Fund aims to help investors achieve

financial objectives while encouraging positive social and

environmental impact

BlackRock, Inc. (NYSE: BLK) has expanded its suite of socially

responsible ETFs with the launch of the iShares Sustainable MSCI

Global Impact ETF (MPCT). Launched on Earth Day, the fund aims to

help investors use their investment portfolios to target companies

that enable positive social and environmental change. Its launch

further illustrates BlackRock’s commitment to creating innovative

investment solutions, empowering investors to align their

portfolios with their values.

The iShares Sustainable MSCI Global Impact ETF seeks to track

the investment results of the MSCI ACWI Sustainable Impact Index, a

new index constructed by MSCI. The index is comprised of companies

that derive a majority of their revenue from products and services

that address at least one of the world’s major social and

environmental challenges, as identified by the United Nations

Sustainable Development Goals. Some of the impact themes targeted

in this index include energy efficiency, sustainable water,

sanitation, nutrition, and education.

Martin Small, Managing Director and Head of U.S. iShares at

BlackRock, said: “The iShares Sustainable MSCI Global Impact

ETF provides an easy way for investors to gain exposure to

companies that have a record of positive environmental and social

impact, and further strengthens our suite of socially responsible

exchange traded funds. These ETFs in particular are seeking to meet

growing demand from investors who are looking to have a positive

impact and seek global equity market returns.”

MPCT arrives at a pivotal point in the sustainable investing

market as global political, business and regulatory leaders are

coming together to address climate change concerns. Its launch

comes soon after the landmark COP21 Agreement and the recent

inclusion of ESG standards by the Department of Labor.

Deborah Winshel, Managing Director and Global Head of

BlackRock Impact, said: “Investor needs are constantly

evolving, and BlackRock is focused on creating innovative and

scalable solutions to address these changing demands. This new fund

arrives at a time when investors - from major global institutions

to individual investors - are increasingly looking to achieve their

financial goals in a way that also delivers a long-term, positive

impact on the world."

Jana Haines, Managing Director and Head of Equity Index

Products for the Americas for MSCI, said: “The MSCI ACWI

Sustainable Impact Index is the industry’s first equity benchmark

designed to apply principles of impact investing by

targeting public companies whose products and services

aim to address major social and environmental challenges. Based on

MSCI ESG Sustainable Impact Metrics, a new framework aligned with

the Sustainable Development Goals (SDGs) adopted by the United

Nations, the index weights securities by companies’ revenue

exposure to sustainable impact themes and excludes companies that

fail to meet minimum ESG standards. We are pleased that Blackrock

is expanding their MSCI-based ETF suite and will be introducing the

first sustainable impact ETF to the market.”

Formed in 2015 and led by Deborah Winshel, BlackRock Impact is

the firm’s global investment platform catering to investors with

social or environmental objectives. BlackRock currently manages

more than $200 billion of assets across screened portfolios,

environmental, social and governance (ESG) tilted funds, and impact

investments. For more information about BlackRock Impact, please

visit blackrockimpact.com.

About BlackRock

BlackRock is a global leader in investment management, risk

management and advisory services for institutional and retail

clients. At March 31, 2016, BlackRock’s AUM was $4.737 trillion.

BlackRock helps clients around the world meet their goals and

overcome challenges with a range of products that include separate

accounts, mutual funds, iShares® (exchange-traded funds), and other

pooled investment vehicles. BlackRock also offers risk management,

advisory and enterprise investment system services to a broad base

of institutional investors through BlackRock Solutions®. As of

March 31, 2016, the firm had approximately 13,000 employees in more

than 30 countries and a major presence in global markets, including

North and South America, Europe, Asia, Australia and the Middle

East and Africa. For additional information, please visit the

Company’s website at www.blackrock.com | Twitter: @blackrock_news |

Blog: www.blackrockblog.com | LinkedIn:

www.linkedin.com/company/blackrock

About iShares

iShares® is a global leader in exchange-traded funds (ETFs),

with more than a decade of expertise and commitment to individual

and institutional investors of all sizes. With over 700 funds

globally across multiple asset classes and strategies and more than

$1 trillion in assets under management as of March 31, 2016,

iShares helps clients around the world build the core of their

portfolios, meet specific investment goals and implement market

views. iShares funds are powered by the expert portfolio and risk

management of BlackRock, trusted to manage more money than any

other investment firm.1

1 Based on $4.737 trillion in AUM as of 3/31/16.

Carefully consider the iShares Funds’ investment objectives,

risk factors, and charges and expenses before investing. This and

other information can be found in the Funds’ prospectuses and, if

available, summary prospectuses, which may be obtained by calling

1-800-iShares (1-800-474-2737) or by visiting

www.iShares.com. Read the prospectus carefully before

investing.

Investing involves risk, including possible loss of

principal.

The Funds’ use of derivatives may reduce the Funds’ returns

and/or increase volatility and subject the Funds to counterparty

risk, which is the risk that the other party in the transaction

will not fulfil its contractual obligation. The Funds could suffer

losses related to their derivative positions because of a possible

lack of liquidity in the secondary market and as a result of

unanticipated market movements, which losses are potentially

unlimited. There can be no assurance that the Funds’ hedging

transactions will be effective. The Funds are subject to the risks

of the underlying funds.

International investing involves risks, including risks related

to foreign currency, limited liquidity, less government regulation

and the possibility of substantial volatility due to adverse

political, economic or other developments. These risks often are

heightened for investments in emerging/developing markets and in

concentrations of single countries.

The iShares Funds are distributed by BlackRock Investments, LLC

(together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or

promoted by MSCI Inc., nor does this company make any

representation regarding the advisability of investing in the

Funds. BlackRock is not affiliated with MSCI Inc.

©2016 BlackRock. All rights reserved. iSHARES and

BLACKROCK are registered trademarks of BlackRock. All other

marks are the property of their respective owners.

iS-18184-0416

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160422005523/en/

BlackRock, Inc.Paul Young,

212-810-8142Paul.Young@blackrock.comorTheresa McCartney,

646-310-1653Theresa.McCartney@blackrock.com

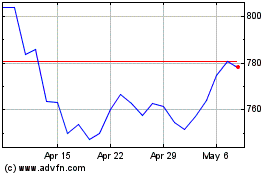

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

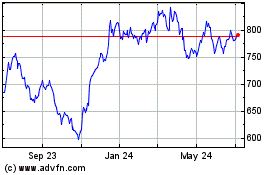

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024