By Ryan Tracy and Emily Glazer

WASHINGTON -- U.S. regulators slapped Wells Fargo & Co. with

new regulatory sanctions Tuesday, saying the firm failed to address

alleged "deficiencies" in a plan to manage its own bankruptcy

without a taxpayer bailout.

Four other huge banks avoided the sanctions: J.P. Morgan Chase

& Co., Bank of America Corp., Bank of New York Mellon Corp.,

and State Street Corp. The Federal Reserve and Federal Deposit

Insurance Corp. announced the verdicts Tuesday after saying in

April that the five banks didn't have adequate "living will"

plans.

Wells Fargo said in a statement that while it is disappointed by

the regulators' decision it will work closely with the agencies to

better understand their concerns. That said that it took early

regulator feedback "very seriously and took several steps to

address it," including creating a special office assigned to deal

with the living wills process.

The regulatory shortcoming, akin to failing a makeup test, is

yet another blow to Wells Fargo, which is still struggling with the

fallout from its sales-practices scandal. The firm, once a golden

child among big banks, paid a $185 million fine in September to a

separate set of federal regulators, along with a city official,

over opening as many as 2.1 million accounts with unauthorized or

fictitious customer information.

Since then, Wells Fargo has faced public and political

criticism. Former Chief Executive John Stumpf retired abruptly

after being grilled in two congressional hearings. The bank faces

many state and federal investigations, including from the Justice

Department and the Securities and Exchange Commission. Wells

Fargo's board is also conducting its own internal investigation.

The Office of the Comptroller of the Currency last month imposed

further restrictions on the bank's operations over that

controversy, and is looking at still further restrictions on the

bank's ability to expand.

As part of its efforts to mend relations with regulators, Chief

Executive Timothy Sloan, who took over in October, has been

traveling regularly to Washington, D.C. But Mr. Sloan has said in

meetings with bank executives and employees over the past several

weeks that matters will get worse before they get better, according

to people who attended the meetings and recordings reviewed by The

Wall Street Journal.

Mr. Sloan has also said the bank should expect tough times from

regulators across the firm, not just its retail banking unit. That

appears to be the case with the bank's submission detailing for

regulators how it would plan to go through bankruptcy -- also known

as a living will -- which is separate from issues related to the

sales-practices scandal. The new sanctions issued Tuesday opened a

whole new front of questions from regulators about the

institution's management, related to whether they are properly

structured, in the eyes of regulators, to respond to a new

financial crisis.

Earlier this year, Wells Fargo was the only bank that was

flunked for "material errors" in its living wills submission, with

regulators saying the bank had to make substantial revisions to its

plan. The announcement came as a surprise to it and the banking

industry, since Wells Fargo had, in an earlier round of tests, been

singled out as the only bank to lay out a viable bankruptcy

path.

Though big banks' size have often been their Achilles' heel in

the living wills, Wells Fargo's growth over the years wasn't its

problem. Instead, regulators said the errors called into question

"the extent to which there was appropriate internal review and

coordination." At that time, in April, regulators told Wells Fargo

that its errors included issues around the volume of its available

liquid assets, which "raises concerns regarding quality control,

senior management oversight, and recovery and resolution planning

staffing."

In assessing the new plan that Wells Fargo had submitted in

October, the Fed and FDIC said Wells Fargo still didn't adequately

address two of the three major concerns the agencies had raised.

Big banks must file the will under the 2010 Dodd-Frank law as a way

of ensuring that they can fail without needing a taxpayer

bailout.

The regulators for the first time invoked sanctions they are

empowered to use in Dodd-Frank when they determine a living will

isn't credible or wouldn't facilitate an orderly bankruptcy. Wells

Fargo will be barred from establishing international bank entities

or acquiring any nonbank subsidiary. The regulators could have but

didn't impose higher capital requirements on the firm, a

potentially stricter sanction.

Wells is expected to file a revised living will "addressing the

remaining deficiencies" by March 31, 2017, the Fed and FDIC said.

If the agencies still aren't satisfied, they will limit the size of

the firm's nonbank and broker-dealer assets to levels in place on

September 30, 2016, they said. After two years under the Dodd-Frank

sanctions, Wells could also potentially face requirements to divest

certain assets.

Tuesday's verdict came after months of regular meetings between

regulatory staff and the five firms to discuss aspects of the

living wills, from banks' derivatives businesses to their legal

structures.

In a letter Tuesday to Wells Fargo, the Fed and FDIC hit Wells

with withering criticism. They said when it came to the bank's plan

for potentially reorganizing legal entities it owns, "it is unclear

whether or under what circumstances WFC would take action or what

type of actions it would consider taking."

Mr. Sloan wrote to bank employees Tuesday afternoon that the

bank took "several steps" to improve its October resubmission after

getting regulator feedback, according to a memo reviewed by The

Wall Street Journal.

While he said that the bank will continue to work closely with

regulators "to better understand their concerns" he added that

"living wills are a form of contingency planning. They are not a

scorecard for the current health of Wells Fargo or any bank."

He added: "We believe our planning complements the practices we

already have in place for managing our capital, managing risk, and

planning for a variety of contingencies." He expects the bank to

address the agencies' comments in the time frame provided.

On the other hand, Tuesday's decision was a significant win for

J.P. Morgan, Bank of America and the other firms that regulators

rebuked in April.

Verdicts on the living wills are closely watched on Capitol

Hill, where advocates of breaking up megabanks have pushed

regulators to aggressively use this part of Dodd Frank to pressure

them to shrink or reduce risk.

Tuesday's decision didn't directly address whether the big banks

remain "too big to fail." In April, the five big banks, along with

Goldman Sachs Group Inc., Morgan Stanley, and Citigroup Inc., were

given a list of separate regulatory concerns that were required to

be addressed by July 2017, when all the firms must submit new

living wills. That will pose another test for each of the banks,

and it is possible that regulators could impose additional

sanctions on some firms if they don't make enough progress by

July.

By then, some of the regulators who voted on Tuesday's decision

may no longer be in office. President-elect Donald Trump's team has

indicated it wants to fill several empty slots on the Fed's

governing board, for example, including vice chair in charge of

bank oversight.

--Christina Rexrode contributed to this article.

Write to Ryan Tracy at ryan.tracy@wsj.com and Emily Glazer at

emily.glazer@wsj.com

(END) Dow Jones Newswires

December 13, 2016 17:50 ET (22:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

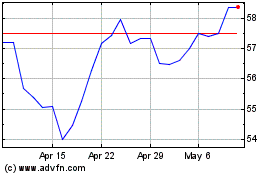

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

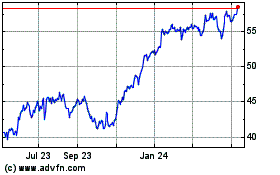

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024