By Kirsten Grind And Tim Puko

Bank of New York Mellon Corp. warned at least one money manager

that it might not be able to solve pricing problems caused by a

computer glitch before markets open Monday, the latest delay in an

unprecedented outage that has frustrated investors and prevented

nearly 50 fund companies from providing accurate values for their

holdings.

More than 100 executives at the New York company worked through

the weekend to correct the glitch and provide up-to-date pricing

for hundreds of mutual funds and exchange-traded funds that have

lacked accurate asset value figures since last Monday, said a

person familiar with the firm.

By midday Sunday, BNY Mellon had calculated the net asset values

for all funds through last Wednesday, with the exception of one

company, the bank said in a statement Sunday afternoon. BNY didn't

name the company.

The bank was still working through a backlog from Thursday and

Friday, and it was unclear whether it would be able to complete the

task by the time the market opens Monday, said the person.

The bank, fund companies, regulators and exchanges hoped to

start the week with the issue resolved, this person said.

The outage has roiled money-management firms that strive to

provide investors with accurate pricing for their funds. In its

first attempt at quantifying the outage, BNY Mellon said over the

weekend that 20 mutual-fund companies and 26 providers of

exchange-traded funds had been affected.

Setbacks in resolving the issue have put BNY Mellon's reputation

on the line, said analysts, likely prompting some clients to at

least consider whether to move their business to a rival

custodian.

For BNY Mellon, "this isn't life threatening but it's a black

eye," said CLSA banking analyst Mike Mayo. "The company is a

plumber to the banking industry."

Finding a solution is "overdue" for the bank, said Todd

Rosenbluth, director of ETF and mutual-fund research at S&P

Capital IQ. He called the business of providing accounting for fund

firms a competitive one and said BNY's ability to help clients

price assets correctly "is paramount to maintaining their

relationships."

Fund companies affected include Goldman Sachs Group Inc.,

Guggenheim Investments, Prudential Investments, Federated Investors

and Invesco PowerShares. All have had to rely on backup methods for

calculating asset values, and are now reconciling the values that

they published last week with the new data provided by BNY

Mellon.

One money-management firm complained that BNY Mellon has

frequently provided status updates while leaving open the most

important question for investors, whether the overhaul will be

complete and the system functional by Monday.

On Sunday, Federated said it "has continued to work through

issues over the weekend and we expect to have an update for our

customers in the morning."

Prudential said it had 38 retail funds and two closed-end funds

affected out of about 60 at the firm. A Guggenheim representative

said the company was "optimistic that NAV pricing will return to a

regular schedule very soon." Invesco declined to comment, and

Goldman Sachs didn't return phone calls seeking comment.

The problem stemmed from a SunGard Data Systems Inc. accounting

system used by BNY Mellon that became "corrupted" last weekend

after an upgrade, SunGard said in a statement Thursday. A SunGard

spokesman didn't respond to a request for comment Sunday.

BNY Mellon in a statement Sunday said it is also "using

alternative methods to address the backlog from SunGard's system

failures this week."

"SunGard's system is restored, and we have made significant

progress over the weekend to process the backlog," a BNY Mellon

spokesman said.

BNY Mellon, the largest fund custodian in the world by assets,

provides accounting services for money managers. Those services

include calculating the price of a fund's securities each day.

Pricing is crucial for money managers, which are obliged to provide

investors with an accurate price for securities in their funds.

The problems have made it much harder for investors in mutual

funds and exchange-traded funds who rely on accurate pricing to

trade in and out of funds.

Last Monday, the pricing system went down. It went back online

midday Wednesday, and the system was working through a backlog

Thursday afternoon, the bank said.

By Thursday afternoon, multiple fund companies were reporting

discrepancies of 1% or more in the prices they had calculated

earlier in the week compared with the new prices from BNY

Mellon.

Invesco PowerShares, a large provider of ETFs, revised the net

asset value of 14 funds, according to a news release. Securities

and Exchange Commission officials reviewing the pricing glitch are

aware of only a few instances of price discrepancies greater than

1%, according to people familiar with the agency's review of the

matter. They cautioned that the figures are preliminary.

In its first public statement on the matter Thursday afternoon,

SunGard said that the malfunction appears to have been caused by an

operating system change performed on Aug. 22. Although the change

had been tested by SunGard, the platform "became corrupted," when

applied to SunGard's InvestOne platform used by BNY Mellon, the

company said. The backup system was concurrently corrupted.

NYSE Group, a unit of Intercontinental Exchange Inc., declined

to comment, as did Nasdaq OMX Group Inc. and BATS Global Markets

Inc.

Bradley Hope contributed to this article.

Write to Kirsten Grind at kirsten.grind@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 30, 2015 19:21 ET (23:21 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

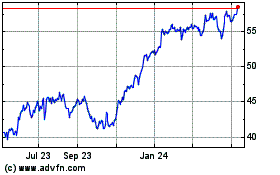

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

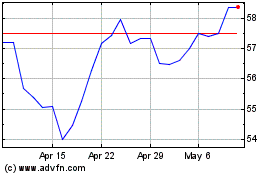

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024