Revised 'Living Wills' Released for Five Big U.S. Banks -- 2nd Update

October 04 2016 - 5:03PM

Dow Jones News

By Donna Borak

WASHINGTON -- U.S. regulators on Tuesday made public new plans

submitted by five of the biggest U.S. banks explaining how they

could wind down their operations in a period of extreme distress

without requiring a taxpayer bailout.

The government required the plans, called "living wills," to be

submitted after declaring in April that earlier versions from the

institutions weren't sufficiently credible. The five banks are J.P.

Morgan Chase & Co., Wells Fargo & Co., Bank of America

Corp., Bank of New York Mellon Corp., and State Street Corp.

In releasing the documents, the Federal Reserve and the Federal

Deposit Insurance Corp. said in a joint press release that they had

no assessment yet of the documents and hadn't yet reviewed them.

They said they "will now be initiating their process for

review."

The documents that were made public -- about 50 pages each --

were just a small portion of the full filings made by the

institutions. Much-longer private documents containing detailed

confidential information were also submitted to the agencies.

The regulators also released documents submitted by three other

banks, whose plans cleared the regulatory assessment in April, but

which submitted updates on their blueprints: Goldman Sachs Group

Inc., Morgan Stanley and Citigroup Inc.

The living-will submissions are part of the extensive list of

new requirements imposed on big banks after the financial crisis,

when the government bailed out the country's largest banks, aiming

to prevent an even deeper collapse, but stoking a widespread

political backlash.

As part of the 2010 Dodd-Frank financial-overhaul law, big banks

are required to submit detailed plans convincing the Fed and FDIC

they have credible plans for failing without costing taxpayers a

dime.

If the regulators feel that the plans aren't sufficient, they

have the power to order the banks to increase their capital

cushions to guard against further losses, and, eventually, to order

an extensive restructuring of their operations, including shedding

certain business lines.

In its 58-page public document, J.P. Morgan Chase said it put

together "a robust legal analysis of potential creditor and

fiduciary challenges to capital and liquidity support." Based on

that analysis, the bank decided to "immediately establish, and

begin transferring assets into, an intermediate holding

company."

As part of the planning, the financial institutions group in

J.P. Morgan's investment bank conducted an "expert analysis" to

objectively identify and analyze possible "objects of sale." It

found 16 along with potential buyers for each. It has a divestiture

playbook for each of those possible sales.

--Emily Glazer contributed to this article.

Write to Donna Borak at donna.borak@wsj.com

(END) Dow Jones Newswires

October 04, 2016 16:48 ET (20:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

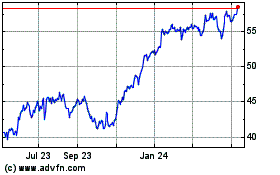

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

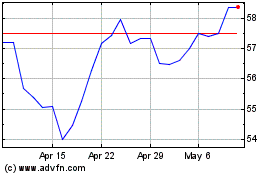

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024