Puerto Rico's Top Creditors Flex Muscles in Bond Fight

November 23 2016 - 4:20PM

Dow Jones News

Puerto Rico's largest mutual-fund bondholders have broken their

silence in an ongoing $30 billion creditor standoff, underscoring

tensions between the commonwealth's traditional municipal investor

base and the hedge funds now involved in its financial

restructuring.

Funds controlled by fixed-income giants Franklin Investments and

OppenheimerFunds asked a federal judge last week to enter them as

defendants in a lawsuit brought by hedge funds holding general

obligation, or GO, bonds that have been in default since July.

The lawsuit pits those creditors against investors holding $17

billion in competing bonds known as Cofinas for their Spanish

acronym and backed by sales tax revenues. If successful, the

lawsuit could compromise the Cofina bondholders' liens and free up

a fresh source of repayment for the GO bondholders, which are

guaranteed under the Puerto Rican constitution.

The courts, on the other hand, could affirm the commonwealth's

longstanding position that the sales-tax revenues are off-limits to

the GO bondholders. U.S. District Court Judge Francisco Besosa

could also freeze the dispute in the hopes that the warring

investor groups will negotiate a settlement, as the Cofina

investors have urged.

Congress installed a federal oversight board over the summer to

take over Puerto Rico's financial decision-making, but it has yet

to announce the hiring of legal and financial advisors with whom

creditors will negotiate. The legal status of the Cofina revenues

has never been tested in the courts, and resolving it now would

take a major question on creditors' rights out of the board's

hands. For now, it wants the dispute paused under the automatic

stay provisions of the Puerto Rico Oversight, Management and

Economic Stability Act, or PROMESA.

Franklin and Oppenheimer, along with Santander Asset Management,

are cross-holders with a combined $3.6 billion in Cofina claims and

$1.1 billion in GO claims, according to a filing in Puerto Rico

federal court.

With $2.8 billion of their exposure in subordinated Cofina debt,

the mutual funds said they have the "greatest possible interest" in

protecting the sales taxes from being diverted. Junior Cofina bonds

would suffer the most if the revenue stream were interrupted,

although they have continued to be paid even with the territorial

government in default on its constitutional debt.

Hedge funds exclusively holding senior Cofina bonds have already

asked to be heard in the lawsuit. Those bondholders, including

GoldenTree Asset Management, Merced Capital and Taconic Capital

Advisors, hold zero-coupon bonds that don't come due for decades,

according to people familiar with the matter. Their group has taken

the position that diverting the sales taxes would cause their

claims to come due immediately, leapfrogging over those of junior

creditors.

As holders of both types of bonds, the mutual funds said they

aren't conflicted and have reason to guard the interests of all

creditors within the $17 billion Cofina debt stack. Puerto Rican

lawmakers first segregated sales-tax revenues from its general fund

a decade ago to create an alternate borrowing mechanism.

"The interests of Cofina, its bondholders generally and its

current-pay subordinate bonds in particular are served by

maintaining the statutory transfer," lawyers for Franklin,

Oppenheimer and Santander wrote in court papers. "It is likely that

the senior Cofina bondholders want Cofina to default."

A spokesman for the mutual funds declined to comment beyond the

filing. Representatives for the GO bondholder group and for Cofina

bond trustee Bank of New York Mellon didn't immediately respond to

requests for comment.

James Doak of Miller Buckfire & Co., an adviser to the

senior Cofina bondholder group, called the mutual funds' appearance

"a positive for Puerto Rico, the oversight board and the incoming

administration."

"Major, long-standing investors holding both GO and Cofina bonds

are stepping forward to defend PROMESA's stay provision and reject

more litigious GO bondholders' attempts to seize [sales tax]

revenue," he said.

The benchmark 8%-coupon GO bonds due in 2035 traded Friday at

69.5 cents on the dollar, according to FactSet, having cooled off

from a post-election rally that pushed prices to 73 cents. Puerto

Rico recently elected Dr. Ricardo Rossello, a statehood supporter

perceived by investors as friendlier to creditor interests, to

replace Gov. Alejandro Garcí a Padilla. The new governor takes

office in January.

(END) Dow Jones Newswires

November 23, 2016 16:05 ET (21:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

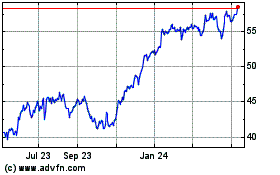

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

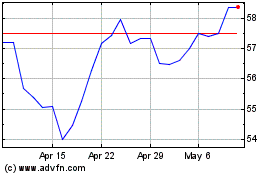

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024