Banking Regulator, 4 Banks Reach Pact Over New Chat Platform

September 14 2015 - 12:50PM

Dow Jones News

New York's top banking regulator struck a deal Monday with four

major banks over record-keeping at the new chat and messaging

platform, Symphony Communications LLC.

The New York State Department of Financial Services, which had

expressed concerns that certain Symphony features could hinder

regulatory investigations, said the agreement covers record-keeping

requirements and other protections "to help ensure the banks'

responsible use" of the platform.

The agreement was reached with Goldman Sachs Group Inc.,

Deutsche Bank AG, Credit Suisse Group AG, and Bank of New York

Mellon Corp.—four banks regulated by the agency and among the 14

banks and money managers invested in the company's technology.

Deutsche Bank and Credit Suisse declined to comment on the

agreement, and a Bank of New York Mellon spokesman was unable to be

reached. A representative of Goldman Sachs said "We are pleased our

discussions with the DFS have been constructive and Symphony's

messaging solution addresses their concerns and further enhances

our process around security and compliance."

The four banks that reached agreements represent all of the

banks within the consortium that NYDFS regulates, the regulator

said.

Under the agreement, Symphony will retain for seven years a copy

of all e-communications sent through its platforms to or from the

four banks, and the four banks will store duplicate copies of the

decryption keys for their messages with independent custodians.

Dow Jones & Co., which owns The Wall Street Journal and Dow

Jones Newswires, has agreed to provide news content on the Symphony

service. Dow Jones is a unit of News Corp.

In July, NYDFS had asked software-company Symphony for details

about its document retention and deletion, encryption services and

open-source features.

Banks have coalesced around the Silicon Valley startup as the

industry seeks ways for employees to instantly and securely

communicate with each other. The service, set to launch this week,

is viewed as a potential lower cost alternative to a popular

messaging service on Bloomberg LP's terminals.

"We are pleased that these banks did the right thing by working

cooperatively with us to help address our concerns about this new

messaging platform," said Anthony Albanese, Acting Superintendent

of Financial Services. "This is a critical issue since chats and

other electronic records have provided key evidence in

investigations of wrongdoing on Wall Street."

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 14, 2015 12:35 ET (16:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

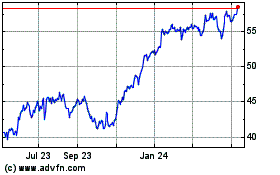

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

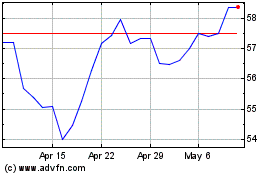

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024