By Katy Burne

A dispute over technology could pose a new threat to Wall

Street's plumbing by severing a link that allows big banks to

borrow freely from one another, according to market

participants.

A unit of Depository Trust & Clearing Corp., the dominant

processor of repurchase agreements, or repos, between securities

dealers, has told traders it will stop facilitating certain

interbank repos as of July 15. The roadblock affects an estimated

$45 billion in daily repo loans, short-term loans through which

banks and other financial firms exchange cash and securities to

raise funds for their trading activities.

A clearing bank confirms the identity of parties to a trade and

their terms, before processing the transaction. In settlement, a

third party ensures the quantities agreed upon in the trade are

transferred.

The suspension would mean the DTCC unit couldn't match up trades

between dealers that have cleared their interbank repos through

Bank of New York Mellon Corp., a large clearing bank, and dealers

that clear through BNY's distant competitor in repo clearing, J.P.

Morgan Chase & Co. Since a unit of DTCC will no longer bridge

the divide, dealers will only be able to trade with firms that

process their trades through the same clearing bank.

A handful of dealers have already scheduled some monthslong

repos to expire before the cutoff, in a bid to insulate themselves

from changing conditions as the break ripples through that corner

of the roughly $3 trillion U.S. repo market, according to people

with knowledge of the contracts.

The shift "will further bifurcate" the repo market at a time

when it is already under pressure from regulation, said Josh

Galper, managing principal at consultancy Finadium. The change,

which would have to be signed off by the Securities and Exchange

Commission, also would likely lead to the adoption of different

repo rates for Bank of New York Mellon and J.P. Morgan clients,

said Joseph Abate, an analyst at Barclays PLC.

The trades that would be affected by the suspension are repos

between dealers that cross clearing banks and are backed by

Treasurys, mortgage bonds and agency debt in trades known as

"general collateral finance." Those GCF trades account for about

$45 billion, or 15% of the $300 billion in daily interdealer repo

trading.

The decision is the latest twist in a long-running struggle by

bankers and the Federal Reserve to reduce risk in repos. Regulators

accelerated those changes after the 2008 financial crisis exposed

structural flaws. Under the overhaul, BNY and J.P. Morgan

rejiggered settlement times and virtually eliminated the amount of

intraday credit they have extended to dealers in some repos, moves

lauded by the Fed.

Last year, the Federal Reserve Bank of New York said the

industry had met several repo-overhaul milestones but that

settlements of interdealer GCF repos across clearing banks remained

out of sync with other repos. It called the misalignment a

"potential source of market instability in periods of stress."

In an effort to align interdealer GCF trades and other repos,

BNY, J.P. Morgan and DTCC set out to build new technology for

swapping information about the cash and securities being exchanged

between clients of the clearing banks.

J.P. Morgan completed a series of enhancements and the DTCC unit

completed the majority of its own, but BNY determined that the

technology work would have taken too much time and resources,

people familiar with the situation said. At the same time, BNY

asked a unit of DTCC to accept new limits on a credit facility the

bank provides to the settlement firm.

When they couldn't resolve their differences, the DTCC unit,

called Fixed Income Clearing Corp., chose to suspend its interbank

GCF repo services.

Repo volumes already have been shrinking in response to new

rules targeting banks. The planned suspension has traders and the

Fed on watch for further disruptions, participants said. The New

York Fed, which has overseen the repo reform efforts, hasn't

intervened in the standoff, said people familiar with the

matter.

"In a world where everyone is concerned about lack of liquidity,

why take this away?" one large dealer complained of the planned

suspension.

The activity across clearing banks was suspended by DTCC once

before, between 2003 and 2008, but at that time the business was

divided more evenly between clearing banks. Now, BNY Mellon has a

roughly 85% share of the dealer client base in such repos.

Changing clearing banks is operationally taxing and few are

expected to do so.

Some traders said the suspension could leave J.P. Morgan and its

clients--which people familiar with the matter said include units

of Credit Suisse Group AG, Royal Bank of Scotland Group PLC and

HSBC Holdings PLC--disadvantaged, with fewer trading partners in a

panic, and could potentially complicate any attempts to resolve

firm failures. Representatives of those firms declined to

comment.

Others said that dealers on the J.P. Morgan side tend to have

more cash than securities, but they may have to pay more to

transact than BNY Mellon clients under the change. J.P. Morgan

already has an account at BNY and could expand its own

capabilities, said one person involved in the talks between the

banks.

One industry idea under discussion is a new repo clearinghouse

that could solve the issues across the clearing banks, but the

mechanisms are complex and unlikely to be ready by July 15.

(END) Dow Jones Newswires

January 31, 2016 19:18 ET (00:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

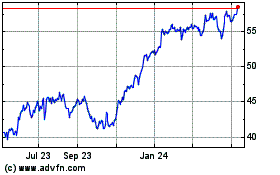

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

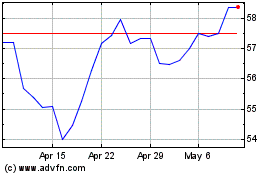

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024