A New Computer Glitch Is Rocking the Mutual Fund Industry

August 26 2015 - 2:10PM

Dow Jones News

The U.S. fund industry was in turmoil Wednesday as executives

scrambled to respond to a computer glitch that prevented dozens of

mutual and exchange-traded funds from promptly pricing their

securities.

The outage, which wasn't believed to be related to the market

turbulence Monday that included the largest-ever intraday decline

in the Dow Jones Industrial Average, prompted emergency meetings

Wednesday at banks, fund companies and financial intermediaries, as

directors and executives sifted through pricing data and addressed

likely legal ramifications of any mispricings.

The promise of accurate, readily available pricing lies at the

heart of the industry's pitch to investors and any problems could

have significant implications for the industry, analysts said.

Bank of New York Mellon Corp. said it was having problems with a

SunGard Data Systems Inc. system that "has impacted a limited

number of fund accounting clients and the processing of net asset

values of certain mutual funds and ETFs," a spokesman said in a

statement Wednesday. Bank of New York Mellon acts as a custodian

for asset management firms, providing accounting services that

include calculating the price of the funds' securities each day.

The company relies on SunGard's software system to calculate those

prices.

The problem, which began earlier in the week, has affected a

number of large mutual fund firms, including Federated Investors,

Prudential Financial Inc., Guggenheim Partners LLC and Voya

Investment Management.

Monday's trading turmoil, which saw more than a thousand shares

halted, unleashed wild trading in the ETF universe in which some

investors complained they were unable to buy or sell securities.

And the glitch was the latest example of an unexpected technology

problem reverberating across the market.

Many of the recent glitches have taken place inside stock

exchanges. NYSE halted trading on its exchange for nearly four

hours in July after a software update caused problems. Trading

continued on other exchanges, but it highlighted issues around the

fragility of the technology infrastructure on Wall Street.

The ETF pricing outage set off alarm bells in mutual fund firms,

where pricing issues are rare, say analysts and experts, and

mistakes can carry broader implications for investors. It's the

first widespread issue that asset managers have faced in at least a

decade.

"Funds have very sophisticated systems for dealing with this, so

it doesn't happen very often," said Niels Holch, the founder of the

Coalition of Mutual Fund Investors.

Executives used back-up accounting systems for calculating the

net asset values of their funds. Emergency meetings were called

with each mutual funds' board of trustees, a group of independent

directors that is involved in the pricing of fund shares. At BNY

Mellon, executives were holding multiple conference calls

throughout the week with affected fund companies, according to

people familiar with the calls.

"The SunGard system became available with limited capacity late

yesterday. Our teams have been working together to clear the

backlog and we are working with SunGard to resume normal processing

as soon as possible," the bank said.

By early afternoon Wednesday, some fund companies had received

correct net asset values from Bank of New York Mellon and were

trying to reconcile those numbers with what they had reported

earlier in the week, according to people familiar with the process.

In a statement Wednesday morning, First Trust Advisors L.P. said

that the net asset values it had reported on four of its

exchange-traded funds contained errors greater than 1%. A First

Trust spokesman didn't immediately return a call for comment.

Guggenheim Partners LLC, which offers 64 ETFs to investors, said

it had to use older data from previous days because of the problems

with Bank of New York Mellon's systems.

"Once we receive actual net asset values from our third-party

administrator, adjustments will be made and reposted to our

website, as necessary," said Ivy McLemore, a spokesman for

Guggenheim.

In a statement, Federated Investors said it has experienced a

"significant delay in the availability of net asset values" for

dozens of its mutual funds. The problems could result in a need to

reprocess trades, the company said.

A Voya spokesman said in a statement said that it was unable to

publish net asset values for its registered investment funds and

commingled funds where it serves as a trustee. The company is

"working closely with BNY Mellon" to publish net asset values for

Tuesday and Wednesday. "Voya has been providing investors and its

intermediary partners periodic updates during the situation," the

company said.

A SunGard spokesman didn't return calls for comment. A

spokeswoman for Prudential declined to comment.

Write to Kirsten Grind at kirsten.grind@wsj.com and Bradley Hope

at bradley.hope@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 26, 2015 13:55 ET (17:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

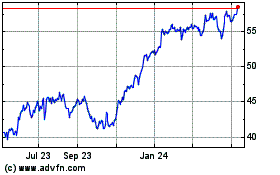

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

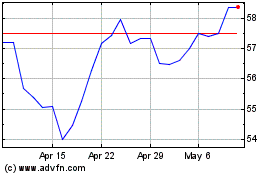

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024