Bankrupt Rochdale Securities Wins $8 Million Award Against Wall Street Firm

October 04 2016 - 4:52PM

Dow Jones News

By Katy Stech

A judge has ruled that Rochdale Securities LLC, a Connecticut

trading firm that shut down after a loss from a $1 billion Apple

Inc. stock purchase executed by a rogue trader, can collect nearly

$8 million in damages from Wall Street firm Pershing LLC, which it

accused of mishandling the firm's fatal trade.

In a recent ruling, a New York state-court judge agreed with the

damages award against Pershing, which executed the unauthorized

trade in Apple stock in October 2012 that left Rochdale Securities

with a loss of several million dollars.

In earlier court papers, Rochdale Securities argued that

Pershing, a unit of the Bank of New York Mellon Corp. that

administered more than $1 trillion in assets as of June, had the

power to reverse the massive trade, knowing it was a mistake and

that Rochdale Securities didn't have the money to pay for the

purchase.

Pershing denied wrongdoing and asserted in court papers that it

didn't have the power to undo Rochdale Securities' trade.

A Pershing representative didn't respond to requests for comment

on the damages award.

Rochdale Securities stopped trading the day after the fraudulent

Apple stock purchase and later filed for bankruptcy. The Stamford,

Conn., firm, which employed 60 brokers and analysts at the time of

the shutdown, operated as a licensed broker-dealer for more than 35

years.

The downfall of Rochdale Securities began with a stock

purchasing scheme executed by trader David Miller and a customer at

the time that Apple released its quarterly earnings on Oct. 25,

2012.

Under the scheme, Mr. Miller agreed to submit an order for Apple

stock and write it in a way that Mr. Miller could later claim he

misinterpreted it, according to officials from the Federal Bureau

of Investigation who investigated the trade and later prosecuted

him. Mr. Miller then made a trade for 1,000 times the number of

shares, FBI officials said.

If Apple shares rose after the release and the trade provided

profitable, Mr. Miller and the customer would share the profits,

FBI officials said. If the trade lost money, Mr. Miller "would

claim human error, leaving Rochdale holding the losing position,"

according to FBI officials.

In 2013, Mr. Miller was sentenced to 30 months in prison for his

role in the scheme.

Rochdale Securities who realized Mr. Miller's giant purchase

began selling off the Apple stock the next morning. They made a

small profit, but the price dropped by about $9 dollars per share

several hours later.

Despite the dip, Pershing officials pressured Rochdale

Securities to sell the rest of the stock immediately.

The sudden sale left Rochdale Securities on the hook for a big

loss: $5,314,967.

Waiting several hours until the price rebounded, Rochdale

Securities lawyers argued, would have enabled the firm to avoid

that loss.

"Pershing didn't start the series of events [that led to

Rochdale Securities' shutdown], but Pershing did end" them, said

Aaron Romney, a Connecticut lawyer who represents Rochdale

Securities.

Rochdale Securities also argued that Pershing was reckless by

clearing the Apple trades and knew that doing so could put the firm

out of business. Court papers included an email from a Bank of New

York Mellon managing director who called Rochdale Securities' Apple

trade a "hilarious screw up" that came from "a guy who otherwise

would have had a massive X-mas bonus."

In April 2014, Rochdale Securities lawyers filed an arbitration

claim with a Financial Industry Regulatory Authority panel,

asserting damages for the loss of business and several other

claims. The panel later ruled in Rochdale Securities' favor,

awarding $7.6 million.

On Sept. 23, New York judge Saliann Scarpulla denied Pershing's

request to reconsider the arbitration award. Part of the damages

award will pay the firm's final bills as part of the bankruptcy

process.

Write to Katy Stech at katherine.stech@wsj.com

(END) Dow Jones Newswires

October 04, 2016 16:37 ET (20:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

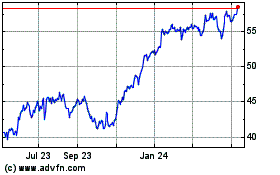

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

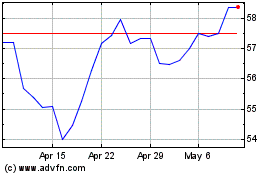

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024