Bank Scrambles to Price Funds After Glitch

August 27 2015 - 5:31PM

Dow Jones News

By Kirsten Grind

Computer problems plagued the U.S. asset-management industry for

a fourth consecutive day Thursday, as Bank of New York Mellon Corp.

said it was still working to correct a glitch that caused hundreds

of mutual and exchange-traded funds to miscalculate the value of

fund assets.

The bank said in a statement that the performance of the

accounting platform it uses to price fund securities, the SunGard

InvestOne platform operated by SunGard Data Systems Inc., began to

improve in the early morning hours Thursday, "although some

performance issues remain."

BNY Mellon, the largest fund custodian in the world by assets,

provides accounting services for money managers. Those services

include calculating the price of a fund's securities each day.

Pricing is crucial for money managers, which are obliged to provide

investors with an accurate price for securities in their funds.

The problems have made it much harder for mutual fund and

exchange-traded fund investors who rely on accurate pricing to

trade in and out of funds.

On Monday, the pricing system went down. It went back online

midday Wednesday, the system was working through a backlog Thursday

afternoon, the bank said.

In its first public statement on the matter Thursday afternoon,

SunGard said that the malfunction appears to have been caused by an

operating system change performed on Aug. 22. Although the change

had been tested by SunGard, the platform "became corrupted," when

applied to SunGard's InvestOne platform used by BNY Mellon, the

company said. The backup system was concurrently corrupted.

"We at SunGard apologize to BNY Mellon for the adverse impact

this unfortunate incident has had on its operations and clients,"

SunGard president and CEO Russ Fradin said in a statement. The

company said the issue wasn't related to "the recent turmoil in

equity markets."

Fund-research firm Morningstar Inc. said about 800 mutual funds

were missing their net asset values on Wednesday afternoon.

On Thursday, some fund firms worked to restate the net asset

values of their funds from previous days after receiving updated

information from BNY Mellon. In an update to investors Thursday

morning, Federated Investors said it has received net asset values

for Monday, and that the values it calculated for two of its mutual

funds differed from BNY Mellon's figures.

The company said it is recommending reprocessing shareholder

transactions in both those funds for that day. The company is still

relying on its internal valuation committee to price securities

because of "a significant delay in the availability of net asset

values," Federated said in a statement.

By Thursday afternoon, BNY Mellon said it had generated net

asset values for affected ETFs and mutual funds for Tuesday, and

had begun work to process the prices for Wednesday. The bank

expected to finalize net asset values for Wednesday by Thursday

night. After that, the bank said it would work on net asset values

for Thursday.

"Teams continue to work around the clock," the bank said in an

earlier statement.

In a separate afternoon statement, the bank said it continued to

have "an open dialogue with the regulators and exchanges to keep

them apprised of the current status of this situation."

The outage, unprecedented across the money-management industry,

affected a number of firms offering mutual funds and ETFs,

including Goldman Sachs Group Inc., Prudential Financial Inc.,

Guggenheim Partners LLC. and Voya Investment Management. By

Thursday afternoon, multiple fund companies were reporting

discrepancies of 1% or more in the prices they had calculated

earlier in the week compared with the new prices from BNY

Mellon.

Invesco PowerShares, a large provider of ETFs, revised the net

asset value of 14 funds, according to a news release.

SEC officials reviewing the pricing glitch are aware of only a

few instances of price discrepancies greater than 1% of what they

should have been, according to people familiar with the agency's

review of the matter. They cautioned the figures are preliminary

stages.

Write to Kirsten Grind at kirsten.grind@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 27, 2015 17:16 ET (21:16 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

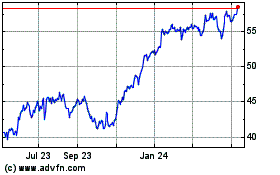

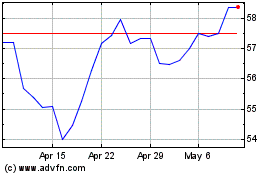

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024