Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 26 2016 - 6:04AM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration Statement No.: 333-209450

July 25, 2016

THE BANK OF NEW YORK MELLON CORPORATION

Depositary Shares, Each

Representing a 1/100th Interest

in a Share of Series F Noncumulative Perpetual Preferred Stock

|

|

|

|

|

Issuer:

|

|

The Bank of New York Mellon Corporation

|

|

|

|

|

Security:

|

|

Depositary shares, each representing a 1/100th interest in a share of Series F Noncumulative Perpetual Preferred Stock (“Preferred Stock”)

|

|

|

|

|

Size:

|

|

$1,000,000,000 (1,000,000 depositary shares)

|

|

|

|

|

Maturity:

|

|

Perpetual

|

|

|

|

|

Expected Ratings*:

|

|

Baa1 / BBB / BBB / A (low) (Moody’s / S&P / Fitch / DBRS)

|

|

|

|

|

Liquidation Preference:

|

|

$1,000 per depositary share (equivalent to $100,000 per share of Preferred Stock)

|

|

|

|

|

Dividend Payment

Dates:

|

|

(i) each March 20 and September 20, commencing March 20, 2017, to and including September 20, 2026, and (ii) each March 20, June 20, September 20 and

December 20, commencing December 20, 2026

|

|

|

|

|

Dividend Rate (Non-

cumulative):

|

|

At a rate per annum equal to 4.625% from the original issue date to but excluding September 20, 2026; and from and including September 20, 2026, a floating rate equal to Three-month

LIBOR plus 313.1 basis points; in each case, only when, as and if declared.

|

|

|

|

|

Day count:

|

|

From August 1, 2016 to, and excluding, September 20, 2026, 30/360

From and including September 20, 2026, Actual/360

|

|

|

|

|

Redemption:

|

|

On September 20, 2026, or any dividend payment date thereafter, the Preferred Stock may be redeemed at the Issuer’s option, in whole or in part, at a cash redemption price

equal to $100,000 per share (equivalent to $1,000 per depositary share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends to but excluding the redemption date. The Preferred Stock also may be redeemed at the

Issuer’s option in whole, but not in part, at any time within 90 days following a “Regulatory Capital Treatment Event,” as described in the prospectus supplement, at a redemption price equal to $100,000 per share (equivalent to $1,000

per depositary share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends to but excluding the redemption date. Holders of depositary shares will not have the right to require the redemption or repurchase of the

depositary shares.

|

|

|

|

|

|

Trade Date:

|

|

July 25, 2016

|

|

|

|

|

Settlement Date:

|

|

August 1, 2016 (T+5)**

|

|

|

|

|

Public Offering Price:

|

|

$1,000 per depositary share

|

|

|

|

|

Underwriting Discount:

|

|

$10 per depositary share

|

|

|

|

|

Net Proceeds (before

expenses) to Issuer:

|

|

$990,000,000

|

|

|

|

|

Joint Book-Running

Managers:

|

|

Citigroup Global Markets Inc.

Merrill Lynch, Pierce, Fenner & Smith Incorporated

Morgan Stanley & Co. LLC

UBS Securities LLC

BNY Mellon Capital Markets,

LLC

|

|

|

|

|

Joint Lead Managers:

|

|

Barclays Capital Inc.

Deutsche

Bank Securities Inc.

HSBC Securities (USA) Inc.

J.P. Morgan Securities LLC

RBC Capital Markets, LLC

Wells Fargo Securities, LLC

|

|

|

|

|

Co-Managers:

|

|

MFR Securities, Inc.

Nomura

Securities International, Inc.

Santander Investment Securities Inc.

|

|

|

|

|

CUSIP/ISIN:

|

|

064058AF7 / US064058AF75

|

The depositary shares are not deposits or other obligations of a bank and are not insured or guaranteed by the Federal

Deposit Insurance Corporation or any other governmental agency.

* A securities rating is not a recommendation to buy, sell or hold

securities and may be subject to revision or withdrawal at any time.

** The Book-Runners, Lead Managers and Co-Managers expect to

deliver the Depositary Shares in book-entry form only through the facilities of The Depository Trust Company against payment in New York, New York on or about the fifth business day following the date of this Term Sheet. Trades of securities in the

secondary market generally are required to settle in three business days, referred to as T+3, unless the parties to a trade agree otherwise. Accordingly, by virtue of the fact that the initial delivery of the Depositary Shares will not be made on a

T+3 basis, investors who wish to trade the Depositary Shares before a final settlement will be required to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement.

This communication is intended for the sole use of the person to whom it is provided by us. The issuer

has filed a registration statement, including a prospectus and a preliminary prospectus supplement, with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement,

the preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov.

Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Citigroup Global Markets Inc. at 800-831-9146, Merrill Lynch, Pierce, Fenner & Smith

Incorporated at 800-294-1322, Morgan Stanley & Co. LLC at 866-718-1649, UBS Securities LLC at 888-827-7275 or BNY Mellon Capital Markets, LLC at 800-269-6864.

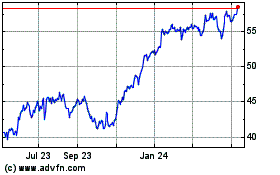

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

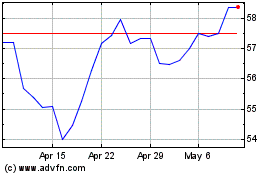

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024