By Katy Burne

J.P. Morgan Chase & Co.'s retreat from a mundane but crucial

settlement role in the $13 trillion U.S. Treasury market poses a

fresh challenge for regulators seeking to bolster the market's

capacity to withstand shocks.

The New York bank's decision, announced July 21 and due to be

complete next year, leaves rival Bank of New York Mellon Corp. as

the lone firm handling the settlement of U.S. government debt for

big bond brokers.

Having just one firm in the business of making sure traders

deliver cash and securities as expected will pose a fresh test for

a sprawling market whose functioning has come under scrutiny since

the financial crisis. Many analysts already worry that liquidity,

the capacity to trade quickly without moving prices, has been

falling when markets come under stress.

Following J.P. Morgan's exit, Bank of New York will settle

transactions including the majority of Treasury debt sold at U.S.

government auctions, the majority of Treasurys traded in the

secondary market and most U.S. government debt exchanged in the

overnight "repo" market, a key source of funding in which financial

institutions use the bonds as collateral for cash loans.

Officials at both banks said they had been in touch with the

Federal Reserve and the Treasury Department to reassure them the

moves wouldn't disrupt trading in U.S. Treasurys or the $2.2

trillion daily market for repos. But the move could inflame

concerns that there already weren't enough options for traders,

potentially exposing the market to a shutdown in the event of an

outage at a large settlement firm.

"You have all your eggs in one basket here, and if you're the

Fed, that has to be a little disconcerting, because you don't want

any hiccups in this market," said Ray Stone, a former New York Fed

researcher and head of Stone & McCarthy Research

Associates.

The change, deep in Wall Street's financial plumbing, reflects

pressure from new regulations as well as banks' efforts to cut back

less-lucrative activities.

There were about half a dozen providers of settlement services

in the Treasurys market before consolidation whittled the market

down to two in the 1990s.

But for more than a decade, banks that operate as "primary

dealers" in the Treasury market have only had two options for

settling trades -- Bank of New York and J.P. Morgan.

Bank of New York is prepared to work with dealers that want to

move to its platform and expects to be able to handle the extra

volume, spokeswoman Cheryl Krauss said.

J.P. Morgan said it would continue to provide other related

services, like managing government bonds as collateral for client

trades.

The Treasury is "confident that Treasury securities will

continue to settle and trade in the usual manner," a Treasury

spokesman said.

The Fed and others have been concerned for more than a decade

about Bank of New York's large market share -- now 85% -- for

settlement in a $1.6 trillion part of the repo market.

The central bank worried as far back as 2006 that concentration

could present systemwide risks and considered forming a utility as

a backup, people briefed on the matter said. J.P. Morgan's

announcement may restart those discussions, the people said.

The Fed also is holding Bank of New York to higher operating

standards due to its share of the market.

"A single provider of settlement services -- or a new entrant,

should there be one -- will be expected to operate in a safe and

sound manner that supports market functioning and that is resilient

to stress," said Darren Gersh, a spokesman for the central bank in

Washington.

One concern is damage to infrastructure. The 2001 terror

attacks, for example, hit Bank of New York's telecommunications

lines close to the World Trade Center, causing payment disruptions.

Since 2001, the bank has strengthened and diversified its disaster

recovery procedures, said Ms. Krauss, the bank's spokeswoman.

"If they have a technical glitch, what happens if the collateral

can't be sent back or the money can't be sent? That's wild

business," said Bruce English, who ran the repo desk at Aubrey G.

Lanston & Co., which previously was a primary dealer.

Bank of New York has $29.5 trillion in assets under custody or

administration. It already handles settlement for all but four of

the 23 primary dealers that trade bonds directly with the Fed.

Primary dealers handle the majority of bonds sold in U.S.

government auctions. Most subsequent trades in the market also

involve primary dealers, and settle at either J.P. Morgan or Bank

of New York, although smaller dealers and alternative providers do

exist.

Citigroup clears trades of government securities for clients

such as hedge funds. BMO Harris Bank, a Chicago based unit of BMO

Financial Group with $104 billion in assets under management, is

considering expanding its government securities settlement and

custody services to broker dealers.

"We think there's further opportunity," said Scott Ferris, head

of the financial institutions group at BMO Harris.

Write to Katy Burne at katy.burne@wsj.com

(END) Dow Jones Newswires

July 31, 2016 16:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

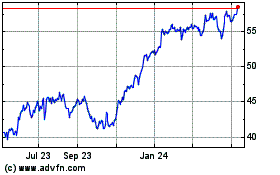

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

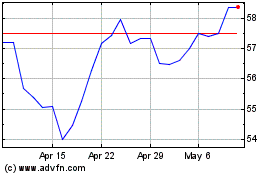

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024