By Ryan Tracy and Emily Glazer

WASHINGTON -- U.S. regulators slapped embattled Wells Fargo

& Co. with new sanctions Tuesday, concluding the bank had

failed to devise an adequate blueprint for avoiding a taxpayer

bailout if it were on the brink of bankruptcy.

The rebuke over the bank's so-called "living will" submission

surprised executives and was another black eye for a bank that is

still reeling from a scandal over its creation of bogus customer

accounts. Even more stinging: the news was akin to failing a

make-up test as the San Francisco bank had failed an initial test

in April.

The bank's executives raced to figure out what went wrong and

immediately began "doing a post-mortem," a person familiar with the

matter said. In response to the announcement - and the amount of

detail released by regulators - the bank on Tuesday also released

more detail about work it has done since resubmitting its living

will, this person said.

This is the first time the Federal Reserve and Federal Deposit

Insurance Corp. have imposed penalties on a bank under the

living-wills process created by the 2010 Dodd-Frank

financial-overhaul law. As a result, Wells Fargo is now barred from

creating new international banking units or acquiring any nonbank

subsidiaries. If regulators aren't happy with the bank's response

to Tuesday's findings to be submitted by March 2017, they could cap

growth at the bank and, in two years, force it to divest itself of

certain assets under Dodd-Frank.

Wells Fargo was alone in being flunked by regulators. Four

others who also failed in the first round, including J.P. Morgan

Chase & Co. and Bank of America Corp., were found Tuesday to

have corrected the problems regulators had identified.

Wells Fargo now faces a new challenge from Washington even as it

remains under investigation by numerous federal and state agencies,

including the Justice Department: to show it can live up to its

obligation, imposed after the financial crisis, to create a plan

for how it would go through bankruptcy during a period of severe

distress without tapping into public funds, the way some big banks

did in 2008.

The living-wills process is a pillar of the new financial

regulatory regime enacted under President Barack Obama. Many banks

have complained that regulators have applied the rules too

stringently, and President-elect Donald Trump has vowed to ease up

on postcrisis regulations. While he can't immediately change the

leadership at the Fed and FDIC, he can quickly fill a longstanding

vacancy for the Fed's top banking overseer, who will have

significant sway over how living wills are enforced going

forward.

Wells Fargo said in a statement that it took its feedback from

its 2015 living-wills submission "very seriously and took several

steps to address it." The bank said that while it is disappointed

by the regulators' decision, it will work cely with the agencies to

better understand their concerns.

In a memo to employees Tuesday reviewed by The Wall Street

Journal, Wells Fargo Chief Executive Timothy Sloan wrote that the

bank will continue to work closely with regulators "to better

understand their concerns," but added that "living wills are a form

of contingency planning. They are not a scorecard for the current

health of Wells Fargo or any bank."

The regulators could have, but didn't, impose higher capital

requirements on the firm, a potentially stricter sanction.

Wells Fargo has been under fire since its sales-tactics scandal

exploded into public view in September. The firm, once a golden

child among big banks, paid a $185 million fine to a separate set

of federal regulators, along with a the Los Angeles City Attorney's

office, over opening as many as 2.1 million accounts with

unauthorized or fictitious customer information.

Since then, Wells Fargo has faced withering public and political

criticism. Former Chief Executive John Stumpf retired abruptly

after being grilled in two congressional hearings. The Office of

the Comptroller of the Currency last month imposed further

restrictions on the bank's operations over that controversy and is

looking at still further restrictions on the bank's ability to

expand.

As part of its efforts to mend relations with regulators, Mr.

Sloan, who took over in October, has been traveling regularly to

Washington. But Mr. Sloan has said in meetings with bank executives

and employees over the past several weeks that matters will get

worse before they get better, according to people who attended the

meetings and recordings reviewed by The Wall Street Journal. Mr.

Sloan has also said that the bank should expect tough times from

regulators across the firm, not just its retail-banking unit.

The new sanctions issued Tuesday opened a whole new front of

questions from regulators about the institution's management,

related to whether they are properly structured, in the eyes of

regulators, to respond to a new financial crisis.

Tuesday's verdict came after months of regular meetings between

regulatory staff and the five firms to discuss aspects of the

living wills, from banks' derivatives businesses to their legal

structures. Along with J.P. Morgan and Bank of America, Bank of New

York Mellon Corp. and State Street Corp. were told they had

addressed regulators' concerns.

In a letter Tuesday to Wells Fargo, the Fed and FDIC hit Wells

Fargo with blunt criticism. They said the firm "has not even

completed an assessment" related to how it would keep operating

critical services during a bankruptcy, for example.

Earlier this year, Wells Fargo was the only bank that was

flunked for "material errors" in its living-wills submission.

Regulators said Tuesday that the firm had addressed governance

issues in the living will.

Verdicts on the living wills are closely watched on Capitol

Hill, where advocates of breaking up megabanks have pushed

regulators to aggressively use this part of Dodd-Frank to pressure

them to shrink or reduce risk.

Tuesday's decision didn't directly address whether the big banks

remain "too big to fail." In April, the five big banks, along with

Goldman Sachs Group Inc., Morgan Stanley and Citigroup Inc., were

given a list of separate regulatory concerns that were required to

be addressed by July 2017, when all the firms must submit new

living wills. That will pose another test for each of the banks,

and it is possible that regulators could impose additional

sanctions on some firms if they don't make enough progress by

July.

Write to Ryan Tracy at ryan.tracy@wsj.com and Emily Glazer at

emily.glazer@wsj.com

(END) Dow Jones Newswires

December 14, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

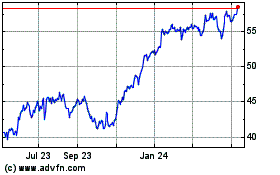

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

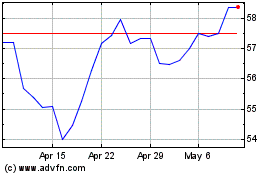

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024