Libya's sovereign-wealth fund alleged Goldman Sachs Group Inc.

abused a relationship of trust to earn about $222 million from it

through several complex trades arranged in 2008, according to

documents for a long-awaited trial that started in London on

Monday.

The $67 billion Libyan Investment Authority, or LIA, which is

suing the New York-based bank in the High Court in London, wants

Goldman Sachs to repay $1.2 billion to cover its losses from the

equity-derivatives trades.

Goldman Sachs denies wrongdoing and disputes the amount of

profit it made.

The Libyan fund alleges in court documents that Goldman Sachs

executives exerted "undue influence" over officials at the new

sovereign-wealth fund. The fund was created in 2006 to manage

income from Libya's oil fields after the country was removed from

the U.S. government's list of state sponsors of terrorism.

"Libya had been an international pariah for decades, cut off

from much of the rest of the world and from international financial

markets," lawyers for the fund wrote in court documents. "In its

isolation, Libya's financial system was under-developed and

unsophisticated, as were the individuals who worked within it."

Between January and April 2008, the Libyan fund entered into

nine financial derivative transactions, the disputed trades, with

Goldman Sachs. Those trades expired worthless in 2011.

"The claims are without merit and we will continue to defend

them vigorously," a representative from Goldman Sachs said.

Documents show Goldman Sachs executives saying that the Libyan

fund had little experience in finance. "They are very

unsophisticated—and anyone could "rape" them," one executive wrote

in 2008.

In another internal email exchange, a Goldman Sachs executive

wrote to a colleague that "you just delivered a pitch on structured

leveraged loans to someone who lives in the middle of the desert

with his camels."

Goldman has declined to comment on the email exchanges, which

were revealed in the court documents.

Libyan fund officials first met executives from the U.S. bank in

November 2006, court documents presented by the Libyan fund show.

The fund presented an investment opportunity that was "one of the

largest I've ever seen," a Goldman Sachs executive wrote. "We are

all over them."

Goldman Sachs banker Youssef Kabbaj "was quickly embedded within

the nascent institution" and became close to the Libyan management

team, lawyers for the Libyan fund wrote. Within Goldman, he was

encouraged to "stay a lot" in Tripoli, the lawyers wrote, citing

Goldman correspondence. Mr. Kabbaj is no longer at Goldman

Sachs.

"It's important you stay super close to the client on a daily

basis. Teach them, train them, dine them," one executive wrote to

Mr. Kabbaj, the documents show. Another told him that, "This is a

once in a career opportunity."

In 2008, Mr. Kabbaj helped arrange an internship at the bank for

the younger brother of Mustafa Zarti, an executive at the Libyan

fund. Mr. Kabbaj texted Mustafa Zarti on April 17, 2008, with the

"good news" that the internship had been arranged. In the following

days, Mr. Zarti committed to the largest four disputed trades with

Goldman Sachs, involving payments of more than $828 million.

During a visit to Dubai in early 2008 with Mr. Zarti's younger

brother, Mr. Kabbaj paid $600 for "a pair of prostitutes to

entertain them both," according to the documents submitted by the

Libyans.

Mr. Kabbaj said in an interview that he didn't pay or arrange

for prostitutes for Mr. Zarti's younger brother or any official of

the Libyan fund. He said that Goldman Sachs partners signed off on

all his expenses for the Libyan fund. Mr. Kabbaj declined to

comment on whether he paid for a prostitute for himself.

The Libyan fund describes the internship that Goldman Sachs

offered as "bespoke and highly-coveted." The internship started on

June 23, 2008, and was initially due to last three months. It was

extended a number of times.

Goldman Sachs says the internship isn't important. "We do not

believe the internship influenced in any way the LIA's decision to

enter into the trades," the representative for the bank said.

The Securities and Exchange Commission has been—and may still

be— scrutinizing the internship, lawyers for the Libyan fund said.

A representative for the SEC declined to comment.

Banking internships awarded to people connected to

sovereign-wealth funds have been investigated before. Last year,

Bank of New York Mellon Corp. agreed to pay $14.8 million to settle

allegations that it violated U.S. antibribery laws when it gave

internships to family members of officials affiliated with a Middle

Eastern sovereign-wealth fund. An SEC investigation found the

family members didn't meet the "rigorous criteria" to join the

bank's internship program, yet they were hired, to help the bank

keep the sovereign-wealth fund's business. The bank neither

admitted nor denied the SEC's findings.

The Libyan fund's assets were valued at $67 billion in 2012.

Most of the assets are currently frozen by United Nations and

European Union sanctions because of continuing conflict in

Libya.

The fund has been the subject of a power struggle between two

rival chairmen loyal to competing Libyan governments that emerged

in the civil war following the death of Moammar Gadhafi in 2011.

Both chairmen support the lawsuit against Goldman Sachs.

Write to Simon Clark at simon.clark@wsj.com

(END) Dow Jones Newswires

June 13, 2016 17:25 ET (21:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

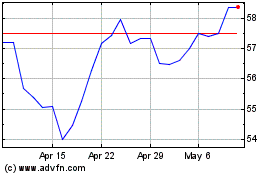

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

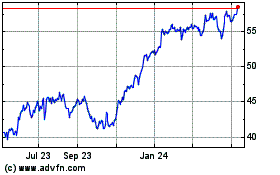

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024