Fed's Dudley: Giving More Firms Access to Discount Window 'Worth Exploring'

May 01 2016 - 9:00PM

Dow Jones News

Federal Reserve Bank of New York President William Dudley said

the powers the central bank can use to step in and aid a faltering

financial institution are still flawed, more than seven years after

the crisis, and that allowing more firms access to the discount

window "might be worth exploring."

In a speech Sunday kicking off the Atlanta Fed's annual

conference on financial markets in Amelia Island, Fla., Mr. Dudley

said global regulators were focused on plugging gaps in those

mechanisms, known as lender-of-last resort powers, but more work

was needed.

"In my view, an important issue is to identify and address gaps

in the lender-of-last-resort function," he said. "In the U.S., some

significant gaps remain."

He added, "I am happy to report that the Committee on the Global

Financial System—one of the Bank for International Settlements'

central bank groups—is engaged in a project to determine what

lender-of-last-resort gaps currently exist, focusing, in

particular, on those that may create vulnerability in terms of

financial stability."

One area he expects the group to focus on heavily, he added, is

how those procedures would work in the event a failing firm had

several units operating across international borders. In that case,

the expectations of the domestic and host countries would need to

be properly understood, he said.

In the speech, Mr. Dudley also said regulations crafted since

the financial crisis have done much to safeguard the largest

lenders in the U.S., but he said more work was needed to study the

potential side effects, in particular on the ease of trading.

Now that the rules have made all major securities firms in the

U.S. part of bank holding companies subject to routine capital and

safety checks, Mr. Dudley said providing these firms with access to

the discount window could be a worthwhile addition. Currently, the

Fed's discount window is only available to depository institutions,

and the law hampers the ability of a bank to pass along discount

window funding to its securities unit.

"To me, this is a more reasonable proposition now than it was

prior to the crisis, when the major dealers weren't subject to

those safeguards," he said.

Overall, Mr. Dudley said in the speech, market liquidity—or the

ability to transact securities easily in large sizes and at

reasonable sizes and costs—has worsened in some ways since the

financial crisis, but may have actually improved in others.

He said it isn't clear that rules have been the most important

driver behind those shifts, but acknowledged that the rules had

played a role. Existing studies on the changes, he said, were

insufficient because the metrics available so far "don't tell the

whole story."

"While increases in regulatory requirements have undoubtedly

played a role, I think that other nonregulatory factors are also

important," he said.

Write to Katy Burne at katy.burne@wsj.com

(END) Dow Jones Newswires

May 01, 2016 20:45 ET (00:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

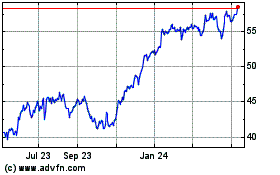

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

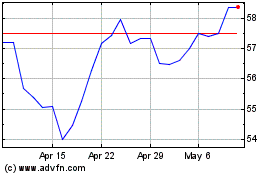

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024