs), must consider an extra minimum capital requirement equivalent to 1% of the total risk-weighted

assets (RWA) according to the schedule mentioned in the Solvency Section of this Press Release and which ends on January 2019.

Either way, if dividends would be distributed, this incremental has immediate effect. |

| · | In January 2015, within the scope of the

principles of the Basel Committee on Banking Supervision, BCRA graded Banco Macro S.A. as a domestic systemically important entity

(D-SIBs). |

| · | In January 2015, according to Communication “A” 5689,

the Bank accounted provisions for administrative and/or disciplinary sanctions, which were applied or initiated by BCRA, UIF and

CNV. Such provisions totaled Ps.11.4 million. |

|

4Q14

Earnings Release |

| QUARTERLY BALANCE SHEET | |

MACRO consolidated | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | |

| ASSETS | |

| 59,295.0 | | |

| 68,241.1 | | |

| 72,858.7 | | |

| 72,730.3 | | |

| 74,995.6 | |

| Cash | |

| 12,860.5 | | |

| 9,434.9 | | |

| 9,993.0 | | |

| 12,175.9 | | |

| 15,434.2 | |

| Government and Private Securities | |

| 2,441.3 | | |

| 10,930.3 | | |

| 14,842.0 | | |

| 13,436.0 | | |

| 10,312.5 | |

| -LEBAC/NOBAC | |

| 173.0 | | |

| 8,381.6 | | |

| 11,225.6 | | |

| 9,421.0 | | |

| 5,729.9 | |

| -Other | |

| 2,268.3 | | |

| 2,548.7 | | |

| 3,616.4 | | |

| 4,015.0 | | |

| 4,582.6 | |

| Loans | |

| 39,022.4 | | |

| 39,507.8 | | |

| 39,916.8 | | |

| 41,586.7 | | |

| 43,740.3 | |

| to the non-financial government sector | |

| 640.2 | | |

| 693.3 | | |

| 672.5 | | |

| 639.5 | | |

| 604.4 | |

| to the financial sector | |

| 364.9 | | |

| 295.4 | | |

| 804.3 | | |

| 401.7 | | |

| 213.9 | |

| to the non-financial private sector and foreign residents | |

| 39,023.8 | | |

| 39,573.5 | | |

| 39,553.6 | | |

| 41,659.4 | | |

| 44,108.1 | |

| -Overdrafts | |

| 4,450.0 | | |

| 4,622.5 | | |

| 4,692.4 | | |

| 5,152.0 | | |

| 3,385.6 | |

| -Documents | |

| 4,320.8 | | |

| 4,333.9 | | |

| 4,061.4 | | |

| 4,144.3 | | |

| 4,627.4 | |

| -Mortgage loans | |

| 2,308.9 | | |

| 2,292.1 | | |

| 2,319.5 | | |

| 2,361.4 | | |

| 2,466.1 | |

| -Pledge loans | |

| 1,429.4 | | |

| 1,416.5 | | |

| 1,513.3 | | |

| 1,688.3 | | |

| 1,857.1 | |

| -Personal loans | |

| 13,873.8 | | |

| 13,875.1 | | |

| 14,051.5 | | |

| 15,040.5 | | |

| 16,120.9 | |

| -Credit cards | |

| 6,841.4 | | |

| 7,157.5 | | |

| 7,298.7 | | |

| 7,447.4 | | |

| 9,189.5 | |

| -Other | |

| 5,206.6 | | |

| 5,260.8 | | |

| 5,035.0 | | |

| 5,235.0 | | |

| 5,835.2 | |

| -Accrued interest, adjustments, price differences receivables and unearned discount | |

| 592.9 | | |

| 615.1 | | |

| 581.8 | | |

| 590.5 | | |

| 626.3 | |

| Allowances | |

| -1,006.5 | | |

| -1,054.4 | | |

| -1,113.6 | | |

| -1,113.9 | | |

| -1,186.1 | |

| Other receivables from financial intermediation | |

| 2,680.2 | | |

| 5,923.2 | | |

| 5,502.0 | | |

| 2,659.0 | | |

| 2,349.1 | |

| Receivables from financial leases | |

| 385.9 | | |

| 380.2 | | |

| 376.5 | | |

| 361.5 | | |

| 384.4 | |

| Investments in other companies | |

| 13.5 | | |

| 13.7 | | |

| 13.6 | | |

| 11.1 | | |

| 11.2 | |

| Other receivables | |

| 435.3 | | |

| 453.3 | | |

| 513.5 | | |

| 545.8 | | |

| 605.4 | |

| Other assets | |

| 1,455.9 | | |

| 1,597.8 | | |

| 1,701.4 | | |

| 1,954.3 | | |

| 2,158.5 | |

| LIABILITIES | |

| 50,667.6 | | |

| 58,427.3 | | |

| 62,927.5 | | |

| 61,813.5 | | |

| 63,503.8 | |

| Deposits | |

| 43,427.0 | | |

| 46,913.8 | | |

| 51,278.3 | | |

| 53,151.5 | | |

| 54,716.6 | |

| From the non-financial government sector | |

| 6,580.0 | | |

| 7,529.2 | | |

| 9,203.6 | | |

| 10,178.9 | | |

| 8,570.1 | |

| From the financial sector | |

| 26.9 | | |

| 25.2 | | |

| 27.6 | | |

| 29.2 | | |

| 38.7 | |

| From the non-financial private sector and foreign residents | |

| 36,820.1 | | |

| 39,359.4 | | |

| 42,047.1 | | |

| 42,943.4 | | |

| 46,107.8 | |

| -Checking accounts | |

| 8,602.7 | | |

| 8,607.3 | | |

| 10,003.8 | | |

| 10,419.5 | | |

| 11,896.3 | |

| -Savings accounts | |

| 8,440.7 | | |

| 7,954.8 | | |

| 9,467.0 | | |

| 9,262.1 | | |

| 11,013.9 | |

| -Time deposits | |

| 18,416.5 | | |

| 21,306.7 | | |

| 20,933.1 | | |

| 21,574.6 | | |

| 21,510.8 | |

| -Other | |

| 1,360.2 | | |

| 1,490.6 | | |

| 1,643.2 | | |

| 1,687.2 | | |

| 1,686.8 | |

| Other liabilities from financial intermediation | |

| 4,697.7 | | |

| 8,114.2 | | |

| 8,306.5 | | |

| 5,350.4 | | |

| 5,356.7 | |

| Subordinated corporate bonds | |

| 981.1 | | |

| 1,235.0 | | |

| 1,223.9 | | |

| 1,304.7 | | |

| 1,287.3 | |

| Other liabilities | |

| 1,561.8 | | |

| 2,164.3 | | |

| 2,118.9 | | |

| 2,006.9 | | |

| 2,143.2 | |

| SHAREHOLDERS' EQUITY | |

| 8,627.4 | | |

| 9,813.8 | | |

| 9,931.2 | | |

| 10,916.8 | | |

| 11,491.8 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| LIABILITIES + SHAREHOLDERS' EQUITY | |

| 59,295.0 | | |

| 68,241.1 | | |

| 72,858.7 | | |

| 72,730.3 | | |

| 74,995.6 | |

|

4Q14

Earnings Release |

| ANNUAL BALANCE SHEET | |

MACRO

Consolidated | | |

Annualy | |

| In MILLION $ | |

2012 | | |

2013 | | |

2014 | | |

Change | |

| ASSETS | |

| 47,894.1 | | |

| 59,295.0 | | |

| 74,995.6 | | |

| 26 | % |

| Cash | |

| 10,047.0 | | |

| 12,860.5 | | |

| 15,434.2 | | |

| 20 | % |

| Government and Private Securities | |

| 2,343.1 | | |

| 2,441.3 | | |

| 10,312.5 | | |

| 322 | % |

| -LEBAC/NOBAC | |

| 612.9 | | |

| 173.0 | | |

| 5,729.9 | | |

| 3212 | % |

| -Other | |

| 1,730.2 | | |

| 2,268.3 | | |

| 4,582.6 | | |

| 102 | % |

| Loans | |

| 31,202.6 | | |

| 39,022.4 | | |

| 43,740.3 | | |

| 12 | % |

| to the non-financial government sector | |

| 586.6 | | |

| 640.2 | | |

| 604.4 | | |

| -6 | % |

| to the financial sector | |

| 299.3 | | |

| 364.9 | | |

| 213.9 | | |

| -41 | % |

| to the non-financial private sector and

foreign residents | |

| 31,203.9 | | |

| 39,023.8 | | |

| 44,108.1 | | |

| 13 | % |

| -Overdrafts | |

| 4,280.6 | | |

| 4,450.0 | | |

| 3,385.6 | | |

| -24 | % |

| -Documents | |

| 3,651.4 | | |

| 4,320.8 | | |

| 4,627.4 | | |

| 7 | % |

| -Mortgage loans | |

| 1,508.5 | | |

| 2,308.9 | | |

| 2,466.1 | | |

| 7 | % |

| -Pledge loans | |

| 928.7 | | |

| 1,429.4 | | |

| 1,857.1 | | |

| 30 | % |

| -Personal loans | |

| 10,826.6 | | |

| 13,873.8 | | |

| 16,120.9 | | |

| 16 | % |

| -Credit cards | |

| 4,725.2 | | |

| 6,841.4 | | |

| 9,189.5 | | |

| 34 | % |

| -Other | |

| 4,808.5 | | |

| 5,206.6 | | |

| 5,835.2 | | |

| 12 | % |

| -Accrued interest, adjustments,

price differences receivables and unearned discount | |

| 474.4 | | |

| 592.9 | | |

| 626.3 | | |

| 6 | % |

| Allowances | |

| -887.2 | | |

| -1,006.5 | | |

| -1,186.1 | | |

| 18 | % |

| Other receivables from financial intermediation | |

| 2,380.2 | | |

| 2,680.2 | | |

| 2,349.1 | | |

| -12 | % |

| Receivables from financial leases | |

| 321.5 | | |

| 385.9 | | |

| 384.4 | | |

| 0 | % |

| Investments in other companies | |

| 11.6 | | |

| 13.5 | | |

| 11.2 | | |

| -17 | % |

| Other receivables | |

| 370.3 | | |

| 435.3 | | |

| 605.4 | | |

| 39 | % |

| Other assets | |

| 1,217.8 | | |

| 1,455.9 | | |

| 2,158.5 | | |

| 48 | % |

| LIABILITIES | |

| 41,695.0 | | |

| 50,667.6 | | |

| 63,503.8 | | |

| 25 | % |

| Deposits | |

| 36,188.7 | | |

| 43,427.0 | | |

| 54,716.6 | | |

| 26 | % |

| From the non-financial government sector | |

| 8,318.4 | | |

| 6,580.0 | | |

| 8,570.1 | | |

| 30 | % |

| From the financial sector | |

| 24.2 | | |

| 26.9 | | |

| 38.7 | | |

| 44 | % |

| From the non-financial private sector and

foreign residents | |

| 27,846.1 | | |

| 36,820.1 | | |

| 46,107.8 | | |

| 25 | % |

| -Checking accounts | |

| 6,716.9 | | |

| 8,602.7 | | |

| 11,896.3 | | |

| 38 | % |

| -Savings accounts | |

| 6,467.2 | | |

| 8,440.7 | | |

| 11,013.9 | | |

| 30 | % |

| -Time deposits | |

| 13,596.2 | | |

| 18,416.5 | | |

| 21,510.8 | | |

| 17 | % |

| -Other | |

| 1,065.8 | | |

| 1,360.2 | | |

| 1,686.8 | | |

| 24 | % |

| Other liabilities from financial intermediation | |

| 3,785.1 | | |

| 4,697.7 | | |

| 5,356.7 | | |

| 14 | % |

| Subordinated corporate bonds | |

| 740.2 | | |

| 981.1 | | |

| 1,287.3 | | |

| 31 | % |

| Other liabilities | |

| 981.0 | | |

| 1,561.8 | | |

| 2,143.2 | | |

| 37 | % |

| SHAREHOLDERS' EQUITY | |

| 6,199.1 | | |

| 8,627.4 | | |

| 11,491.8 | | |

| 33 | % |

| | |

| | | |

| | | |

| | | |

| | |

| LIABILITIES + SHAREHOLDERS' EQUITY | |

| 47,894.1 | | |

| 59,295.0 | | |

| 74,995.6 | | |

| 26 | % |

|

4Q14

Earnings Release |

| QUARTERLY INCOME STATEMENT | |

MACRO consolidated | |

| In MILLION $ | |

IV13 | | |

I14 | | |

II14 | | |

III14 | | |

IV14 | |

| Financial income | |

| 2,987.7 | | |

| 3,916.3 | | |

| 3,470.7 | | |

| 3,752.8 | | |

| 3,542.8 | |

| Interest on cash and due from banks | |

| 0.0 | | |

| 0.1 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| Interest on loans to the financial sector | |

| 16.7 | | |

| 13.2 | | |

| 28.5 | | |

| 10.0 | | |

| 12.6 | |

| Interest on overdrafts | |

| 327.9 | | |

| 351.7 | | |

| 352.2 | | |

| 340.9 | | |

| 293.4 | |

| Interest on documents | |

| 202.4 | | |

| 248.0 | | |

| 244.0 | | |

| 216.2 | | |

| 252.2 | |

| Interest on mortgage loans | |

| 100.0 | | |

| 115.7 | | |

| 123.5 | | |

| 120.3 | | |

| 123.6 | |

| Interest on pledge loans | |

| 58.6 | | |

| 62.2 | | |

| 64.5 | | |

| 67.8 | | |

| 79.8 | |

| Interest on credit card loans | |

| 316.0 | | |

| 408.1 | | |

| 466.3 | | |

| 497.4 | | |

| 558.3 | |

| Interest on financial leases | |

| 18.4 | | |

| 20.3 | | |

| 19.7 | | |

| 18.6 | | |

| 17.7 | |

| Interest on other loans | |

| 1,366.0 | | |

| 1,468.7 | | |

| 1,493.4 | | |

| 1,567.1 | | |

| 1,743.2 | |

| Income from government & private securities, net | |

| 95.9 | | |

| 271.0 | | |

| 567.2 | | |

| 761.1 | | |

| 374.9 | |

| Interest on other receivables from fin. intermediation | |

| 0.9 | | |

| 0.9 | | |

| 0.7 | | |

| 0.5 | | |

| 1.4 | |

| Income from Guaranteed Loans - Decree 1387/01 | |

| 9.5 | | |

| 20.3 | | |

| 6.3 | | |

| 6.7 | | |

| 6.9 | |

| CER adjustment | |

| 12.0 | | |

| 36.9 | | |

| 19.6 | | |

| 11.6 | | |

| 10.2 | |

| CVS adjustment | |

| 0.1 | | |

| 0.3 | | |

| 0.1 | | |

| 0.1 | | |

| 0.2 | |

| Difference in quoted prices of gold and foreign currency | |

| 342.6 | | |

| 678.9 | | |

| 35.1 | | |

| 82.0 | | |

| 31.6 | |

| Other | |

| 120.7 | | |

| 220.0 | | |

| 49.6 | | |

| 52.5 | | |

| 36.8 | |

| Financial expense | |

| -1,169.3 | | |

| -1,452.9 | | |

| -1,748.5 | | |

| -1,631.0 | | |

| -1,750.1 | |

| Interest on checking accounts | |

| -0.2 | | |

| -0.1 | | |

| -0.2 | | |

| -0.2 | | |

| 0.0 | |

| Interest on saving accounts | |

| -10.2 | | |

| -11.1 | | |

| -12.1 | | |

| -12.5 | | |

| -13.6 | |

| Interest on time deposits | |

| -900.0 | | |

| -1,120.4 | | |

| -1,421.5 | | |

| -1,280.3 | | |

| -1,315.0 | |

| Interest on interfinancing received loans | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| -0.3 | | |

| -0.9 | |

| Interest on subordinated bonds | |

| -22.8 | | |

| -29.2 | | |

| -29.1 | | |

| -30.6 | | |

| -31.5 | |

| Other Interest | |

| -0.9 | | |

| -0.8 | | |

| -0.8 | | |

| -0.8 | | |

| -0.7 | |

| Interests on other liabilities from fin. intermediation | |

| -17.0 | | |

| -22.1 | | |

| -23.3 | | |

| -24.1 | | |

| -22.2 | |

| CER adjustment | |

| -1.1 | | |

| -3.2 | | |

| -2.8 | | |

| -1.7 | | |

| -1.5 | |

| Contribution to Deposit Guarantee Fund | |

| -18.0 | | |

| -19.0 | | |

| -20.2 | | |

| -21.6 | | |

| -90.2 | |

| Other | |

| -199.1 | | |

| -247.0 | | |

| -238.5 | | |

| -258.9 | | |

| -274.5 | |

| Net financial income | |

| 1,818.4 | | |

| 2,463.4 | | |

| 1,722.2 | | |

| 2,121.8 | | |

| 1,792.7 | |

| Provision for loan losses | |

| -158.5 | | |

| -131.3 | | |

| -167.7 | | |

| -151.5 | | |

| -214.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fee income | |

| 928.8 | | |

| 1,019.2 | | |

| 1,113.2 | | |

| 1,239.5 | | |

| 1,283.9 | |

| Fee expense | |

| -226.9 | | |

| -264.9 | | |

| -285.2 | | |

| -311.9 | | |

| -353.7 | |

| Net fee income | |

| 701.9 | | |

| 754.3 | | |

| 828.0 | | |

| 927.6 | | |

| 930.2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Administrative expenses | |

| -1,104.9 | | |

| -1,222.6 | | |

| -1,314.2 | | |

| -1,396.6 | | |

| -1,565.5 | |

| Minority interest in subsidiaries | |

| -5.4 | | |

| -6.8 | | |

| -5.3 | | |

| -5.9 | | |

| -5.5 | |

| Net other income | |

| 29.8 | | |

| 21.7 | | |

| 59.2 | | |

| 54.9 | | |

| -47.0 | |

| Earnings before income tax | |

| 1,281.3 | | |

| 1,878.7 | | |

| 1,122.1 | | |

| 1,550.3 | | |

| 890.6 | |

| Income tax | |

| -327.9 | | |

| -692.4 | | |

| -389.4 | | |

| -564.8 | | |

| -315.6 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 953.4 | | |

| 1,186.3 | | |

| 732.7 | | |

| 985.5 | | |

| 575.0 | |

|

4Q14

Earnings Release |

| ANNUAL INCOME STATEMENT | |

MACRO

consolidated | | |

Annualy | |

| In MILLION $ | |

2012 | | |

2013 | | |

2014 | | |

Change | |

| Financial income | |

| 6,904.4 | | |

| 9,753.5 | | |

| 14,682.6 | | |