Stung by Mutual Fund and ETF Glitch? Ask for a Refund

August 26 2015 - 7:51PM

Dow Jones News

By Leslie Josephs

A software glitch this week at fund administrator Bank of New

York Mellon Corp. caused difficulties in pricing many mutual funds

and exchange-traded funds, prompting some fund sponsors to publish

lists of funds whose stated asset values were erroneous.

What can you do if one of your funds is on the list, meaning you

may have overpaid for shares?

Reach out to your fund company and ask for a refund. They don't

have to give you one but firms may do so because of their often

long-term relationships--ones they want to keep--with investors,

analysts said.

The answers you get may depend on the type of fund you own.

Mutual funds may face easier-to-adjudicate claims because of the

nature of their product, analysts said, and may be more likely to

compensate investors because they and their shareholders tend to be

less trading-focused.

"I think that mutual-fund companies tend to have longer-term

relationship with their shareholders and may be more accommodative,

whereas ETF investors may be more short term in nature," said Todd

Rosenbluth, director of ETF and mutual fund research at S&P

Capital IQ.

Mutual fund trades in general are easier to track, he said,

"because they're executed only once at the close."

In exchange-traded funds, in which investors can buy and sell

throughout the day and whose price can become divorced from the

underlying assets even without the market unrest of this week,

investors' options may be more limited.

Several exchange-traded fund providers, including Guggenheim

Partners LLC, First Trust Advisors LP and Van Eck Global, said the

net-asset values in some funds that were calculated as of the

market close on Monday contained errors greater than 1%. But some

analysts said that isn't a large swing in the ETF world and it

might be possible for providers to argue that they don't owe

investors anything.

Incorrect pricing could affect investor decisions.

For example, First Trust Advisors said Wednesday that the

per-share net asset value of its First Trust Nasdaq Auto Index Fund

on Monday was overstated by 69 cents, which could potentially

inform an investor decision, although some analysts said the amount

is too small to make much of a difference and that most ETF trading

is done independent of the end-of-day price.

"Was the deciding factor in your making an investment decision?

Then I suppose you could, as an investor, claim that you've been

misled and sue" the ETF provider, said Dave Nadig, director of

exchange-traded funds at FactSet.

He said such a claim seems unlikely in response to "one day of

disconnect for a fairly small amount of money."

Write to Leslie Josephs at leslie.josephs@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 26, 2015 19:36 ET (23:36 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

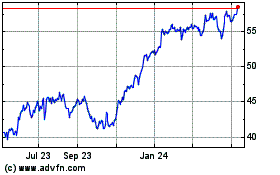

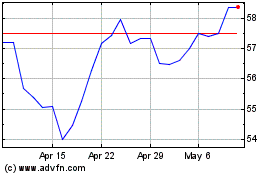

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024