Bank of New York Mellon Profit Jumps -- Update

January 21 2016 - 12:09PM

Dow Jones News

By Lisa Beilfuss

Bank of New York Mellon Corp. said profit soared in its latest

quarter, despite rocky market conditions that hit assets and

pressured fee revenue, as the asset-manager came up against a

favorable comparison from the year-earlier period.

As a custody bank, BNY Mellon derives a major portion of its

business from serving trillions in assets for money managers and

other clients, in addition to managing clients' investments. Amid

emerging market weakness, higher regulatory compliance requirements

and low interest rates, the bank saw net long-term outflows of $11

billion during the quarter as investors pulled out of index

funds.

Those outflows, together with the effect of the strong U.S.

dollar, pushed assets under management lower during the period. The

dollar has been a particular headwind for the trust bank, as it

does substantial business in Europe. Assets under management stood

at $1.63 trillion at the end of December, down 4% from a year

earlier and flat from the third quarter.

Lower assets capped revenue from fees--which represent more than

two-thirds of overall revenue. Overall fee revenue of $2.93 billion

was roughly flat from a year earlier and down 3.4% sequentially.

"We service the capital markets so it's certainly not helpful,"

Chief Financial Officer Todd Gibbons said of the market volatility

that has extended into 2016. "People are trying to understand it,

understand if this is the beginning of something greater," he said,

adding that further weakness could impact Bank of New York's

businesses but that economists there don't think another recession

is looming.

Soft assets under management were consistent with what fellow

trust bank Northern Trust Corp. reported Wednesday, said Jefferies

analyst Ken Usdin, noting that sovereign-wealth fund redemptions

remain a headwind.

A smaller slice, about a fifth, of the bank's business comes

from interest income. Interest revenue increased 6.7% from a year

earlier to $760 million, a rise that helped to modestly boost the

bank's net interest margin, a key measure of lending profitability.

Banks have been hoping the Federal Reserve's move in December to

raise interest rates would help increase lending profitability, and

higher rates also bode well for the fees Bank of New York charges

on products like money-market funds.

Overall, Bank of New York reported a profit of $693 million, or

57 cents, up from $233 million, or 18 cents, a year earlier. The

comparable period included 53 cents in litigation and restructuring

charges, partially offset by a tax benefit, while the latest

quarter included a loss stemming from a loan to a now-bankrupt

firm.

Excluding those items, among others, earnings per share

increased to 68 cents from 58 cents. Revenue inched up 1.5% to

$3.72 billion. Analysts predicted 64 cents in adjusted earnings per

share on $3.75 billion in revenue, according to Thomson

Reuters.

Bank of New York said it set aside $163 million in the fourth

quarter to cover potential credit losses, up from $1 million a year

earlier. While many lenders have been raising loss provisions as

the rout in energy markets threatens some loans from the oil patch,

Bank of New York's increase was entirely the result of an

impairment charge resulting from the aforementioned loan loss, Mr.

Gibbons said.

"Almost all of the exposure in the energy sector is to

investment grade names," he said, adding that the bank doesn't

expect to see losses resulting from the intensifying energy price

decline.

Shares in the company, down 13% since the start of the year,

rose 0.9% in morning trading as equity markets improved.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

January 21, 2016 11:54 ET (16:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

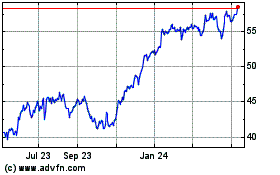

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

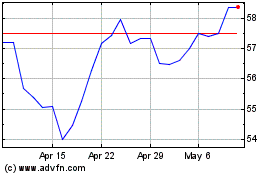

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024