Current Report Filing (8-k)

August 17 2015 - 4:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 17, 2015

THE BANK OF NEW YORK

MELLON CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35651 |

|

13-2614959 |

| (State or other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| One Wall Street

New York, New York |

|

10286 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 495-1784

Not Applicable

(Former

name or former address if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On August 17, 2015, The Bank of New York Mellon Corporation (the

“Company”) issued (i) $1,100,000,000 aggregate principal amount of its 2.600% Senior Medium-Term Notes Series G due 2020 (the “5-Year Fixed Rate Notes”) and (ii) $300,000,000 aggregate principal amount of its Floating

Rate Senior Medium-Term Notes Series G due 2020 (the “5-Year Floating Rate Notes” and, together with the 5-Year Fixed Rate Notes, the “Notes”). The Notes were registered under the Securities Act of 1933, as amended, pursuant to a

registration statement on Form S-3 (File No. 333-189568). In connection with this issuance, the legal opinion as to the legality of the Notes is being filed as Exhibit 5.1 to this report.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) EXHIBITS

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 5.1 |

|

Opinion of Kathleen B. McCabe. |

|

|

| 23.1 |

|

Consent of Kathleen B. McCabe (included in Exhibit 5.1). |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

The Bank of New York Mellon Corporation

(Registrant) |

|

|

|

|

| Date: August 17, 2015 |

|

|

|

By: |

|

/s/ Craig T. Beazer |

|

|

|

|

Name: |

|

Craig T. Beazer |

|

|

|

|

Title: |

|

Secretary |

3

EXHIBIT INDEX

|

|

|

|

|

| Number |

|

Description |

|

Method of Filing |

|

|

|

| 5.1 |

|

Opinion of Kathleen B. McCabe. |

|

Filed herewith |

|

|

|

| 23.1 |

|

Consent of Kathleen B. McCabe. |

|

Included in Exhibit 5.1 |

4

Exhibit 5.1

[BNY Mellon Letterhead]

August 17, 2015

The Bank

of New York Mellon Corporation

One Wall Street

New York,

New York 10286

Ladies and Gentlemen:

In

connection with the issuance and sale by The Bank of New York Mellon Corporation, a Delaware corporation (the “Company”), of (i) $1,100,000,000 aggregate principal amount of its 2.600% Senior Medium-Term Notes Series G due 2020 (the

“5-Year Fixed Rate Notes”) and (ii) $300,000,000 aggregate principal amount of its Floating Rate Senior Medium-Term Notes Series G due 2020 (the “5-Year Floating Rate Notes” and, together with the 5-Year Fixed Rate Notes,

the “Notes”), in each case pursuant to an Indenture dated as of July 18, 1991, between the Company and Deutsche Bank Trust Company Americas (formerly known as Bankers Trust Company), as Trustee (the “Indenture”), a

Distribution Agreement, dated June 15, 2006 (the “Distribution Agreement”), among the Company and the agents party thereto, a Letter Agreement, dated August 10, 2015 (the “Letter Agreement”), among the Company and

the agents party thereto and a Terms Agreement, dated August 10, 2015, relating to the Notes (the “Terms Agreement”), I, as counsel for the Company, or attorneys under my supervision, have examined such corporate records, certificates

and other documents, and such questions of law, as I have considered necessary or appropriate for the purposes of this opinion.

Upon the

basis of such examination, it is my opinion that the Notes have been duly authorized and established by the Company in conformity with the Indenture, and, when the Notes have been duly prepared, executed, authenticated and issued in accordance with

the Indenture and delivered against payment in accordance with the Distribution Agreement, the Letter Agreement and the Terms Agreement, the Notes will constitute valid and legally binding obligations of the Company enforceable against the Company

in accordance with their terms, subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to general equity principles.

The foregoing opinion is limited to the Federal laws of the United States, the laws of the State of New York and the General Corporation Law

of the State of Delaware, and I am expressing no opinion as to the effect of the laws of any other jurisdiction.

I have relied as to

certain matters on information obtained from public officials, officers of the Company and other sources believed by me to be responsible, and I have assumed that the Indenture has been duly authorized, executed and delivered by the Trustee, and

that the signatures on all documents examined by me are genuine, assumptions which I have not independently verified.

August 17, 2015

Page 2

This opinion letter has been prepared to be filed by the Company as an exhibit to a Current

Report on Form 8-K (the “Form 8-K”). The Form 8-K will be incorporated by reference in the Company’s registration statement on Form S-3 (File No. 333-189568). I assume no obligation to advise you of any changes in the foregoing

subsequent to the delivery of this opinion letter.

I hereby consent to the filing of this opinion letter as Exhibit 5.1 to the Form 8-K

and to the use of my name therein and to the reference to the Chief Securities Counsel in the Prospectus dated June 25, 2013, as supplemented by a Prospectus Supplement, dated June 25, 2013, under the captions “Validity of the

Notes” and “Validity of Securities.” By giving such consent, I do not hereby admit that I am within the category of persons whose consents are required under Section 7 of the Securities Act of 1933, as amended.

|

| Very truly yours, |

|

| /s/ Kathleen B. McCabe |

|

| Kathleen B. McCabe |

| Chief Securities Counsel |

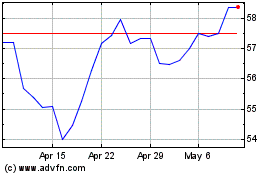

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

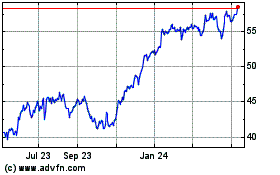

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024